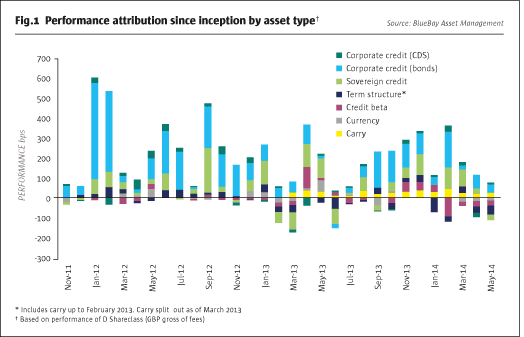

In 2014 BlueBay’s Event Driven Credit (EDC) strategy had its best year since the strategy began in 2009, amid a more challenging backdrop for traditional credit and distressed investors: high-yield indices in 2014 delivered returns in the low single digits with the lower-rated paper even struggling to stay positive for the year. Some credit funds were negative after fees and costs, seeing their worst year since 2011, and others had their toughest spell since even 2008, due in part to record outflows and declining liquidity. But EDC matched its return target.

Why was this divergence so stark? The EDC strategy does have a short book, which did contribute, but that clearly does not account for the compelling returns. “The world has changed in the past six to 12 months,” says BlueBay partner and EDC senior portfolio manager, Anthony Robertson (pictured above), explaining, “A year or two ago there was an absence of idiosyncratic risk with plenty of liquidity, industries highly correlated, no blow-ups and returns mainly a function of the market beta environment.” In that kind of market Robertson was content for EDC to make high single-digit returns, with some correlation to the credit markets. Now EDC’s market correlation has collapsed to 0.2 versus the S&P 500 and 0.1 against the high-yield indices over the past two years, “definitively decoupling from the markets.”

It is the idiosyncratic, or company-specific, opportunities that have allowed this to happen. “In times of meaningful spikes in defaults, and dislocations in some industries, there are very interesting and unique opportunities for outsized returns and differentiation,” says Robertson – who goes further in stating that, for EDC, “I believe the strategy offers very positive total and risk-adjusted return prospects over the next three to six years,” across BlueBay’s extensive suite of fixed income strategies, which include a wide range of long-only, absolute return, and alternative products spanning sovereign, emerging and corporate debt. South African Robertson, who joined BlueBay in 2004 after working at Putnam, Standard Asset, London and Capital and West Merchant Bank, runs the circa $10 billion leveraged finance group, including around $7.5 billion of long-only money, but day to day he is focused on the $2.5 billion absolute return segment.

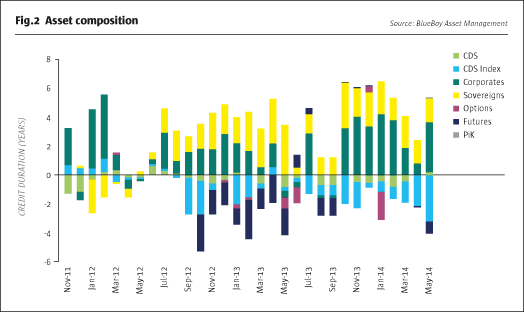

The shifting opportunity set is apparent in how EDC has rebalanced its allocations amongst its buckets. “Restructuring was very small two years ago, but now more classic distressed opportunities are emerging,” observes Robertson. The event driven book has also been steadily rising, with special situations being deployed tactically. Market volatility is throwing up entry points for the opportunistic bucket – and indeed the short book. With openings coming from so many directions, it is no surprise that the core income book has been de-emphasised to the point where net income for the strategy is now running at only around 4%, slightly shy of the usual 5% target. Although EDC does expect to maintain positive carry, the double-digit returns have mainly come from trading price action, not clipping coupons, in common with Geraud Charpin’s BlueBay Credit Alpha Long Short strategy, which The Hedge Fund Journal profiled last year. But in contrast to the investment-grade focused product, EDC employs no leverage and trades the sub-investment-grade credit markets, which are now worth $4.4 trillion globally.

Myriad opportunities

The EDC strategy is firing on all cylinders, with all sub-strategies bringing something to the table, and this reflects the breadth of the opportunity set. Robertson identifies five main sources of opportunities: primary markets; tactical opportunities; stressed and event driven; bank deleveraging; and the short book.

The primary markets are starting to offer compelling value as new issues can be priced at attractive levels, particularly if the offering takes place under challenging trading conditions such as those of late 2014. Not every asset manager can rely on getting decent allocations to new issues, as “relationships are excruciatingly important in sourcing deal flows,” Robertson observes, and it is also critical to be able to strike while the iron is hot. BlueBay scores well on both counts. The $62.9 billion manager “has a very large primary new issue franchise with all counterparties, all under one umbrella, so deals have been evaluated by desk and team, meaning we are already up to speed on the names.” The direct lending business also provides synergies here, as it revolves around principal to principal relationships. New issues might make up 5-10% of the strategy’s exposure.

The market volatility that can prompt underwriters to cut the price of a new issue is also providing more general tactical opportunities. Here the markets can get spooked by any number of panics, with recent stories including fears of rising interest rates in the US, “Grexit” concerns that Greece may withdraw from the Eurozone, and emerging markets crises ranging from Russia and Ukraine to Argentina and Venezuela. These episodes can cause “mispricing and price dislocations that the strategy can take advantage of,” Robertson confirms.

The opportunistic bucket is also thriving on heightened volatility arising from the pressures on dealer balance sheets. Says institutional portfolio manager, Kerry Hugh-Jones, “The balance of debt outstanding has doubled, but bank inventories have massively contracted by 70% or more.” Hugh-Jones even goes as far as arguing that banks have been reduced to “essentially acting in an agency capacity with near zero appetite to warehouse risk.” This helps to explain the gappy price action, particularly at quarter-end ahead of balance sheet reporting dates. Hence Robertson reflects how “the market overshot to the downside with huge mispricing.” BlueBay generally picks single names, but occasionally will make excursions into index products.

Hugh-Jones, who joined in September 2014, has a unique role. She sits on the investment committee but does not take risk or manage the portfolio on a day-to-day basis. Instead her remit is to “interface with the client base and translate the ideas to the broader community,” and BlueBay offers a high level of transparency to investors. Hugh-Jones started her career in credit, debt work-outs and restructuring advisory, and now authors white papers and case studies that set out the team’s views, such as how the US energy rout is contributing to mispricing.

Market panics do not always involve genuine fundamental problems for certain companies or industries but stressed situations do – and the volume of restructuring opportunities has at least doubled lately. Some deals are hangovers from pre-crisis leveraged buy-outs (LBOs) but others relate to more recent events such as the oil price crash. “Energy exploration and production weakness have thrown up some interesting longer-term investment opportunities,” in companies that have been indiscriminately sold off, opines Robertson. “If oil stays at current prices, more than 30% of E&P [exploration and production] issuers could default, and as they make up 18% of the market, that adds up to a 6% default rate for high-yield overall from this sector alone,” warns Robertson. Even if oil recovers to $60 he still sees currently 20% of the E&P sector defaulting – yet that still leaves 80% surviving, and BlueBay seeks to identify those that will still be standing after the dust has settled.

The same logic applies to European retail, where some more resilient firms have been unfairly dragged down by the sector sentiment. “On single names risks are often misunderstood and the market overplays downside, due to liquidity,” explains Robertson. Trades in stressed names can variously involve operational restructuring, debt for equity swaps, and earnings recovery stories. BlueBay emphasises senior and secured instruments, with the main return driver being capturing the discount to par.

If primary issuance, tactical trading and stressed opportunities are by their nature more cyclical, ebbing and flowing with market moods, then European bank deleveraging is a trend that Robertson views as “structural, multi-year and substantial in quantum.” Regulatory capital constraints under the new Basel rules are forcing banks to sell off portfolios as it becomes too capital-intensive to hold some sub-investment-grade debt. BlueBay reckons the process began with various types of asset-backed securities, including student loans and credit card-backed receivables, as well as aircraft and shipping-related paper. Now that those areas of balance sheets have been cleansed, banks can move onto recognising losses on corporate loans that are still often held at par until and unless restructuring occurs. The recovery of bank profitability also leaves more latitude for making the necessary write-downs.

BlueBay cites a 2012 PwC report suggesting banks would sell €1.2 trillion of sub-investment-grade loans at prices between 50 and 70 cents on the dollar. With some €250 billion already disposed of that still leaves €1 trillion. Robertson admits that some parts of this space can be more fully exploited by BlueBay’s direct lending strategy, which has a multi-year lock-up, but the quarterly dealing EDC fund can still take advantage of some opportunities – just not those that need to be held to maturity. Its liquidity criteria include that “a secondary market sale always has to be part of the investment thesis,” and this points the strategy towards syndicated loans rather than bilateral deals.

The fifth bucket has been almost hibernating for the strategy’s first five years – Robertson admits that 2014 is the first year when the short book has made money. “There was not enough differentiation before, and the short book works in a higher default environment when risk skews to the downside and recovery rates are lower.” Although the climate for shorting is definitely getting better, BlueBay still needs to be very selective. Of 80 names identified as fundamentally vulnerable, the strategy is not likely to be short of more than 10 at a time. “If the catalysts are too distant then the cost of carry on the shorts becomes prohibitive,” explains Robertson. That said, he expects shorts to contribute a growing share of returns over the next few years.

Real world trade examples

Robertson has shared with us one trade example for each of the strategy’s five buckets. In classic restructuring, a commercial services provider has entered into a debt for equity swap that the strategy participated in. The fundamental rationale here is a turnaround in the beleaguered hospitality sector as the economy recovers. Through the swap, the services provider has converted its debt partly into a new loan and partly into some private equity, which brings us onto one of the strategy’s risk limits. “We can hold up to 5% in private equity without creating a side pocket, but in practice we have never come close to this in the past,” recalls Robertson.

In stressed event driven, a broadcasting company is trying to rationalise its business. Faced with the spectre of fire-sale prices, the company sought some refinancing to provide breathing room. BlueBay pounced on the opportunity. “We and two other managers stepped in and provided fresh capital to the business, having acquired loans at deep discounts to par, and we also have a public equity kicker in the form of warrants,” says Robertson. EDC’s base case is simply getting repaid at par – any profits from the warrants are icing on the cake.

In the opportunistic arena, there are “tons of names,” Robertson claims, and an entertainment group is a classic example of one such opportunity. This group saw its bonds trade down significantly against a backdrop of weaker earnings in 2014. “However, our very thorough analysis suggested this was a temporary phenomenon and a strong film slate would see a near-term recovery. The bonds are now reflecting this as the price of debt has rebounded significantly.”

Yield-seeking is being de-emphasised now, but equally there are some interesting pockets in core income, often associated with new issues, such as one from a company in late 2014. As market conditions were not too welcoming on the day of the issue, it ended up being priced at a 5.25% spread and a discount of 1.5 points to par, adding up to a yield of 6.5%. BlueBay found this level of yield attractive for what Robertson views as “a pretty stable business operating in a duopoly, representing low risk for the sub-investment-grade space.” Robertson stresses that this secured loan was an exception, mainly because it came to market on a volatile day.

Legal eagle eyes

As head of the leveraged finance business, Robertson “sits on the investment committees of all strategies, has oversight of everything, is involved in all decisions and has a veto on anything.” The number two on the product is portfolio manager, Richard Cazenove, who has been with BlueBay since 2003, after a long career in distressed debt starting at UBS Warburg. The portfolio managers’ (PMs) involvement in BlueBay’s deep fundamental analysis is so hands-on that they say, “We don’t have to ask all PMs for their best ideas – we already know what they are.” EDC typically invests in 30 to 50 names, but can go as high as 20% in any one name, although this is highly improbable. The team of 35 investment professionals for sub-investment-grade is a cosmopolitan group drawn from the UK, Ireland, US, Australia, South Africa, Italy, Spain and elsewhere. They work across a whole suite of BlueBay’s leverage finance products, and will often have industry or geographic specialities, which is particularly useful in Europe.

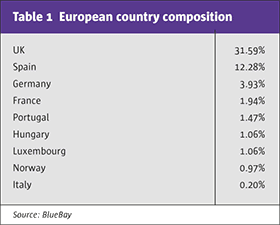

An important barrier to entry in European credit remains the differences between jurisdictions. “Outcomes can vary depending on the type of process, with differences amongst liquidations, restructurings and bankruptcies, whether it is consensual or not, and whether the paper is senior or unsecured,” Robertson explains. He has been doing European credit since the genesis of Europe’s high-yield market in the mid-1990s, and claims to have been exposed to almost all jurisdictions in Europe, including Romania, Bulgaria and Hungary. “The worst two countries are France and Italy in terms of honouring creditor rights,” he finds. Does this mean France and Italy are off limits? No. But BlueBay would need “a lower price, a more thorough evaluation and more confidence in alignment of interests amongst stakeholders.”

Where are the best jurisdictions? The US and UK are EDC’s largest allocations, and within continental Europe Spain stands out for having introduced a more predictable creditor regime, modelled on the UK reorganisation approach. To exploit this BlueBay has hired a dedicated Spanish analyst, and seconded over a restructuring bank debt lawyer from Spain. BlueBay has hefty legal resources – the in-house Loan Solutions Transactions Team “do everything end to end, looking at structure, loan closing and administrative elements,” and external law firms are also used.

A pragmatic attitude applies to the length of the due diligence process, which can range from days to months. “Ideally we would like two to three weeks for all deals, but we do not always have that luxury,” explains Robertson. As with France and Italy, BlueBay will sometimes just accept a lower price for the greater uncertainty. In contrast, euro or any other currency risk is one uncertainty that EDC generally hedges at the share class level.

Why now?

Why should investors heed Robertson’s enthusiasm for his product? The EDC strategy has not been aggressively marketed since it was started in 2009, and this is intentional. “Timing is everything,” says Robertson. “The recent economic divergence between the US and Europe highlighted the potential for a concurrent divergence in default cycles.” He believes this was compounded by increased idiosyncratic risk in Europe, which steered investors away from high-yield, and prominent price action in the US high-yield energy sector, which increased the possibility of a spike in the US default cycle. BlueBay believes these factors have increased the opportunity set for EDC. This is compounded by increased market volatility more broadly, and more pronounced illiquidity, both of which exacerbate price dislocation. Combined with the structural opportunity brought about by European bank de-risking, Robertson believe this makes for a very attractive environment to make strong returns that are de-correlated from other risk asset classes. BlueBay’s view is that today’s markets are conducive to the strategy; with an initial capacity target of $500 million there is plenty of room to grow the $40 million strategy.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical