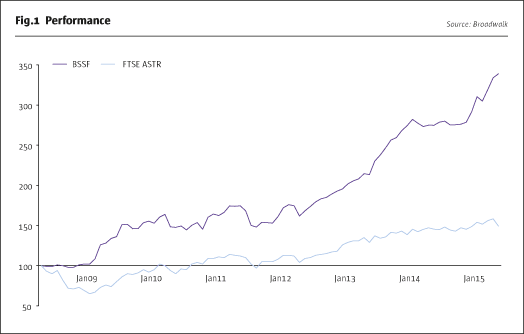

Star sell-side analysts do not always succeed on the buy side, but Charlie Cottam and Mark Shepperd have produced remarkable performance. Since launch in June 2008, Broadwalk Select Services Fund has surpassed its 15% pa performance target and delivered high-teens annualized returns, preserved capital in the second half of 2008, and limited losses to single digits in 2011. This has been attained with gross exposure below 115% and net exposure typically between 60% and 100% since 2009. Despite running on average less than 100% net exposure, Broadwalk has been compounding at around three times the return of the FT All share, as shown in Fig.1.

Takeover bids and IPOs

Unsurprisingly, over this period, the returns have come from the long book. Broadwalk runs a concentrated book of up to 35 stocks where longs can reach 15% position sizes, but will rarely exceed 10%. Broadwalk’s biggest holding in 2015, Telecity, illustrates how “we discover value that is recognized by third parties even if not by the market,” says Cottam, who has been following the firm since it floated at the top of the TMT boom in 2000, when he worked at Cazenove. Since then Telecity has been taken private and relisted in 2007. In Telecity’s niche of carrier neutral data co-location centres, hyper-fast connectivity is vital for content such as videos and real-time share prices. Cottam thought the stock was undervalued by other investors partly due to Telecity’s suboptimal investor communications. The depth and detail of Cottam’s company analysis is illustrated by his observation that “Telecity’s square footage figures included toilets and corridors until a shareholder pointed out the discrepancy which upset the market but we did not believe it to be relevant to the investment case.”

Broadwalk bought Telecity after the share price retreated to around 700p – and it received a bid worth some 50% more this year from Equinix. Profits have not yet been taken as the stock is trading about 6% below the value of the blended cash and share offer. Shepperd explains that the fund is not a merger arbitrage fund, and seldom buys after announced bids, but the spread in this case is too compelling to ignore. Roughly half of the bid is in the form of cash, and Telecity trades at a 10% discount to the equity element of the offer. Telecity is one of four Broadwalk holdings that have been bid for over the past 18 months. Anite and Aer Lingus each received offers at premiums of around 25%. “Aer Lingus was very cheap and geared to the recovering Irish economy,” says Shepperd. And Invensys was last year bought by Schneider at 150% above Broadwalk’s original entry level. The Invensys story was a classic “sum of the parts discount” as the firm had first sold a division for its entire market cap before falling prey to Schneider.

On top of corporate activity, IPOs have been a contributor. Double-glazing windows maker SafeStyle is one example where Broadwalk bought into the AIM float in November 2013 at 100p, and has happily ridden the stock up to 240p. In contrast, Royal Mail was an IPO where Broadwalk did not obtain any allocation, but bought it in the after-market, made a quick 50% profit – and then jumped ship before the pullback.

Sector landscape

Broadwalk argues that their industrial sectors provide a rich opportunity set – and possibly also a neglected one: Broadwalk is the first hedge fund to focus on the support services sector whereas numerous hedge funds specialize in financial and healthcare stocks. Yet in Broadwalk’s core market of the UK,support services account for a slightly larger share of GDP, at 8.6%, than do financial services at 8.1% (according to The Business Services Association and Oxford Economics). The sector has benefitted from the UK blazing a trail towards privatization and outsourcing, fostering the growth of a vibrant ecosystem of services firms. Broadwalk’s UK investment universe is estimated at 400 stocks with a combined $350 billion market cap, and 22 of the stocks in the FTSE 100, but this ignores European names that Broadwalk started buying more into in 2014. Europe is one area, along with recruitment that Shepperd, who had headed Support Services Research for UBS, spends more time on, whereas Cottam has more experience of property and software sectors, but overall there are many stocks and sectors that both of them are very familiar with. Incidentally, Broadwalk’s annual Business Services Awards are quite separate from the fund, and award winners do not necessarily have any overlap with portfolio positioning – but the awards do show how Broadwalk recognizes the outstanding performances in the sector.

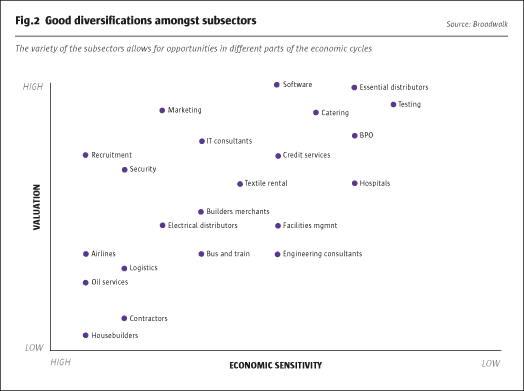

Broadwalk acknowledges that they have enjoyed a tailwind like their sectors have and, on average, have outperformed the broader UK market since 2008, but this does not mean that support services is merely a fair weather, bull market, trade. “Our universe is very diverse, with Adecco recruiting people and Ashtead renting equipment. In general we see limited correlation amongst our holdings,” says Cottam. Broadwalk highlights the diversity of the support services sectors in terms of both valuations, and economic sensitivity, as shown in Fig.2. For instance, airlines, house-builders and logistics tend to be have cyclical earnings patterns and are ascribed relatively low valuation multiples. Cyclicality per se does not, however, consign firms to lower valuations – Broadwalk reckons that marketing and recruitment firms are relatively highly valued. Software, catering and hospitals are three examples of sub-sectors with low economic cyclicality, and high valuations. Meanwhile engineering services and facilities management are subsectors with both low economic sensitivity, and low valuations. Broadwalk rotates around sub-sectors, according to economic and industry cycles and opportunities.

Immature economic and market cycle

The global equity bull market is now into its seventh year, but Broadwalk remains upbeat on their preferred stocks. This cycle could be longer and shallower than previous ones, partly as central bank activity has dampened the amplitude of economic fluctuation. Broadwalk views the UK and Europe as being at a much earlier stage of the economic and market cycle than the US, with the European bull market only really starting in 2012. Says Shepperd “Inflation is still zero, and interest rates are still zero, so even though employment is quite full in the UK we are nowhere near a hot economy. There is a long way to go in the UK and very much further in Europe.” Indeed, profits in Europe remain well below pre-crisis levels, partly as Europe had its banking crisis in 2012, Broadwalk notes. One sub-sector geared to this stage of the cycle is construction, where Broadwalk prefers commercial construction in the UK and Europe. Cottam thinks a series of profits warnings in the UK construction sector should now be baked into cost estimates.

The property sector shows how Broadwalk takes a bottom-up view to differentiating between firms within the sub-sectors. “We are more cautious on London housing as a lot of supply is coming on stream at the top end, such as one-bedroom flats on the market for £1 million,” says Cottam, who prefers regional UK house-builders such as Taylor Wimpey and Bovis – partly because house prices in some regions outside London remain below their peak levels. Overseas, Broadwalk sees value in some segments of Europe’s property markets. The fund is, for now, avoiding deeply distressed Spanish plays, partly due to uncertainty over the upcoming election. Instead Cottam selects parts of the German residential and multi-tenanted commercial sector, where yields on offer are very attractive versus German Bunds that are yielding less than 1%. “It is harder to raise rents in Germany but existing yields are good enough,” he adds. Broadwalk also think residential property in Europe is ideally suited to reflationary measures from governments: “all the inputs – labour, land and raw materials – are local, as bricks and cement are too heavy to import,” he points out. Hence “help to buy” type housing schemes could boost the sector in Europe.

Broadwalk measures its geographic exposures by the revenue breakdown of holdings, rather than where the shares happen to be listed. In September 2015, some 20% of the portfolio’s revenue exposures were derived from Europe, which is the highest since the fund launched. “It has been a no-go zone until a year ago,” says Cottam. He timed the continental excursion well – moving into Europe-focused names in 2014 before the ECB embarked on QE.

Cinderella small-caps

But it is UK small-caps that may be most compelling, according to Shepperd, and as an all-cap fund, Broadwalk owns a balance of large-caps, mid-caps and small-caps in search of the best opportunities. Shepperd was once head of Small-Cap Research at UBS and reckons in broad-brush terms, small-caps might average 10 times earnings with large-caps on 15. Moreover, profit margins are nowhere near previous peaks, Shepperd claims, so these stocks are not deceptively cheap due to an unsustainable denominator in the PE equation. “Of course it varies by sector with biotechs (which we don’t trade) very punchy while industrials might be at a 20% discount,” says Cottam, who thinks the discount is explained by the market’s obsession with liquidity. “The market is mispricing liquidity due to the horrendous experience of 2008,” asserts Cottam, who thinks the illiquidity discount for small-caps is too large. Adds Shepperd “there are plenty of small caps out there on PE ratios below 10, with good growth, balance sheets, strong management and really nothing wrong with them. Lavendon is one example that is doing just fine, hunky dory.” Broadwalk also finds value in some Alternative Investment Market (AIM) stocks. Cottam realizes that AIM “has a mixed reputation but the market contains some good stocks where you could have made a decent amount of money on.” The managers see two drivers of returns for their small-cap holdings: earnings growth, and multiple expansion. But Cottam admits that if there were a big market selloff, these small-caps (which can be up to 35% of the fund at cost) would probably get caught in the downdraft – and then end up even cheaper.

Accounting practices and sell-side research

Company valuation, of course, is a matter of diverse opinion and the two managers have, over their combined 50 years’ experience, seen how accounting practices can impact and distort reported earnings. Reflects Shepperd, who spent 30 years with UBS, mostly on the equity analysis side, “It was unusual to be at the same firm for so long and I lived through the Big Bang, the 1987 crash and all manner of scandals.” These included accounting scandals and in the early 1990s Shepperd belonged to the UBS Research team that collectively authored a note identifying a number of questionable accounting practices in UK firms, including Polly Peck and The Mirror Group, where bosses Asil Nadir and Robert Maxwell were both later found to be crooks. This research ended up forming the basis for the book “Accounting for Growth,” which Terry Smith published in 1992 without the permission of UBS, leading to his summary dismissal.

Since then, accounting standards have improved hugely, reckons Cottam, who qualified as a Chartered Accountant with PWC and recalls how “you could write off goodwill, provisioning was terrible and disclosure was poor.” Today, transparency is much better and virtually all, if not all, of the firms in Broadwalk’s book are striking accounts under International Accounting Standards (IAS). Nonetheless Cottam finds “the support services sector lends itself to aggressive accounting due to factors such as long-term contracts, which lead to subjectivity over when to recognize profits and whether to capitalize or recognize costs.” This means some firms are more aggressive than others, though it is not always easy to spot what is going on – so footnotes in the accounts, industry hearsay, and dialogue with finance directors can all provide clues for accounting sleuths. They are still vigilant because accounting scandals are still seen, particularly in the US. Indeed, Broadwalk is currently short of one firm due to its aggressive accounting. Another short in mining services is motivated more by fundamental analysis than accounting. The testing firm that checks quality of mining ores is vulnerable to the miners reining in their capital spending in response to collapsing metals prices.

If opaque or dubious accounting has become a less significant source of stock-market inefficiency, another factor may increase the chances of equities being mispriced: the implosion of sell-side research, for which Cottam and Shepperd’s exits are examples. Although it is rare for Broadwalk to own firms with no sell-side coverage at all – and the sell side is used to canvass consensus earnings forecasts and valuations – some firms may only be followed by a house broker and perhaps another remunerated by the firm. Surmises Shepperd “the quantity and quality of sell-side coverage has come down, as the sell side has shrunk in terms of the number and quality of people.” In particular, the more senior staff headcounts have been cut, so the depth of research is reduced – which opens up opportunities for sector experts such as Broadwalk to identify potential for positive earnings surprises and valuation expansion.

Risk management and liquidity

As classic stock-pickers, Broadwalk’s primary tool of risk management is doing thorough fundamental and accounting research on the companies they trade. The firm does not use position-level stops, nor solely concentrate on Value at Risk, with the response to hostile markets been to shrink the book. When the fund launched in 2008, Cottam played defence by running gross exposure of only 30%. “In retrospect we should have been more short, but this was a time of huge uncertainty and we were not sure where the trough was, so it was all about capital preservation.” he reflects. Broadwalk protected capital in 2008 and had plenty of dry powder to take advantage of the recovery in 2009, when the fund made 51.4% net of fees. “The fund could go net short at some point but is only likely to increase the short book when valuations are quite a bit higher,” summarizes Cottam.

Short exposure, which has averaged around 20% of the fund, has not contributed much to returns but more important, it has not detracted much either, in what has been a hazardous time for shorting. The fact that Broadwalk has not been short of any bid targets is ascribed to their penchant for “shorting stuff that is highly valued.” Shorts have played a backseat role because “we have been generally bullish since 2009 and a rising tide floats all boats,” says Cottam. Despite the accurately bullish stance, gross exposure has never been anywhere near the 200% limit. It has not exceeded 115%, as Cottam finds it easier to manage a smaller book and admits that “some of the companies themselves have a lot of leverage in them.” Maintaining the freedom to batten down the hatches, and sit on cash, is one reason why resolutely independent Cottam has eschewed acceleration capital providers: he fears they might interfere with the investment process.

Cottam is cautious on capacity, which he intends to review when and if the fund reaches $400 million. The smallest market caps Broadwalk have owned are around £15 million, but the expectation is that if these triple or quadruple, and raise some assets, they may end up at 10 times that level. Cottam stresses that these minnows will initially be sized as tiny 0.5% positions. The fund’s dealing terms, requiring three months’ notice, match or exceed Broadwalk’s estimate of the time it might take to exit the least liquid holdings. This could be conservative as Cottam observes, “A lot of small-caps trade by appointment, so liquidity looks worse than it may really be, as you can sometimes sell through a block trade.” For the time being a UCITS, which must offer dealing bi-monthly or more often, would not appear to be an alternative to the Cayman fund structure.

Institutional drive

Cottam doubts if he could today launch with the £1 million that the fund began with in 2008. Broadwalk has been nurtured by supportive service providers that have an excellent reputation for working with smaller, and earlier stage, hedge fund managers. The prime broker has been Societe General Prime Services (formerly known as Newedge) since the inception of the fund, with Morgan Stanley recently added as a second prime broker. The administrator is Apex Fund Services.

Broadwalk has grown assets to $57 million as of August 2015. This has come from a mixture of investment performance (day one investors are up over 240% and Cottam himself will be up more as he is in a no-fees share class for management) and a steady trickle of tickets from high net worth and family offices. Some investors are portfolio managers or chief investment officers of other hedge fund groups, who appreciate the speciality and focus on performance. In 2013, a heavyweight head of Administration, carrying out many COO functions, was hired in the form of erstwhile chess champion Shaun Taulbut, who was formerly head of Finance at ANZ Bank. In 2014 Broadwalk hired Elise Auer to head up business development, and started to approach institutional investors. Inflows are beginning to come from some funds of funds and the launch of a USD share class, in 2015, alongside the GBP one, appeals to a wider audience.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical