AE Capital defies easy categorization. Its use of quantitative analysis may lead some allocators to bucket it as a CTA, but co-founder Lyle Pakula rejects this as a common definition of a CTA involves the use of technical or price-based signals, such as trend-following/momentum/breakout, none of which applies to AE. Given AE’s fundamental data inputs, quantitative macro or systematic macro could be more useful labels, but AE Capital employs some discretion, both in identifying themes and at times for risk management purposes, for example intervening to reduce risk four times since inception in 2012. Thematic macro is another possible umbrella, and AE does aim to home in on big-picture, structural shifts that can drive markets over multi-year time frames; but AE also does much shorter-term, intraday, trading based partly on sentiment. Hybrid macro, or eclectic macro, could be possible descriptions. Any attempt to statistically infer an appropriate style group from returns-based analysis has, so far, been fruitless. AE has displayed no correlation to hedge fund or global indices, nor to any other individual fund, based on daily data, according to one allocator who has trawled through the databases.

Clearly, then, AE is doing something very different and being rewarded for originality, with a Sharpe ratio around two since 2012 and an appealingly asymmetric return pattern – up months have been bigger numbers than down months. While many fund managers question whether a Sharpe above one is sustainable through a full cycle, Pakula strikingly argues that the climate for their strategy has actually been challenging since 2012. Hence he is striving for a still higher Sharpe. Attribution has been broad-based amongst the seven G7 currency majors (USD, EUR, GBP, JPY, CAD, AUD, NZD) that AE trades, both versus the US dollar and against each other, through 21 crosses such as AUD/JPY.

Forecasting weather and financial markets

AE’s variant perspective may derive in part from the educational and professional background of Pakula, who has spent most of his career as an Atmospheric Scientist at Colorado State University. But Pakula’s hobby of storm-chasing has also been influential in understanding the limits of computer modelling. Asserts Pakula “weather is one of the most advanced forecasting paradigm in the world, using observations, fundamental fluid mechanics, computer models and human interpretation to produce a forecast. All meteorologists and atmospheric scientists should go storm chasing to work out the limits of computer models, which can only represent the world in broad brushstrokes.” AE does not use weather patterns and events for forecasting financial markets and nor does it trade weather derivatives, but the same logic applies to forecasting the financial markets that AE does trade (currently just currencies). Pakula, who had a spell at Australian CTA Boronia Capital before forming AE in 2011, adds “financial computer models are very useful but we have to have a hypothesis before looking at the data, to reduce the risk of being fooled by randomness.” This takes the form of a Bayesian “prior” which, for AE, must be based on sound fundamental analysis, to avoid the risk of spurious correlations.

Why hire PhDs?

Pakula hires PhDs for their intellectual tenacity, and not necessarily specific knowledge acquired from their doctorate. “A PhD is neither a necessary nor sufficient qualification to be a critical thinker, but someone who completes a strong PhD and has failed at times will generally be a very critical thinker who knows how to question themselves. We need to find people who question their work,” is his view. For instance, Pakula’s own PhD was a time of trial and error involving an ambitious project to integrate a theoretical model to a more physical model requiring supercomputers and six months of parallel coding and experimentation. However it failed and the lesson learned was that his conceptual thinking had been incorrect which led to a deeper understanding of the theory, a more theoretical PhD and the CSU Alumni Award for outstanding PhD research. Pakula’s undergraduate studies entailed a triple major in computer science, maths and physics. Though not a prodigy, he did skip the first year at university and graduated aged 20 – after taking a year out to go snowboarding! Pakula had started in the Dean’s Scholar’s Program with a Sir John Monash scholarship at Monash University.

Pakula as CIO has the final say on picking new themes and still does coding, though this is now shared with two quants. Co-founder and CTO Jess Morecroft, who helped develop the Barclays Capital BARX FX platform, and is also ex-Boronia, is in charge of AE’s IT platform. Financial controls are handled by another Barclays Capital alumnus, Robert Szyszko. AE has hired a dedicated COO, Darran Goodger, who was previously COO of another Australian CTA, $2 billion Kaiser Trading. There are additionally three fundamental analysts monitoring markets for new themes as well as two software developers assisting Jess, the CTO.

Humans identify themes

So, as well as a clutch of hard science PhDs, AE employs a team of fundamental analysts who use sell-side research and discretion to anticipate the zeitgeist of markets, which represents a new theme driving markets. Regime changes are perhaps the hardest market phenomenon for any fund manager to spot in sufficient time to adapt, and the hedge fund graveyard is littered with those who blamed losses on regime change. AE is patient in waiting to discover a new theme that passes through their process and tests. “New themes are added fairly infrequently with only two new ones since the fund started trading in 2012,” says Pakula. These were Abenomics and the QE Taper/Fed Rate Rises. The other themes have included Global Risk, Eurozone Crisis, US economy, China Growth, Commodities, and the Carry Trade Arbitrage. Reflecting on how some of these themes have driven markets post-crisis, Pakula reckons that directly after the crisis the only theme that mattered was Risk On versus Risk Off. Later on the Carry Trade became predominant, “pulling the Australian dollar up to a level of 1.10 that was driven by the search for yield and not justified by fundamentals,” opines Pakula. Then in 2012 Abenomics began to drive the Japanese yen while recently commodities have switched on latent pathways in AE’s models.

Clearly these themes are familiar to the reader of any financial newspaper, and Pakula makes it clear that he is not seeking esoteric market movers, acknowledging that “we are not a large fund with the capacity to put five quants onto a project developing lexical paths to monitor twitter and media for a small outcome.” But one differentiator is how AE validates a new theme. Whereas many quant funds want their models to be replicable throughout a range of time periods and market regimes, AE is seeking models specific to a new market regime, and proof of concept is arrived at if the models did not work before the postulated regime change. For instance, “The Eurozone crisis did not exist 10 years ago and hopefully will not exist in 10 years from now,” observes Pakula – so he would not expect models inspired by the crisis to have worked before it, and at some stage in the future these models will need to be retired and superseded by new themes, because markets endlessly evolve. AE uses “hypothesis testing” techniques to test theses over different time periods. Another test for models is that “Pathways must be backed by cash flows,” says Pakula – a sound fundamental thesis is a necessary requirement but must be backed by detectable cash flows.

Data versus information

“Anyone can do signal processing but the value lies in interpreting the data and converting it to information,” says Pakula, who quotes his old professor of atmospheric science, Dr Graeme Stephens – who was the first scientist to lead a NASA mission and is now director of the Centre for Climate Sciences at NASA – as saying “There is a misconception that we are in the Golden Age of Information, rather we are in the Golden Age of data and the stone age for information.” Put another way, AE capital uses the same ingredients as other managers, but the recipe is different. “We only select from information pathways defined by humans via fundamental analysis and then determine which of our pathways are correct using robust quantitative techniques,” says Pakula. To percolate the data into useful information it is crucial to avoid “over-fitting” models with too many variables and Pakula says a big concern is over-parameterization. His solution is to simply produce models with no parameters and notes AE has only one significant parameter that governs the entire model, but naturally that one parameter is not revealed.

Models translate themes into positions

Once humans have defined themes and relationships between markets, then the process of dynamically allocating amongst the themes is 100% systematic – and Darwinistic in rebalancing towards the fittest themes. For example, in July 2015 some 103 of the 413 algorithms were switched on. Pakula gives a simple example of how the fundamental analysis maps onto portfolio positions. “We think the price of oil will affect an exporting country in the opposite way to an importing country. Major exporters are Australia and Canada while major importers are Europe and Japan. Hence we will go short of the Canadian dollar against the euro in response to lower oil prices.” To forecast oil prices, AE uses signal processing but the feedback loops can in fact operate in both directions – sometimes movements in the currency markets could lead the oil markets. This is reminiscent of George Soros talking about reflexivity in markets. The two-way process makes Pakula nostalgic for his PhD, which explored the feedback loops between clouds and planetary waves.

This process helps to explain how August 2015 was a huge success with AE firing on all cylinders – “All of the themes got it right,” says Pakula and the fund made 7.83%. The core themes had been detecting oil and China as a strong driver of markets, along with Abenomics and QE. These ideas were expressed through shorts in the Canadian and Australian dollar versus the euro and the yen.

Pakula readily admits that AE’s themes can impact all asset classes, but currently focuses on foreign exchange because he finds “it is the easiest asset class to get into from a legal and regulatory standpoint.” Over time AE may branch out into other asset classes and has hired somebody on the futures side to assist with a possible launch of a futures fund.

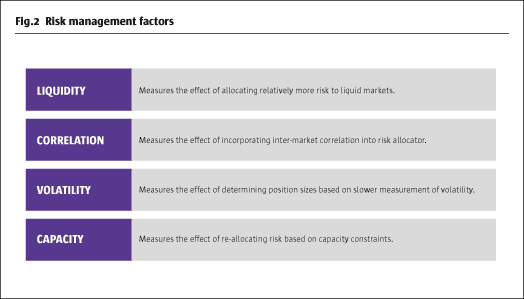

Liquidity and capacity

Currencies are widely perceived as the most liquid asset class, owing partly to BIS surveys measuring turnover of trillions each day, and some quantitative funds are running tens of billions in the space. But Pakula takes a very conservative view on capacity, which is currently indicated at $500 million. So far AE has not run into any capacity bottlenecks, but Pakula thinks “things can degrade at higher levels of assets.” At the shortest time frames AE trades are around two to three hours in duration, and it is here that liquidity and capacity are much more constrained compared to their longer-term systems that trade up to a month. To gauge slippage, AE’s transaction cost analysis looks at the cost of trading in terms of spreads, and average entry prices are referenced against the best bid or ask from before the model ran. In 2015 they estimate average bid-offerspreads at between half a pip and one pip, with minimal slippage.

AE sizes positions in part inversely to liquidity, which explains why the fund has had less exposure to the New Zealand dollar than to the other G7 currencies. At one stage on Monday 24 August 2015 the NZD was reportedly trading with a 0.5% bid-offer spread, and Pakula does recall several counterparties pulling out of some FX markets by switching off their electronic feeds; dealing was still possible by telephone. This illustrates the importance of relationships in the currency markets, and two of those are with AE’s prime brokers, Societe Generale Prime Services, and Citibank.

Discretionary tail risk overlay

Economic and geo-political concerns can also be one reason for AE exercising discretion to avoid certain markets, which has happened on four occasions over the past three years. Two instances involved specific currencies and two forced AE to temporarily cease trading altogether. The de-pegging of the Swiss franc in January 2015 reportedly caused at least one macro fund (Everest) to shut down and inflicted large losses on at least three others (Comac, Fortress, and Dymon Asia Capital). AE Capital has never in fact traded the Swiss franc as the fund launched in 2012 after the currency was pegged in 2011. Explains Pakula “we viewed the Swiss franc as a euro trade that was selling a nasty out of the money option to receive liquidity.” Physicist Pakula stresses that AE models are based on fundamental principles, and the Swiss franc peg did not make sense. Further model violations requiring intervention include the US debt ceiling crisis in 2013 which would have potentially violated key assumptions around sovereign default risk. On one occasion, a weather event has indirectly led AE to take down risk: but only because Hurricane Sandy in 2012 caused closures of the New York and Chicago markets which then violated information continuity assumptions. Around the Scottish Referendum in 2014, AE also switched off pound sterling models as they felt the uncertainties and volatility were too great.

Drawdowns can also force risk reduction: at a 5% intra-month loss, risk is halved and at a 10% intra-month loss all positions are closed out. These triggers are calibrated to the 10% volatility target on the fund, so in effect the fund could temporarily go to cash at one annual, or around three monthly, standard deviations of returns.

Volatility targets and investment vehicles

While the discretionary overlay distinguishes AE from many CTA or quantitative funds that insist they are 100% systematic, AE does have one thing in common with other quantitative funds: AE is targeting volatility – and doing so pretty accurately. The fund’s realized volatility, of 9.62%, has been very close to the target of 10%, and AE will tend to trim back position sizes on a spike in volatility.

Clients can dial up or down their desired volatility target via AE’s feeder on the Citi Macro Access Platform, or can allocate via managed accounts, including unfunded overlays. AE also has two Australian unit trusts, in Australian and US dollars. Currently AE is regulated by Australia’s ASIC, and the strategy is available to “sophisticated wholesale investors,” an Australian definition that is similar to terms that apply in other jurisdictions, such as “professional,” “qualified,” and “accredited” investors. All of the investors in Australia are high net worth individuals and family offices. Indeed AE was partly seeded by a prominent Australian family that also seeded Merricks Capital, whose manager, Adrian Redlich, featured in The Hedge Fund Journal’s 2014 “Tomorrow’s Titans” survey, sponsored by EY. AE is now using its three-year track record as a basis for attracting institutional capital. When we met, Pakula was on a worldwide roadshow meeting up with leading investors in London. Many of them are as curious about the strategy as is THFJ.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical