Credit hedge fund strategies have garnered inflows at both extremes of the liquidity spectrum: liquid alternatives offering daily, weekly or bi-monthly dealing, and private lending strategies with multi-year, private equity style, lock ups are all sought after. Neither of these buckets fit Altum Capital Management LLC (Altum)’s strategy, which has generated aSharpe ratio above two with low correlation to equities and credit. Altum finds its sweet spot in the middle ground of liquidity, trading instruments that generally have counterparty quotes but also expected holding periods consistent with at least a one year lock up. Altum’s fundamental, value-driven, multi-strategy credit approach seeks out value in areas including smaller parcels of asset backed securities (ABS) that might not be on the radar screen of some larger asset managers.

ABS Pioneer and Trader

Altum’s distinctive approach synthesises its founder’s more than 30 years’ of diverse and innovative experience in structured and credit markets. Altum Managing Member, and CIO, Marjorie Hogan, who was selected for EY and THFJ’s 50 Leading Women In Hedge Funds 2015 survey, has been a proactive pioneer in the asset backed securities markets since their beginnings in the 1980s. While working in Bear Stearns’ research department she founded its mortgage derivatives business in 1991. Hogan’s mentor, Warren Spector, who later became President and co-CEO of Bear Stearns “was very supportive and it was not tough to persuade him to approve the move into mortgage derivatives,” she recalls. Spector sat in the trading department to where Hogan later migrated.

Around the turn of the millennium, Hogan was also at the leading edge of new developments: as one of the first market-makers in structured credit instruments, such as CDOs (Collateralised Debt Obligations). The secondary market in CDOs had been slow to get off the ground because “it took a while for firms to feel they had confidence to trade the product, and documentation previously just warned that there might not be any secondary trading markets develop,” she recalls. Bear Stearns blazed a trail because “we were more disciplined, and wanted to make markets in the assets we were underwriting.” Hogan was an ideal candidate to spearhead this drive, because “by then I had profitably traded through many cycles so people were confident in my abilities,” she explains.

Hogan’s next chapter saw her running the Bear Stearns' distressed credit proprietary trading group between 2005 and 2008. “We were finding cheap, undervalued, bonds with errors, idiosyncratic features and hidden features and we did well through 2008,” she recalls. As early as 2007 Hogan started unwinding some deals and by the end of that year she had put on both hedges and some outright shorts. In March 2008, when JP Morgan took over Bear Stearns she was ready for a new challenge.

Hogan spent just one month at JP Morgan. “I was happy to be made redundant as I did not think I would be a good fit for the JP Morgan structure,” she reveals.

Though JP Morgan’s takeover of Bear Stearns may have precipitated Hogan’s migration to the buy side, she admits the move was “probably several years overdue anyway.” Hogan had by then built up a series of unaudited pure proprietary trading track records, which did not need to be disentangled from any client-driven market-making as that took place on different floors. “We were inside a fishbowl room and away from flow trading” she confirms. Hogan converted the prop trading records into something that looked close to a hypothetical hedge fund strategy track record and began touting her wares.

In searching for seed capital Hogan reckons she probably spoke to five or 10 firms before deciding to join the Capstone platform. Paul Britton’s Capstone is not customarily in the seeding business but in 2008 the firm wanted to opportunistically take advantage of dislocated Wall Street people (and markets) and offered Hogan the chance to further broaden her repertoire. Capstone’s appeal lay partly in its breadth of asset class coverage.

Despite this draw, and capital that peaked at $200 million, Hogan soon realised that the Capstone structure might not always be ideally suited to the strategies she wanted to pursue, particularly because the seed money had more generous liquidity terms and “the investor base thought that a longer lock up would be more appropriate to take advantage of less liquid and more complex opportunities.”

When Hogan first joined Capstone, she had not intended to spin out but did make a clean break: Capstone has no residual ownership in Altum, which is 100% owned by Hogan. Meanwhile, after a lucrative excursion into credit markets, Capstone has come round full circle to its roots in volatility strategies where it is renowned as one of the most consistent and long lasting players.

Idea generation and sourcing

In setting up Altum, Hogan put her own stamp on the research structure. At Altum the investment team of five are distinct from the quant team of three as the quants do not look at individual bonds. Whereas the investment team go through the documents, features, price history and market dynamics of single assets the quants “are more looking at models but not individual instrument models so they do not directly analyse bonds” she explains.

Altum has macro and credit sector views but the research “has more of a bottom up focus to try and find idiosyncratic opportunities” Hogan goes on. The investment team is Hogan’s former Bear Stearns colleague Lynn Paquette who holds a PhD degree in Economics from the Massachusetts Institute of Technology; ex-Citi CLO specialist Alexei Kroujiline; ex-Aberdeen PM and Lehman CLO originator Cathy Price who holds a PhD in Statistics from the University of Warwick and statistician Andy Wang. Together they have extensive experience particularly in structured credit and this helps to inform their in-house modelling. Altum uses some industry standard analytics systems, including Intex, and standard pricing services, but these are overlaid with proprietary models. Explains Hogan: “We are not taking each CLO and teasing out its own cash-flows but rather tweaking models to pull the information together in our own way. This allows us to avoid group think. We can scan a long list of bonds simultaneously and hone in on particular features to identify undervalued bonds. This would not be possible if we analysed bonds one by one.”

Altum has quantitative know-how throughout the firm. Hogan has a PhD in Mathematics from Stanford while the quant team includes former professor of statistics Michael Hogan, as well as Yin Chan who holds an MA from Princeton University in Electrical Engineering, and Zhao Cheng who holds a PhD in Electrical Computer Engineering from the University of Rochester. Altum models OAS (option adjusted spread) levels, values collateral, looks at path dependencies, interest rate and currency exposures, delinquencies, defaults and prepayments. In particular, Altum has found patchy data on collateral can leave gaps, particularly for pre-2008 deals. Sometimes the anomalies are not differences of opinion about modelling but rather outright errors: “Some pieces of collateral can be omitted as they do not affect cash-flow triggers, and trustees then might fail to report particular pieces of collateral in a pool,” Hogan notes. There can also be simple errors, for example failing to take account of a loan’s upcoming settlement amounts during the settlement period, Hogan has seen.

In fragmented markets that still trade overwhelmingly over the counter (OTC), sourcing is crucial and Altum “maintains good relationships with dealers, regional dealers, smaller brokers and larger brokers who we have known for years”, says Hogan. She is of the opinion that it could be difficult for family offices and high net worth individuals to access the market, and claims that even the largest banks and broker dealers may show some deals only to a few potential buyers. Hogan alsofeels that Altum’s level of assets – at around $400 million – provides an advantage in that an $8 million ticket size is 2% of the fund, whereas it would be less than 0.10% for a $10 billion fund. Altum identifies greater pricing inefficiencies in these smaller parcels and odd lots.

Altum is also distinguished by its transatlantic presence with London and New York offices both active. The entire team participates in a morning call and Hogan spends about half of her trading time in London to stay close to the European credit markets that have recently thrown up more opportunities than the US markets.

European opportunities

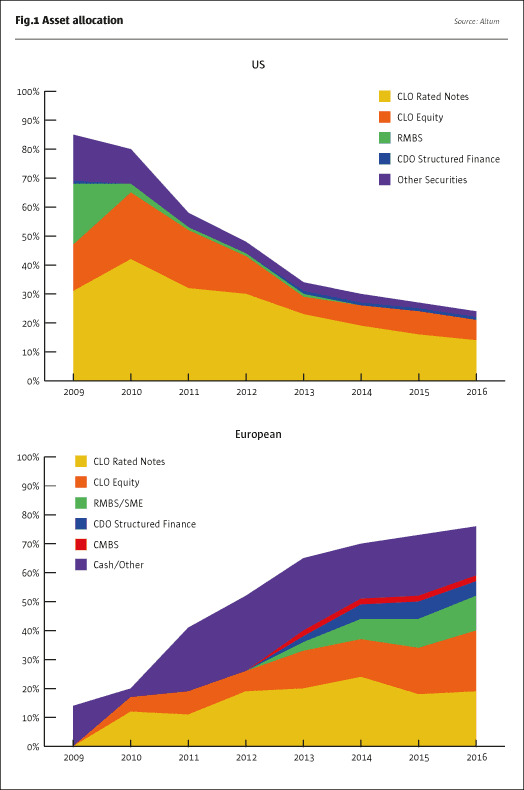

Altum pursues a broad strategy, with no minimum or maximum allocations to particular sub-sectors. Since 2009 the strategy has dynamically and opportunistically rebalanced exposures, as shown in Fig.1. Hogan has adapted her style of trading as market regimes have changed with illiquidity characterising 2009-2010 and then normalisation defining 2011-2012. So, for instance, in 2009 US CLO equity, US CLO rated notes and US RMBS were chunky allocations. But by 2016 the first two have been greatly reduced and the last bucket has been empty for three years.

Altum’s biggest geographic shift has been from the US (down from 86% to 24% since 2009) to Europe, which has gone from zero at the start to 59% of the strategy today. The European allocation has been the mirror image of the US: with growing allocations to European CLO equity, CLO rated notes and RMBS. Hogan finds Europe is a less well researched area as “European markets do not have such a big hedge fund community and also have fewer ‘real money’ buyers.” She thinks “the lower level of comfort around Europe sets a higher threshold for returns – and can mean European assets trade chronically cheap.”

Other European assets include mezzanine debt; CLOs backed by smaller and medium sized enterprise (SME) loans; UK non-conforming mortgages and commercial mortgage backed securities (CMBS).

Europe is attractive for fundamental as well as technical reasons. Fundamentally, Hogan expects lower corporate defaults in Europe, for two reasons: “There is less energy exposure and the US cycle is more mature.” On the mortgage side, Hogan sees reasonable fundamentals in Europe but her investment thesis “does not factor in Home Price Appreciation (HPA). There are more distressed bonds to pay back and unwind, and defaults can come down as delinquency pipelines are worked through.” Altum’s collateral types tend to be RMBS and CMBS with some corporate credit CLO tranches with auto loans, credit cards and student loans less common in Europe.

Altum has some exposure to peripheral Europe through Spanish and Portuguese RMBS and owns some UK ‘non-conforming’ mortgages. These can be seen as analogous to US sub-prime but Hogan views them as having a very different risk profile for several reasons. “Lenders have full recourse ruling out any strategic default option; home prices never fell as far as in the US; and mortgages can be re-assigned to new properties.” With stressed paper, Altum relies on servicers to go through any workout processes that may be required. Altum is aware of Brexit risk, which has arguably contributed to some selling in peripheral Europe. Hogan recognises that the uncertainty associated with any Brexit could slow down economic activity in the UK and EU.

Technically, European structured credit has become interesting because floors setting a minimum reference rate for floating interest rates now offer a significant spread over the risk free rate. “Floors matter more in Europe as Euribor is negative so the floor has more value,” Hoganexplains.

Opportunity set in 2016

Hogan has an evenly weighed outlook this year and expects some selective opportunities to buy oversold assets – but not an indiscriminate sell off. She is mindful of pressures from the unwinding of leverage in 2016 but views the climate as “neither like 2011 nor 2008 as there is less investor-level leverage in general, though some investors who levered up to buy mezzanine CLOs got margin calls.” But in general Hogan thinks investor redemptions, rather than counterparties curtailing leverage, lie behind the liquidations. Moreover, she reckons that deleveraging has already played out to some degree in late 2015 and early 2016 and on balance thinks “we are now back to a risk-on climate albeit with some continuing downsizing of books.”

Hogan is biding her time with respect to US CLOs in awaiting the right moment to apply her distressed structured credit expertise. Altum sees further energy defaults on the horizon and thinks it is still early in that process and “does not see any bottom yet with much more distressed to come.” When the dust settles, Altum is on the lookout for under-priced CLOs, particularly if various triggers get tripped. Altum, which does not use balance sheet leverage, already has some dry powder to take advantage of any forced selling, and expects more cash to come from inflows into the strategy.

Risk retention rules now sound like more or less a non-event. Already applicable in Europe, different rules will apply to some US CLOs from December 2016, but Hogan does not see either having much impact on the strategy. In particular she does not expect the rules to put a dampener on issuance. “Many structures can be used to comply and consolidation among managers has also helped cluster resources,” Hogan observes. Notwithstanding this, Hogan thinks US issuance could be lower than in 2015 while European issuance will maintain the momentum.

Risk management

Hogan’s earlier career included a stint as Head of Risk Management at investment bank Credit Suisse First Boston and the strategy has a framework of risk controls. Though Altum has high conviction in particular segments of the markets, it has some internal concentration limits and also seeks to mitigate several other types of risks.

Altum’s strategy takes both credit risk and prepayment risk and Hogan argues that default risk in practice has some overlap with prepayment risk. She is cognisant of heightened prepayment risk as house price appreciation, combined with low loan to value ratios, can allow for new mortgages to be taken out. Hogan also thinks that a rate rise could prompt a bout of refinancing as borrowers try to lock in fixed rates. Altum acknowledges that it is not that easy to hedge prepayment risk, as any interest rate hedges are imperfect offsets against prepayment risk per se, which is one of the risks that the strategy gets paid to take. Altum maintains a basket of credit hedges including some credit indices, and foreign currency exposure is mainly hedged.

In contrast, with interest rates currently below floors, many assets have no exposure to the first few rate rises. Even if rates surmount floors, as most of the book is floating rate, there is minimal interest rate exposure in the period between resets. Both assets and liabilities of CLOs are, broadly speaking, floating rate. A technical nuance is that there can be mismatches between periodicity of resets on each side of the book or between payment frequencies of assets and liabilities; but basis swaps can help to align these to some degree.

Liquidity risk is a concern for many credit strategies and Hogan empathises with the cacophony of complaints about credit market liquidity. “It is still deteriorating as dealers are dialling back on risk, research departments are shutting or desks are closingdown entirely. Many dealers are just crossing trades now rather than holding inventory,” she says. Therefore, Altum feels long term investors are more appropriate for the strategy, which may also be more nimble by dint of its size.

Valuation subjectivity can be a feature of credit assets and particularly of structured credit. Though as of December 2015 approximately 50% of Altum assets are classified as ‘level 3’ under ASC 820, Hogan has found that auditors can be somewhat conservative in classifying as level 3 some instruments that do have counterparty quotes. Of course it is precisely the difference of opinions over the valuation of more complex and esoteric instruments that is one source of the perceived anomalies that Altum aims to exploit.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical