A cover of The Economist newspaper this month points out that Japan is changing. Regular readers of our research will know that this has been GFIA’s thesis for several years.

Socially, the Japanese have been readying for change for many years. Younger Japanese can’t find jobs in big companies, as inflexible labour restrictions mean that “jobs for life” are decreasing in favour of temporary and flexible work. While some will be consigned to flipping burgers and serving coffee, many are becoming unwitting entrepreneurs, forced to be creative in different ways to build their lives, incomes, and careers. Immigration remains taboo, and tantamount to political suicide in an extraordinarily homogenous society, but you’ll find Chinese students working in the fields, Korean interns in the kitchens, and Indian service workers on god-knows-what-visas in the big cities (not counting the mandatory muscle-bound black bouncers outside Roppongi clubs). Visa application processes appear to have been streamlined, and application turnround times have fallen dramatically.

We’re familiar with educated young Singaporeans who, seeing the success of their parents’ generation, are inherently inclined to conservatism and risk avoidance. Their counterparts in Japan look back at their parents with a “whatever we do, we must do things differently” perspective; culturally conformist, hard working, disciplined, and focused, they have a streak of independence and an appetite for risk almost unique amongst Asia’s privileged youth – and without the privileged sense of entitlement of most young people in developed Asia.

Abe probably won’t win too many big battles. Japan doesn’t do confrontation well at the best of times, and Abe knows he has to measure the rate of expenditure of his political capital carefully. He’s unlikely to stake everything on, for example, a fight with the farmers in the same way that Margaret Thatcher bet the ranch on a showdown with the mining unions. He’s already capitulated on agricultural land reform. But expect a constant trickle of smaller wins. We’re seeing, for example, government statistics being published much more quickly than a few years ago. And the pressure on the banks to push out mortgage lending is beginning to feed through into urban real estate prices.

This isn’t a riskless exercise. The Bank of Japan (BoJ) is re-defining QE, and public sector borrowing is at dangerous levels. Private sector balance sheets are, however, hugely underleveraged – so at some point the government is going to have to transfer private sector wealth to the public sector. At the moment that looks to be via targeted inflation, but inflation, once entrenched, is hard to control – and in any case may not be enough. So the potential for socially destructive pain is very real. Although the demographic picture is stabilising, Japan is still a shrinking country and it’s hard to see how that could translate into universal dynamism. Japanese commentators agree that Abe’s push for a newer, stronger, Japan is driven by a fundamental nationalism, and that as (if?) Japan revitalises he will push for a much more robust international policy; in the face of a China desperate to become strong before it, too, becomes old – and, with the history between the two countries, that could be dangerous.

But for now, Japan is edging its way back into the game. This time, it is different.

MANAGERS REVIEW

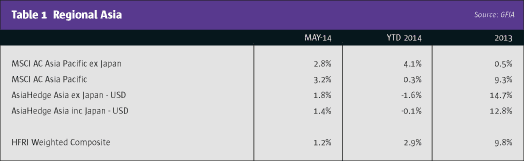

Regional Asia

Political factors took centre-stage in much of Asia in May. In India, the election of Bharatiya Janata Party’s Modi was well received by investors with many seeing a new era for the country if promised reforms take hold. Thailand saw the army declare martial law before staging a coup, while in Indonesia the focus remains on the impending presidential elections. Despite a bilateral dispute with its neighbour Vietnam, China outperformed, helped by the government’s targeted fiscal and monetary moves in response to slower economic growth.

Asia equity markets had a strong month with MSCI Asia Pacific gaining 3.2%. ASEAN equity markets continued their positive performance with the exception of Vietnam VN down 2.5% and the Philippines PSEi down 0.9%, giving up some of their earlier gains. Indonesia JKSE was up 1.1%, Singapore STI up 1.0%, Thailand SET up 0.1% and Malaysia KLSE up 0.1%.

Equity managers among the biggest returns

Most of the Asia Pacific managers managed to generate substantial returns above the index (as tracked by AsiaHedge Asia inc Japan 1.4%) during the month. The outperformers in the month include stock-pickers like New Harbour Asia (3.4%), NT Asia Discovery (3.4%) and Albizia ASEAN (2.6%) where the latter’s Thailand holdings actually benefited from the coup.

Other Asian country specialists also benefited from the region’s upward momentum this month. Doric Small Caps (12.9%), in particular, is one of the few small cap managers with an active short book. The fund harvested handsome gains from their positive tactical stance in India as well as short positions in Australia, China and South Korea. Kelusa Asia (-6.4%) is one of the negative outliers in May as they had negative returns coming from both their long and short books. With a -6.6% loss generated from stock-picking, the rally in May was unable to buoy the fund above water.

Event driven and credit funds lagged but were mostly still positive

Compared with their long-biased equity peers, event driven funds generally reported lacklustre returns for May. Athos Asia (0.7%) had a decent month as a number of high-conviction positions matured during the month in addition to an increase in dual-listed arbitrage opportunities in the portfolio. Australia has also once again become the single biggest gross exposure market for the fund, primarily due to significant renewed deal activities which provided compelling opportunities for the fund. Imperia Asia, which also has a 62% overweight to Australia, ended the month with 0.44%. Pengana Asia Special Events (0%) fund ended the month flat as positive performance during the month was curtailed by a deal break in a Hong Kong M&A event.

Asian credit markets showed positive returns for May, helped by continued strength in US rates, further stimulus measures from China, and a less active primary market following April’s record issuance. The combination of a US treasury rally and a possible QE from Europe fuelling demand for Asian Credit products has propelled Sentosa and Tahan Asia Opportunities’ return to 1.5% and 1.3%. Positive performance drivers for Income Partner’s IP all Seasons Asian Credit (1.6%) are credit carry and CDS hedges.

Macro and multi-strategies funds suffered

Nevertheless, not all funds were rejoicing at the end of May. Macro and multi-strategy funds recorded most of the negative outliers for the month. Funds such as Alphadyne Asia (-0.5%), Octis Asia Pacific (-0.5%) and Phalanx Japan AustralAsia (-1.8%) suffered in the range-bound market conditions. Counterpoint Asia (-0.5%) remains cautious in this choppy, sideways market by keeping stop limits tight and running a fairly balanced book.

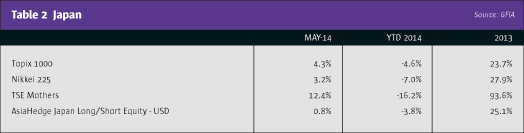

Japan

The Topix 1000 rose 4.3% in May as Japanese stocks regained a robust momentum from a lower valuation perspective and from the realisation that the negative side of the consumption tax increase has already been factored in to prices. TSE Mothers surged 12.4% as Japanese small cap companies were also buoyed up by across-the-board favourable sentiments, although the companies’ earnings forecasts remained conservative.

Mixed results from Japanese managers with specific stock issues affecting returns and some funds were penalised for their cautious positioning.

Given the positive momentum, most managers reported impressive returns, although some of the managers saw their returns suppressed by losses on the short book. The Monterey Japan Equity Fund inched 1.2% as most of the gains from the long side were erased by losses from the short side which also includes futures hedges. The APS Japan Alpha Fund returned 2.2% as two of their pharmaceutical portfolio companies recorded positive performance, mounting expectations for higher earnings growth as a result of new products in pipeline. UMJ Kotoshiro maintained its positive streak with a 3.1% return as small and mid-caps positions produced a considerable contribution on the long side. Its short positions on biotechnology-related names have shifted to negative amidst the short covering during May. This short covering in biotechnology and pharmaceutical names also dragged Four Season’s (-2.8%) portfolio into the negative territory. The portfolio manager expects Japanese retail stocks to face disappointments due to bad summer weather caused by the El Niño event as well as consumers’ failure to catch up with continuing price hikes.

Akito had their fourth flat month with a reported 0.3%. The fund’s loss accumulated due to loss cutting of some of their names which had lower liquidity in the current market. Also, their short positions were affected as names which have been shorted due to bad fundamentals recovered during the latter half of the month. Despite bringing down risk on both sides of the portfolio, Shin-Ka Fund fell 1.1%. The portfolio manager expects the new fiscal year guidance will be conservative, and that changed his sentiment on the small and mid-caps to negative.

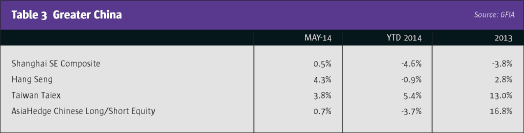

Greater China

Sluggish performance from Greater China managers

The market staged a rebound in the month as sentiment started to improve in May as market participants were expecting a Required Reserve Ratio (RRR) cut and more substantial stimulus from the government. The improvement of external economics also underpins the recovery of China’s exports and the related value chain. Hang Seng advanced 4.3% while the Shanghai Composite Index moved in a very narrow range in May with a lull performance and ended the month up 0.5%. Managers underperformed the offshore index as AsiaHedge Chinese Long/Short Equity returned 0.7%.

Acru+ China posted a marginally positive performance of 0.04% with the portfolio managers holding a relatively low gross exposure of 97%. They expect the market to be locked in a trading range before the macro picture and policies become clearer. Spring China (1.7%) has also been keeping a low gross exposure in recent months as the portfolio managers continue to take profit and cut exposure on the real estate sector. While the portfolio managers expect an overall downbeat market sentiment, they have identified a few short-term thematic opportunities that they could allocate to. Pinpoint China (0.6%), on the other hand, is more optimistic about China’s economy which they expect will bottom out around October.

Quam China Focus Segregated Portfolio (2.0%) finally saw a breather after two consecutive months of sharp drawdown. The portfolio remains overweight TMT and clean energy as both sectors have positive prospects not only in China, but globally. Greenwood’s Golden China Fund (2.1%) also jumped back into positive territory after two months of bloodshed; the performance was primarily driven by the long positions in tourism, TMT and energy sectors.

Both Pure Heart Natural Selection (0.4%) and Open Door China Absolute Fund (0.7%) had a sluggish month with few activities as the managers continue to hold a defensive stance towards the current market. The latter is keeping a high cash position to be deployed opportunistically during trust defaults which are expected to surface as the number of trusts maturing reaches a peak in May and June.

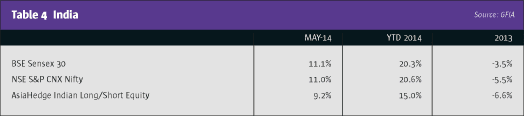

India

Investors in India are enjoying the rally

India’s Sensex and Nifty surged 11% respectively on the back of a landslide victory for the Narendra Modi-led Bharatiya Janata Party. The election result is expected to herald a sea change for India’s economy which has struggled with stagflationary-type conditions over the past few years. Managers across the board generated remarkable returns (as measured by AsiaHedge Indian Long/Short Equity Index: 9.2%) on the back of this huge beta rally. As expected, given that Indian managers are congenitally bullish about the long-term secular growth of India, long-only funds lead the pack in posting stellar performance. The IndiaCapital Fund and the Alchemy India Long Term Fund gained 17.5% and 13.5% respectively.

Emerging markets

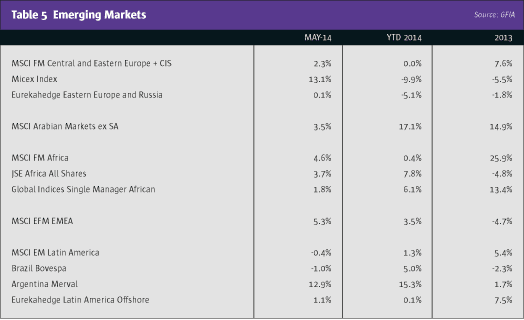

Emerging markets mostly rallied with Russia being the obvious outperformer

Russia had its best one-month performance since October 2011. The political tension between Russia, Ukraine and the international community abated somewhat over the month. Kazimir Russia Growth outperformed the Micex Index (13.1%), helped by its overweight in the consumer and IT sectors.

The Brazil equity market, on the other hand, fell as a result of the negative performance of the financial and mining sectors. Performance between managers was more dispersed. Brasil Capital Equity Fund and BTG Pactual PAR Plus led the pack with 2.0% and 2.1% respectively. BNY Mellon ARX Brazil Fund went under water with a -0.5% return and gross exposure of 167%.

MENA managers were largely positive with favourable capital market events

Although the MENA region was volatile throughout the month, the MSCI Arabian Markets ex SA and the S&P Pan Arab Index closed the month up 3.5% respectively. Turkey’s Istanbul-100 Index surged 8.4% (in USD terms). Saudi Arabia was a main performance contributor to Arqaam Capital Value Fund (2.6%) and Al Mal MENA Equity Fund (1.6%). With the inclusion of UAE and Qatar in the MSCI Emerging Index, Arqaam remains positive on selective UAE names, especially those revolving around improving bank asset quality, falling non-performing loans and cost of risk. Unlike its peers, Duet MENA Horizon Fund (0.8%) derived almost half of its positive performance from Egypt, in particular from a real estate developer.

Nigeria was the top performing market with a gain of 6.5% while Zambia was the worst performing market, shedding 7.8%. Enko Opportunity Growth Fund went down 1.2% while Altree (1.0%) held up better. Duet Africa Opportunities (2.2%) had a good run as holdings in most countries generated positive returns, in particular, Nigeria, Kenya and Zambia.

Funds to date

In June, China’s central bank announced to cut the Required Reserve Ratio (RRR) of certain China banks by 50bps again. This is the second time of RRR cut within a short period. China equities reacted positively to the RRR cut, with H-shares outperforming A-shares after the market opened.

The upward trend was short-lived as Hang Seng (-0.1%) and Shanghai Composite (-0.1%) gave back all gains towards the end of the month.

Japan and India, however, continued their positive momentum from May as Topix and MSCI India posted a 3.7% and 2.9% MTD. The estimates we’re seeing from managers are mostly positive, even for managers investing in Asia ex Japan which reported flat interim return of 0.3%.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical