Jonathan Berger, who was selected for The Hedge Fund Journal’s ‘Tomorrow’s Titans’ survey sponsored by EY in 2014, was called out by nominators for his strong ability to build businesses and run money. That’s certainly been the case since Berger set up Birch Grove after his former firm, Stone Tower Capital, was sold to Apollo in 2012. As CIO and President of Stone Tower, Berger helped the firm grow from a $7 billion long only CLO manager into a $17 billion powerhouse with a substantial alternatives franchise. In 2013, Berger left to form Birch Grove and was joined by several members of his Stone Tower team. The goal was to continue the successful alternatives strategy they had developed at Stone Tower. In August 2013 Birch Grove launched with $300 million in capital from Berger’s longstanding institutional relationships, and when THFJ visited the firm’s offices in New York in February 2016, assets had grown to $800 million.

Birch Grove’s objective is to generate absolute, and strong, risk-adjusted returns throughout the various cycles for the multiple, corporate-related asset classes and strategies it trades. Birch Grove aims to outperform equity, credit, and hedge fund indices, measured on risk adjusted returns and alpha generation (and so far, the strategy has attained this aim, according to Berger). For a longer lookback, potential investors can review a portable track record spanning 17 years (with a few gaps) stitched together from Berger’s previous firms, including Stone Tower and Pegasus.

A flexible mandate

The goal of ‘all-weather’ returns is pursued through a flexible mandate and a versatile skill set. Birch Grove “are experts right across the capital structure from bank debt to bonds and equity, in Europe and the US,” says Berger. The strategy also opportunistically adjusts directional exposure to be net long, net short or market neutral. So broad is the mandate that some allocators might bucket Birch Grove as ‘multi-strategy’ but its internal structure is far from the traditional model of a multi-strategy hedge fund. There are no siloes or traders running their own books. “There is one team, one portfolio, one strategy and the investment team build a consensus over positions,” Berger confirms.

Neither Berger, nor his colleagues, have always run the gamut of corporate capital structure strategies. Historically, Berger sometimes specialised in particular strategies, and co-founded Pegasus to invest and trade in distressed, distressed for control, and solution capital. But, reflecting on his25 years in the business, Berger is now of the opinion that “markets have evolved so much that a narrower approach such as equity, distressed or high yield makes it harder to make money at all stages of the market cycle.”

Regulation is one factor changing the landscape. “Dodd Frank has pushed banks away from using their balance sheets to support risk assets, be they bonds, bank loans, equities or commodities,” from what Berger has seen. He says this decline in dealer liquidity, combined with a rise in retail ownership through mutual funds and ETFs, has created more volatile and erratic markets. In recent years Berger has observed more volatility and gap risk in both bonds and stocks, noting that “individual equities can gap down 50% after missing earnings.”

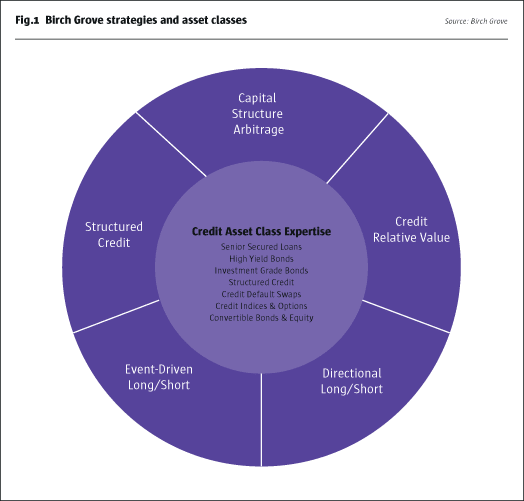

Berger greets the volatility with equanimity and feels he needs maximum flexibility in terms of asset classes, strategies, directionality and instruments, to navigate the new territory. The spectrum of asset classes and strategies traded is shown in Fig.1.

Range of directionality

Managers rigidly wedded to any directional stance can clearly struggle at particular stages of the cycle. A net long bias to US credit will often lose money in a year like 2008, 2011 or 2015, while net short credit strategies frequently need price action severe enough to cover the negative carry that they often entail. Nor are market neutral strategies necessarily indifferent to market cycles, as they can struggle in periods of high correlation, when limited dispersion amongst securities makes it harder to extract enough alpha to cover the fixed costs of running a strategy.

Birch Grove has no structural directional bias and can be net long, net short or market neutral at various points in the cycle. Lately the strategy has been occasionally net short, within a broadly neutral book, and could become “more net long and less neutral” if the distressed cycle plays out in the way the Berger expects.

Birch Grove’s target return pragmatically varies according to the opportunity set, and the attribution split between trading and carry will also move around. In early 2016, parts of Birch Grove’s market neutral book still had positive carry as longs yielded more than shorts. Recently, the strategy has been net short on some days, as a consequence of negative views on single name credits rather than due to any broad macro call. “If there was more investor-level leverage in the system we would have gone more aggressively net short,” reflects Berger, who feels that prime broker leverage remains well below pre-crisis levels (though corporate leverage is quite high).

Anticipating downgrades and bankruptcies

But Birch Grove’s big picture thematic trade is a relative value spread predicated on the fundamental view that “secured credit is oversold while unsecured credit has room to widen out.” The long book is populated by secured, floating rate debt, with high yields, event catalysts, and downside protection, so “we are targeting low double digit returns in well covered asymmetric situations,” Berger says. The short book is dominated by those investment grade names that Birch Grove thinks could be downgraded to non-investment grade status – and Berger envisages downgrades well beyond those that are already happening in the energy, mining and metals space. “Industrials are already in recession and some consumer retailers and auto retailers are trading very tight, even though there are disruptive changes such as new technology and consumers migrating to the Internet,” he points out.

Yet Berger perceives many investment grade names as being “priced for perfection,” possibly in part because investment grade credit, as an asset class, has greater interest rate sensitivity than high yield (partly due to longer average durations), and arguably has piggy-backed on the Treasury rally in early 2016. While top-down macro investors and asset allocators might buy an investment grade credit index, Berger looks at individual names and sees risks. Even the credit ratings agencies are starting to smell the coffee, with Berger citing $70-80 billion of downgrades seen when we met in late February 2016. This may only be the beginning – “though $100 billion of investment grade was downgraded in 2008, the market is now far larger” Berger points out.

Equity markets also are complacent, Berger thinks, which is why he needs the flexibility to trade the whole capital structure. Credit traditionally leads equity and this time is no different. “Some energy companies with debt downgraded to non-investment grade have equity valued at $10-15 billion that will be worthless if oil prices stay at $20-40,” Berger opines. Indeed, Berger mentions recent analysis published in the Financial Times suggesting some companies’ equity might even be worthless at an oil price of $50. One explanation for this apparent disconnect could be that equities are perceived as call options on the oil price and therefore have some option value even when the companies are loss-making. Berger sees dislocations between debt and equity in many other sectors, too.

Views on credit relative value

Berger shared with us a selection of insights that demonstrate his variant perspective. As well as comparing equity and credit, Birch Grove closely monitors discrepancies between various credit markets and instruments. In early 2016 the basis between spreads on cash credit, and credit derivatives, has blown out to some of the widest levels seen since the 2008 crisis. Some managers perceive this as an ‘arbitrage’ opportunity. Though Birch Grove has the ability to construct arbitrage trades, Berger is not inspired to do so for cash versus CDS. He views the basis as being primarily a function of scarce investor level leverage, which is in turn explained by counterparty constraints. This is one reason why he also is not confident that funds could be sure of holding such a trade to the maturity of all elements, as “counterparties might pull capital away, there is huge volatility day to day, and the basis could widen further.” Moreover, Berger points out that cash and credit derivatives have different ownership bases. He thinks that “with every investor questioning how they invest” it is dangerous to presume that markets will revert to notions of normality that may be relegated to history.

Closed end funds trading at discounts to NAV are another ‘arbitrage’ that Berger casts a sceptical eye over. “Nearly all Business Development Companies (BDCs) are trading at discounts, but that does not mean they are ‘cheap’ as they could get cheaper, so we are not diving in right now,” warns Berger. Once again Birch Grove could go long or short right across the capital structure of BDCs, and the fund is short of some BDC debt that could be downgraded.

Another relative value idea Berger is not pursuing is the long Europe/short US ‘arbitrage’ credit trade. The supposed safe haven status of some parts of European credit markets also is questioned by Berger. The virtual absence of energy exposure helps to explain why loans of non-financial companies have been more resilient than has US credit. Yet Berger cautions “European companies have more emerging markets exposure than US companies; lower liquidity means loans can gap down sharply on bad news; and there is less transparency.” Consequently, Birch Grove’s European book emphasises short side exposures in credits viewed as fundamentally weak.

Rising defaults

Berger accepts the consensus view that US defaults must spike up. He expects 2016 default rates for US high yield to reach high single or low double digit rates in energy, and 2-3% in high yield non-energy, adding up to an overall high yield default rate of 5-6%, which might rise again in 2017 as some firms will struggle to refinance. Though the supply of distressed debt has expanded in 2015, from a low base, Berger does not see an abundant supply of distressed paper until 2017-2018. When the time comes, Birch Grove’s approach will be passive and liquid. “I have done distressed for control before, been on committees, and spent five years on workouts – but it does not create incremental value for the investor, and we do not want to give up optionality,” Berger says. Hence Birch Grove does not intend to get into a situation where it becomes restricted from trading securities; nor does the firm file 13Ds for activist positions in equities.

Asymmetric optionality

All of the above trade ideas are intended to generate asymmetric risk/reward profiles with more upside than downside so “essentially, our book is a collection of cheap call options,” Berger says. The team’s backgrounds in distressed and private equity (Berger for instance once worked at middle market private equity firm Rosecliff, Inc.) provide valuable expertise for the process. “We can do deep fundamental valuation work on all kinds of collateral, from inventory, receivables and real estate to ships, planes or tanks,” reveals Berger. Collateral backing is only one of many ways to obtain the asymmetric risk/return profiles sought. “There are so many layers to creating asymmetry, such as the underlying collateral, coupon maturities, particular events, improving credit stories and the instruments used,” Berger explains.

Trade construction can employ instruments including single name cash and derivatives, credit index options and tranches, structured credit, equities or equity options, and options on the VIX volatility index.

Though Berger has the flexibility to trade market indices in credit, equity or volatility, he does not predicate trades on any macroeconomic, or commodity price, forecasts that the team may have. Some managers start with macro, but it is not front and centre for Birch Grove. “With most macro predictions we know we are as likely to be right as we are to be wrong, and so is everyone else,” he says. That said, Berger does not expect even a hawkish Fed to raise US interest rates by much, and he entertains some wild card possibility of a QE #4 if the economy weakens. As with macro, Birch Grove is not basing its investment thesis on commodity price forecasts. “Freight markets should eventually balance, but we do not know when they will,” says Berger.

Liquidity, clearing and capacity

While Birch Grove expects investors to remain invested for many years, liquidity is available to those who need it. Birch Grove has therefore developed proprietary measures for ranking portfolio liquidity on a scale of one to five. An asset ranked as liquidity grade one would probably have 20 market makers, while a grade four might only have two or three counterparties posting quotes. Grade five would be something like a direct, bilateral loan with no liquidity at all, and Birch Grove avoids these assets.

To access liquidity and shop around for keener prices, Birch Grove trades with a wide range of 20 or so counterparties and has 12 ISDA agreements. Most of this is still OTC voice traded. The firm witnesses a wide range of bid/offer spreads from a few basis points for credit indices, to 5 or 10 basis points for investment grade or high yield, 10 or 20 basis points for CDS, and as much as 2 whole bond points (i.e. 2% for issues trading at par) for some off the run names. Clearing can also help with accessing liquidity.

Strategy capacity for Berger is a moving target updated alongside evolving metrics of market liquidity. “Eighteen months ago we estimated strategy capacity at $1.5 billion, but today dislocation in the credit markets is increasing the opportunity set – so it could be as much as $2-3billion,” he expects.

Institutional quality infrastructure and operations

“From the start Birch Grove was determined to build an institutional quality infrastructure, to match the expectations of large pension funds, endowments and consultants,” says firm President, Andrew Fink, who states “we want to look as good or better than what the team had at Stone Tower.” This was crucial as the initial capital of $300 million came from institutions, including pension funds and endowments, which obtained lower fees but no ownership stake. The firm is wholly owned by its staff. Fink gave us a whistle stop tour outlining a 10,000 foot view of ways in which Birch Grove helps to meet investors’ operational due diligence criteria.

Fifteen people were hired before the firm took a penny of outside money, and Birch Grove employs more people on the business side – in operations, finance, accounting, risk – than it does on the investment side. Substantial investments were made into building and testing systems with the help of Credit Suisse’s Prime Brokerage group. Northern Trust provides live access to real time pricing and assists with risk aggregation reporting such as Open Protocol Enabling Risk Aggregation (OPERA) – as well as customised risk reporting for some clients. Investors get full transparency on portfolio positions (through a time lagged monthly portfolio report) and access to senior managers. Northern Trust uses Bloomberg AIM to interface with their Order Management System (OMS) and this allows for “more precision and better real time accuracy,” says Fink, who finds the NAV portfolio management system behind AIM meshes well with Northern Trust systems.

For portfolio risk, RiskMetrics was chosen after testing, because Birch Grove found that it was better suited for credit markets than some other risk systems. Portfolio risk management also draws upon the operational team, who are kept busy producing a dashboard of internal metrics for the investment team to use. This includes compliance metrics around issues such as best execution. It also includes portfolio metrics monitoring liquidity, volatility, changing patterns of beta and correlation to various markets and stress tests for historical adverse events, as well as credit metrics such as loan to value or enterprise value. Birch Grove has developed proprietary indicators for all of these concepts and thinks in terms of whether returns are adequate compensation for liquidity and volatility.

Business continuity and disaster recovery involves several aspects. Global Relay backs up email; Iron Mountain maintains an offsite file server; there are three levels of redundancy on the telephone systems; and an entire replicated office including IT and telephone systems sits within driving distance in Western Massachusetts.

Independence of service providers is also demonstrated. The Cayman fund has three directors. Fink is one and the other two are independent, professional fund directors “who spend a meaningful amount of time and do the job well.” Valuation is also independent and is almost entirely done by Northern Trust. As for level three assets, a small sleeve of 2% in structured credit is independently valued by Houlihan Lokey. There are no internal marks. There have been no material valuation disputes, according to Fink (differences in valuation are allowed, below a $200,000 threshold).

All of this, and the performance numbers, are resonating well with allocators. Investor Relations Head Ryan O’Connell isseeing a very high level of interest from big institutions. “People are interested in dislocations,” he says, and “our long term track record shows our ability to avoid volatility and produce positive returns in all environments, with outsized returns when it is opportune to take more directional risk.”

Reiterates Berger: “Our long standing investors view us as an alternative credit allocation intended to profit at every stage of the market cycle.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical