In the summer of 2018, the investment world felt poised for change. By many measures, the major asset classes had reached what appeared to be relatively full valuations against a backdrop of a less certain future environment. With deference to those who previously coined “crisis alpha” we provided some thoughts on potential inflection point alpha constituents. As markets became more unsettled and alternative managers started to give back significant returns, we further began to pontificate on the possibility of a “December to Remember”. Be careful what you ask for, because the markets certainly provided that!

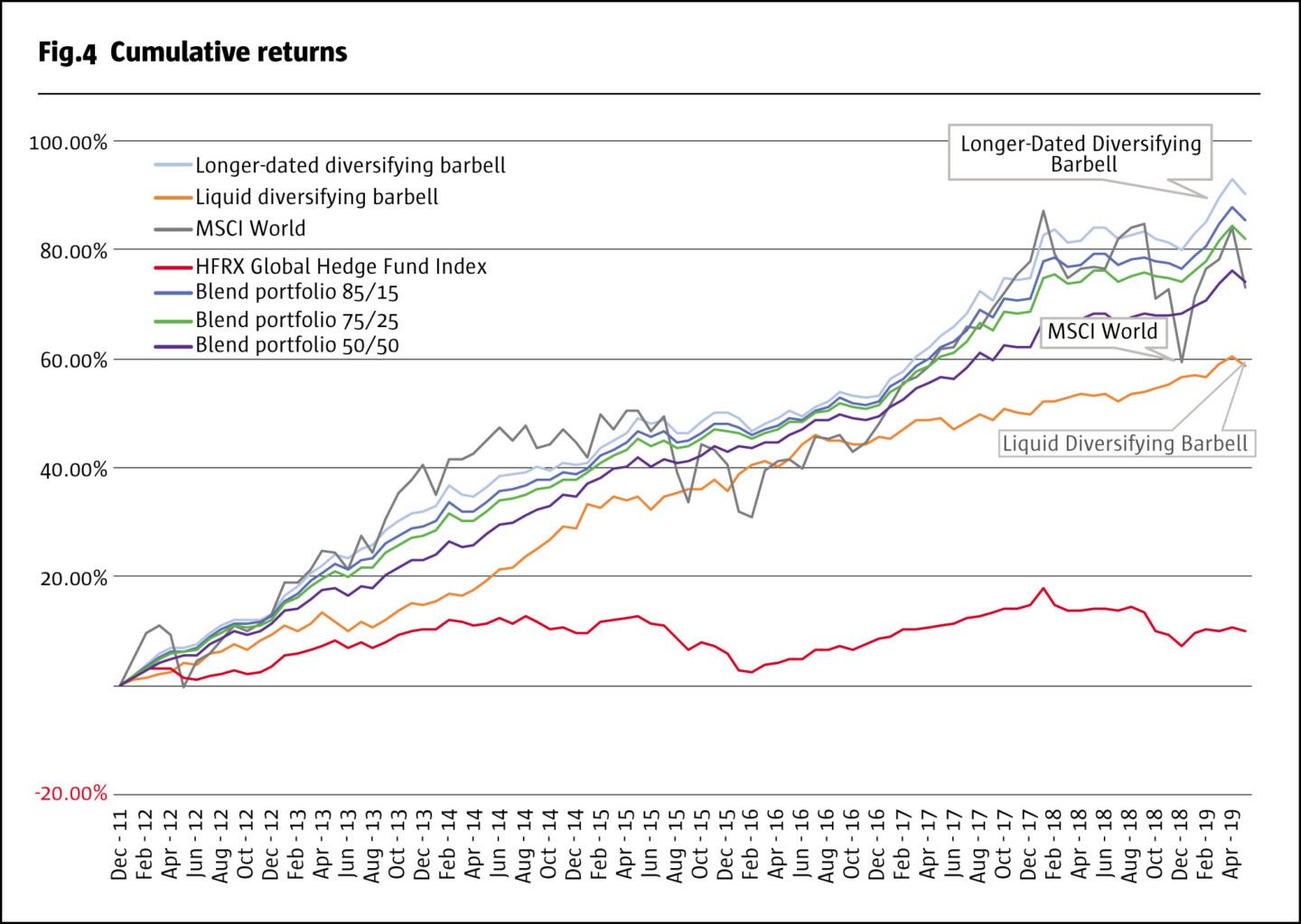

Fast forward to the remarkable asset recovery in 2019 which brought the equity markets to new highs and uncertainty once again seems to beckon. The clarification around the status of the US economy and central bank have removed some clouds on the economic horizon, but much remains unchanged. The environment since Q4 2018 may be the new normal, but it has certainly been a challenge to allocators seeking to insulate their portfolios from adverse price and liquidity events which are typically prevalent around market shifts. Despite the violent sell-off and the euphoric rebound, the need to diversify traditional and alternative investment portfolios is greater than ever. Having looked previously at the diversifying alpha portion of the portfolio, it is perhaps useful to examine the balancing, return seeking side of the portfolio which is longer-tenored, idiosyncratic alpha. It is this combination of two powerful return streams that seems to resonate with investors as they try and find upside returns while minimizing negative skew.

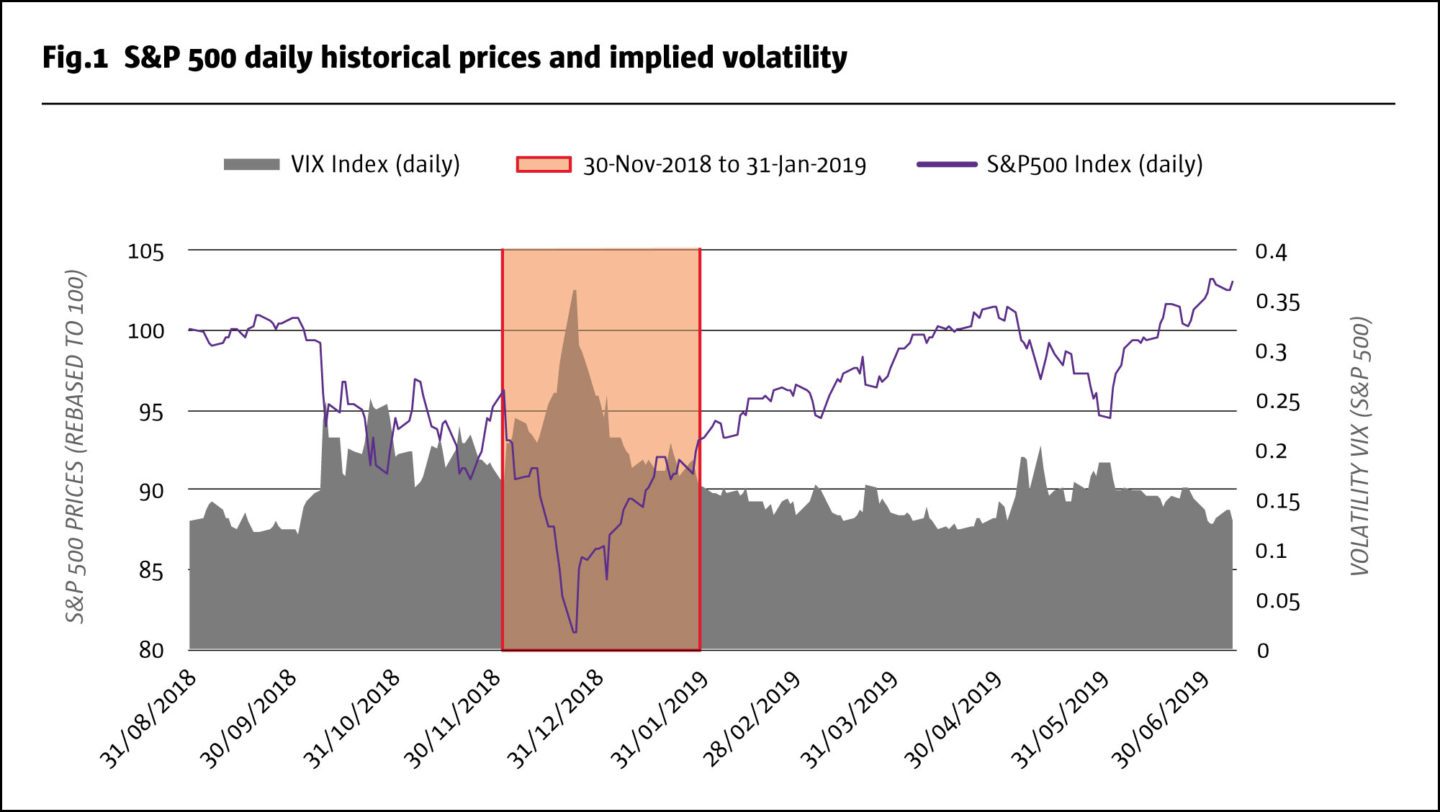

A quick re-hash of the current (dynamic) market environment makes sense. The lead-up to December’s marked correction, which was centered on equities but affected all assets, was one of divided opinion amongst investors and pundits. By Christmas Eve, the predictors of market despair and global recession drowned out more constructive views. However, buy the dip (or stay the course) investors were rewarded by the double-digit recovery experienced quickly afterwards in early 2019. While the equity market swoons seem to be twitter-frequent, markets, particularly US, seem to be weathering the storm, with a reasonable glide path going forward. On investors’ minds is the question “has anything changed since last summer?”. Although there have been a myriad of developments, market levels (ex-volatility), seem to indicate that the globe is still at an inflection point. The major geographies are diverging a bit more and the central banks seem to be united on not becoming Japan, which should probably be factored into asset allocation for the next cycle. The pundits now seem to have aligned behind the vision of a slowing, if not recessionary, global economy. Global rates have continued to decline and fixed income has led defensive assets’ returns, with the US 10 year’s yield falling below 2%, surprising many. The fact that equity markets continue to peak at the same time does cloud the crystal ball, but has perhaps given investors a window to make adjustments. Equities cannot persist as the money market substitute they seem to have become.

A manager generating idiosyncratic returns cannot be easily identified if their peer group is performing similarly.

Jim Neumann, Partner, Sussex Partners

The addition of uncorrelated, diversifying elements to traditional and/or alternative portfolios remains critical. The results since last summer have correctly called the environment and preserved capital. However, the absolute return of these diversifying portfolios has not been significant against the renewed US equities rally. This seems to be on a positive trajectory in 2019, but the many daily reversals are making the path harder to navigate. In fact, this dramatic increase in significant up and down equity days, particularly when nearby each other, has managers struggling to produce more consistent returns reflective of their track records.

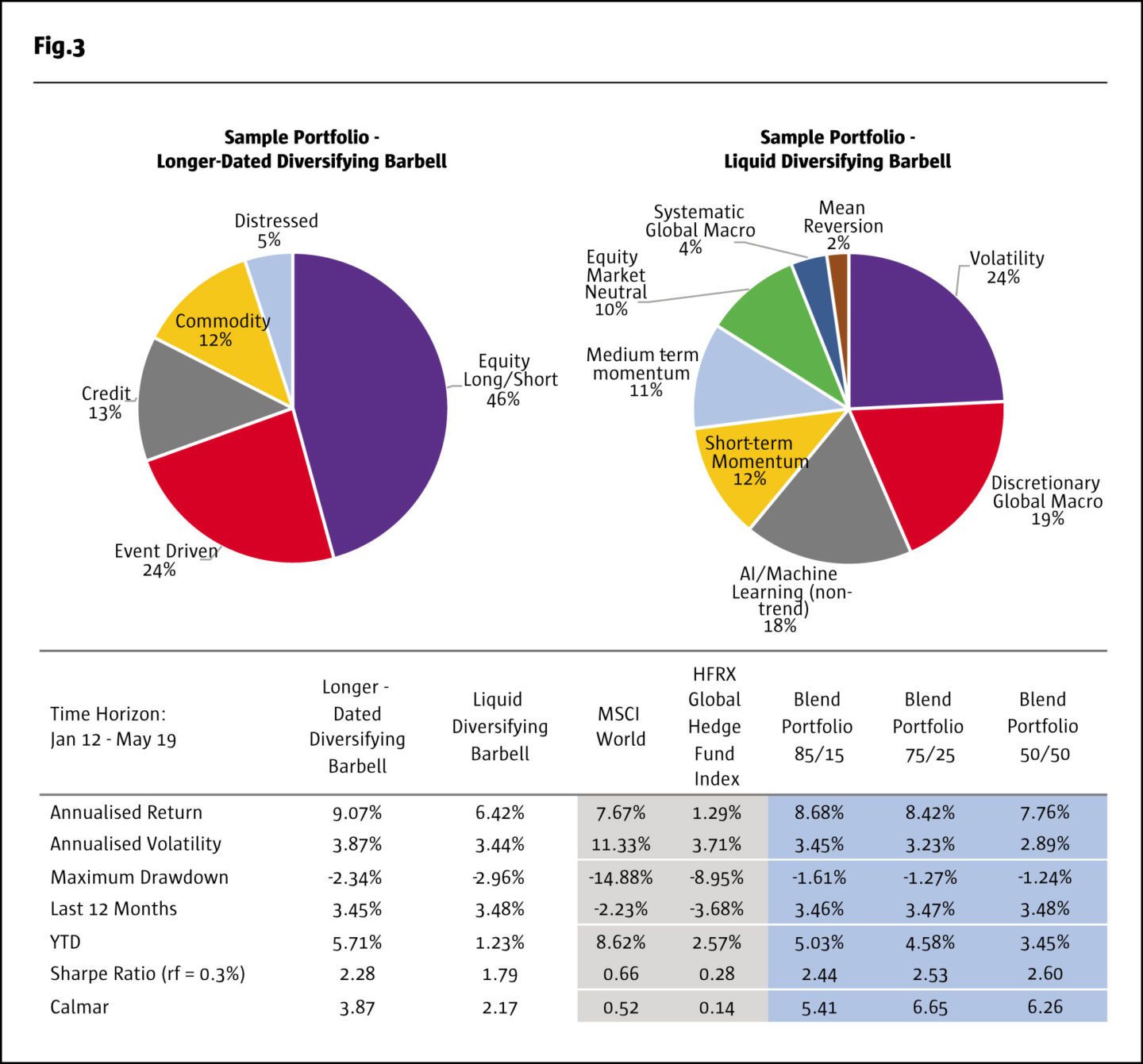

In performance terms, this environment has resulted in even the faster trading managers finding themselves in a coin-flip P&L situation on the reversals, which have mainly been led by US equities. The challenge has been to adjust the diversifying portfolio elements to deal with these sustained market conditions. While some of the strategies outlined in the following table may appear generic, the key is to find managers executing the non-pedestrian, new technology, better math, etc strategies that fit into the siloes. Upon line item P&L examination since last summer, it is clear that chunky losses are centered in the equity sleeve around sharp reversals.

Global Macro: Long a diversifying standard, has evolved over time with the markets

Systematic Global Macro: An attempt to systematize what the most profitable traders do in reaction to flowing price movements and fundamental information

Discretionary Global Macro: Here mixing styles, core assets employed, and geographical focus helps to further diversify.

Managed Futures: A bit of a catch-all, as the term CTA has been historically. Trend is the biggest sub-constituent to this group

Trend & Counter-trend: As it sounds, tries to capture price movements, both up and down or fade the moves. Here managers using more sophisticated entry, exit, and trade execution are favored over the older technology systems.

Non-trend AI/Machine Learning: Managers that have developed systems that can refine themselves both on the investment and execution sides are sought. Over time these systems would not correlate with others

Commodities: All liquid (futures) commodities can be included on a directional or spread basis. Seasonal, rather than price-based or curve-shaped derived, calendar spreads are an interesting uncorrelated, market-neutral way to participate.

Volatility-centric: In a world of fully priced (over priced?) assets, volatility across asset classes frequently stands out as mispriced to the cheap side. Fixed income, FX, and Asia equity markets provide interesting fodder for alpha generation.

Positive Skew: The secret sauce is the trade/trades that offers a positively skewed risk return, with a convex payout profile. Sub-prime shorts are an old example and currently volatility trades, negative yielding debt shorts, and debt curve trades (steepeners) may be the new candidates for inclusion in some form.

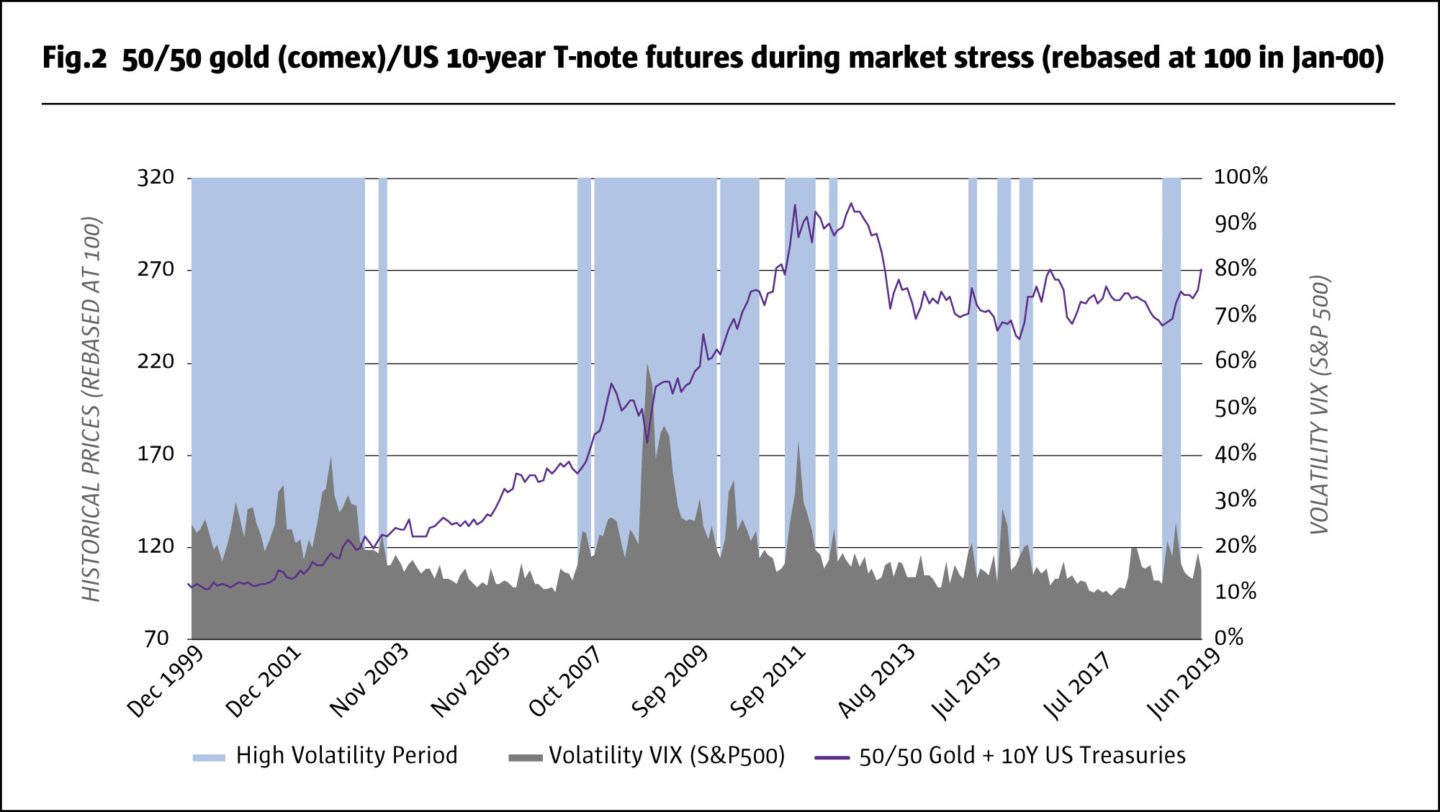

Resultingly, there has been some rotation of the diversifying portfolio by equity exposure reduction if not strategy (there is little equity beta by design). Those strategies that tend to have bigger equity positions have been re-sized and some removed. The mix of underlying assets has thus become more skewed to non-equity (FX, FI, Commodity, Volatility) assets that have fewer performance anomalies during reversals. It is important to keep in mind that equities are often the drivers of returns and, without any equity exposure, many uncorrelated managers would have had a difficult time surviving post-crisis. The on-going goal is to seek out uncorrelated returns which have defensive characteristics in market dislocation/transition periods. To this end, increasing the exposure to assets which perform well in flight to quality moves have been added. Exposure to non-directional commodities should also be considered for uncorrelated alpha.

This basket of uncorrelated, diversifying strategies has a strong protective role, but is also designed to act as a pure alpha component. Since the underlying assets are the most liquid, this side of the barbell’s fund terms are also liquid. An added benefit is that this liquidity fits well with the UCITs requirements and thus can be placed in a UCITs vehicle as favored by many (particularly European) investors. Some equity focused investors, happy with the 2019 rally but less sanguine going forward, have begun to employ some of these exposures directly in their formerly long-only funds. The goal is to access both the defensive characteristics as well as the uncorrelated alpha stream to outperform benchmarks/peers.

It is widely accepted that sacrificing liquidity should earn a return premium, or at least the objective of one. Here we are focused on hedge funds, rather than much longer dated drawdown/private equity-like structures. As a rule, the liquidity offered by the managers should be no more restrictive than the liquidity needs of the strategy. This should probably be around quarterly liquidity, although lock-ups may have to be accepted for the initial period. This less-liquid barbell of a portfolio, built for greater uncertainty, should be uncorrelated by design and have some of the defensive characteristics of the liquid barbell. This again means avoiding strategies dependant on market direction. Those strategies that subsist on manufactured alpha, which often requires “heavy lifting” on the part of the manager are favored. This set of idiosyncratic exposure strategies will not be immune to general asset re-pricing, but should be less sensitive to sustained equity market downturns. Many of these strategies center around events and although there may be exposure to equity financing, it is generally not the return driver. Current income from bonds may help the return profile but is not central to the strategies employed. (Carry strategies, particularly at this stage of the recovery with the tight spreads and low yields, should be avoided, unless involving senior bonds which are well covered).

The less-liquid barbell requires a thorough investigation into the source of the mangers returns versus market beta. A manager generating idiosyncratic returns cannot be easily identified if their peer group is performing similarly. While well-timed beta can be considered alpha, it is much more difficult to sustain and less resilient unless after a relatively substantial correction/paradigm shift. If a manager is to identify, source, structure, and ultimately exit a set of unique opportunities they require real pedigree, solid infrastructure, and often global reach.

The strategies to be utilized can vary, but the key remains the control element the portfolio manager exerts in order to extract alpha. Leverage is not a tool to be employed, so this generally restricts any relative value strategy focused on arbitraging out small price differences from consideration. A top-down assessment of opportunities by strategy, asset, and geography are to be part of the portfolio construction process. Some of the interesting, somewhat overlapping candidates for inclusion currently are:

- Idiosyncratic event: This strategy can be a bit of a catch-all around positions with a catalyst, but here the managers being sought are very selective. There may be some merger arbitrage, but mainly on deals that require some specialized insight or research edge. Other positions involve specialized activities that require multiple stages and time to deliver. Generally, the positions should be hard to source and replicate by newer peers trafficking in more pedestrian situations.

- Regional multi-strategy: The fastest growth region, Asia, is favoured over others as having more good risk/reward opportunities. The strategies should be well-resourced and the allocation should be dynamic.

- Dynamic global credit with distressed capability: This is not a long/short credit book reliant upon new issue and frenetic trading, but a well-resourced credit-centric strategy with access to interesting situations across geographies which can source debt from credit worthy borrowers at reasonable attachment points. In today’s environment there might be some stressed positions, but there should be the capability to actively participate in a distressed cycle, whatever form that might take.

- Multi-asset global volatility: While some volatility exposure exists in the liquid portfolio, there are some more structural exposures requiring more restrictive terms to avoid a mis-match. The goal is to access cheap volatility in fixed income, currencies, commodities, and to a lesser extent equities. The position should be convex and thus there is likely to be an element of option premium drag.

- Convex, opportunistic “hedging” exposures: This is the “holy grail” category of finding exposures (think short sub-prime) that can be put on at a reasonable cost with a skewed payout profile during a more severe dislocation and we have included it in both barbells for emphasis. In today’s market it might relate to a curve anomaly, a structural problem with a product, or severely mis-priced assets from government intervention. The goal is to keep looking and listening for ideas that meet the criteria.

This higher returning portfolio is best implemented together with liquid exposures which can help cushion any of the expected mark-to-market noise in dislocated markets.

As the uncertainty around disparate economies, geo-political tensions, and myriad other market influences grows, portfolios can assume a more defensive posture without foregoing returns. Our suggestion last summer was to add some uncorrelated elements to traditional or alternative portfolios. These very liquid strategies fit nicely with the requirements of most investors. The new equity highs are eclipsing their benefit, but having them in place and making some positive return remains comforting. Now adding additional alternative exposures instead of or alongside long-leaning asset positions can balance the risk/return profile. The mix of the two liquidity barbelled exposures can be tailored to each investor’s portfolio, but the defensive concept remains constant. Those with significant PE style drawdown structures will end up with more of a liquidity continuum, the most liquid being the two buckets discussed here. The careful qualitative and quantitative evolution of managers will allow a portfolio that meets most investment objectives and can better weather any coming storm.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 142

Barbelling Diversifying Strategies by Liquidity

Diversifying alpha + idiosyncratic alpha = outperformance

Jim Neumann, Partner, Sussex Partners

Originally published in the August 2019 issue