The structural shift in global wealth, accelerated by the credit crunch has turned the established order upside down. The result is that emerging markets have stronger economic and financial fundamentals than developed markets. Emerging market debt ratios in both the private and public sectors are substantially lower, while economic growth rates are considerably higher. All this makes the creditworthiness of emerging market sovereign bonds much higher than previously. J.P. Morgan, for example, estimates that around 60% of emerging countries are now rated investment grade compared with just 2% in the early 1990s. The ratings changes of sovereign debt amplify this story. During 2011, emerging countries experienced 35 upgrades, while developed countries had 32 downgrades. In addition, over the past five years J.P. Morgan estimates emerging market reserves have doubled to $8 trillion, while developed countries have gorged on debt.

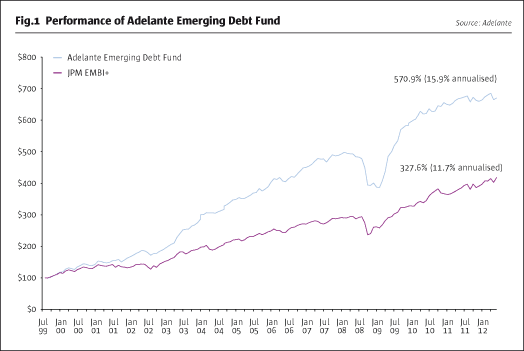

All these factors underscore the opportunity set targeted by the Adelante Emerging Debt Fund. The fund has shown strong returns since inception in mid-1999 (See Fig.1) with an annualised gain of almost 16%. Julian Adams is the Chief Investment Officer, heading a six strong investment team with broad emerging market experience. Adams has traded emerging markets for over two decades. He launched the Emerging Debt Fund at Aberdeen Asset Management in 1999 before spinning out and selling to Threadneedle from whom Adams bought back the business, naming it Adelante (Spanish for ‘Moving Ahead), in March 2009.

Permanent wealth shift

“The strategy is looking to participate in what is a permanent shift of wealth from developed markets to emerging markets,” says Adams. “That movement underscores the support for emerging market debt as an asset class.”

The investment team look at emerging market sovereign bonds, focusing on improving and deteriorating credits or rates, either in dollar or local currency issues. The aim is to understand each country in its particular historical and development context to work out how to position an investment by going long, short or flat. Given the improving financial conditions of most emerging market countries and the subsequent strength of their sovereign credits, the fund has a long bias. But the investment team will also take short-term top down views that can see long or short positions opened at any time. Gross and net exposures are actively managed. The core portfolio is generally 40-60% of net asset value. These comprise bottom up situations that they feel will play out over the medium term – some two to 12 months. In late July, the fund was long Nigerian local currency one year treasuries yielding 18%. Adelante opened the position following government reform of petroleum subsidies reasoning that the cut in government spending would have a positive impact on Nigeria’s sovereign debt. “This is a steady state situation,” says Adams. “There is no event that caused market distress. It is just a superb opportunity that has arisen.”

Wagering on Argentina

The fund has substantial exposure to Argentina with around 9% of the portfolio allocated there. The position was opened following a 15% sell-off in dollar denominated Argentine treasuries after the government expropriated Repsol’s local subsidiary and investors feared policy changes relating to the repayment of dollar denominated local-law bonds which were actually targeted at real estate transactions. Adelante reckoned that strong soy bean exports would continue to bring in dollars and that the bonds were oversold. The fund also went long on Peruvian sovereign debt during a period of negative market sentiment following the 2011 election of Ollanta Humala as president. The investment team thought the event offered a good opportunity to invest in local currency bonds.

“The great thing with emerging markets is that there are many events and situations like this coming up all the time,” says Adams. “The opportunity set is increased by us looking at both the local and external debt markets.”

In Asia, the fund is playing the relationship of the South Korean won and the yen where there is a long run average of 11 won to the yen. But as the won sold off and the yen rallied on the Bank of Japan introducing its own form of quantitative easing, the cross rate has gone out and is around 14.5. In response, the fund has gone long the won and shorted the yen to play the expected reversion.

Revisiting the 1980s

Adams draws an interesting parallel between Europe now and Latin American in the 1980s. Debt ratios are going up and growth is pitifully low. European states, notably Greece, are borrowing to service foreign debt just as occurred under the Baker plan. When this failed in the late 1980s, the Brady plan imposed hair cuts on creditors and replaced floating rates with fixed rates. With access to international finance restored, emerging market growth was kicked started.

While Greece may not be ready for its own Brady plan just yet, Adelante has taken a small long position in Greek sovereign credit. Greek bonds with long maturities issued under the private sector debt restructuring in March are trading at 14 cents on the euro with the yield across a basket of bonds running at 25%. Adams has been encouraged by the post-election budget cuts, a renewed privatisation push and the return of money to the Greek banking system from overseas. All of this has helped Greek sovereign debt prices inch up. “It follows the theme of identifying a situation, seeing how things can improve and then waiting for it to happen,” says Adams. “With emerging market analysis, it is very political. Getting that right is at least 50% of what you need. Politics is often a game changing event in emerging markets. It is a question of seeing these things coming and understanding the incentive structure facing a political leader.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical