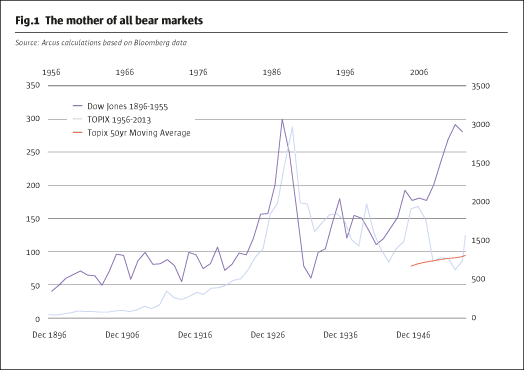

Having a market surge 60% within a few months is bound to attract attention, and Arcus has been enjoying Japan’s sudden return to the limelight after so many years of obscurity. “You cannot underestimate just how anomalous Japan’s two-decade bear market is,” says CEO Robert Macrae.

Abenomics

The catalyst for all the excitement is Abenomics, the new policy environment initiated by prime minister Abe. “I’ve been waiting for this for 15 years,” says Japan veteran and strategist Peter Tasker. Perhaps the only manga (Japanese comic magazine) discussion of Japan’s policy options, his “I am a digital cat”, anticipated several ingredients of Abenomics, notably that Japan’s hard money policy had to come to an end. Arcus is not forecasting specific levels for the yen exchange rate, or even calling it down, but at 90 yen per dollar, the impact on the real economy is enough to end the vicious feedback loop whereby a strong currency reinforces deflationary pressures, exacerbates economic weakness and encourages ever more excessive saving. At current currency levels Tasker is “confident Abenomics will support the corporate profit cycle for at least two years and that profits will rise to new highs.” He adds, “If you are not afraid of holding Japanese Government Bonds (JGBs) and cash then Abenomics isn’t working”, hinting that a “Great Rotation” from bonds to equities could be on the cards.

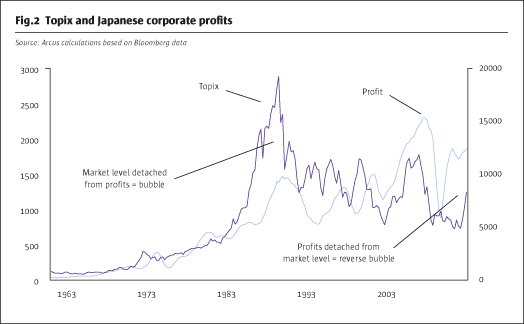

One reason that Abenomics marks such a sea change for Japanese equities, according to Arcus, is that companies had been making much more progress over the last decade than was generally recognised by investors. “In contrast to the 1990s, corporate fundamentals have been improving for the last decade,” says Tokyo representative Mark Pearson. Japanese companies have generated strong earnings growth between 2000 and 2012: 5% annualised for Topix while TSE second section has done twice as well, he says.

“Many people focus on the negative aspects of Japan: high debt, demographics and deflation. But we invest in companies, which have been growing profits in the past decade, even as GDP contracted and the population aged,” notes Pearson. Tasker adds: “The surprise is not so much that the market reached 15,000 but that this took so long after the recovery in corporate profits. Twenty-two years after the Topix peak the index was flirting with new lows and indeed trading below its 50-year moving average.” No other market in the world has offered such dismal returns for such an extended period, and as investors have lost interest the level of investor attention has become apathetically low, so that real improvements were overlooked for a long time. With expectations so subdued and Abenomics as a trigger – the consequent bounce was naturally sharp.

Inefficiency

“Japan is one of the most neglected and inefficient markets in the world, with a fraction of the analyst coverage of even that of emerging markets. That’s fine by us as we go directly to the companies to learn about their businesses,” says Pearson. Market inefficiency creates opportunities for stock-pickers like Arcus, particularly when their market experience dates back to the 1980s. “Mark has visited more than half the 4000 companies in Japan. There may be no-one else in the world who has done that.” says Macrae.

Arcus just do Japan. All funds are managed from London but the research team of Pearson and analysts Nick Brooks and Takaaki Haruki are based in Tokyo where they typically make two company visits a day, conducted in Japanese. Arcus initiates almost one new position after every two meetings, getting this high hit rate by concentrating the visits on companies where – so long as numbers stand up and there are no surprises – the value decision is very clear.

“We are a value manager, focusing mainly on the earnings stream that companies can generate. Probably what distinguishes us most is the extent to which we focus solely on value and the aggression with which we implement,” says Macrae. Ranking on simple value ratios is a first step to identify potentially cheaper companies, but ex-auditor Brooks cautions that a proper valuation requires substantial adjustments as Japanese accounting certainly has its peculiarities. After years of deflation, book values may need adjusting, and off-balance-sheet pension liabilities can be another quirk of Japanese accounting. However, compared with US accounting in particular, earnings tend to be a much more realistic measure of the increase in shareholder value.

The longevity and cohesion of the Arcus team is clear: “with the honourable addition of Nick we are the same team that set up in 1998,” says Macrae. Arcus’s investment principles have also remained remarkably consistent over time, with a strong value emphasis ensuring that the team are always searching in areas that most investors ignore or actively dislike, and usually taking a two to three-year perspective. “What is cheap changes over time,” notes Brooks. For most of the post-crisis period the value number-crunching increasingly indicated that shorting expensive defensives and owning cheap cyclicals was the best trade, probably due to the fashion for “low volatility” stocks. Now, following the rally, more of the higher-quality companies are offering better value and the market appears more balanced.

However, as value is a much over-used (and abused) term, the team see their track record, warts and all, as giving investors a more practical idea what they can expect. With a performance history this long you can see the conditions in which they do well and badly, notes Macrae. No-one enjoys losing money, and it is always tempting to hope that lessons have been learned and that it isn’t going to happen again – but this seems unwise. “Our trade is always sensibly contrarian”, says Pearson, and betting against the market always carries the risk that you are wrong.

History

Arcus was born in 1998.Its three founders were Robert Macrae, a quant value specialist; Mark Pearson, a stock picker; and Peter Tasker, an award-winning sell-side strategist at Kleinwort Benson. From their differing perspectives all agreed that Japan offered fertile ground for value investing.

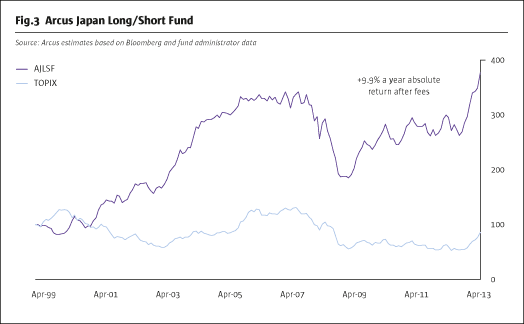

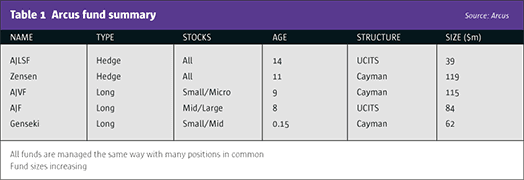

They raised domestic assets via local broker, Universal Securities, who gathered the best part of a billion dollars of assets in the early years. Unfortunately the bear-market mentality, already deeply ingrained in the local investor psyche, made the Japanese rigorous sellers of winners and so turnover was high as investors took profits. Day-one investors in the Arcus Japan Long Short Fund (AJLSF), a UCITS, have now almost quadrupled their money since April 1999.

From 2001 Arcus sought out stickier investors overseas, making the strategy available as Cayman fund Zensen. Both funds are serial winners of The Hedge Fund Journal’s Europe 50 and UCITS Hedge performance awards. Arcus also run long-only funds that have generated substantial absolute returns as well as beating benchmarks by an impressive margin. The mid and large cap-focused Arcus Japan Fund, a Luxembourg UCITS, has made 40% since 2005, in contrast to the horizontal journey made by the Topix index.

“We have been able to pick undervalued, successful companies that have allowed our funds to perform even if the market did not,” is Pearson’s explanation. Overall Arcus’s mid/large-cap long-only strategy, stitching this together with the earlier Leaders fund, has delivered annual outperformance of 8.7% since September 2000.

The highly specialist small and micro-cap vehicle, Arcus Japan Value Fund (AJVF), has outpaced the Topix by almost 10% a year since December 2003. Half the positions in this fund are below $100 million market cap, demanding a mandatory 5% monthly gate and restricting its appeal mostly to families and high-net-worths. The new Genseki fund is a more conventional small-cap fund aiming at a wider audience by offering 90-day liquidity.

While Arcus aims to outperform over periods of a few years it is perfectly frank about some spells of under-performance. The climax of the TMT bubble in 1999 was naturally tough time for any value investor, and AJLSF lost 18%. This was recovered as the bubble burst and fundamentals re-asserted themselves, allowing for strong performance during the 2000-2002 bear market and for a great 2003. 2005 however was another weak period, at least in relative terms, when Japan experienced a small-cap bubble as many foreign funds tried to invest unmanageable amounts into smaller stocks.

2008 was also very difficult, with investor fears rising to unprecedented levels. At the time, “Prices were discounting such a severe depression that multi-year losses would destroy most of book value and a meaningful fraction of listed companies would go bankrupt,” notes Pearson, and Arcus was, as usual, too early to argue that the world was not going to end. As Arcus wrote in a 2008 investor circular two days before the Lehman insolvency, “To be quite clear on what these numbers mean to us, AJVF on P/E 3.9x, PB 0.32x and AJF on 6.0x and 0.65x are simply the cheapest and most attractive that we have ever seen.” Though it gave investors a rough ride, this aggressive approach did very well as fears started to recede over the following months.

Opportunities

Fast-forward from the crisis, through the neglected but profitable years of 2009-2012, and we come back to Abenomics. How is the new environment going to drive returns?

Earnings may be the fundamental driver for stocks, but somehow the cash generated has to be returned to shareholders. “The prevailing wisdom has long seen Japanese companies as chronically unprofitable and scandalously anti-shareholder,” notes Pearson, “but we expect continued, substantial earnings growth accompanied by increasing dividends and share buy-backs.” With so much of Arcus’s long portfolio trading on single-digit P/E multiples (and also looking good on other metrics such as cash-flow yields and dividend yields) there is clearly scope for multiple expansion.

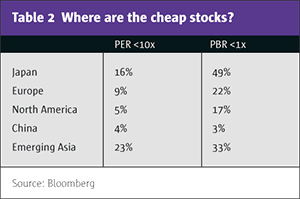

While Arcus very seldom invests in pure asset plays, preferring to see evidence that assets are being used profitably, many companies in the Arcus portfolios have net cash as opposed to net debt. This speaks to another potential booster for share prices. After years of de-leveraging, even a marginal move towards re-leveraging corporate balance sheets could translate into a transformational increase in returns on equity. And there are plenty more opportunities available: over 400 companies still trade below net cash and half of the market trades below book value, more than any other developed market.

Corporate activity

Corporate activity is another way to unlock this value, and since 2009 no fewer than 28 Arcus holdings have been taken over, bought out or subject to other value-enhancing corporate activity. “We have felt for some time that Japan is a market ripe for activism again and that our value style would benefit,” opines Pearson. The first 2005 wave of activists may have beat their retreat, but their legacy is that it has become unacceptable for predators to squeeze out minorities without offering a decent price, and premia are typically substantial. Softbank’s recent takeover of eAccess stands out for the 270% premium paid, but even so is widely seen as a good buy for Softbank. The economic rationale for domestic activism is clear and the trend is clearly rising both in numbers and in the sizes of the companies involved. Many of Arcus’s cheap holdings are natural targets.

Third Point’s interest in Sony suggests a second wave of foreign interest is beginning. Sony was a top-five pick for Arcus back in February, and an example of how even stocks that are reasonably well analysed can be very undervalued. By Japanese standards Sony is well researched with 20 sell-side analysts following the stock, but only one of these had a buy rating on the company when Arcus bought it at half of book value. Now that New York manager Dan Loeb has written a well publicised letter to the company its potential is becoming widely understood: the loss-making televisions division has masked the strong profitability of other units such as music, films and insurance. Loeb’s letter suggests a modest and achievable restructuring that will prove hard to ignore, and could unlock substantial value. Loeb has added to his stake after the market pullback.

Reflation

If Abenomics can re-ignite economic growth and persuade thrifty consumers to stuff less of their earnings into their vast piggy-banks, Brooks points out that this will be game-changing for many stocks. Looking at the real estate for example, renting property currently costs nearly three times as much as buying even with a fixed-rate mortgage, but people are not rushing to buy because, based on the experience of over 20 years, they expect further falls in house prices. If property prices merely stop falling for a period, then buying instead of renting becomes a rational decision. Even if property prices doubled, buying would still be cheaper than renting. Rising real estate prices should have a powerful wealth effect encouraging construction and consumption.

Arcus’s preferred stock in the sector, Nisshin Fudosan, is an apartment builder that, even after shooting up 175% since Arcus bought, trades well below book value – and holds substantial netcash. This has allowed it to ride out the 20 years of deflation and benefit from being one of the few survivors, and still provides substantial security if the investment thesis – as has often been the case in Japan – takes longer than expected to play out. By contrast the consensus trade appears to be to buy the iconic real estate stocks, and Arcus are short several as the sharp rises has moved them far beyond book value, even considering any likely gains. “Is it ever smart to pay more than one dollar for real estate that is worth one dollar?” asks Macrae. Suspicion of thematic investing, shorting companies priced for perfection, and buying neglected value are all Arcus trademarks.

The same philosophy applies in the retail sector. Uniqlo (the owner Fast Retailing) doubled in a matter of months, helped by being the largest constituent of the share-price-weighted Nikkei index, and encouraging Arcus to short it. At the same time other retailers started looking like the cinderellas of the rally, languishing on fears that a weaker yen would increase the cost of their imported inputs. However there are signs of a sea change in consumer sentiment and nascent pricing power for producers. Apple has recently imposed a 20% price rise on its products and as other importers follow suit, attitudes will change. Typically, Arcus has profited from a revival in discretionary spending in less trodden areas, buying, for example, unique niche retailer Komehyo that recycles gifts given to Geisha girls and hostesses. Arcus also sees value in Japan’s answer to Ikea, Nitori. This bottom-up approach to identifying earnings power creates a highly individual portfolio.

Looking to the future

Similar examples exist in most sectors, with stocks in great niches but totally unknown to most investors, and with so many interesting opportunities it might be natural to get carried away. With Arcus, however, this does not seem likely as they have always taken a slow and cautious approach, particularly on capacity. After the good performance of 2003, hard-closed in 2004 with $850 million, staying shut until 2007 because, Macrae argues, studies suggest fund size rather than age is the key factor degrading returns in older funds. As the Arcus team are associated with more than one-quarter of their funds – the result of reinvesting performance fees – their over-riding aim is to keep returns high and so grow their capital alongside that of external investors.

However, with assets around $500 million there is still a reasonable amount of capacity to fill before Arcus’s small-cap and hedge funds get close to their target of $1billion, and attaining that is likely to take some quarters yet. Macrae wryly notes that institutional due diligence now comes by the kilo not the page. However, there is no rush. Two decades of deflation have taught the best Japanese companies patience and made them lean and efficient; the Arcus team have learned the same lessons.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical