Though early 2009 marked the bottom for developed market equity prices, investors have remained ultra cautious about most equity hedge strategies. Periodic bouts of volatility, notably in August 2011 and May 2012, have underscored the adverse risk of investing in stocks with a net exposure designed to capitalise on any sudden positive beta.

It’s a world where risk-off caution is the new normal. Even stock pickers running equity market neutral strategies find the market environment difficult to trade and returns tough to generate.

In response, some investors want to be positioned to profit from possible further lurches downward in equity prices. Among these investors may be some pension funds which have limited ability to withstand another market shock and need to protect their portfolios against extreme negative moves in the market.

Typically, funds could purchase insurance through buying puts on equity market indexes. But sellers of puts have left the market, increasing the cost of protection and pricing many potential buyers out of the market. Nor is the provision of such puts likely to expand much since the Volcker Rule is forcing banks and others to decrease the amount of long-dated options they will sell to reduce excessive risk.

Tail protection

Against this backdrop AXA Investment Managers developed the AXA IM Tail Equity Diversifier or AXA IM TED. When the alternative investment arm of the giant French insurer set up the fund in 2010, it was the first multi-manager tail solution on the market.

Francisco Arcilla took over as AXA IM’s global head of funds of hedge funds in October 2011. Shortly after this AXA launched a commingled TED fund. Including dedicated mandates, there is now over $600 million in the strategy. In an interview, Arcilla explained the thinking behind making AXA IM’s alternative arm a new generation solutions provider and began by providing some insight into the development of TED.

“The underlying vehicles we use for this solution are not black swan funds that just buy protection,” says Arcilla. “We aim to achieve the payout profile by combining managers who do things that are unrelated. The idea is we give them constraints. One of the constraints we give them is they can never be short volatility because we don’t want any manager to be wrong footed in the sudden impact of a systemic event, such as political crisis or a massive downgrade of a key issuer.”

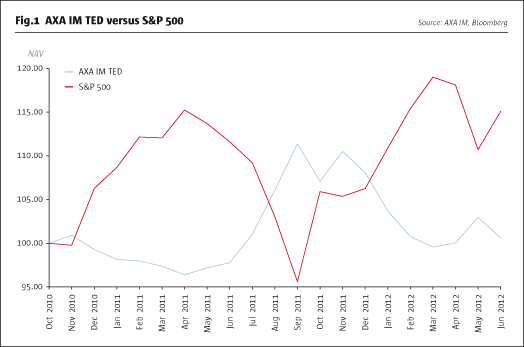

Whether so-called ‘black swans’ are less rare than generally believed, recent events have shown that unconventional market developments are relatively frequent. In mid-2011, for example, interest rate rises were priced into the market and systemic challenges to valuations were being downplayed, while this year a powerful rally has petered out but downside risk was probably underestimated. Thus the equity market hiccups of August 2011 and May 2012 look to have come out of the blue. But in both instances as sharp downside moves in equities took place, TED profited strongly (See Fig.1).

Investor types

As an insurer, it isn’t surprising that AXA IM’s design of TED may appeal to other insurance groups. The Solvency II rules that mark risk scores for different asset classes (making it more costly for insurers to hold equities) may well push investors to buy tail risk solutions like TED.

“In general, investors who have diversified asset allocations and work at a chief investment officer levelmay look at TED because it is not just working on an assumption about a market scenario,” says Arcilla. “Instead it is also working on the fact that when these moves manifest themselves, or the perception that these moves may happen arises in the market, then the usual relationships between assets quit functioning and their portfolios become dysfunctional.”

Long volatility bleeding

The use of put options which are priced in terms of implied volatility has become more expensive as investor demand, in a shaky market environment, has risen just as supply has fallen. This has led to excessively high volatility prices, especially in longer-dated maturities. As volatility has gotten more expensive, the cost of portfolio protection for investors has also increased, leading some to wonder if the price of insurance has become too high.

The constraint on AXA IM TED portfolio component managers to never be short volatility means that as long-biased volatility players they will bleed premium income over time. In normal market environments the implied cost means that in any given year TED’s expected returns are a “zero minus” figure. Overall, the strategy is expected to be between -10% and +10% in a typical year. Should a strong rally in risk assets occur, TED would aim to limit losses at about -20%.

Concentrated construction

Given the specific investment aim of providing tail risk protection, the portfolio is relatively concentrated. It launched with four managers and has now expanded that to eight.

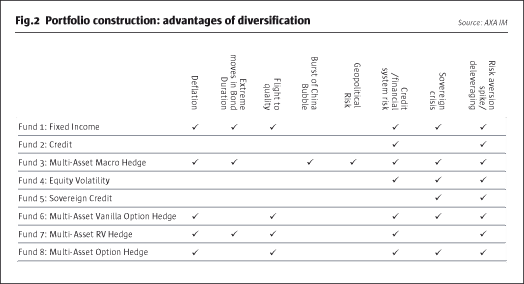

“Our guess is it will never be significantly above 10 managers unless we start looking at new areas of the market or finding new ways to look at the problem,” says Arcilla. “The asymmetry we are looking for in the return profile is based on certain types of stress. Right now with eight managers it is highly diversified as each of them does something different (See Fig. 2).”

The managers cover a wide variety of asset classes trading both directionally and on a relative value basis. Some managers have more of a geopolitical outlook whereas some are more mechanical in their approach to markets, including one active options strategy. The costs of the various styles and trading methodologies differ and not all are inherently costly to run. Generally the strategies are one part of a manager’s existing book lifted out and customised for the fund through exclusive managed accounts for TED.

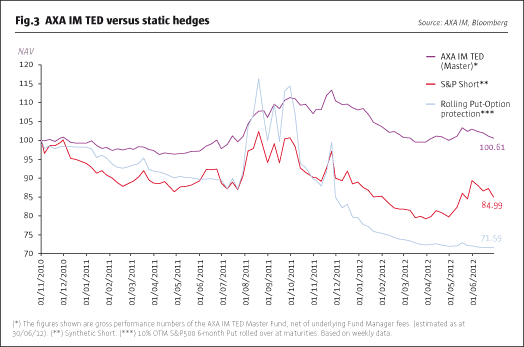

Combining the strategies has an important impact on performance. Since 1 November 2010 TED has strongly outperformed a synthetic S&P short and rolling put-option protection (See Fig. 3).

Rebalancing and downside risk

Taking a measured approach to tail risk protection sees the fund rebalance positions each month. One reason for the rebalancing is that each manager performs differently at different points in the cycle. Performance of these highly convex strategies, which can be lumpy, can also generate a need for rebalancing.

“But the main reason for rebalancing is really a forward-looking stress test where we try and establish the asymmetry of the portfolio,” says Arcilla. “So we try to migrate away from managers who because they have started performing become less asymmetric. Typically what you find is that when a manager has made a significant amount of money it is very possible that the risk return/risk reward might not be the same any more in which case we will readjust.”

Also built into the portfolio construction is a risk budget assigning a maximum loss tolerance to each manager. Pooling these together is the rationale underpinning the worst case scenario of a -20% maximum intended drawdown for the fund in a strong bull market. The loss tolerance has a speed limit so that the risk budget is stretched over the year. Only if trades went uniformly wrong among the managers over the year would the -20% scenario come into play.

Core multi-strategy fund

The several multi-strategy fund of hedge funds portfolios AXA has run for over a decade all follow a low volatility, diversified approach. Each portfolio contains 30 to 40 positions across all strategies, including macro, event driven, arbitrage and equity market neutral.

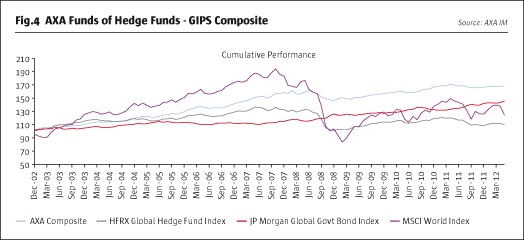

The AXA Funds of Hedge Funds Composite (see Fig.4) is the asset-weighted GIPS-compliant aggregation of these multi-strategy portfolios. This composite’s conservative risk profile – its return target is Libor plus 400 basis points per annum over the cycle – got reinforced in mid-2011 when it repositioned from having modest net equity market exposure to currently running with 0% forward-looking beta.

“Historically we have had a lower equity beta than the industry average,” says Arcilla. “If a standard multi-strategy was around 30% we tended to be around 15% or half that. We tried to overturn the general intuition among investors that the portfolio would perform slightly better in up markets than in down markets. We wanted to kill that obvious directionality.”

The approach paid off in 2012. The AXA Funds of Hedge Funds Composite was up 0.59% in the first quarter, but also up 0.41% in May when markets – and most funds of funds – lost money. Essentially, the fund produced a similar result, up an estimated 0.91% for the first half, without the volatility displayed by many multi-manager funds where a strong performance in the first quarter preceded sharp losses in the second quarter.

TED helps discipline

A by-product of the development of TED is that it has introduced some new processes at AXA IM’s hedge fund platform. This has been applied to gap risk in different market environments, for example. Assessing forward-looking scenarios and measuring correlations among different asset classes within the fund is another beneficial discipline.

“I think it helps us get a behaviour that is better for what we have been hired for which is a very low volatility, conservative and accretive investment,” says Arcilla. “Our parent client (AXA Insurance) is prudent and objective-driven. They rely less on where we stand versus the rest of the hedge fund industry at any given time. Instead, they want to hit a target or get as close to the target as often as possible.”

Since inception in December 2002 the AXA Funds of Hedge Funds Composite’s track record shows an annualised return of about 5.93% (See Fig. 4) and good risk controls. When most multi-manager funds lost 20% or more in 2008, the AXA Fund of Hedge Funds Composite was down just 8.04%. In 2011, it also outperformed, losing just 0.93%.

“It’s a different type of approach,” notes Arcilla. “I think objective-driven investors like pension funds and insurers want money managed in a very different way where avoiding and minimising drawdowns lead to accretive capital growth through a more stable path. It is a very different mindset.”

Running AXA IM

Arcilla has day to day responsibility for running the fund of hedge funds operation of AXA IM, which oversees about $5 billion, including about $4 billion from the parent. He took on the post in the autumn of 2011 just as the business began to adopt a much more direct solutions-focused approach to hedge fund investing.

This transition was accelerated with the appointment in May of former Lyxor Asset Management CEO Laurent Seyer who now heads investment solutions at AXA IM. Seyer is expected to unveil some changes later this year about how AXA IM will offer investment solutions across its €100 billion asset pool.

Arcilla sees three key aspects to his role. One is the promotion of the solutions designed by the hedge fund investing unit; the second is overseeing the investment process and its governance; and the third is running the business operationally day-to-day involving IT, administration and the like.

He chairs the fund of hedge funds investment committee. It looks at different managers that may be added to the funds, determines what the top-down view should be and considers the broader strategic outlook. Risk apportioning among managers and in the investment process is also actively monitored by an independent risk function.

It is in the promotion and message positioning that some of Arcilla’s most important duties lay. Here the aim is to show investors that hedge funds can work for them in a number of different ways. A multi-strategy approach, for example, can prioritise an investor’s specific priorities, while something like TED can hedge tail risk. Meanwhile, on the drawing board is a negative duration solution to launch before the year end that will be designed to make money if yields go up.

“Our repositioning message goes beyond saying investors should buy hedge funds because they diversify your income exposure,” says Arcilla.

“It’s really about saying you can utilise hedge funds and make them work for you in many different ways. If it is very difficult to do something with a traditional investment we can then propose using hedge fund techniques, whether to the various AXA companies or to external clients.”

Edgy investors

Perhaps the great unknown in hedge fund investing is when European allocators will come back to the table. Traditionally, Europeans have favoured the fund of funds approach. In 2012, the continental landscape is fairly riddled with the carcasses of underperforming multi-manager funds as consolidation continues to slowly rationalise the sector. But European investors, even with reduced allocations, continue to have an impact as the growing emphasis on liquidity and transparency shows.

“The American market is more patient with hedge funds because they have more experience,” says Arcilla. “If you have a long enough horizon you are thinking this is a bad patch but that it is still within the range of probability. In Europe, a lot of investors came in late, sometimes for the sake of diversification or because everybody else was doing it. They might not have been certain what was in some portfolios until things went wrong and that was a bad way to go about it.”

The dynamic of the US market is quite different, he notes. US institutional investors want to be invested with hedge funds for the long run and don’t want to be commingled with the so-called ‘fast money’ that may quickly enter and exit a fund with frequent liquidity.

Asked what might kick start hedge fund allocations among European investors, Arcilla says straightforwardly: “Performance, performance, performance.”

Hedge fund scapegoats

But it is likely a fair bet that strong performance may prove illusive for hedge funds as a group in 2012. In the meantime, the element of risk from unexpected events in markets, particularly in Europe, could quickly see hedge funds blamed for wider systemic problems. In such a scenario, arguments that hedge funds provide downside protection, give an option on the future or improve the efficiency of capital markets will mean relatively little.

“I think there is a lot of emotion when it comes to hedge funds,” says Arcilla. “I think in some cases hedge funds are a bit of a scapegoat. There is a perception that hedge funds are evil but by most metrics against most asset classes they have actually done alright over time.”

The future role for alternative investing may take several years to work out even if the appetite among investors remains relatively constant. But to Arcilla the key is for hedge fund managers to offer types of returns that aren’t available from traditional asset allocation.

“I think the intuition of investors is that alternatives are going to get you something different,” says Arcilla. “For the last 20 years every time equity made money, fixed income lost money and vice versa. There has been a nice, comfortable inverse relationship. Going forward that might change and there might be cases where they both make or both lose money. With zero rates and massive stimulus and liquidity being pumped in, inflation may result. If the debt equity relationship becomes less stable, there will be a strong case for revisiting hedge funds and alternatives.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical