The Earliest Bird Catches the Worm

Revenue shares on hedge funds

– Marcus Storr, Head of Alternative Investments, FERI Trust GmbH

Truths in Combining Equity Long/Short and Systematic Investing

The quantamental holy grail

– Carson Boneck, Chief Data Officer, Balyasny Asset Management (BAM)

How to Build a Hedge Fund in Asia

Under-researched event-driven opportunities

– Damian L. Edwards, Chief Investment Officer, Metrica Partners Pte. Ltd

Pragmatic Value Investing

Finding value, quality and growth amid a “Duration Bubble”

– Jacob Mitchell, Founder and Chief Investment Officer, Antipodes Capital

The Rise of Systematic Investing

From static trend-following to evolutionary models, risk premia and alternative data

– Martin Lueck, Co-Founder, Research Director and President, Aspect Capital

*

The Earliest Bird Catches the Worm

Revenue shares on hedge funds

– Marcus Storr, Head of Alternative Investments, FERI Trust GmbH

FERI’s 8th annual hedge funds investment day was attended mainly by institutional and family office investors, predominantly from Germany, Switzerland and Austria, who are increasingly embracing hedge funds. A live vote during the event showed some 68% of attendees are now invested in hedge funds and/or UCITS hedge funds and 88% of them are holding meetings with alternative investment managers.

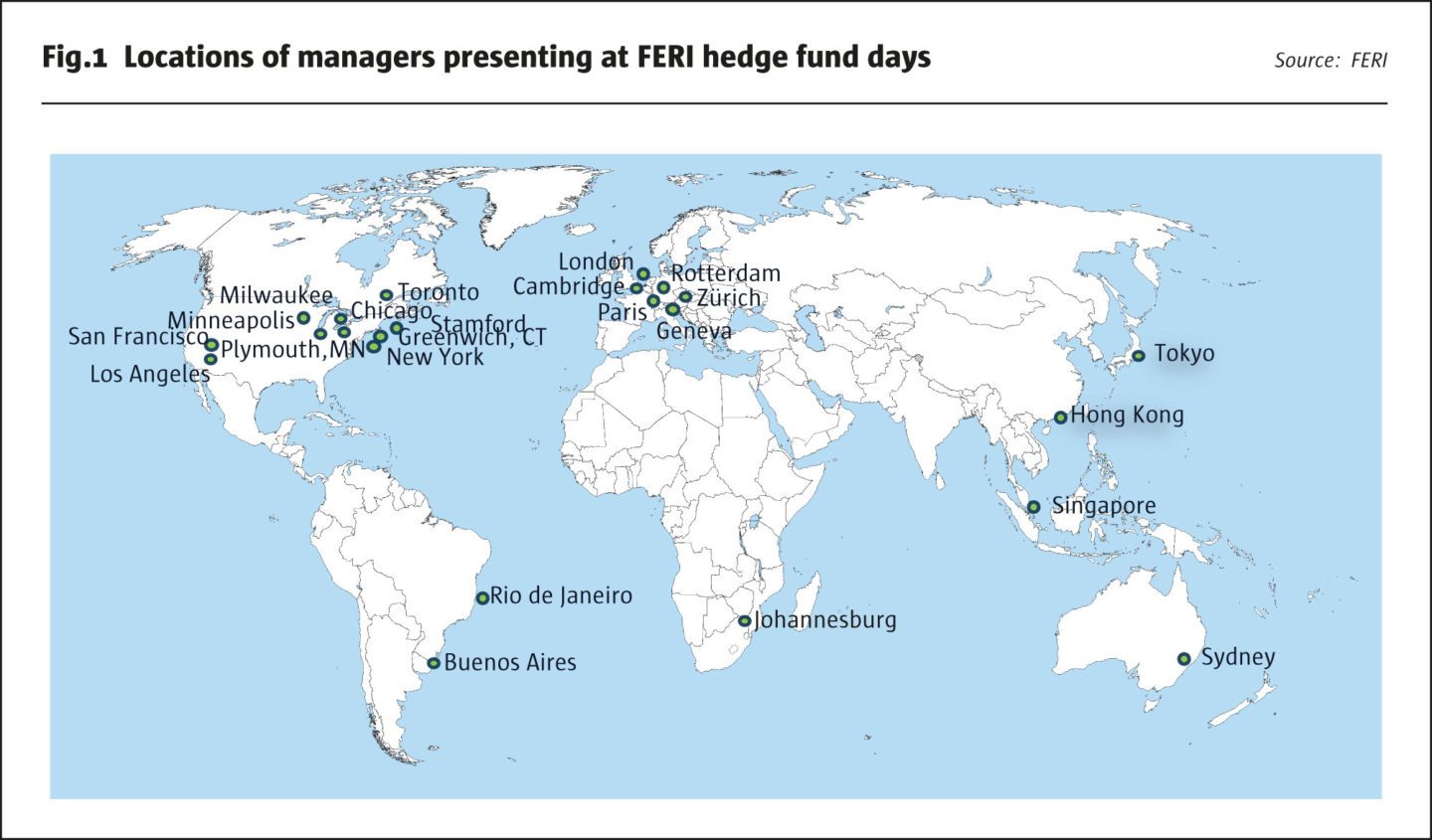

The one-day conference showcased four managers based in London, Singapore and Sydney. At previous events, managers from five continents have presented, including many from outside the major hedge fund centres of London and New York. FERI, which is one of Germany’s largest hedge fund investors, scours the globe in search of talented and differentiated hedge fund managers.

Global hedge fund assets of around USD 3 trillion are near an all-time high, but most of this is managed by established managers. Some 43% of start-ups run less than USD 100 million on day one (according to the JP Morgan 2018 Hedge Fund Terms Analysis). This level of assets rules out allocations from over half of all pension funds (according to the Deutsche Bank Alternative Investment Survey 2019). In the typical life cycle of a hedge fund manager, it can take four or five years to start raising assets from institutional investors (according to AIMA and GPP’s 2018 survey, Making it Big, which was reproduced in The Hedge Fund Journal).

FERI’s coverage of the industry runs the gamut from legendary managers with multi-decade track records, to emerging managers who have launched over the past few years. Many of today’s leading hedge fund managers running tens of billions started with only tens of millions, and have thus multiplied their assets more than one thousand-fold. Herein lies an opportunity for a special kind of venture capital investing, with extraordinary potential returns – but relatively low risks.

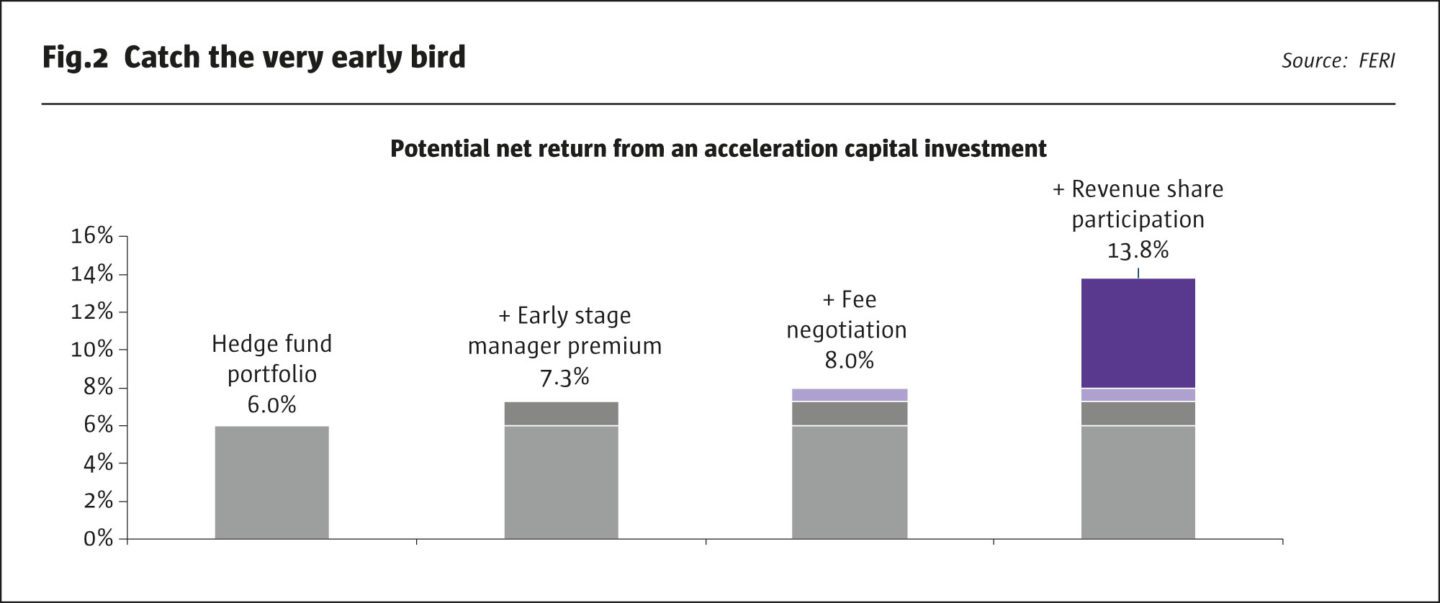

Early investors in hedge funds may be able to negotiate a revenue share agreement whereby they receive part of the manager’s management and performance fees. This is sometimes offered in addition to paying lower fees on an “early bird” share class. The third “turbocharger” for performance is that emerging hedge fund managers also tend to outperform, according to many academic studies. The fourth source of extra returns could arise from selling the revenue share sometimes back to the manager, or to a third party such as a multi-affiliate asset manager that specializes in taking stakes in hedge fund management companies.

FERI’s approach to early stage hedge funds is more akin to providing “acceleration capital” than seed capital per se because FERI does not invest on day one, but rather waits to get comfortable that operations are running smoothly after launch. FERI also diversifies its acceleration allocations across a basket of managers, and does not want to make up too large a percentage of individual manager assets.

FERI’s eight hedge fund specialists have an average of over 20 years’ experience, which is close to that of many of the hedge fund managers they allocate to. FERI’s manager search process is active, involving as many as 700 contacts with managers in 2018, including meetings, conferences, teleconferences and videoconferences.

Marcus Storr, FERI

*

Truths in Combining Equity Long/Short and Systematic Investing

The quantamental holy grail

– Carson Boneck, Chief Data Officer, Balyasny

Balyasny was founded in 2001. It manages circa USD 6.5 billion in equity market neutral, global macro and commodity strategies and has over 500 staff in the US, Europe and Asia. The firm started macro trading in 2005 and hired its first systematic portfolio manager in 2015. Boneck argues that combining discretionary and systematic processes poses challenges but holds out the prospect of worthwhile rewards for alpha generation and performance attribution.

Since the 1980s or earlier, discretionary and quantitative managers have been using similar data inputs: mainly company and technical information from vendors, exchanges and brokers. Factor investing based on well known premia such as value, momentum and growth was an early example of quant equity investing.

What has changed since the late 1990s is an explosion in volume and velocity of data as the latency of all datasets has decreased. For instance, there are more satellites and they go round the world more often. Credit card, email and e-receipt data is also valuable (though its use may soon become curtailed by privacy laws and tech giants restricting access). Many new sorts of alternative data are not as well organized as traditional data, and it takes more cleaning and engineering to effectively harness unstructured data.

Balyasny’s fundamental long/short unit contains portfolio manager “pods”, which typically contain one portfolio manager and three to eight analysts with deep industry and company knowledge of key performance indicators. Alternative data is widely used and these fundamental investors specialize in linking specific data to individual company prediction. In contrast, systematic teams, which are largely comprised of computer scientists and statisticians, build portfolios of 500 or 1,000+ companies and base their process on the law of large numbers. Alternative data with short histories can pose challenges for quants, such as that derived from web-scraping, as deep history is preferred. The firm has found success by building a team of “translators” – former fundamental analysts and data specialists – to help fundamental portfolio manager teams to incorporate alternative data. These translators build the bridges between the schools of thought, and translator roles are increasingly an attractive career path at Balyasny.

Balyasny is seeking to foster an environment where the discretionary and systematic managers can recognize the value of one another’s knowledge and techniques and optimize the use of insights from both traditional and alternative data. Infrastructure and data engineering have been revamped, with investments in elastic cloud technologies and APIs. The central data team, named the Data Intelligence Group, is not siloed. Rather, it serves Balyasny’s equity long/short, macro and systematic investment teams. It includes a data sourcing effort which procures exclusive and proprietary datasets for the firm from both the private and public sector. Boneck commented that the most unique data is not likely to be found at conferences. The firm has also built a cloud based data screening portal which enables potential data providers to test their data in as little as 20 seconds. The nitty gritty of enriching data involves tedious, time consuming work: structuring, tagging and evaluating the data. Feature selection and machine learning techniques can help with this. Balyasny is hiring people who enjoy this meticulous work, in addition to those whose ambitions lie in areas such as artificial intelligence.

Discretionary and systematic managers could find different end uses for the same data. Discretionary teams may be looking to identify KPIs and predict earnings surprise for individual names, while quants are seeking alphas that can be extracted from style, factor or sector-based baskets of stocks. In addition to traditional quant and discretionary portfolios, there is scope to develop a “grey box” hybrid approach that combines discretionary insights with systematic trading. Quant in general improves performance attribution, and the added value from the quantamental approach can be measured in various ways.

Aligning incentives is another focus area for the firm. Balyasny’s data team, proven to be a development ground for the investment teams and the firm, believes it serves as a unique recruiting ground for developing talent in data science and quantamental investing.

The key lessons Balyasny has learnt is to be pragmatic, objective, and collaborative, and to describe their use of technology without overselling it and using too many hyped-up buzzwords.

*

How to Build a Hedge Fund in Asia

Under-researched event-driven opportunities

Damian L. Edwards, Chief Information Officer, Metrica

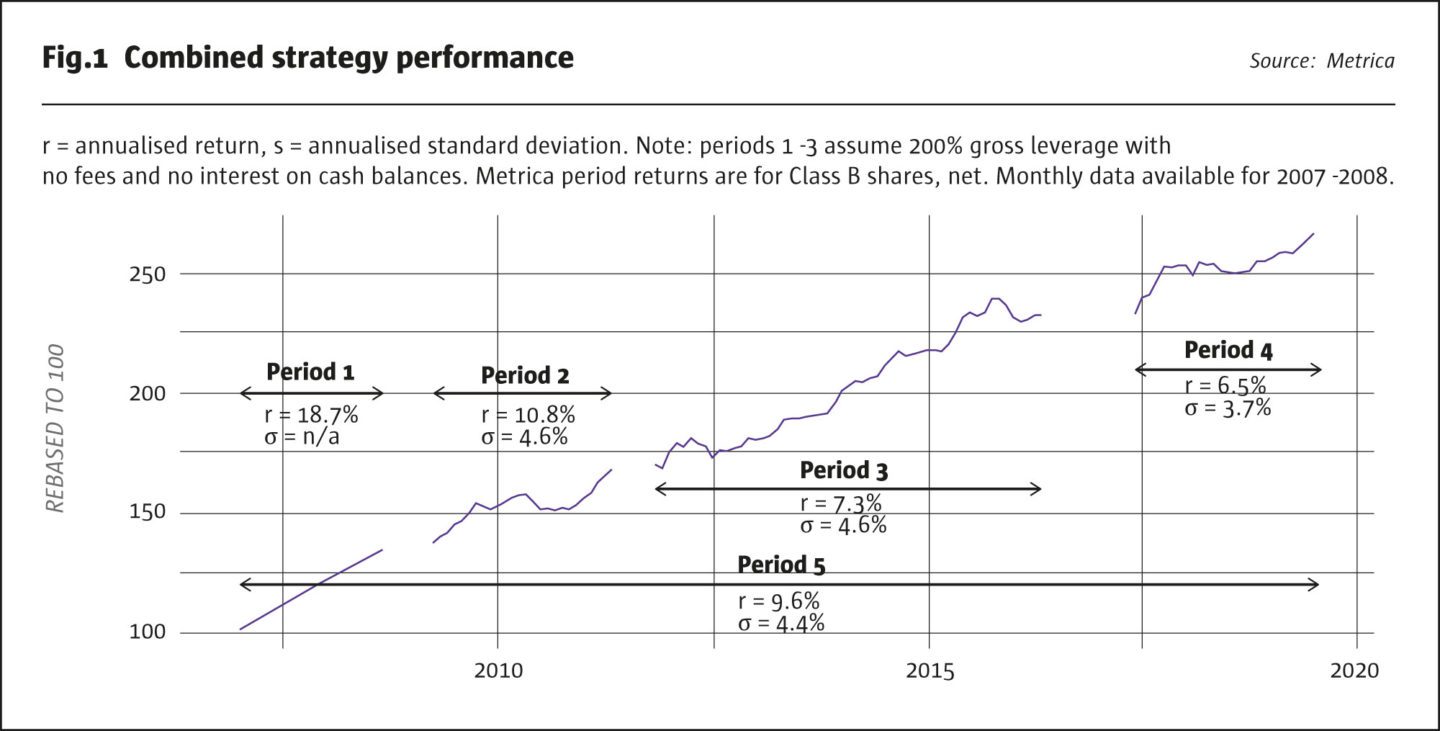

British-Canadian dual national Damian L. Edwards has spent 20 years working primarily as a proprietary trader in Japan, Hong Kong and Singapore. He has a track record since 2007 of generating high single digit annualized returns with moderate volatility without a single down year.

Edwards teamed up with fellow London Business School alumnus, and Canadian, David Mulvenna to launch Metrica partners in 2016. Singapore was an attractive location thanks to its political stability, time zone, regulatory climate, low personal and corporate taxes, English-speaking workforce, office rents 80% below central Hong Kong (even in Raffles Place, at the heart of Singapore’s financial centre), and high quality service providers located within a few minutes’ walk.

The name Metrica means measurement in Latin. It symbolizes Metrica’s risk management parameters, and its formalized and documented investment process, which has been constantly refined over the past decade. Metrica aims to deliver absolute returns with low drawdowns and no market correlation, while defining risk as a permanent loss of capital rather than volatility of returns.

Edwards finds Asia Pacific markets attractive due to their relative inefficiency: just 70% of large-cap stocks have sell side analyst coverage, versus 90% in the US; bank proprietary trading desks have retreated, and few funds specialise in Asian corporate events. Various trading restrictions, such as capital controls and foreign ownership limits, can lead to market anomalies and arbitrage opportunities, as can tax policies such as Australia’s franking credit system, which gives some local investors a higher dividend yield.

As Asia’s capital markets are still developing, they have unique features: China has a new Nasdaq-style STAR Market; Wholly Foreign Owned Enterprises (WFOE) for foreign investment managers; the expansion of QFII and RQFII (which were just abolished for certain qualified foreign investors); depositary receipts listed overseas; nascent index futures, and has recently joined the MSCI index. Hong Kong has multiple share class listings, some of which are linked to mainland China listings through the Stock Connect. Singapore also has multiple listings, and lists Indian single stock futures. India has GIFT (Gujarat International Finance Tec City), a technological and financial services centre. Japan has a corporate governance code and Korea has a stewardship code that can engender more shareholder friendly behaviour.

For equity investors, Asia Pacific is distinguished by faster GDP growth, driven by rising consumer spending, an abundance of holding companies, a buoyant IPO market and plenty of M&A activity. Edwards does not expect his event-driven investment strategy could be fully automated, partly because it entails engagement with management.

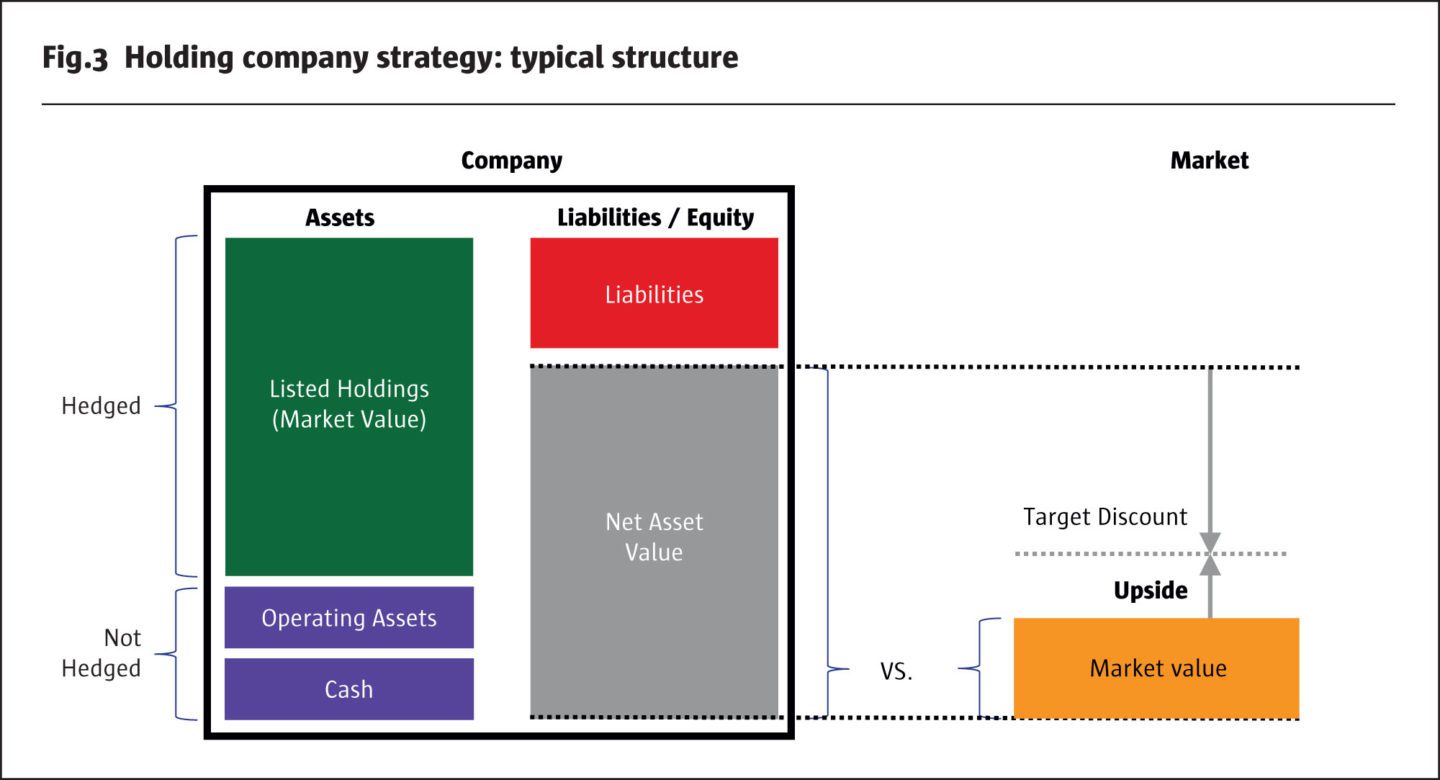

Rather than timing markets, Metrica runs a broadly market neutral book with three main relative value trade types: event-driven trading include merger arbitrage, holding company sum of the parts trades, and share class trades such as preferred versus ordinaries. The book is well diversified, combining trades that have a concave, bond-like payoff, and those with a convex payoff profile more like cheap options. Metrica also expects to earn some premium from liquidity provision. A probabilistic approach is taken to defining upside and downside.

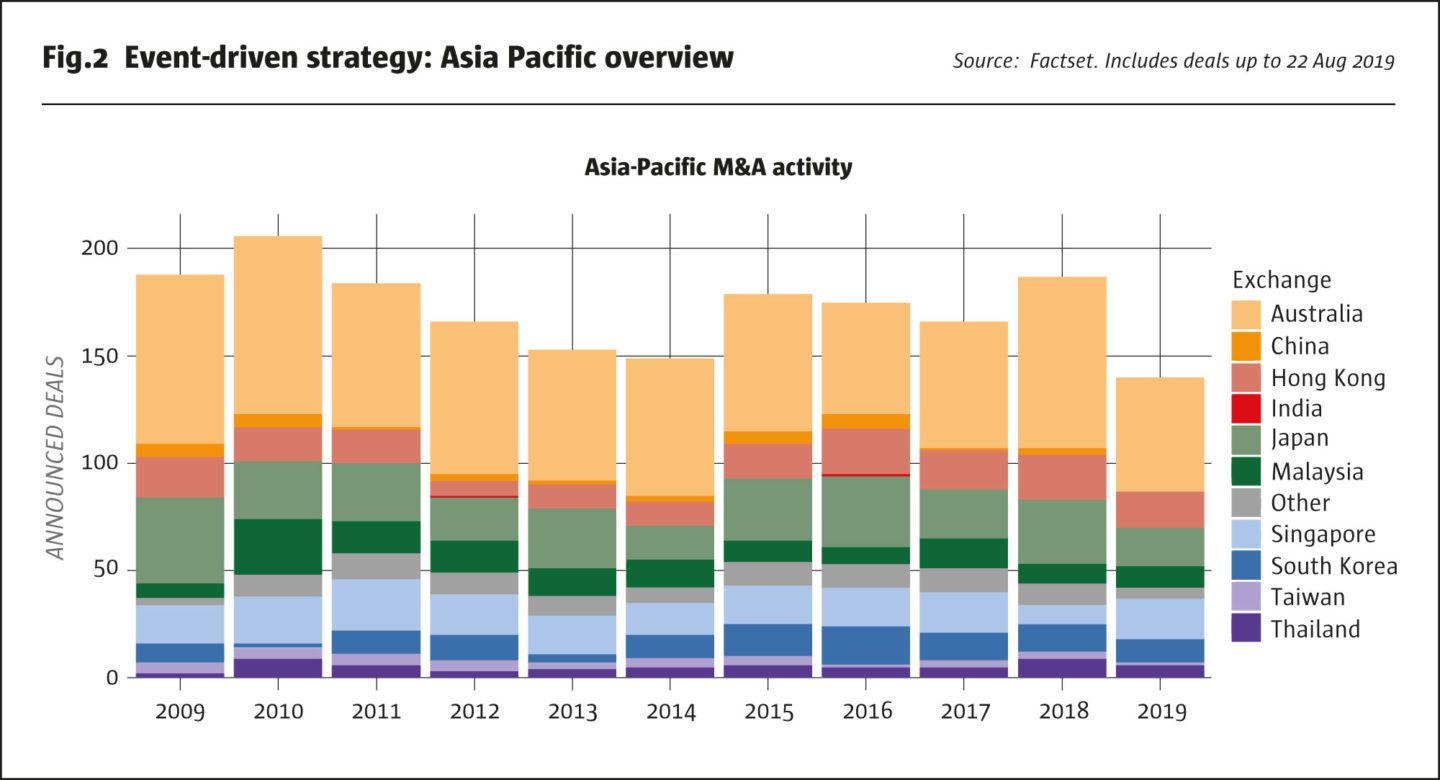

Asia Pacific typically has 150 to 200 merger deals each year. The drivers include the fact that private equity investors cannot deploy all of their assets in private markets. Companies from mainland China may find taking over a Hong Kong shell company is an easier way to obtain a Hong Kong listing than satisfying Hong Kong’s strict IPO rules. In slow-growing Japan, consolidation is a key motive as some industries such as regional banks struggle to profit.

The most active M&A market is usually Australia. Japan tends to rank second, but it has been Singapore so far in 2019. Australia and Japan are at opposite ends of the spectrum in terms of deal break risk. In Australia only 65% of announced mergers are consummated, while in Japan – where the culture prizes consensus – the proportion is over 95%.

It is partly due to high deal break risk that merger arbitrage spreads can be wider in Australia, where Metrica identified a bidding war for the largest local intellectual property services companies as an interesting situation to invest in. Analysing the deal contained elements of game theory, since one of the companies at one stage reached a position where it had the potential to veto the offer. It also involved regulatory risk since the deal needed approval from local competition regulators.

Metrica tracks around 500 holding companies in Asia Pacific, which own other listed entities. They are popular in Asia partly due to the absence of tax disadvantages that apply elsewhere. They usually trade well below their NAV. The discount can be captured through share buy backs, tender offers from the major shareholder or from third parties, restructurings, spin offs, buy backs of subsidiaries, or more attention from retail investors. Engagement with companies can help to bring about these catalysts.

The holding company strategy can sometimes morph into the merger arbitrage strategy. A Japanese company (Tosho Printing) shot up 40% after its parent, Toppan Printing, announced a takeover.

*

Pragmatic Value Investing

Finding value, quality and growth amid a “Duration Bubble”

– Jacob Mitchell, Founder and Chief Investment Officer, Antipodes

CIO Jacob Mitchell co-founded Antipodes in 2015 after spending 14 years at Keir Neilson’s Platinum Partners. ASX-listed multi-affiliate group, Pinnacle Investment Management, is a minority equity partner, which owns 23.5% of Antipodes and provides infrastructure for legal and compliance, distribution and marketing, finance, IT and operations. Antipodes manages c USD 6.1 billion across global long only, global long/short and Asia long/short strategies, all of which have beaten their benchmarks between inception in July 2015 and July 2019. Performance fees apply only to benchmark outperformance versus the MSCI All Country World Net Index for both global strategies, and against the MSCI All Country Asia ex Japan Net Index for the Asia strategy.

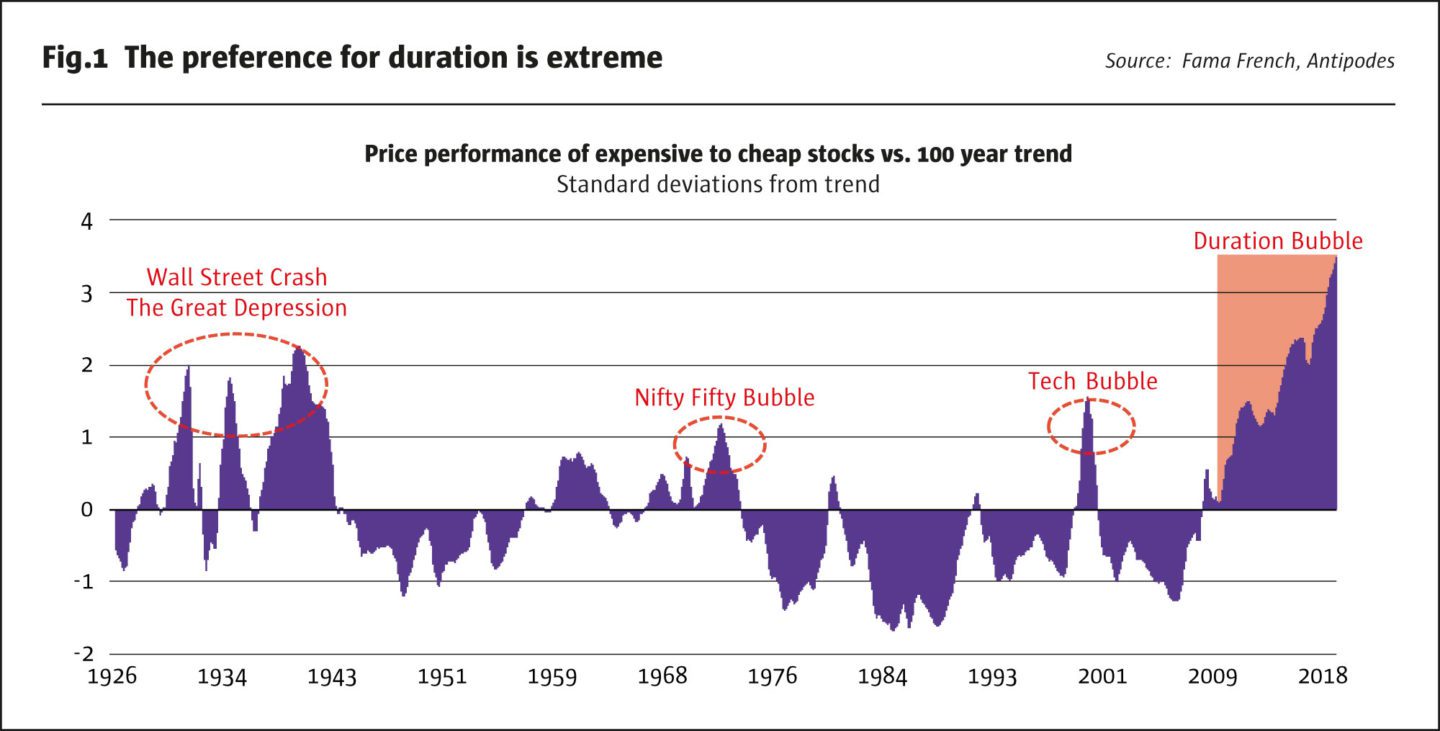

A generic value approach would have lagged benchmarks by a large margin over this period – but Mitchell’s approach is pragmatic value not dogmatic value, seeking some growth and quality in less obvious parts of the market. He views 2019’s growth-oriented equity market as ‘growth and quality at any price’: a duration bubble which is analogous to the TMT bubble of the late 1990s or the Nifty Fifty bubble of the 1970s. Equity markets have become more like bond markets. The longest duration assets with very high PE ratios have benefitted far more from lower discount rates than have stocks on lower PE ratios.

Indeed, Mitchell stresses that investors are not chasing yield per se, and the fixation with duration has thrown into sharp relief some glaring paradoxes. European banks have a dividend yield of circa 7%, while their funding cost is twenty times less at 0.35%; since 2001, these two yields have often been similar and the fixed income yield has sometimes even been higher. Granted, the banks are cyclical, and vulnerable to recession, and the latest round of ECB QE could threaten their margins, but these factors should surely also stress their fixed income obligations.

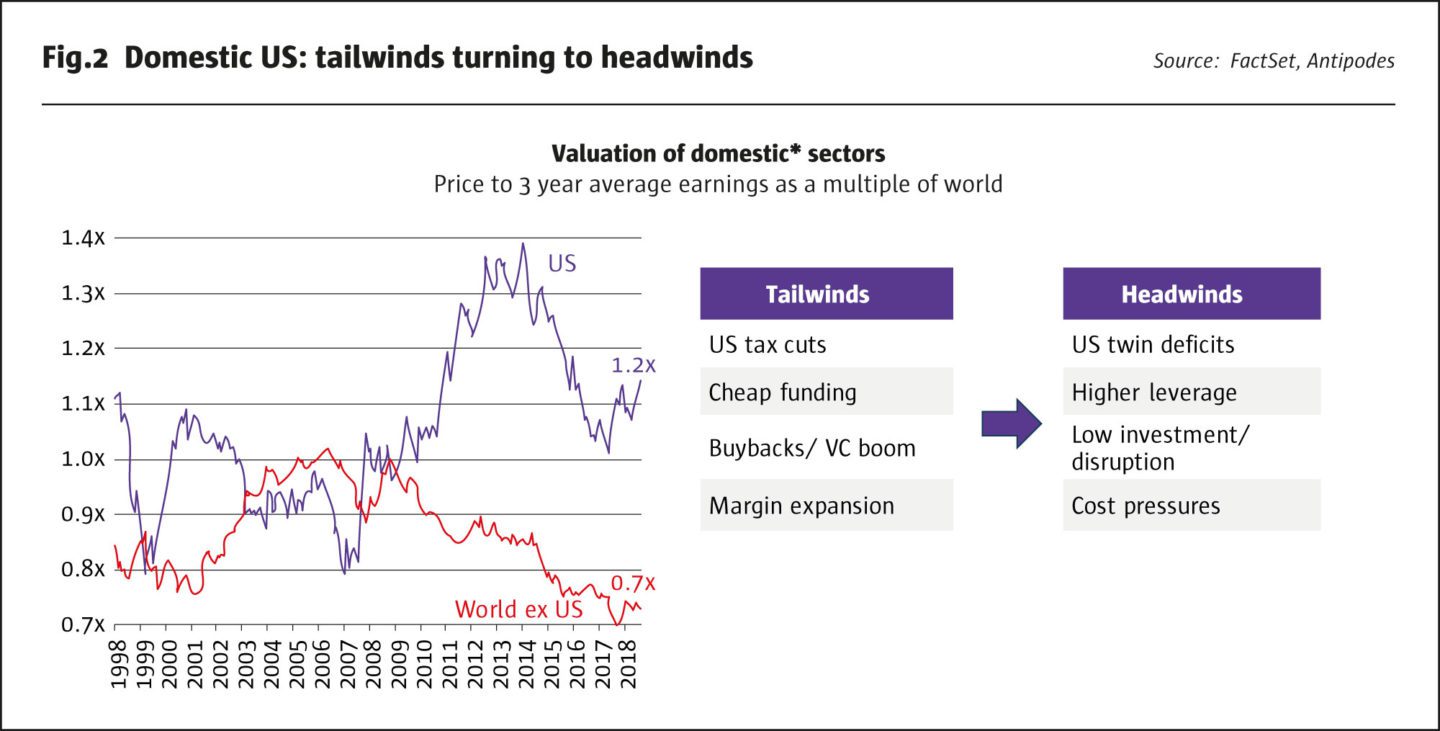

Cyclicals in general are priced for recession, and the valuation gap between cyclicals and defensives is about two standard deviations. But Mitchell is wary of taking on too much cyclical risk because it is not clear if the levers of monetary and fiscal policy will avert a recession; Europe and China have dry powder to use fiscal policy, and there is some scope for a green infrastructure spending cycle to boost Europe’s economy but it is not clear if any of these things will happen. Nonetheless, he views European and emerging market equities as generally cheap: domestic US sectors such as property and retail stand at a 20% premium to the rest of the world while the same stocks outside the US are at a 30% discount.

Antipodes covers some sectors – industrials, commodities and TMT – globally, while others – consumer and domestic services, financials and infrastructures – that are more sensitive to local regulations, are analysed regionally. The firm’s 25 professionals are split between the Sydney head office and the London office which handles US and European trading. Investment professionals are remunerated on both individual and team performance, based partly on their model portfolio performance versus the sector, and partly on their actual ideas present in funds. There is some degree of competition for capital between teams, but not to the degree that they are incentivized to try and get their ideas in the portfolio at the expense of colleagues.

The investment process seeks a margin of safety in valuations that are expected to provide an absolute return of 15%, and that are 10% better than the region or sector (opposites apply to shorts). Antipodes also looks for business resilience and sustainable competitive advantages from product, management or regulatory cycles, as well as considering a range of ESG principles. The company research process includes some web scraping for data, and selectively uses expert networks. Antipodes’ macro quantitative team assist with portfolio construction, and monitor style and macro tailwinds. There are around 12 well diversified alpha clusters, with correlated alpha clusters (long or short) restricted to around 15% exposure; pair trades can also be used to offset factor concentrations.

This process has highlighted some anomalous valuations. Given very low life insurance penetration, China’s Ping An offers a secular, structural growth story with a 20% return on equity, yet it trades at a PE ratio of 10. Similarly, Germany’s Siemens is growing at twice global GDP – thanks partly to its leadership in design automation – but the firm trades at two thirds of the market multiple. In contrast, pure play growth stories in sectors such as medical devices, automation and aerospace are trading 2.5 standard deviations above their historical average (using an EV to sales metric).

If bond yields imply very low economic growth and price in recession, then earnings growth for some companies could suffer, and valuations become much more dependent on terminal growth assumptions. It could then be dangerous to pay high valuations. Stocks such as Netflix – a short position – could be threatened by competition from Amazon, Disney and Google. Mitchell has no aversion to mega cap tech at the right price: Facebook appeals, on a PE of 15 with 20% earnings growth.

There are also valuation discrepancies within defensive sectors. Large cap pharma stock Merck trades at a PE of 17 and offers earnings growth of 12% that is double that of consumer staple stocks trading on a richer PE of 25.

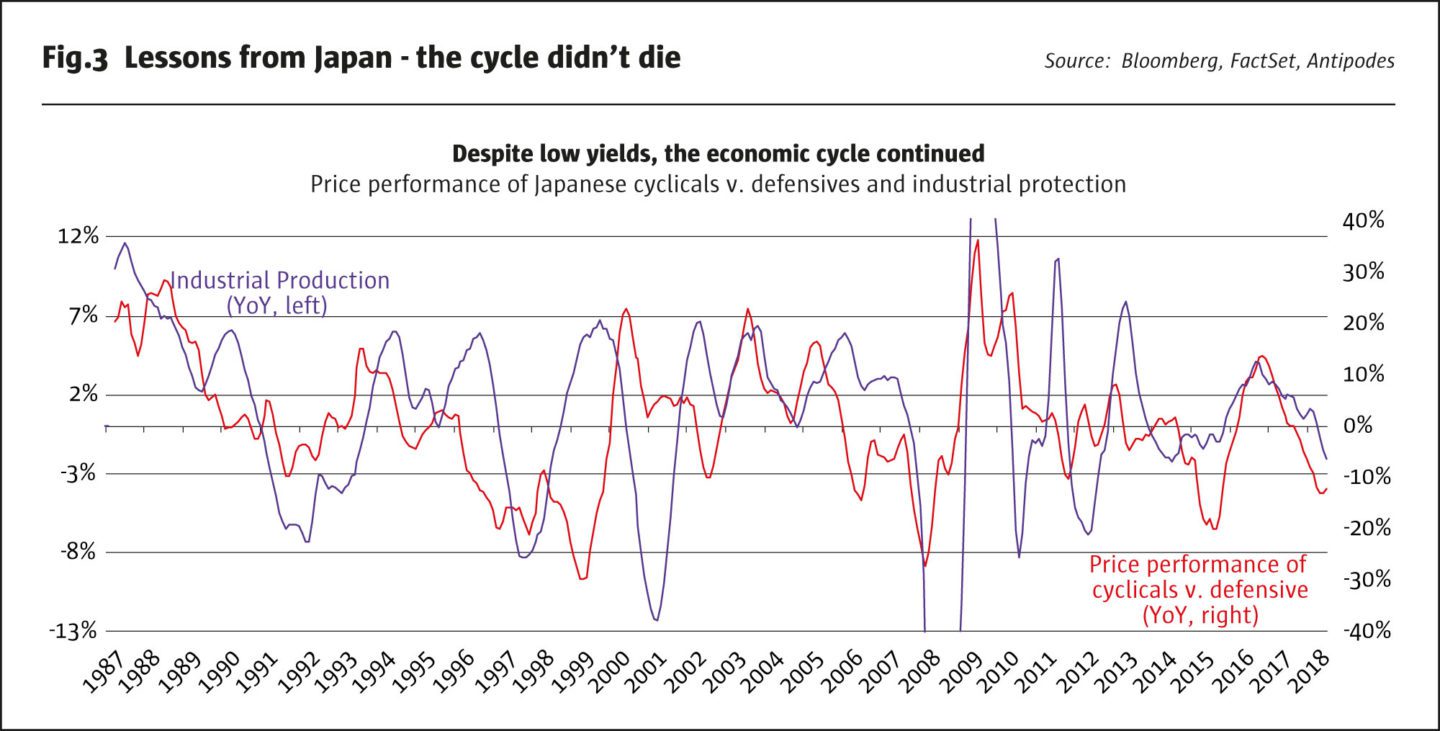

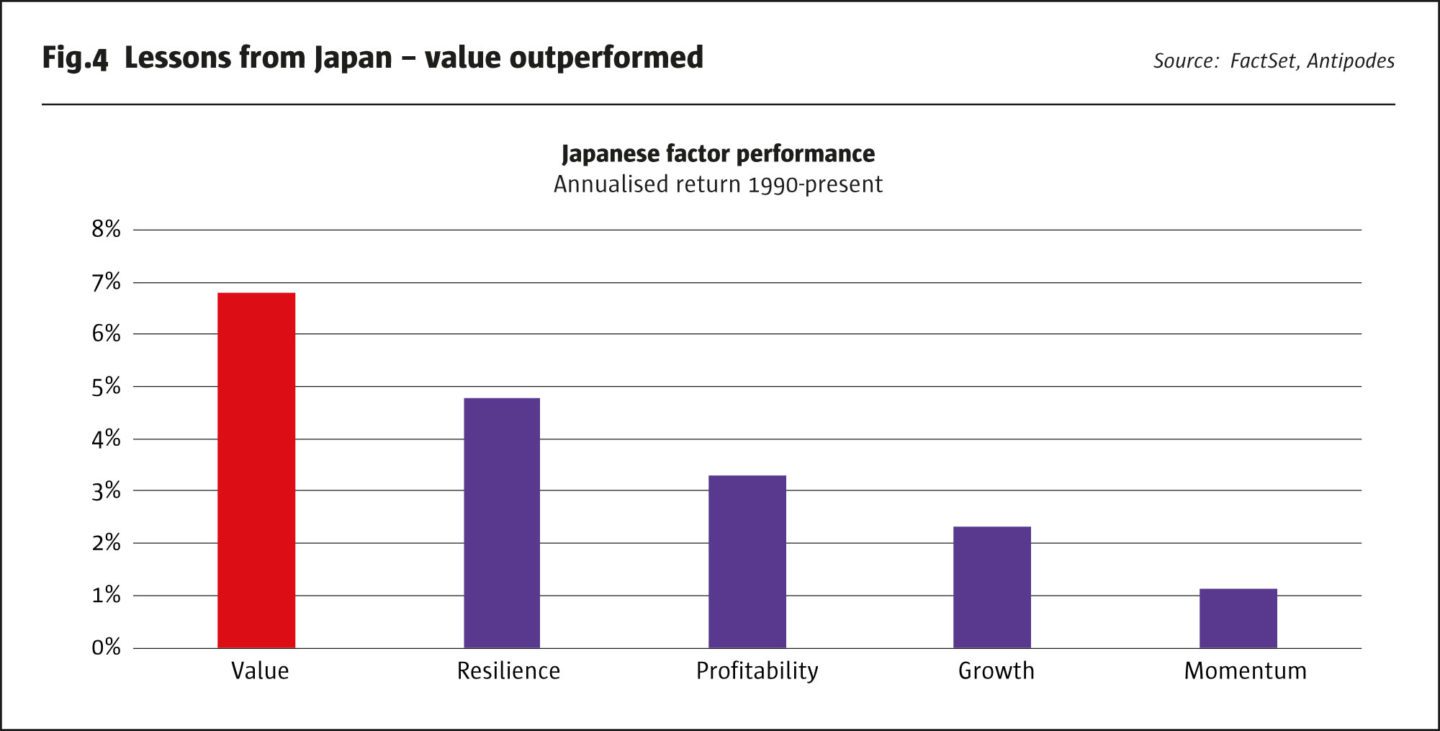

Defensives will not necessarily perform best in a slower growing economy. If Japan does now provide a blueprint for an extended period of low growth and low interest rates, this need not mean growth defensives will outperform. Mitchell has invested in Japan for 20 years and found the market rotated between cyclicals and defensives; the value style ultimately won out generating the highest returns since 1990, well ahead of growth stocks.

Mitchell’s style does not easily fit into factor buckets. Antipodes has assembled an eclectic portfolio where the long book offers above-market growth and quality at a discounted valuation, and the short book is vice versa. Long picks include Expedia, retail bank oligopolies, Sony and Alibaba.

Mitchell is cognizant of tail risks, which include populism. Portfolio hedges include short European credit crossover costing about 3% annually and Antipodes tactically buys equity put options when they are good value.

*

The Rise of Systematic Investing

From static trend-following to evolutionary models, risk premia and alternative data

– Martin Lueck, Co-Founder, Research Director and President, Aspect Capital

For its first few decades, systematic investing was pioneered by Richard Donchian’s Futures Inc. in 1949; commodity floor traders John Henry, who now owns sports teams, and Richard Dennis, who started the Turtle Traders; and Larry Hite’s MINT investment management company, which was brought into Man Group (then EDF & Man) and was probably the first billion dollar hedge fund. Though these strategies were highly innovative in their heyday, they were based on static rules. Lueck, together with fellow scientists David Harding and Michael Adam, formed AHL, which was also bought by Man Group, and developed a more evolutionary approach: expanding the investment universe, trading over more time frames, and adapting the trading systems to different volatility regimes.

In 1997, Lueck co-founded Aspect, which aimed to cater for institutional investors by offering more transparency and lower fees. The 2 and 20 model was, at that time, well below typical fees on managed futures strategies, which had been as high as a 6% management fee, a 15% incentive fee and substantial commissions.

Of course, some types of systematic strategies can now be accessed for a flat management fee with no performance fee, partly because perceptions of alpha and beta have changed over the decades. Generic factor exposures such as value, momentum and carry, are now perceived as forms of alternative beta or risk premia that are more scalable and available at lower fees. Yet Lueck is of the opinion that even these widely recognised strategies are hard to do well: some pension funds that have attempted to replicate risk premia approaches in-house have been disappointed with the results and have reverted to using specialist systematic managers. Risk premia strategies still require continuous research, and effective portfolio construction, in order to execute well. Indeed, if some individual risk premia or alpha streams are decaying as they become more widely adopted, the need for improved portfolio construction becomes even greater – to maintain a reasonable level of portfolio returns by combining lowly correlated strategies that might no longer be as attractive on a standalone basis. Even so, if returns from some risk premia have declined, they remain positive and the rationale for their persistence is partly based on the biases identified by behavioural finance. These include loss aversion: the tendency of investors to take small profits (often prematurely) while they struggle to cut losses with a small loss. Probability mis-estimation is another bias that lies behind purchases of lottery tickets. Recency bias leads investors to chase recent winners, as does herd mentality. Aspect has had a strong year in 2019 to September, partly because it continued to hold fixed income assets that were appreciating into new territory in terms of negative yields, which are outside the frame of reference and comfort zone of some investors. Making decisions free from behavioural biases is one benefit of systematic investing. Others include risk management, scalability and consistency. The ability to formulate and test hypotheses also appeals to many investors.

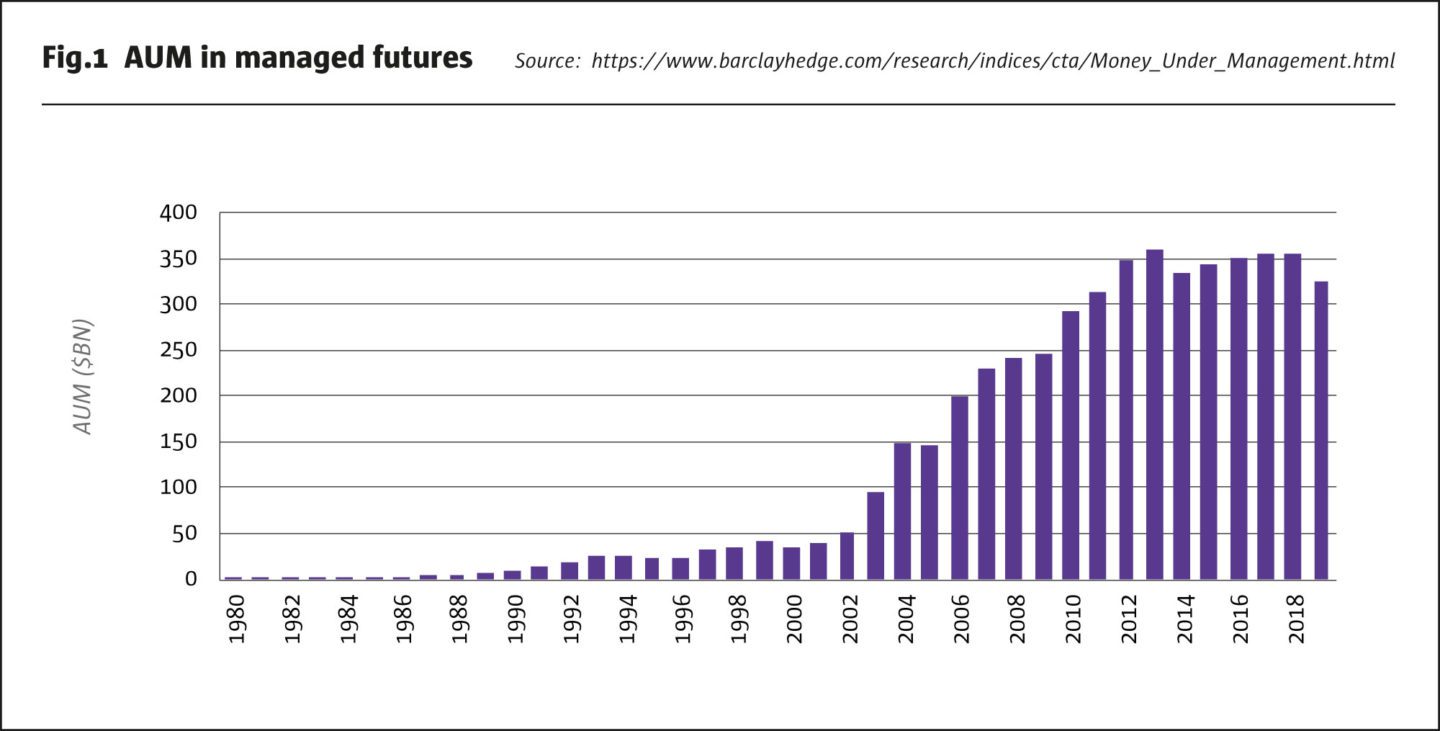

Managed futures assets have grown from under $1 billion in the 1980s to circa $350 billion today as the benefits of systematic investing are more widely understood. Inflows into systematic strategies have risen from 5% to 71% of the total for hedge fund strategies, according to “The Rise of the Machines”, published by Barclays in 2017.

Systematic investing is garnering more inflows partly because technology and computing power is becoming more widely appreciated, in what Lueck dubs a decline in algorithm aversion. Technology helps managers to extract insights from growing volumes of alternative data, which could include satellite telemetry on shipping, consumer behaviour, or “nowcasting” techniques such as using trade data as a proxy for GDP forecasts. For instance, a fundamental valuation model using new data inputs has generated vastly superior performance.

Of course, the alpha from these signals may decline as they become more widely disseminated, so there is an ongoing battle to stay ahead of the competition. Aspect finds alternative data offers opportunities, but also challenges. It holds the potential for exploiting growing breadth of higher frequency data inputs, albeit with shorter histories. It can be widely applicable across asset classes and industries, but requires appropriate infrastructure and expertise to manage; Aspect has over 70 staff in R&D.

Aspect has grown its own assets – to circa $8 billion – by offering its client base outcome-based solutions. Aspect is offering clients a range of building blocks that can facilitate their strategic investment decision making by responding in a predictable way. These range from relatively transparent risk premia strategies to alpha strategies that must remain somewhat opaque in order to protect the intellectual property.

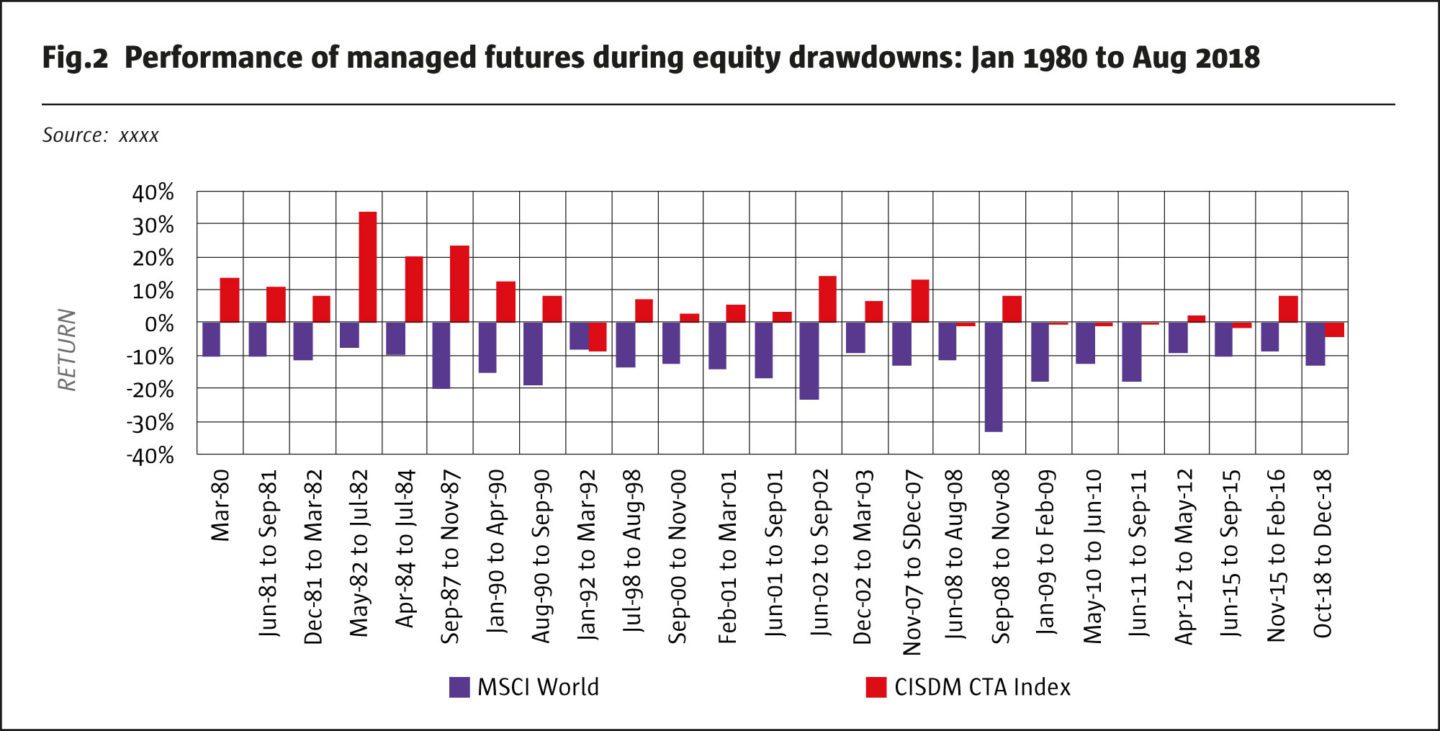

For instance, US pension funds that are heavily exposed to equities want a strategy that could offer diversification benefits. Managed futures has, on average, done so, but Lueck stresses that this quality is partly path dependent: the strategy is more likely to perform well in a slow, grinding bear market lasting at least a few months, than during a sudden reversal.

Having often started with trend following, clients may now opt for systematic macro, shorter term trading strategies, alternative markets, currency overlays or various combinations thereof in multi-strategy programmes, benefitting from execution and fee efficiencies. Across all its strategy offerings, Aspect is continually improving its process through expanding market access, employing alternative data inputs, leveraging machine learning techniques and improving risk management. Aspect’s ongoing research projects include market microstructure modelling; risk management in terms of position sizing and risk targeting; portfolio diversification and risk budgeting, and algorithmic execution.

Biographies

Marcus Storr

Marcus Storr joined FERI in 2005. As Head of Alternative Investments, he is responsible for the hedge fund and private equity portfolio management, manager selection and due diligence within FERI’s asset management department. He is also responsible for the alternative investment client reporting. He started his career in 1994 as an advisor to UHNWI before moving to London in 1998 joining the Investment Banking division of Robert Flemings Ltd. (acquired by JPMorgan). Until 2003 he was a Director within the Global Equities department of Dresdner Kleinwort Wasserstein in London. He has over 25 years’ experience in capital markets, corporate transactions and manager selection. He has written several articles and book chapters on hedge funds which have been published in professional journals and industry magazines. He holds a master’s degree in Finance/Capital Markets and International Management/Economics from Humboldt University Berlin.

Carson Boneck

Carson Boneck, CFA, is the Chief Data Officer at Balyasny Asset Management (BAM) where he is responsible for data sourcing, data science, webscraping and data engineering across all of the firm’s strategies. He joined BAM as a Director of Quantitative Research in 2016, building and overseeing a research team which created systematic strategies for the firm’s discretionary long/short investors. Prior to BAM, he was the Global Head of Investment Management & Quantitative Research at S&P Global Market Intelligence (formerly Capital IQ) for eight years and founded the Capital IQ’s Quantamental Research team. For ten years prior, he was a quantitative researcher, specializing in listed equities, at several sell-side firms. He began his career in management consulting specializing in company valuation, corporate finance, and M&A advisory. He is an Indiana University graduate and a CFA charterholder.

Damian L. Edwards

Damian L. Edwards, CFA, is the co-founder and Chief Investment Officer of Metrica Partners Pte. Ltd., a Singapore-based manager of investment strategies focusing on event-driven and relative value opportunities. Prior to co-founding Metrica, he was Managing Director and Head of Event-Driven Trading in the Discretionary Capital Group of Royal Bank of Canada, where he built a pan-Asian event-driven and relative value equity trading business in Hong Kong. Prior to that he was a portfolio manager in the Strategic Investment Group of Morgan Stanley, where he managed a pan-Asian event driven and relative value multi-asset class trading book from Hong Kong as part of the global proprietary trading group. Prior to that he was a Quantitative Analyst in the Research Department of Jardine Fleming Securities in Tokyo. He received an MBA with Distinction from London Business School in 2002, and an MA with Honours in Computer Science and Law from the University of Cambridge in 1994. He has also passed the highest level of the Japanese-Language Proficiency Test.

Jacob Mitchell

Jacob Mitchell is Chief Investment Officer at Antipodes, which he founded in March 2015. Prior to this, he spent 14 years at Platinum Asset Management where he was most recently the Deputy Chief Investment Officer and a portfolio manager of the flagship Platinum International Fund. On resigning from Platinum in November 2014, he had direct portfolio management responsibility for over $3.5bn in AuM and was responsible together with the CIO for the firm-wide ($25bn in AuM) implementation of the investment process. From 1996 to 2000, he was Head of Technology and Emerging Industrials Research at UBS Warburg Australia. He commenced his investment career in 1994 as a trainee investment analyst at high conviction, value-oriented Australian equities manager, Tyndall Australia. He holds a Bachelor of Commerce from the University of Western Sydney.

Martin Lueck

Martin Lueck co-founded Aspect Capital, the $6.9bn London-based systematic investment manager, in September 1997. As Research Director, he oversees the research team responsible for generating and analysing fundamental research hypotheses for development of all Aspect’s investment programmes. He is also a member of Aspect’s Investment Committee. Prior to founding Aspect, he was with Adam, Harding and Lueck Limited (AHL), which he co-founded in February 1987 with Michael Adam and David Harding. Man Group plc completed the purchase of AHL in 1994 and he left in 1996. At AHL, he was instrumental in developing AHL’s trading systems and approach to research as well as the proprietary software language that provided the platform for all of AHL’s product engineering and implementation. From May 1996 through August 1997, he was on gardening leave from AHL during which time he helped establish his wife’s publishing business, Barefoot Books. Previously he was a Director of Research at Brockham Securities Limited, a London based commodity trading advisor. He serves on the Board of the National Futures Association. He holds an M.A. in Physics from Oxford University and currently serves as Chair of the Oxford Physics Development Board.

Marcus Storr joined FERI in 2005. As Head of Alternative Investments, he is responsible for the hedge fund and private equity portfolio management, manager selection and due diligence within FERI’s asset management department. He is also responsible for the alternative investment client reporting. He started his career in 1994 as an advisor to UHNWI before moving to London in 1998 joining the Investment Banking division of Robert Flemings Ltd. (acquired by JPMorgan). Until 2003 he was a Director within the Global Equities department of Dresdner Kleinwort Wasserstein in London. He has over 25 years’ experience in capital markets, corporate transactions and manager selection. He has written several articles and book chapters on hedge funds which have been published in professional journals and industry magazines. He holds a master’s degree in Finance/Capital Markets and International Management/Economics from Humboldt University Berlin.

Carson Boneck, CFA, is the Chief Data Officer at Balyasny Asset Management (BAM) where he is responsible for data sourcing, data science, webscraping and data engineering across all of the firm’s strategies. He joined BAM as a Director of Quantitative Research in 2016, building and overseeing a research team which created systematic strategies for the firm’s discretionary long/short investors. Prior to BAM, he was the Global Head of Investment Management & Quantitative Research at S&P Global Market Intelligence (formerly Capital IQ) for eight years and founded the Capital IQ’s Quantamental Research team. For ten years prior, he was a quantitative researcher, specializing in listed equities, at several sell-side firms. He began his career in management consulting specializing in company valuation, corporate finance, and M&A advisory. He is an Indiana University graduate and a CFA charterholder.

Damian L. Edwards, CFA, is the co-founder and Chief Investment Officer of Metrica Partners Pte. Ltd., a Singapore-based manager of investment strategies focusing on event-driven and relative value opportunities. Prior to co-founding Metrica, he was Managing Director and Head of Event-Driven Trading in the Discretionary Capital Group of Royal Bank of Canada, where he built a pan-Asian event-driven and relative value equity trading business in Hong Kong. Prior to that he was a portfolio manager in the Strategic Investment Group of Morgan Stanley, where he managed a pan-Asian event driven and relative value multi-asset class trading book from Hong Kong as part of the global proprietary trading group. Prior to that he was a Quantitative Analyst in the Research Department of Jardine Fleming Securities in Tokyo. He received an MBA with Distinction from London Business School in 2002, and an MA with Honours in Computer Science and Law from the University of Cambridge in 1994. He has also passed the highest level of the Japanese-Language Proficiency Test.

Jacob Mitchell is Chief Investment Officer at Antipodes, which he founded in March 2015. Prior to this, he spent 14 years at Platinum Asset Management where he was most recently the Deputy Chief Investment Officer and a portfolio manager of the flagship Platinum International Fund. On resigning from Platinum in November 2014, he had direct portfolio management responsibility for over $3.5bn in AuM and was responsible together with the CIO for the firm-wide ($25bn in AuM) implementation of the investment process. From 1996 to 2000, he was Head of Technology and Emerging Industrials Research at UBS Warburg Australia. He commenced his investment career in 1994 as a trainee investment analyst at high conviction, value-oriented Australian equities manager, Tyndall Australia. He holds a Bachelor of Commerce from the University of Western Sydney.

Martin Lueck co-founded Aspect Capital, the $6.9bn London-based systematic investment manager, in September 1997. As Research Director, he oversees the research team responsible for generating and analysing fundamental research hypotheses for development of all Aspect’s investment programmes. He is also a member of Aspect’s Investment Committee. Prior to founding Aspect, he was with Adam, Harding and Lueck Limited (AHL), which he co-founded in February 1987 with Michael Adam and David Harding. Man Group plc completed the purchase of AHL in 1994 and he left in 1996. At AHL, he was instrumental in developing AHL’s trading systems and approach to research as well as the proprietary software language that provided the platform for all of AHL’s product engineering and implementation. From May 1996 through August 1997, he was on gardening leave from AHL during which time he helped establish his wife’s publishing business, Barefoot Books. Previously he was a Director of Research at Brockham Securities Limited, a London based commodity trading advisor. He serves on the Board of the National Futures Association. He holds an M.A. in Physics from Oxford University and currently serves as Chair of the Oxford Physics Development Board.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical