After years of low prices and disappointing investment returns, there are signs that agriculture markets finally have real upside potential. Many of the headwinds that have pushed agriculture prices to multi-decade lows – good weather, lackluster demand, a strong dollar, and low inflation – are reversing course. Given the potential upside and exceptional diversification benefits that agriculture markets offer, it’s worth taking a closer look at these unique commodity markets today.

Investments in agriculture markets haven’t paid off

Recent years have been difficult for long positions in agriculture futures markets – there hasn’t been a supportive “bull story” on either side of global balance sheets. Global stockpiles of ag commodities have grown as South American acreage has exploded and crop genetics have improved. Farmers are growing more crops than ever before, and those crops are more durable. Demand for these commodities hasn’t kept up with growing supplies, so prices have dropped.

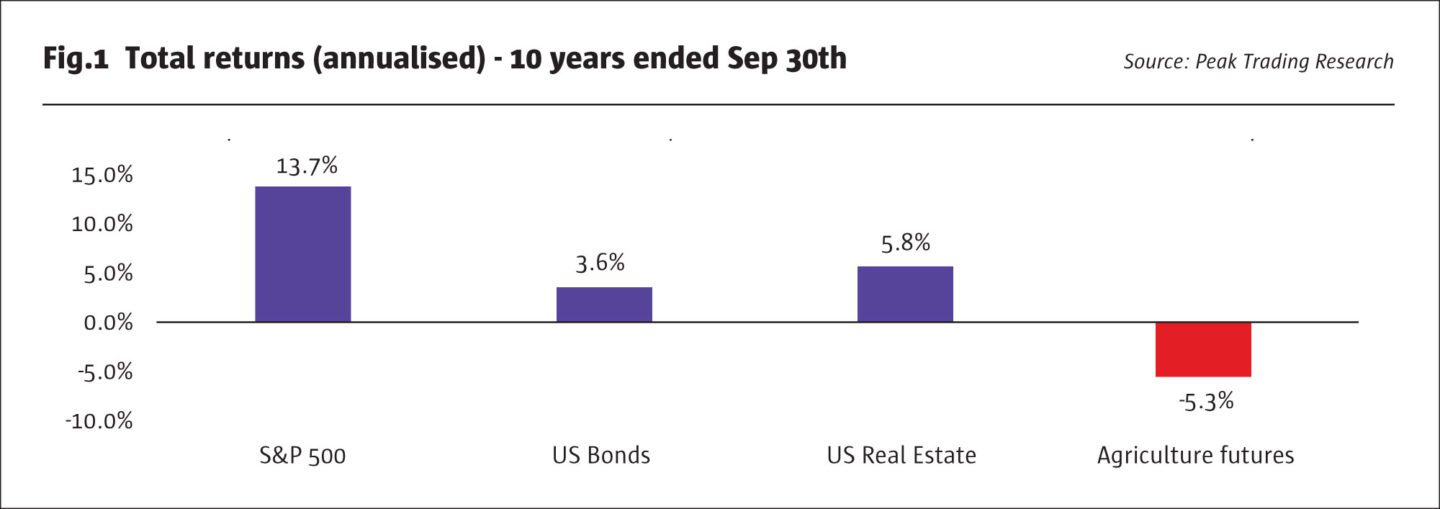

The Bloomberg Commodity Agriculture Subindex – a basket of nine liquid agriculture futures markets – has returned -5.3% on an annualized basis over the ten years ended September 30th. Meanwhile, the S&P 500 has returned +13.7% over the same period, US bond markets +3.6%, and US real estate +5.6%. Agriculture futures have shown exceptional diversification benefits to other asset classes – unfortunately, this is because ag prices have dropped while everything else has rallied. “Want to make a small fortune in ag markets?”, traders often quip, “Start with a large fortune.”

Green shoots are finally emerging for this battered corner of the commodity market

After many years of underperformance, there are signs that agriculture futures finally have some real upside. Investors today see a convergence of bullish fundamental and financial trading inputs that have put a floor under agriculture futures and pushed some markets like soybeans to new multi-year highs. The US government’s weekly investor positioning reports show that speculators and inflation hedging funds have been on a buying spree, anticipating higher prices.

Ag markets have a sustainable bullish story for the first time in more than two years on the back of supply concerns (climate volatility), demand (Chinese imports), a weaker US dollar, and higher inflation expectations.

Climate volatility is having a measurable negative impact on US crop production

Prior to 2019, it had been a long time since agriculture markets saw a real US production problem. Many farmers will point to the drought of 2012 as the last big US crop event. If the past 15 months are any indication, serious weather events that take a real bite out of US production are becoming more common:

- Late May 2019 – Wet weather and massive flooding across the US midwest caused the biggest corn planting delay in US history.

- Early August 2020 – Powerful Derecho thunderstorms battered large swaths of Iowa farmland, causing billions in damages and decimating corn production.

- Late August 2020 – Drought conditions across the US midwest hurt soybean production during a critical production window (farmers often say “corn is made in July, beans are made in August”).

Severe weather events are a real threat to agriculture production looking forward. Crop genetics have made plants more durable in recent years, but corn and soybeans can’t yet withstand hurricane-force winds or severe droughts – both of which we’ve seen in 2020.

China is buying US agriculture products at a breakneck pace

China is the world’s biggest importer of agriculture products, importing cargo ships full of bulk dry commodities from all over the world – including roughly 100 million metric tons of soybeans every year. For perspective, China’s annual soybean imports are the equivalent weight of one small car for every US adult living west of the Mississippi. China’s buying programs are truly massive.

When the US government introduced broad Chinese tariffs in May 2018, China froze agriculture imports from the United States. US ag markets plummeted, thousands of farms applied for government crop subsidy programs, and farm bankruptcies jumped +20% in 2019. China was also struggling with a domestic outbreak of African Swine Flu during this period, which further limited the need to import soybeans to feed pigs.

In the middle of 2020, something changed. South America ran out of ag products to export, and China turned its vacuum back towards the United States. Since June, China has been on a buying spree for US agriculture products. The US Department of Agriculture tracks all US agriculture exports and has posted massive China export numbers in its weekly grain sales reports since June.

Many traders expect this buying campaign to continue. In addition to buying 100+ million metric tons of beans this year, China will import 25+ million metric tons of corn. Combined with recent US production losses, there could be balance sheet tightness – less supply and more demand – that agriculture traders haven’t seen since early 2018, before the Trump trade tariffs.

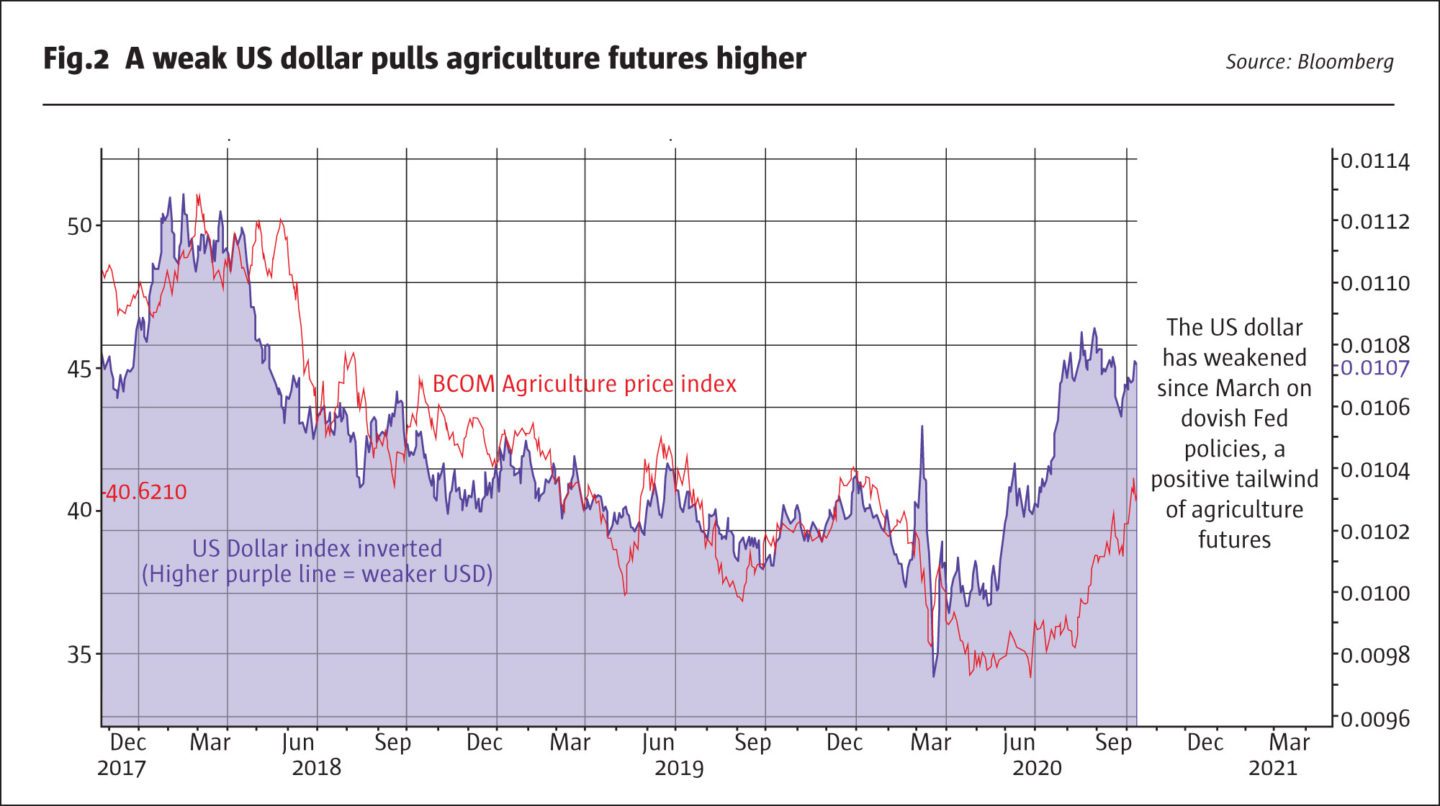

The Fed-driven US dollar collapse has been a powerful lever for higher agriculture prices

Agriculture commodities are extremely sensitive to currency moves – more than most other financial instruments. Because ag commodities are produced and consumed all over the globe, currency swings have a dramatic impact on agriculture prices.

For example, if a large French wheat importer sees the Euro strengthen versus US dollar, it means the company can import more US wheat at lower dollar-translated prices. When the Euro goes up (US dollar down), US wheat prices also go up. This relationship plays out across all ag markets: when the US dollar drops, agriculture prices rise.

Investors have seen this relationship play out over the past six months. As the US Federal reserve has introduced aggressive stimulus measures to backstop the US economy against Covid-19 – including cutting interest rates to zero in March and unveiling a new “average inflation target” in August – the US dollar has dropped significantly. In July 2020, the US dollar weakened -4.4% against a basket of other G10 currencies, its worst month in nine years. This dollar weakness has translated directly into higher agriculture futures prices. We can see this relationship clearly below: dollar down = ag futures up.

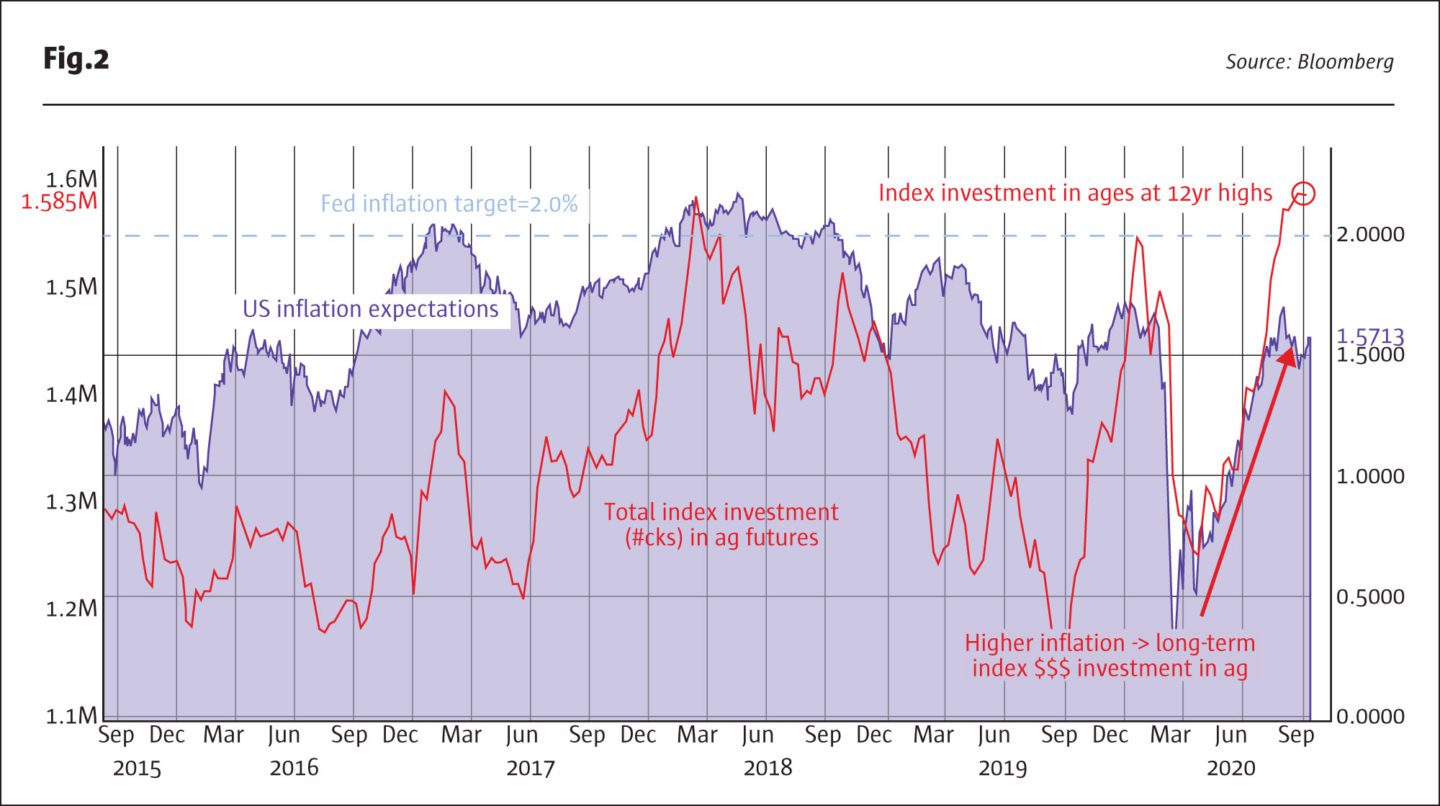

Higher inflation expectations have driven new investments in agriculture futures

Agriculture markets – like other hard commodities – are viewed as an effective inflation hedge. Pension funds, endowment funds, and sovereign wealth funds will often dedicate some percentage of their overall investment portfolio to ag markets as a hedge against rising prices. If inflation starts trending higher, these investors hope that owning a basket of markets like corn, wheat, beans, and sugar will help protect the real purchasing power of the portfolio.

As the Federal Reserve has pledged to let inflation run hot, forward-looking inflation expectations have crept higher, and inflation-hedgers have placed big bets in agriculture markets. The US government’s weekly Commitment of Traders positioning report shows that inflation hedgers have their biggest investment in agriculture futures since 2008.

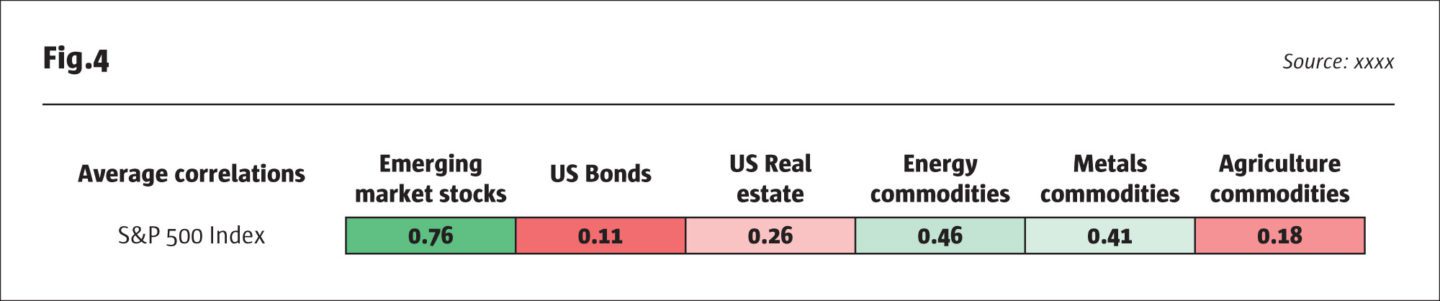

Agriculture markets offer exception diversification benefits: Ags zig when other markets zag

From a portfolio perspective, agriculture futures offer incredible diversification benefits. This diversification works across a few dimensions:

- Agriculture markets show low correlations to other major asset classes like stocks, bonds, and real estate. Ags are uniquely insulated from the price drivers that normally drive other asset classes, e.g., central bank stimulus has less impact on ags versus stocks or bonds.

- Agriculture markets show low intra-market correlations. The corn market follows different price drivers than sugar or cotton or soybean oil. Unlike energy commodities – where crude oil, heating oil, and gasoline all move in tandem – each agriculture market has its own unique price drivers and supply and demand balances.

Agriculture markets zig when other markets zag – only bonds offer better diversification benefits to moves in the US stock market.

Agriculture prices are still low from a historical perspective – especially against stocks

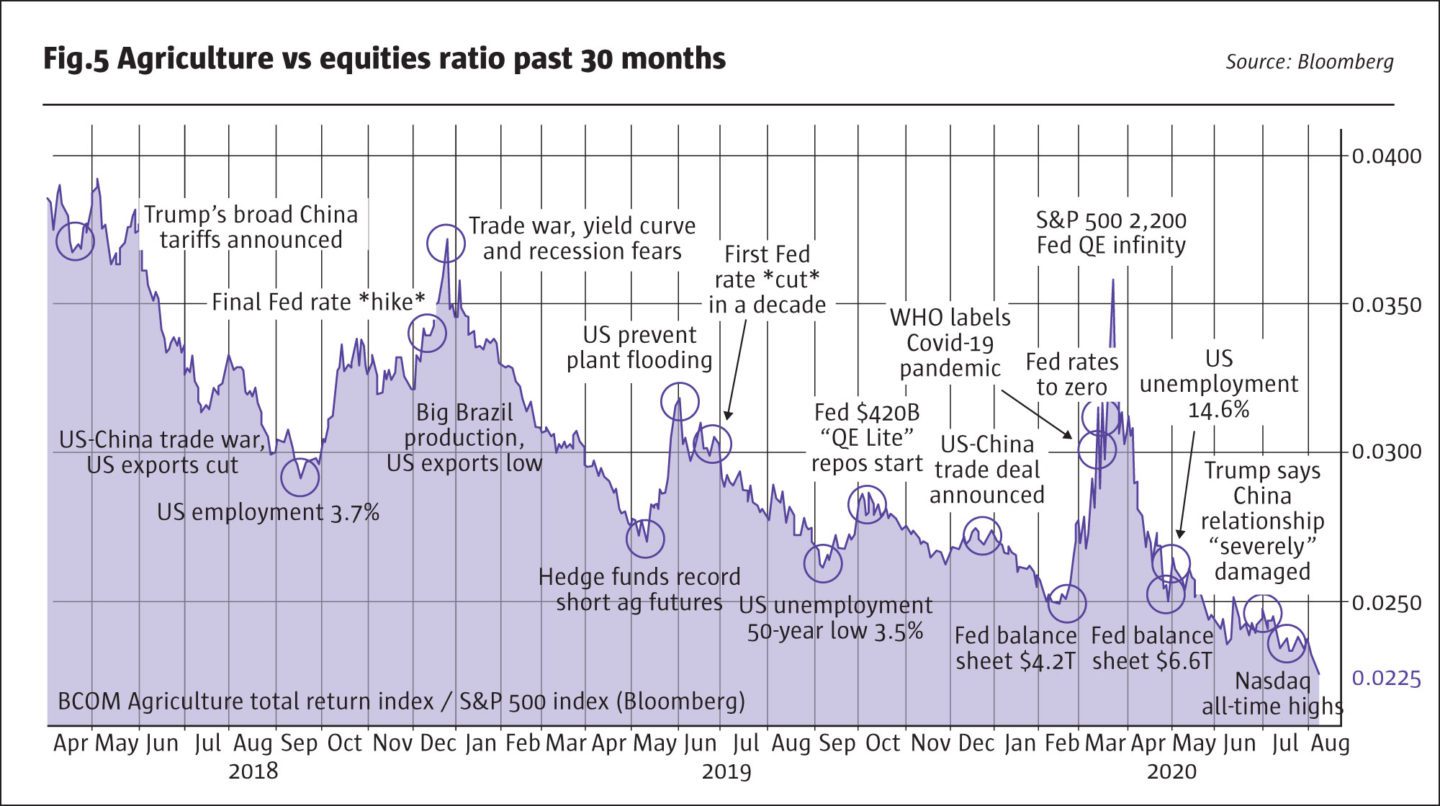

Ag markets have diverged significantly from other capital markets in recent years and today the spread between the S&P 500 Index and the BCOM Agriculture Subindex sits near all-time lows.

For investors believing in an equity correction, higher inflation, or simple mean reversion, this is an attractive set-up for agriculture market ownership.

Hedge fund positioning is crowded today, buyer beware

Ag prices have responded positively to the combination of supportive fundamental inputs (bad weather and China imports) and financial inputs (weak dollar and higher inflation). The BCOM Ag Subindex basket of commodities is at 7-month highs, back to pre-Covid levels. From a historical perspective, prices are still low, but trending higher.

One concern for agriculture investors today: As bullish trading inputs have accumulated; hedge funds and inflation-hedging funds have added to massive long bets in agriculture futures. Weekly US government Commitment of Traders positioning reports shows that hedge funds hold record net long positions in agriculture futures and index fund traders are the longest they’ve been in 12 years. Speculators have massive investments in ag futures today, betting that prices will continue to rise over the near term.

So, being long agriculture futures today is a crowded trade – is this a bearish signal? Not necessarily. Crowded trades are like crowded bars…they’re crowded for a reason. But if the music stops, there’s plenty of speculators who will look for the exits at the same time, which could lead to big price corrections. Buyer beware.

A case for ags

Agriculture markets see a combination of supportive fundamental and financial tailwinds today – a combination that starts to look vastly different than the big supply and low demand picture of the past two years.

There are still ample stockpiles of corn, soybeans, and wheat around the globe, but for the first time in several years, those stockpiles are shrinking, not growing. Ag markets only need one of the several narratives to continue for prices to keep trending higher. If China demand remains strong, Brazil production disappoints this year, or inflation expectations keep trending higher – there is a lot of upside for agriculture markets.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Agriculture Markets Finally Have A Story

It’s worth taking a closer look

David Whitcomb, CFA, Head of Research for Peak Trading Research, Geneva, Switzerland

Originally published in the issue