Aspect Capital celebrates its 20th anniversary this year. The firm’s CEO Anthony Todd reckons that investors have had it too easy for the past 20 years, when a straightforward 60% equities, 40% bonds, portfolio – and indeed a risk parity approach that might have applied substantial leverage to the bond sleeve – generated remarkable returns. “Now, with compressed yields and potentially stretched equity valuations, there is deep concern about where to find steady returns of 4-6% above cash over the next cycle. That’s where quantitative multi-strategy approaches play a role,” he argues.

Aspect was founded in 1997, though its principals had been among the founding fathers of Europe’s CTA industry in the 1980s, and for many years the firm only did medium term trend-following, via its flagship Aspect Diversified programme, albeit with a growing number of “modulating factors” which now form a new product. “This strategy provides portfolio diversification, risk mitigation, and crisis risk offsets,” says Todd.

1. Trend Following Programmes: Aspect Core Diversified

In addition to its flagship Aspect Diversified programme, which is also available in an award-winning UCITS format, Aspect has launched a lower cost strategy, Aspect Core Diversified, derived from the flagship. Aspect’s Research Director, Marty Lueck, stresses that both Aspect Diversified programmes remain predominantly trend-following, and there is no desire to morph them into multi-strategy quant programmes. “We want to stick to the utility of medium term trend-following, while our new programmes, research and techniques offer a different utility function that investors can choose”. Investors are in the driving seat, ordering from an a la carte menu of strategies, and can treat many of them as building blocks for devising bespoke mandates. For now the new strategies will be offered in offshore funds and in managed accounts, but any of the new strategies could be put into a UCITS format if there is sufficient demand.

2. Multi Risk Premia: Aspect Absolute Return Programme (AARP)

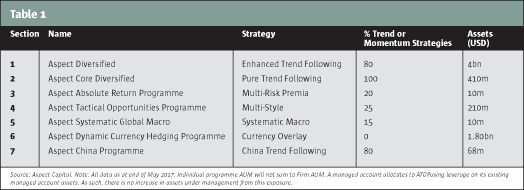

Trend-following has a very strong long-term pedigree over decades and centuries but its annual return profile is less consistent and there can be multi-year stretches when the strategy struggles to keep pace with the risk-free rate. Aspect has therefore greatly augmented its suite of non-trend strategies and the teams that develop them. “The aim is to build a strong, robust, diversified, multi-strategy capability,” says Todd. Most of Aspect’s new programmes are the mirror image of its flagship in terms of the exposure to trend. For instance, “While Aspect Diversified has an 80% risk allocation to multi-frequency trend-following models and 20% in the modulating factors, such as term structure, seasonality, value and relative value, the new Aspect Absolute Return Programme has only 20% in momentum, with 80% in the other strategies for maximum diversification over a broad range of strategies,” says Lueck. The other new programmes have similarly low proportions of their risk budgets in trend strategies. Some key attributes of the strategy range appear in Table 1.

The modulating factors

Aspect began developing the modulating factors in-house, around ten years ago, with the addition of FX carry to Aspect Diversified. Now the carry factor has branched out into multiple directions, with absolute carry, and relative carry, models applied over as many asset classes as possible – and carry is one among dozens of non-trend models across several products. Two years ago, Aspect determined that it was opportune to launch a separate vehicle fully utilising research on the non-trend factors and these have been running on a standalone basis using proprietary capital since May 21st 2016. AARP uses seven futures factors of which trend or momentum is one. Value, carry, sentiment, seasonality, technical and risk premia timing are the others, and it also accesses a range of cross-sectional equities factors through a risk-neutral portfolio of European cash equities. Rather than applying all models to all markets, increasingly some sub-models within each factor umbrella may be targeted at specific markets. For instance, one of the sentiment models, based on publicly available indicators, only applies to equity indices while another sentiment model, based on the futures curve term structure, applies to all futures sectors. All of them will evolve over time and there is much ongoing development of portfolio construction, carry, directional and relative value bets.

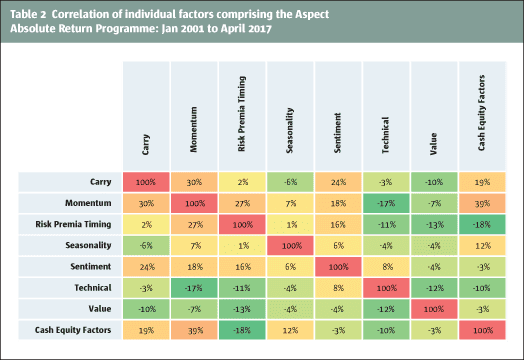

Weightings to the factors are not absolutely fixed, but tend to be fairly stable over time. Optimisation is based on the principle of risk parity, but with respect to risk factors rather than asset classes so that each of the seven families of models should make a broadly equal contribution to portfolio factor risk. Pairwise correlations between the factors are nearly all in a range between +0.20 and –0.20, which is often deemed to be statistically insignificant. Each individual factor has a standalone Sharpe of 0.5 to 1 and the low correlations are intended to increase the Sharpe of the overall programme.

Leading this charge is principal researcher, Dr Panos Dafas. Having been at Aspect for almost 13 years, Dafas is one of its most senior researchers and is a stalwart of the team. Dafas is a prescient scientist who was involved with “Big Data” long before it became fashionable. He initially studied electrical and computer engineering at the Aristotle University of Thessaloniki, in Northern Greece. Dafas then earned an M.Sc in Advanced Computing from Imperial College London, which included artificial intelligence and logic, before garnering a second M.Sc in Finance, at Birkbeck. Dafas finally pursued a PhD in Computing at City University where his subject area was Bioinformatics, a discipline that already used Big Data as a standard technique. Raring to go, Dafas joined Aspect in 2004 before even completing the write-up of his PhD.

His main focus, for much of the past 13 years, has in fact been on honing and refining the trend models, and he thinks investors may underestimate the amount of work that has gone into this. Dafas has also been very much involved with developing the modulating strategies, with portfolio construction and risk management. “All of them are continually evolving, with two to three releases per year, each containing enhancements to both trend-following and multi-strategy programmes,” says Lueck. Dafas reiterates that the flagship, Aspect Diversified fund has been kept close to a pure trend programme.

AARP, which has average holding periods of approximately 3 months, is thought to have overall strategy capacity of $10bn for an 8% volatility target.

Enhanced Risk Premia

Aspect Core Diversified, which could run tens of billions, marked Aspect’s first move into a very scalable space that has several labels including enhanced risk premia, alternative risk premia, and alternative beta. “The principle is simple. You take a straightforward driver, such as momentum, which in its crudest form is easy to get some return from and we apply our experience and expertise to enhance the extraction of value from that driver. We see rapidly growing demand for the new sector of alternative beta,” says Lueck. As a result, Aspect now has two enhanced risk premia offerings. Core Diversified delivers the pure momentum risk premium to its growing investor base, while the recently-launched Aspect Absolute Return Programme provides access to a broader range of different alternative risk premia.

Clearly, there are abundant launches, but Todd argues that there are “few well established managers with the experience and track record to strike a strong chord with institutions who want a liquid source of absolute return, at a competitive price level”. Aspect does not worry that moving into lower cost products will cannibalise its other offerings. “To extract maximum value from medium term trend-following is much harder, hence we have spent 20 years researching, polishing, refining and adding to models,” explains Lueck. Though the big picture is that average hedge fund fees have come down, this belies a degree of bifurcation between some beta-oriented products at lower fees, and true alpha continuing to command premium fees. And all of the other new strategies, which charge typical hedge fund fees on a volatility-adjusted basis, are clearly complementing, rather than competing with, the risk premia programmes. In fact, broadening out the product range opens up opportunities for cross-selling: a conversation that starts with crisis alpha and trend-following could move on to FX overlay. Aspect are confident that they can “blend frequencies, markets and strategies to build out premium multi-strategy capability that can generate high quality, consistent and steady return streams,” says Todd.

3. Shorter-term trading: Aspect Tactical Opportunities (ATOP)

Despite Aspect’s substantial in-house resources – 133 staff of which over 70 are in research and development – the manager has felt it worthwhile to acquire teams from outside Aspect, and in some cases intellectual property and track records as well. From three teams acquired between 2014 and 2016, two strategies are being rolled out. Aspect has hired teams with experience at firms with larger asset bases, namely Capula, and those running smaller amounts, namely Auriel.

Dr Constantin Filitti, who has a PhD in Economics from the University of St Gallen, and mathematician Antonio Botelho, both of whom were previously at Capula Investment Management, joined in July 2014 to run a systematic multi-strategy futures programme, the Aspect Tactical Opportunities Programme (ATOP). ATOP pursues multiple styles as part of a shorter term managed futures programme, trading 100 liquid futures and currencies. Holding periods between one day and one month average out at between five and eight days (depending on whether the weighting is by turnover or risk contribution), which is much faster than a traditional trend-follower. This is the main reason why capacity, currently estimated at $500m given the 10% volatility target, is lower, but new research may increase capacity.

ATOP follows multiple styles, with over 20 models under four distinct themes, each with a different source of alpha, and predicated on different economic hypotheses. The models can be categorised into four families: short term trading, relative value, factor premium timing and momentum. The first, whichhas average holding periods of one to three days, is the most capacity constrained. Risk budget allocations to the four model types are broadly equal.

“ATOP diversifies along three dimensions: by markets, holding periods, and sources of alpha. Markets alone are insufficient because both markets and strategies have become more correlated since 2008,” observes Filitti. Sources of alpha can include flows, macro-economic drivers and lead/lag relationships, price patterns, and time-varying risk premia.

ATOP’s 0.4 correlation with traditional trend-followers derives mainly from the 25% of risk capital in the momentum sleeve. Though the momentum strategies within ATOP can be four or five times faster than those in Diversified, there is still some correlation between momentum over different time frames. “ATOP is not correlated with conventional asset classes and is a portfolio diversifier, for investors that may have long exposure to equities and bonds, and possibly some traditional trend followers as well,” says Filitti. In assessing how ATOP interacts with other strategies and asset classes, Aspect’s statistical analysis goes beyond mean and variance into the higher moments of the distribution: skewness and kurtosis. ATOP returns are positively skewed (albeit not as much as those of traditional trend followers), which enhances the diversification benefit. Additionally, “conditional performance is critical in terms of how strategies perform in bad states of the economy when payoffs are most needed,” points out Filitti. Liquidity is also an overriding concern and “it is not so easy to be liquid, uncorrelated and offer a good payoff,” he argues.

ATOP is now into its third year of live trading at Aspect. It has attracted $200 million of external capital, which “is very encouraging for the team and for Aspect,” says Lueck.

(L-R): Dr Anoosh Lachin, Asif Noor, Dr Constantin Filitti, Dr Panos Dafas

Special challenges of faster models

The ATOP research programme is to some extent “running to stand still” in that it takes considerable effort just to maintain the quality of alpha. The short-term space requires a different research mind-set in terms of both model evolution and execution. Whereas medium and long-term models are predominantly based on well understood, well recognised, and persistent market risk premia, shorter term models suffer from much faster alpha decay, which means that research has to evolve all the faster to keep pace.

More attention must also be devoted to execution at faster time frames. Aspect is fortunate in “having a trading desk that uses both internal, proprietary algorithms and external ones, working closely with brokers to optimally parameterise the algorithms,” says Lueck. Aspect may execute through outright or basket trades, and does not only use off-the-shelf algorithms. The team spend much time understanding and analysing alpha decay, on an intraday or multi-day basis. “For some trade types, 30-40% of alpha is lost if you do not execute optimally while for certain spread or basket trades all of the alpha may be lost through suboptimal execution,” points out Filitti.

4. Aspect Systematic Global Macro (ASGM)

In contrast to ATOP, Aspect’s systematic macro strategy averages multi-month holding periods. ASGM portfolio managers, Asif Noor and Anoosh Lachin, wanted to join a bigger company after they became frustrated that Auriel was not realising its potential post-crisis. Auriel had struggled to grow assets organically as investors seemed to prefer larger firms and the fund that Noor and Lachin ran shut down, despite good long term performance numbers. As well, Lachin and Noor wanted to focus all of their energies on research and portfolio management. “One advantage of belonging to a larger firm is that we no longer have to worry about trade execution,” says Lachin. He also finds that Aspect has the infrastructure to handle the peculiarities of fundamental macro data, which “cannot just be downloaded from Bloomberg. It will often need to be cleaned and modified to allow for data lags and revisions, address look-ahead bias, and so on”. Though the duo explored opportunities with many companies, Lachin recalls that “Aspect felt like the right fit from the first meeting”.

The strategy developed at Auriel is highly complementary to CTAs. ASGM blends three uncorrelated return streams, based on three styles: value, sentiment and technical. “All have been honed and refined through market regimes and business cycles to develop a more robust strategy, and we are always open to new factors,” says Noor.

One simple differentiator from CTAs is that ASGM does not trade commodities, and the managers think that doing so would increase its correlation to Aspect and competitors. ASGM for now trades foreign exchange, fixed income and equity index volatility. “ASGM was deliberately differentiated from the start,” recalls Lachin. The strategy dates back to at latest 2004, and its beginnings were even earlier as part of GTAA (Global Tactical Asset Allocation) programmes run at Deutsche Bank. ASGM has a low correlation to CTAs, of between 0.3 and 0.4. This largely arises from the technical sleeve, which contains some momentum models, but also includes mean reversion.

As with some of the other Aspect programmes, different models apply to different asset classes. For instance, exposure to trend systems varies by asset class, so foreign exchange has more trend models whereas fixed income has none at all. The bond models contain both relative value and directional elements as fixed income exposures are market neutral on a cash basis, but can have minimal duration exposure. “Some fixed income models have been switched off in response to negative interest rates, but these models have not been retired,” adds Noor. Equity volatility is exclusively on a relative value basis, using exchange-listed VIX futures. Rather than taking directional views on volatility, ASGM trades futures at multiple points along the curve to construct calendar spread trades.

In emerging markets, ASGM trades major EM currencies but no EM debt nor interest rates at present. ASGM typically allocates 20% of the currency risk budget to trade seven of the most liquid EM currencies (eg Brazil, Korea, Mexico) which are more liquid than local equity markets and can even be more liquid than some developed equity markets, such as Canada’s. The EM basket is neutral with respect to US dollar exposure. A mix of technical and carry models are used.

Systematic macro programmes are often perceived to have a bias towards the currency carry trade. On average, ASGM will run at some degree of positive carry, though only one of the twelve models is explicitly based on carry. The carry model in isolation could go to zero or flat carry but would not go to negative carry. In contrast the whole book could run at negative carry if positioning in the other eleven models outweighed that in the carry model.

“For instance, a model looking at GDP could be short of Australian Dollar and long of Japanese Yen,” Lachin illustrates.

Noor expects ASGM may expand its investment universe, and is pleased that Aspect already has the infrastructure in place to do this; Aspect Diversified last year added interest rate swaps in EM. “All of the models and systems continue to evolve. They are refined according to the market climate and have worked over 10-15 years,” says Noor. ASGM could run at least $3 billion at a volatility target of 12%.

The ASGM team are confident on the outlook partly because correlations between markets have been falling in recent months. Lachin thinks this is partly due to the changing interest rate climate and divergent central bank actions. For example, the Fed has started raising rates while the Reserve Bank of Australia has kept them low.

5. FX Overlay – Dynamic Currency Hedging Programme

The currency overlay programme carves out the FX models from ASGM. What is different is that they are constrained according to clients’ preferences for base currencies, underlying currency exposures, and so on. “The FX overlay meets different needs which are solution-based. Large pension funds can choose whether to hedge FX exposure, leave it unhedged, or dynamically move the hedge ratio around. This is a very niche area that is much misunderstood,” says Noor. Aspect argues that a dynamic hedge that varies hedge ratios can mitigate risk, add alpha and sometimes free up capital that could otherwise be tied up in providing initial and variation margin for fixed currency hedges. The classic argument for currency market inefficiency is that non-profit making participants, such as central banks and tourists, are price insensitive. The developed currency overlay programme might run as much as a notional $30-40bn at volatility of 1%.

6. Chinese Commodities: Aspect China Programme

Over the years, many hedge funds, both systematic and discretionary, have told us they are closely monitoring, and exploring opportunities in China’s local commodity markets, but are not actually trading them due to various obstacles that exist for non-domestic Chinese investors. Aspect’s pragmatic solution has been to set up a programme that is, for the time being, only available to domestic Chinese investors. This was ten years in the making. Aspect opened a Hong Kong office in 2008, initially for investor relations. “When we resolved to start trading China’s commodity markets, it was vital to find a high calibre local partner. Our approach to China was cautious, conservative and copper-bottomed,” says Lueck. Years of discussions with local regulators were needed for Aspect to get comfortable with the environment. Long term, the hope is that offshore ie non-Chinese investors might, one day, be able to access these diversifying markets as well. “Some of the industrial commodities traded on Chinese futures exchanges cannot be found anywhere else in the world. They include coal, glass, PVC, polyethylene, rubber, lead, palm oil, eggs and Chinese 5 year bonds. Their correlation to commodities traded on other exchanges is low,” Lueck enthuses. Though this is uncharted territory, Aspect has taken its models that have a 30-year track record and applied them to the new dataset. “This is the ultimate out of sample test and the results have been very good,” Lueck is delighted to report.

Simulation and research

Not every new application of a strategy works as well as the China commodities have however. Developing new strategies involves a mixture of historical, hypothetical back-testing, and live management with proprietary capital, before strategies are rolled out. Of the potential new strategies acquired or developed by Aspect over the past few years, one of those that was externally acquired has been replaced with a new, organically developed strategy covering the same asset class. Thus innovation includes some trial and error.

Aspect’s paper, The Art of Simulation, from the Aspect Capital Insight Series, explores the methodological and statistical issues entailed in back-testing. Says Aspect’s Chief Risk Officer, Anna Hull, “we make sure highly skilled people understand the information, what it tells them, and what flaws in a simulation to avoid so they do not get fooled by the information”. The teams are all highly trained in advanced mathematical, statistical techniques so they grasp the problems. Aspect acknowledges that there are survivorship biases over time, as factors that performed well in the past may not do so in future. Aspect is also keen to avoid pitfalls such as “look-ahead bias” or “hindsight bias”, “overfitting” and “back-fitting”. Look-ahead bias takes account of data or events that were not known during the period of the simulation. Overfitting involves including too many parameters, while back-fitting adjusts a model with knowledge of the simulation results. Out of sample testing, over time period(s) different from those used for the in-sample test, is one approach that can help to mitigate these biases. But even with a thorough and disciplined framework for eliminating conscious biases, the research process may still be informed by subconscious biases. Aspect are aware that simulated returns can be unsustainably high. The teams compare simulated and realised performance in order to estimate “shrinkage”. A deflator is applied to “degrade” the results of simulation and thereby allow for alpha decay. No hard and fast rule, such as 50% degradation to allow for 50% alpha decay, will apply, because Hull stresses that “such a fixed rule misses the nuance that relationships between simulations and the future are not linear and are not fixed. Models, data, the speed of signals, whether inputs are fundamental or price data, can all have a bearing on how closely related simulations are to live results”. For instance, “with a behavioural driver of returns such as in managed futures, you can back-test for 200 years but you cannot do so for newer strategies”.

Another multi-faceted problem is how to decide which potential new models are likely to add a diversification benefit. The simplest test of orthogonality is the linear correlation of returns. But a hard maximum correlation coefficient hurdle for adding new models would be too simplistic. Hull looks at correlation from many angles and does not find a one size fits all approach suits investing well. “Simple correlation is only one measure of diversity, which can be measured in many ways,” she explains. The first is simply whether a new model improves the ability to generate returns. A second angle is periodicity – whether models improve the quality of returns over daily, weekly, monthly or annual timeframes. “Diversity can also be measured on more qualitative criteria, such as does it use a different data source?” Hull elaborates. In summary, Hull finds “any hard ceilings on correlation metrics for new models would limit innovation”.

Aspect’s risk team have a two-way dialogue with the investment teams about the techniques used and can highlight flaws. “An ongoing intellectual debate makes for an intellectually stimulating challenge and increases confidence that theoretical research can translate into good and consistent returns,” Hull finds.

Risk management is portfolio management!

Hull, who featured in The Hedge Fund Journal’s 50 Leading Women in Hedge Funds 2017 report, began her career in quantitative fund management and has been a portfolio manager of her own products as well as risk-managing other funds, programme-trading for index funds and trading derivatives. She does not view the role at Aspect as a move from portfolio management to risk management, revealing, “I like the whole fund management process from start to finish, from clients, sales, back office and idea generation to building products that benefit the end client”. Hull joined Aspect in a product management role before shifting to risk management, which at Aspect seems very different to the function at some discretionary firms. “It is not a policeman’s role. It is an integral part of the entire investment process chain, more connected to the research process. Risk management is remarkably similar to portfolio management, and I am a hedge fund manager!” she explains. Hull now has direct responsibility for seven investment and operational staff in Aspect’s risk team. “Our role is about monitoring, and raising questions. The risk management committee independently reviews all work from the research team. Risk management was historically siloed but it is better to have an integrated and combined team so that the risk team understand the rest of the business”.

Brexit stress testing

For Hull, Brexit is “among many events that have an investment risk and an operational risk element to them, which shows the importance of risk management being unified rather than in separate siloes”. She expects “the operational challenges will be large for investment management houses and the financial industry, and the challenges will depend on the client base, product range and regulatory environment”. Two years before Brexit occurred, Aspect ran a stress test exercise that identified a key area was ensuring staff can stay in London. In common with many London hedge funds, Aspect employs staff, such as the new managers interviewed here, who were not born in Britain. Fortunately, Hull “does not envisage immigration restrictions being an issue, because we are working to ensure that is the case”.

As far as portfolio management and fund distribution is concerned, Hull admits that “anything is possible and the issues are not entirely clear at present, but we anticipate there may not be any issues at all”. She also expects that “Aspect will continue to run funds, and market them, globally, partly relying on the equivalency regime and partly through various investment vehicles such as its Irish UCITS, and its Cayman AIF”.

Regulation and counterparties

Reflecting on the frantic pace of regulatory change since 2008, Hull is confident that Aspect can control the impact of those rule changes that directly affect it, but sometimes has more difficulty getting comfortable with rule changes that indirectly impact Aspect, via counterparties. “Our counterparties tend to be much larger and slower moving entities than we are, and regulations can have a much more dramatic impact on their business and ability to deliver services. For instance, US Dodd-Frank rules and MiFID have both taken a lot of bandwidth and distracted counterparties, who respond to these challenges in different ways”. Over-ambitious time frames that leave inadequate time to clarify new rules are a source of stress for Hull. “We do not have control over counterparties’ readiness for meeting the regulations and regulators have often had to provide blanket or selective extensions of rule deadlines, with negotiations coming very close to the line as sufficient guidance only arrived very late in the process,” she explains. In extremis, the only option may be to change counterparties, and Aspect is fortunate in having plenty of relationships.

Liquidity

In general, liquidity risk is not an issue for Aspect, which trades the most liquid markets and runs products with daily or monthly dealing targeted at liquid instruments. Yet this is no cause for complacency. Hull explains, “We are not blasé about the issue. All of our instruments fit into the very liquid bucket but there are gradations within that bucket, particularly as we have expanded into harder to access interest rate swaps and Non-Deliverable Forwards (NDFs)”. Aspect is“conscious that instruments have fluctuating liquidity and has ceased trading markets that became less liquid, with the Russian Rouble in 2014 probably the best example,” she illustrates.

Future research

Research at Aspect is subject to an independent peer review process where no individual is dominant, and the risk management committee provides additional oversight. Aspect continues to hire with the research pipeline now drilling into intraday trading, flexible execution methods, and very broad new alternative datasets, to more swiftly forecast macro variables before they are released. “This is about improving the quality of our macro data by aggregating diverse sets of micro data,” says Lueck.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical