Nordic nations rank highly in the annual World Economic Forum Global Competitiveness Report. The ingredients of corporate success have included exports, innovation and research and development. “Small local markets meant that successful companies always had to be international and export and so they built up great positions in foreign markets long before globalisation,” Catella Nordic Long/Short Equity manager, Martin Nilsson explains. For instance, SKF of Gothenburg celebrated 100 years in China and is unusual in listing the names of countries where it is present in the local language on its website. “Our companies are seen as locals and they have a strong footprint” Nilsson goes on, illustrating that sales exposure of Nordic companies is approximately 30% to the home market, 17% to Western Europe outside the Nordics, and 30% to emerging markets with 16% in North America and 6% in rest of the world. A forward looking mentality is also helpful: Sweden and Finland belong to the top five members of the Bloomberg innovation index (alongside Israel, South Korea and Japan).

An open culture, seen with Sweden passing the world’s first freedom of information law in 1766, extends to the corporate sector. “We take pride in transparency and well run companies”, says Nilsson.

The four Nordics (along with New Zealand) have the lowest corruption ranking according to the 2015 report from Transparency International. Corporate governance is also perceived to be strong and “has clearly improved in the past 20 years” Nilsson has noticed. Non-voting and dual share class structures that can give certain families effective control with minority ownership have been a feature of Sweden for some years. But says Nilsson “the ownership base has become so international that we don’t discuss it so much and some companies have merged share classes”. Share ownership is also very broad based locally in Sweden, with most of the population owning direct equities or equity funds.

Scandinavia is famous for high taxes, and these do apply to high earners but the climate is actually quite competitive for entrepreneurs and business owners. Indeed, Markus ‘Notch’ Persson, who founded gaming firm Minecraft bought by Microsoft, spent $70 million on a house in Beverley Hills, reportedly outbidding Beyonce. Taxation for companies has decreased and Sweden’s abolition of inheritance tax has even enticed some erstwhile emigres, such as IKEA founder Ingvar Kamprad, back to the country.

The macroeconomic climate has also been supportive. As with the US,Sweden’s per capita economic growth (at 1.3%) is slower than the headline figure of 4%, due to population growth. This comes partly from immigration, where Sweden welcomes a disproportionate number of refugees, but also from the strong birth rate: Sweden’s fertility rate of 1.9 is second only to the UK at 2.1 in Europe.

Economic growth has also been supported by a robust banking system. Nordic banks had a crisis in the early 1990s, around 16 years before the sub-prime crisis that devastated many US and European banks. Though some Swedish banks had struggles in 2008 due to Baltic exposure, in general the Nordic banks managed very well and boast lending growth that contrasts with European banks’ continued deleveraging. “In spite of low interest rates the banks have earned good money and built up well capitalised balance sheets,” Nilsson observes.

Floating currencies in Sweden and Norway have helped to maintain competitiveness (Finland has adopted the Euro and Denmark has been more or less pegged to it since 1982). The floating Swedish Krona depreciated in the 2008 crisis and again in 2015 while the Norwegian Krone’s drop has mitigated the impact of lower oil prices.

Nordic equity markets

All of this has helped to foster relatively large and diverse stock-markets with Scandinavia punching above its weight: “Scandinavia has a population of only 25 million people but its stock-markets are of similar size to Germany with 80 million people,” Nilsson points out.

The breadth of Nordic stock-markets is seen with the four countries having very different types of companies. Nilsson highlights the key sectors in each. “Denmark has pharmaceuticals and consumer companies; Norway has shipping, oil service and oil, while Finland and Sweden have more industrials and mining”. The largest sector in each market also differs: healthcare in Denmark, energy in Norway, industrials in Finland, and financials and real estate in Sweden.

Nordic equity markets have a broad spread of industries, with the only almost absent sector being utilities, which tend to be owned by the state. Nordic versus US and European sector weights appear in Fig.1. Nordic equity markets are higher beta markets than Europe or the US for two reasons. Low beta consumer staples are big in Europe, but small in the Nordics, which have a more industrial sector bias that tends to have high beta partly due to its emerging market sales orientation.

Catella

Scandinavia also nurtures asset managers, with a regulatory climate conducive to alternative investments including private equity and hedge funds. Sweden has for many years given retail investors access to hedge funds. Stockholm is second only to London for European hedge fund industry assets and the local hedge fund scene is dynamic. There are plenty of smaller boutiques performing well alongside the largest groups such as Brummer, IPM Informed Portfolio Management AB (IPM) and Catella.

Catella as a group has over 500 staff and manages a total of €12.5 billion, including its stakes in IPM and real estate businesses in Germany and Finland. The group has a banking business including wealth management, cards and payments, and is listed on the Nasdaq OMX exchange.

CLICK IMAGE TO ENLARGE

Catella is well known for its Catella Hedge multi-strategy product, with assets of $1.7 billion making it the third largest hedge fund in the Nordic region. Catella Hedge has a long/short equity sleeve that is less concentrated than the Catella Nordic Long/Short Equity fund and the former has a much lower risk target than the latter. Whereas Catella Nordic Long/Short Equity only trades equities, and equity derivatives, Catella Hedge allocates 50% to fixed income and corporate credit, a strategy where another Catella Fund – Catella Nordic Corporate Bond Flex – won The Hedge Fund Journal’s UCITS Hedge Award for ‘Best Performing European Credit Strategy over a 3 Year Period’. Catella Nordic Long/Short Equity does not take credit risk with its spare cash.

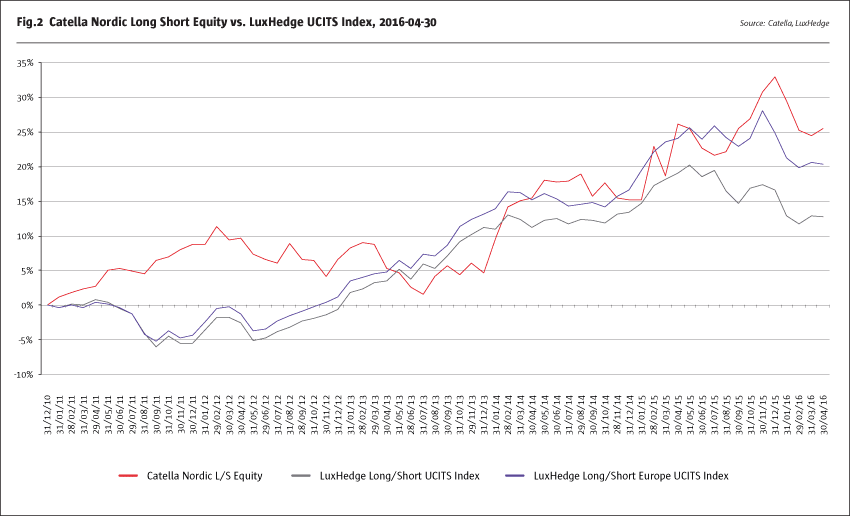

Catella Nordic Long/Short Equity’s launch in 2010 made it one of the first long/short equity UCITS funds in the Nordic region. The fund is led by Martin Nilsson, who has 14 years’ of European equity analysis experience, supported by a desk of nine professionals. Nilsson has primary responsibility for the long book while the short book is run by Ola Martensson, following a mainly quantitative approach. The return profile of the fund, shown below, is clearly uncorrelated with many other long/short equity funds. While 2011 was a tough year for many long-biased funds, Catella made 8.74%. Conversely, while the rebound years of 2012 and 2013 were profitable for many long-biased European equity funds, Catella saw small losses in both years. And if 2015 turned out to be a challenging year for some equity hedge funds (particularly those with a value bias) it was Catella’s best year with a 15.36% return, as both long and short books contributed absolute returns.

CLICK IMAGE TO ENLARGE

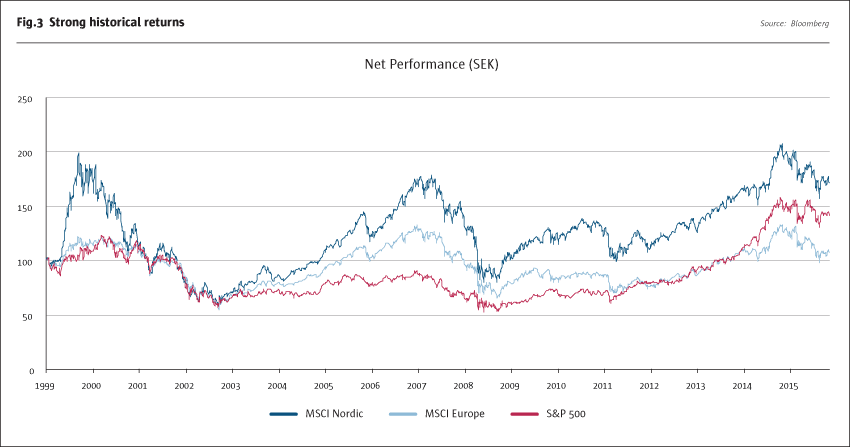

Catella’s equity strategies pursue an active approach with a relatively concentrated book and an unconstrained mandate that can invest in large, mid or small caps though there is something of a mid-cap bias. The strategy invests primarily in the four Nordic stock-markets of Sweden, Denmark, Norway and Finland, partly because it finds sufficient diversity in local markets but also because performance has been strong – in both the short term and the long term. Since 2008 Scandinavia’s markets have led the world, as shown below (led by Denmark’s Novo Nordisk). And on a 100 year lookback, “studies show that Sweden and Australia together have the best performing stock-markets” Nilsson notes.

Though national champions, such as Novo Nordisk lately or Nokia in the 1990s, have sometimes been important drivers of equity market returns, performance attribution in Nordic equity markets has been broad based and recently small and medium sized enterprises have done best. Though the OMX 30 was flat in 2015 including dividends, Nordic small caps were up 35-40%. “New companies are coming to market, in gaming and healthcare,” notes Nilsson. And those that start small can become giants: Nilsson can remember when fashion retailer Hennes and Mauritz – now one of the region’s largest quoted companies – was a small cap.

But Catella does not trade the very smallest stocks, which are listed on the junior ‘First Nordic’ market, and tend to have market caps below €100 million. Liquidity in Catella’s sweet spot of mid-cap Scandinavian stocks is fine for the current fund size of €97 million, with typical bid/offer spreads between 0.10% and 0.50% of share prices. Nilsson admits that if assets grew to €1-2 billion he might run into liquidity bottlenecks.

Key stock winners

Catella are not invested in the ‘overcrowded’ hedge fund stocks that populate prime broker lists. Catella’s best contributor last year was Mycronic, a stock that is still in theportfolio. Mycronic is a technology company that creates production solutions for the electronics assembly, display and packaging industries. Its valuation multiple of 14-15 times looks even better after stripping out SKr 1.1 billion of net cash out of the SKr 6 billion market capitalisation. The company offers a dividend yield of around 6% that has grown three years in a row. Catella meet the management regularly. Another strong contributor was defence company SAAB. It specialises in defence jets, and Catella’s attention was caught when the stock’s market capitalisation of SKr 25 billion was dwarfed by its order book of SKr 115 billion. Nilsson regrets that rising geopolitical tensions are one source of SAAB’s good fortune but finds the investment compelling.

Another top five holding is window and door supplier Inwido, which is consolidating the industry and growing through acquisitions. The valuation is too low according to Nilsson. Forestry and paper group Holmen is also “very cheap with a great balance sheet and is paying out huge extra dividends” says Nilsson, who adds that the firm’s recent results beat estimates. Another conglomerate, Trelleborg, is “a fantastic company and management team led by President and CEO, Peter Nilsson, one of the best in the Nordics”. The company is restructuring, making acquisitions, and shutting down some facilities in order to boost margins, in its tyres, polymers and carpets. A more recent purchase was stainless steel leader Outokumpu, bought in the first quarter of 2016 after a big selloff. Nilsson points out “demand for stainless steel is picking up and inventories are at a 10 year low”.

Short book

2015 was an unusual year in that the fund made money on both sides of the book. Over a bull market, Nilsson would not expect to make absolute profits from shorts, because only 5-10% of stocks will go down in a rising market. The aim is therefore normally for shorts to underperform the long book and contribute alpha.

Most of the short book is single names though index futures can be used. Most shorts are based on seven quantitative models (with a few fundamental shorts too) that look at metrics including technicals, profitability and balance sheets. Larger short positions will tend to score badly on most models and the very biggest shorts will arise if all seven models suggest a short. In 2015 a profitable theme was shorts with emerging markets exposure. A current short is Novozymes, which Martensson thinks is going ex-growth: having once grown at 15-20% it is now slowing down to 3-4%. Other shorts – including Nordea, TeliaSonera, Hexagon and Investment AB Kinnevik, are a consequence of multiple quantitative models.

Catella is becoming one of the most versatile asset managers in Europe. Renowned for its property, credit and multi-strategy hedge funds, and for IPM’s systematic fundamental macro strategy (that THFJ has also profiled), Catella is also earning a reputation for independent thinking in Scandinavia’s diverse equity markets.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical