Campbell’s 1972 birth date makes it one of the oldest CTAs, and it runs the oldest continuously tracked commodity pool. Recently the $3.5 billion manager has caught investor attention as its distinctive research process has helped to maintain positive returns during the most challenging environment CTAs have seen in a generation – for instance, the flagship Managed Futures programme is up 13.0% this year to end November. Investors might assume that this performance can only be explained by non-trend models, which have indeed helped, with the PRISM programme up 14.8% this year to end November. But Campbell’s special approach to trend following has also outperformed other trend followers, and trend indices – witness its pure trend-following fund up 8.8% this year to end November. Campbell has also been forward-looking in terms of providing a wide range of investment vehicles, having this year worked with Equinox Fund Management, who launched a single-manager CTA ‘40 Act fund in the USA – the Equinox Campbell Strategy Fund – and keeping the product’s total expense ratio (TER) at competitive levels.

Team culture

What makes Campbell unusual is that its founder, Keith Campbell, was not a visionary scientist like so many CTA pioneers, but rather an inspirational business builder. Campbell, who received a Managed Futures Pinnacle Achievement Award from CME Group and Barclay Hedge, foresaw the potential of the CTA industry and has exercised sound judgment in surrounding himself with highly intelligent hires, but he does not try to take any personal credit at all for the alpha-generating strategies. Although he remains the largest shareholder and biggest cheerleader, this is one venerable hedge fund where succession issues are not a concern! In fact, no particular person at Campbell tries to cover themselves in glory. Campbell attributes the firm’s success to a team culture which perhaps seems more akin to Asian or European working patterns than to the individualistic “eat what you kill” ethos that characterises many US financial firms – even though all of Campbell’s activities and 140 employees are centralised at its headquarters outside Baltimore, Maryland, in the USA. Researchers may specialise, but they are not siloed, and everybody gets paid bonuses according to Campbell’s overall profitability as a company. Campbell’s entire executive committee, which spans research, technology, trading, business development, accounting, and legal, has stakes in the firm.

“Our people only get paid well if Campbell and its clients do well,” says Mike Harris, president. This team-based remuneration encourages knowledge sharing and discourages territorial behavior amongst researchers. None of the 80 staff in research, research operations and trading has been at Campbell for its entire 41-year history, with the current director of research having been around for 20 years and typical tenures of five to eight years. But the collective institutional memory of Campbell as a company is far greater than that of any individual. “Campbell has collected data and has seen how markets and models have performed across multiple macro regime shifts,” says Harris, and Campbell has adapted its approach to the changing market backdrop.

Strategy development – no 20/20 hindsight

Improbably spectacular “back-tested” or “pro forma” performance will be familiar to any seasoned CTA watcher, and Harris says that applying Campbell’s current suite of models to historical data would generate fantastic numbers. But marketing presentations only display real money track records because, drawing from an American football analogy, Harris cautions, “It is too easy to play Monday morning quarterback and say you would have shot the lights out.” Campbell instead prefers to focus more closely on how models would have performed over the past five or 10 years, which have been more challenging for CTAs, to “set the bar higher.”

Campbell is proud to have maintained a Sharpe ratio around 0.5 over the past three years, when peers’ Sharpes were often near zero or negative. Business development director Tracy Wills-Zapata would like to see the whole CTA industry return to its long-run Sharpes of between 0.5 and 1. Campbell’s newest programme, PRISM, which includes only non-trend-following strategies, has delivered a Sharpe around 1 over the past three years. But Campbell accepts that three years is a relatively short period of time so does not seek to argue that PRISM will sustain a Sharpe above 1 indefinitely.

Differentiating trend following

Whereas some managers talk about moving away from trend following, Campbell talks about moving into non-trend strategies: “We do not feel we ever moved away from trend. It’s at our core where we began in the 1970s,” says Harris. So the flagship fund still dedicates 80% of risk to trend – but with different markets, look-back periods, and momentum styles.

Since the 1970s Campbell has gone from trading 10 commodity contracts to trading 85 markets across all four liquid asset classes – adding fixed income, currencies and equities. In terms of models, Campbell started with one trend model, over one look-back period, and is now highly diversified into trend models and non-trend models over multiple look-backs. Campbell argues that their 85 markets provide enough diversification and avoid extra transaction costs that can come with less liquid markets.

Whereas traditional trend followers have focused on medium-term time frames, which Campbell defines as one to three months, Campbell has diversified into multiple time-frames, following trends over three different look-back periods, including less than one month, one to three months and greater than three months. The commitment to time horizon diversification has been a major driver of Campbell’s recent outperformance relative to other trend followers – this year, the longest look-back periods have performed best. Campbell’s recent performance has also benefited from several innovative approaches to measuring trends based on groupings of markets. These groupings can be defined using statistical methods as well as economic intuition.

Campbell is at pains to emphasise that technical, price-based trend following is still core to what they do. Some 95% of inputs for the flagship Managed Futures programme are still technical, or derivatives of price. Fundamental inputs only feed into the non-trend models, which only make up 20% of the flagship – but these non-trend signals can punch above their weight during tough times for CTAs.

Surviving, thriving under QE and tapering

The Campbell team has not specifically sought to design strategies that would perform well under a QE risk-on/risk-off environment (or a taper-on/taper-off), but rather has always been trying to add uncorrelated strategies that complement trend. So, for example, Harris says that “after a strong trend at some stage you see a strong reversal followed by consolidation. Our short-term mean reversion strategies are designed to be profitable during these choppy periods.”

Currency carry trades in the 1990s were Campbell’s first move into non-trend. The aim was to add diversifying strategies as Campbell realised that there were periods when choppy markets meant trend did not work as well. Similarly, in 2001, Campbell was attracted to cash equities by the low correlation with its existing models – and not because Campbell thought they were running up against any capacity constraints in other markets. Capacity is what Harris describes as “a moving target” and he points out that volumes traded have actually declined over the past five years. Yet under current market conditions, Harris feels Campbell could easily run $10 billion, or triple current assets.

Currency carry trades in the 1990s were Campbell’s first move into non-trend. The aim was to add diversifying strategies as Campbell realised that there were periods when choppy markets meant trend did not work as well. Similarly, in 2001, Campbell was attracted to cash equities by the low correlation with its existing models – and not because Campbell thought they were running up against any capacity constraints in other markets. Capacity is what Harris describes as “a moving target” and he points out that volumes traded have actually declined over the past five years. Yet under current market conditions, Harris feels Campbell could easily run $10 billion, or triple current assets.

Campbell’s non-trend models “span the gamut of carry, cross-sector, and short-term mean reversion.” Whereas the medium to long-term trend-following models can easily execute using standardised VWAP (volume-weighted average price) or TWAP (time-weighted average price) algorithms, other models place a premium on efficient execution.

“The shorter the look-back, the more important execution becomes,” says Harris. Although Campbell does not have any models with intraday holding periods, let alone anything approaching high-frequency trading, execution algorithms are important for the short-term mean reversion models. The statistical arbitrage strategies, which have typical holding periods of between three and 10 days, also make use of an intraday execution framework. The statistical arbitrage programme, which now trades 3,200 cash equities, has been offered as a stand-alone fund since 2010, and part of the multi-strategy product since 2002, but is not part of the flagship Managed Futures offering.

Lessons learnt – rate rises, carry swoons

Reflecting on their performance history, Harris admits that reversals in fixed income caused losses back in 1994 when the Fed surprised markets with a series of rate rises. However, this year the adjustments made to Campbell’s trend models have helped to “play good defense,” he says. Both the shorter-term trend models and short-term mean reversion models helped to take Campbell to a net short stance on bonds by late May/early June of this year, after Bernanke’s taper talk spooked bondholders.

The Campbell view is that rate rises are a question of when, not if, and investors are searching for strategies complementary to bond portfolios. One of Campbell’s thought leadership white papers, published in January this year and entitled Prospects for CTAs in a Rising Interest Rate Environment, examined how CTAs compared with conventional asset classes since 1972. Because the Barclay CTA index only goes back to 1980, Campbell created a trend benchmark mimicking most CTAs and found that, on average, this generated similar performance in both rising and falling rate environments. In contrast, either pure equity or pure bond portfolios, or the classic 60% equities, 40% bonds mix, did far worse during phases of rising rates. Having the flexibility to short equities, as well as bonds, was particularly helpful for CTAs when rate rises started to increase corporations’ cost of capital.

In 2007 the culprit of losses was the carry trade unwind that took place in August of that year. Once again this experience has informed the evolution of allocation and research processes. Campbell has added risk aversion indicators that can switch off the carry trade – and sometimes even cut and reverse, going short FX carry. This year in June, whereas generic FX carry indices lost as much as 8-10%, Campbell pretty much got out of the carry trade and sidestepped these losses. Harris does add that it is actually very rare for them to go net short carry and this only occurs at extreme times.

Just as Campbell has enhanced the raw currency carry trade, so too the manager has developed more sophisticated ways of profiting from commodity carry trades. To reveal the precise details of their own angle would give away the “secret sauce” but Harris is prepared to say that Campbell’s models are considerably more sophisticated than products based on one simple rule. It is easy to understand why when we learn about Campbell’s research process.

Thorough peer reviews from diverse angles

Jim Simons’ Renaissance famously hires doctors of anything but finance, but Campbell’s has both finance PhDs and hard science PhDs. “We like to marry financial markets and natural sciences,” says Harris, who finds that pure science people often have different perspectives.

For instance those who have studied meteorological or weather patterns, and scientists with medical backgrounds monitoring heart or brain waves, are adept at interpreting graphical data. Equally Campbell has hired econometrics PhDs who have spent years on Wall Street. “At the core the product is about diversity, and we want to provide diversification benefits even for those already exposed to multiple CTA managers,” says Harris. Witness how this year the PRISM programme has often had negative correlations to other CTAs.

Campbell’s philosophy is to start with an intuitively sound thesis, and then “use math and science to codify the idea into a repeatable framework,” Harris says. Campbell always resists the temptation of following the reverse approach, starting with science and then seeking an ex-post rationalisation for what might turn out to be an entirely spurious relationship. Many managers use pattern recognition techniques to “mine vast amounts of data and quickly find relationships”. The danger here, Harris warns, is that “if you do not know what is driving the relationship, and what risks lie behind it, then you do not know when it will stop working. Then things change, get arbitraged away, and you are back to square one”. Harris says Campbell aims to build models that can last for many years.

The peer-review process also distinguishes Campbell’s research process. Campbell has five teams within research. Three of them are seeking alpha, from trend, non-trend and cash equities. The fourth team takes a top-down view, focusing on portfolio and risk management, so that alpha generation is always considered in the context of the portfolio and risk controls. This team convenes with the investment committee each day for a risk meeting. The fifth team is the peer-review team, which aims to get the highest-calibre models. The peer-review process can last as long, or longer, than the time taken to build the initial model.

“Everyone, and not only the PhDs, asks a tremendous number of questions,” explains Harris, and they may make changes to the model to find ways of making it more airtight. A short-term mean reversion statistical arbitrage model receives inputs from the trend, counter-trend and equities teams. “There are no walls, and people within and between teams interact freely,” says Harris.

Risk, regulation and reporting

There is scope for the investment committee to exercise discretion in risk management, but human over-rides are in practice very rare, having only occurred during times of systemic risk, such as the tsunami which hit Japan in 2011, when Campbell feared exchanges might shut and liquidated Japanese exposures over two days. Campbell has systematised the risk framework to the point where they feel very little human intervention is needed. Vertical risk has to stay within a threshold. Horizontal risk sets ceilings for exposures to markets, sectors, asset classes and risk factors. Together these predefined constraints act as an effective risk overlay, Harris says, providing adequate safeguards against portfolio concentration.

Decomposing exposures also helps with reporting to investors and regulators. Campbell was early to adopt the OPERA reporting standards now known as Open Protocol, which provides for non-commercial risk aggregation. “We are big believers in the Open Protocol and have no problem with transparency,” says Tracy Wills-Zapata, explaining that “if everyone puts the information in a standard protocol, it is operationally easier.” At Campbell, one person is completely dedicated to all reporting matters, which include filing Form PF reports to the SEC. “It is onerous, and we will have to hire more people to do it,” says Harris, but Campbell feels comfortable that they are on top of reporting requirements. Campbell has been registered with the CFTC since 1976, and the SEC since 2005, so is no stranger to data requests.

Campbell is experienced when it comes to all of these operational routines. While it is more usually administrators and prime brokers who get a Service Organization Control (SOC) SSAE 16 report, Campbell is relatively unusual in being a hedge fund manager with a Type 2 SSAE 16. Additionally Campbell’s internal controls are Sarbanes Oxley-compliant for US institutions.

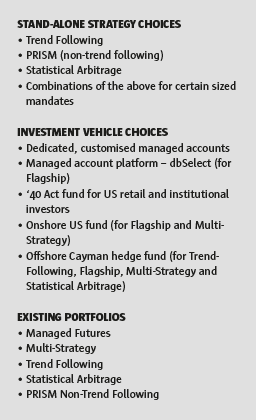

Investment vehicles

Campbell’s strategies can be accessed on a stand-alone basis for those that want pure trend, non-trend strategies only, or just the statistical arbitrage programme, with the Managed Futures flagship combining the first two and the Multi-Strategy programme including all strategies. Campbell also finds that institutional investors often want to build custom portfolios and “everyone wants something slightly different”. These mandates, for size, can be tailored to specific client requirements for particular styles or look-back periods.

Campbell has a feeder on the db Select platform and in April partnered with Equinox to launch a ‘40 Act fund that has already raised some $375 million of assets, aided by both the brand name and recent outperformance. The Equinox Campbell Strategy ‘40 Act fund, which has the ticker EBSIX, is attracting inflows both from retail investors and institutions, which are pleased that its total fixed expense ratio is competitive with Campbell’s other funds – and much lower than some ‘40 Act funds. Campbell awaits regulatory clarity before deciding whether to launch a UCITS.

Campbell is no stranger to private investors. Its continuously operated fund for private placement clients is its oldest product, and has annualised at 15.1% a year since 1972. Yet despite its longevity, Harris says “we are focused on our competitive nature and young spirit.” Campbell’s consistent outperformance over the past four years convinces him that all of the research and innovation is worth the effort.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical