In its first six years, Chenavari has grown assets more than one hundred-fold to $5.5 billion from the $40 million it started with in 2008. The size of assets easily secures Chenavari’s place in The Hedge Fund Journal’s Europe 50 survey each year, while the performance of various funds has earned Chenavari THFJ performance awards. Initially a European credit specialist, Chenavari has now opened offices in Sydney and Hong Kong to cover Asia, adding to London headquarters near Buckingham Palace and the Luxembourg trading base and business continuity backstop. The firm has been on a hiring spree, including private equity specialists, and now employs 90 professionals with roughly half now on the non-investment side handling operations, compliance, and regulation. On top of that there are now several hundred more staff in hands-on, operational roles at Chenavari’s loan servicing affiliates, which are important for some of the less liquid strategies.

Chenavari covers the full spectrum of European credit assets: corporate credit, credit derivatives, credit indices, financials, structured credit, asset-backed securities, real estate debt, regulatory capital and direct lending, including specialty finance activities. The suite of products ranges from a London Stock Exchange-listed permanent capital vehicle, to liquid alternatives offering monthly dealing, hedge funds locked up for between one and three years, and less liquid investment strategies with private equity-style fund structures and five to seven-year terms.

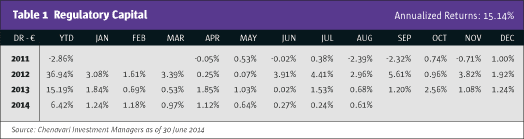

Although the liquid trading strategies still make up two-thirds of firm assets, this feature focuses on two less liquid investment strategies pursued by Chenavari: regulatory capital and direct lending, both of which have a compelling and growing deal flow pipeline. Chenavari is already launching a second regulatory capital fund as its first one, started in 2011, begins to return capital to investors. That pioneering fund has twice won The Hedge Fund Journal’s Europe 50 performance award for Best Performing Regulatory Capital Fund. The new fund will be investing until the end of 2016 and harvesting out to 2019. Meanwhile, a Diversified Direct Lending Fund maturing in 2020 with opportunistic exposure towards SME Lending, Real Estate Lending and Specialty Finance Lending is open to investors, and a dedicated new Real Estate Direct Lending fund is planned to launch in Q1 2015, after Chenavari initial real estate debt fund started to return capital to investors. Dedicated managed accounts are also available for both strategies.

Both of the less liquid investment strategies are taking advantage of opportunities created by the daunting scale of the deleveraging being undertaken by banks mainly in Europe. Like all of Chenavari’s funds, these have a clearly defined mandate, hence there is no overlap of holdings between the two strategies.

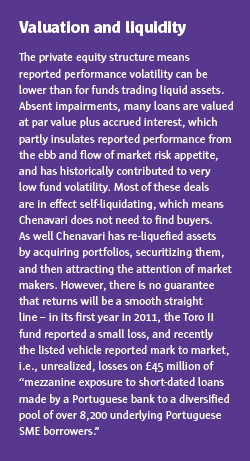

The limited life, closed-end fund structure is common to both. It follows a familiar private equity model – cash is drawn down and invested over a ramp-up phase, inflows level off and then the fund returns capital to investors in stages over the run-off harvesting phase. Management fees are friendlier than at some private equity funds – they apply only to capital drawn down and put to work, not to committed capital. Chenavari only gets performance fees after investors have received their initial principal, and only then above hurdle rates of between 2% and 4% over three-month interbank rates, depending on the amount invested.

Can double-digit returns continue?

So Chenavari must be confident of maintaining double-digit returns if they expect to earn a performance fee of more than 1.6% a year. The 12% return target looks close to what distressed debt has delivered, but Chenavari is keen to emphasize that they focus mainly on performing portfolios of loans, and expect to deliver positive IRRs, even at multiples of historic default rates! So far, their adverse default scenario stress tests have proved realistic. The track record has been flawless, with no significant impairments recognized on any deals, in either the regulatory capital or the direct lending strategies.

Therefore, the 4% hurdle rate alone may seem startling for some investors – it is not far from the yields to maturity on many high-yield bonds or senior secured loans, which, trading near or above par, now offer buy and hold investors no scope for capital appreciation on top of yields. Of course, the Chenavari managers are active traders who aim to beat passive investors through market timing and security selection.

Even buy and hold investors might expect to get double-digit returns from these performing liquid credit assets through explicit fund-level leverage, or implicit leverage – buying more junior assets that have higher exposure to default risk. Chenavari’s less liquid investment strategies have not historically used the first form of leverage, on the balance sheet of the fund, but some of their positions are using the second type of implicit leverage. Just as the junior tranches of structured credit vehicles like CLOs and CDOs are implicitly leveraged, so too are Chenavari’s first loss and mezzanine regulatory capital deals and their second lien direct loans. However, Chenavari’s junior participations are different from “plain vanilla” subordinated instruments, because they contain risk mitigants designed to limit downside, which form part of Chenavari’s expertise at structuring bespoke deals.

So, both trading and efficient debt structuring have contributed to Chenavari’s historical returns from illiquid credit, but Chenavari has also extracted double-digit returns from originating or owning first lien/whole loans – not just riskier slices of loan books – and holding them to maturity. Double-digit returns have been attained partly because illiquid credit still seems be an oasis of historically high risk premiums – even after the rising tide of liquidity appears to have lifted nearly every asset class boat. Yields on many liquid credit assets, such as “high”-yield bonds or senior secured loans, are at all-time lows in absolute or nominal terms, although credit spreads over the risk-free rate remain well above pre-crisis lows. Illiquid credit assets have not ignored the tightening trend, and indeed Chenavari finds that yields on some deals have been compressed to levels that no longer meet their risk/return criteria. “In some recent cases, such as some German SME mezzanine loans, we would welcome shorting the risk if we could,” says Loic Fery, CEO and co-CIO of Chenavari. However, six years after the crisis, carefully selected illiquid credit assets continue to offer potential returns that are historically high – in absolute terms, relative to those on liquid assets, and versus similar US deals, hence the stampede of US private equity firms into the space!

The evolution of market environment has been such that “these 20%+ gross double-digit returns are unlikely to persist,” Fery freely admits, meaning that the net annualized returns of 16% since 2011 for the regulatory capital strategy might not be maintained. Indeed, 2014 returns to August are now only 5.77% for the Euro share class, but Chenavari’s strategies in the space are still targeting net double-digit returns over a five to seven-year time frame. “Given the opportunity set, a net target return of 12 to 15% is still realistic in these investment strategies, ” summarizes Fery.

Why could these returns persist for a multi-year period? The structural imbalance between supply of and demand for capital is one reason, and the expertise required to do these types of deal constitutes a barrier to entry that may further constrain the supply of capital that can be deployed in these opportunities.

Basel III and one trillion

Basel III rules are the main factor forcing banks to lower ratios of loans to capital, with European Banking Authority (EBA) stress tests and asset quality reviews, and EU rules on state aid, also imposing restrictions, according to Chenavari. The Swiss city of Basel straddles three countries – Switzerland, France and Germany – and the Basel III rules are homing in on a maximum loans/capital multiple of just over 12 times, with total capital set at a minimum of 8% of loan books, although regulators in some countries, such as Sweden and Switzerland, have already set lower multiples and higher capital requirements. Chenavari estimates that European banks will in fact converge towards average core tier 1 capital of 12.5%, which in effect limits their leverage to just eight times. To put this into perspective, before the crisis some banks were as much as 40 times leveraged on a “look-through” basis, including their off-balance-sheet leverage via SIVs (special investment vehicles). Fery, who left his investment banking days in mid-2007 before the bubble burst, admits that “less leverage in the banking system will contribute to financial stability”.

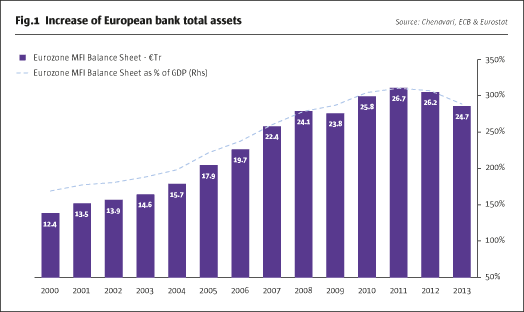

The deleveraging marathon has begun – with two trillion of assets shed by Europe’s banks between 2011 and 2013 (see Fig.1) but it has further to run. Longer-term lending for four or more years appears particularly vulnerable because Basel III D-Day is 2019. This deadline was last year pushed out by four years from the original aim of 2015, with respect to liquidity capital ratios, underscoring the magnitude of the challenge. The extension buys time, but ultimately banks must still meet the new criteria.

A lower ratio of loans to capital is only the most obvious Basel III change. Capital itself is more strictly defined, rendering parts of banks’ current capital bases ineligible. The risk weightings for assets, that once branded residential mortgages as low-risk, have been increased too, making consumer lending, for instance, a more capital-intensive activity.

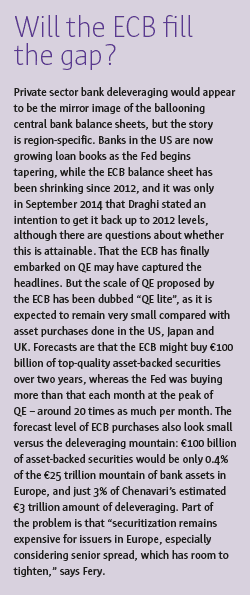

All in all, Chenavari estimates European banks still face a capital shortfall of approximately €1 trillion (one thousand billion), which will imply the need to rein in several trillion of loans currently on balance sheets. Banks are pursuing these goals from many angles. Some banks are conserving capital by retaining earnings, delaying the reinstatement of dividends, or not increasing dividends. Banks are raising capital through issues of equity and instruments such as contingent convertibles (CoCos), which the UK FCA recently said were off-limits for retail investors, and GLACs (gone concern loss absorption capacity bonds) could be the latest acronym to watch out for next year. Banks are letting some loans mature and not extending them. Finally, banks are selling off portfolios of loans, effectively sharing risk with third-party funds to buyers such as Chenavari – and possibly also now to the ECB.

While ECB policies might be infusing liquidity into wholesale markets, and improving the liquidity and cost of loans for some types of banks and borrowers, ECB policies are not removing the need for private banks to deleverage in Europe. That the EU economy has shrunk by 1% since the 2008 crisis, with plenty of depressing data seen in 2014, does not help banks to rebuild their balance sheets. Surprisingly, though, it is not only economically sclerotic Europe where banks need to deleverage. Even in wealthy Australia, which has escaped recession for 18 years and boasts vast pension fund assets, banks are capital-constrained – partly because overseas banks have been repatriating capital.

While ECB policies might be infusing liquidity into wholesale markets, and improving the liquidity and cost of loans for some types of banks and borrowers, ECB policies are not removing the need for private banks to deleverage in Europe. That the EU economy has shrunk by 1% since the 2008 crisis, with plenty of depressing data seen in 2014, does not help banks to rebuild their balance sheets. Surprisingly, though, it is not only economically sclerotic Europe where banks need to deleverage. Even in wealthy Australia, which has escaped recession for 18 years and boasts vast pension fund assets, banks are capital-constrained – partly because overseas banks have been repatriating capital.

Partnerships with banks – and regulators?

Regulatory capital and direct lending investment strategies are both useful in helping banks to climb down the leverage mountain. Here Chenavari sees hedge funds as complementing, rather than replacing, banks. “We are working in partnership with the banks,” says Fery, and most of the time the banks and Chenavari share risk exposure to loan books as a measure of alignment.

Chenavari’s strategies are very niche in scope. The €1 billion Chenavari seeks to raise for the new regulatory capital fund is less than 1% of the UK’s bank lending to smaller and medium-sized companies in the UK of around £180 billion, which is just one of the target markets. “Our investment activities focus on asset-classes that banks now view as non-core, such as real estate or consumer lending,” says Fery. It would be a great exaggeration to think that alternative investors will replace banks. Yes, tens and possibly hundreds of billions have been raised for deleveraging direct lending funds, but that is still tiny – maybe less than 1% – compared with the €25 trillion of lending in the EU economy. Indeed, regulatory capital deals are often designed precisely to let banks hold onto portfolios and to continue making new loans, effectively focusing on monetizing relationships with the clients they lend to. When Chenavari in effect sells credit insurance on a slice of loan book risk, the Basel III new rules can mean that a much larger amount of bank capital is freed up. Nobody disputes that banks must still fulfill the essential utility function of maturity transformation – taking in short-term deposits or wholesale funding and lending for longer periods. This is not an activity Chenavari is willing to engage in – indeed, the liquidity terms of its funds are aligned with their investments to avoid liquidity mismatches.

The term “shadow banking” does not fit the way in which Chenavari interacts with regulators. Indeed, before each transaction, regulators are asked to validate regulatory capital deals considered by banks with funds like Chenavari – otherwise banks would run the risk of not benefiting from actual capital reduction. Fery finds that regulators are generally embracing the influx of alternative capital into this space, and he argues that Chenavari’s deals help to promote “financial stability, as it transfers risk from banks that are still up to 20 times leveraged, to funds that are generally unlevered”. In fact Fery does not see how unlevered (or sometimes term-levered) funds, with no liquidity mismatch between their financing and/or investors and their borrowers, could become a source of systemic risk. Should defaults exceed even Chenavari’s apparently conservative stress test levels, sophisticated investors will simply have to stomach the losses. In contrast, of course, the interconnectedness of the highly levered banking system means that a run on bank deposits (or freezing up of wholesale and interbank markets) would threaten contagion effects that will often require the state to step in as lender of last resort.

Regulatory thinking, however, is shifting from bail-outs to bail-ins. If Dodd Frank started the trend, the Financial Stability Board report was endorsed by the G20, and the EU Bank Recovery and Resolution Directive will prioritize bail-ins before bail-outs. Already Cyprus may be an early example of a bail-in, and 2014 has seen Austrian, Bulgarian and Portuguese bank failures this year described as being at least partial “bail-ins”. Some countries outside the US and EU, such as Canada, are also passing bail-in laws.

Risk retention and bail-ins are, along with bonus deferrals, claw-backs and co-investment requirements, designed to align interests amongst banks, hedge funds, their staff, investors, and the taxpayer. So “skin in the game” is the name of the game, and hedge funds that are regulated, exclusively for professional investors, and outside the scope of government compensation, deposit insurance, or consumer protection schemes, seem to be in tune with the zeitgeist of regulation.

A leading deal sourcer and structurer

In regulatory capital, Chenavari proactively creates its deal flow because few of its deals are available from market makers or brokers, (at least before Chenavari has created the structures, which can then be syndicated or securitized publicly at a later stage). Some deals that are publicly traded might not meet Chenavari’s return requirements – the Credit Suisse Clock transaction only pays 9% above Swiss interbank rates, on tradable notes, which would translate into a net of Chenavari fees return of no more than 6% or 7% to investors.

In contrast Chenavari’s case studies show actual double-digit yields involving German SMES, UK mortgages or Spanish receivables, for instance. Chenavari needs a weighted average gross return in excess of 15% to deliver over 12% net to investors – and to achieve this, they will often tailor deals rather than buying off-the-peg ones conceived by somebody else. Deals that have to be held for several years should carry an illiquidity premium, and arguably Chenavari investors also benefit from an implied arranging fee factored into the yield on private deals.

When it comes to sourcing, Fery highlights that Chenavari is leading the pack. “In 2014, our teams succesfully traded two of the three main consumer finance deals closed in Europe this year, and almost 50% of the significant leasing transactions,” he states. Chenavari appears as one of the busiest players in regulatory capital, with a focus on niche opportunities: as Fery says, “We are told that we closed the largest number of bilateral trades with European banks in 2013. Not sure about that, but we are certainly pleased with our quality deal flow”. This seems logical to Fery, as the Chenavari team has spent their entire careers in European banking and finance.

Operational capabilities

Chenavari’s regulatory capital repertoire ranges from “risk sharing” deals buying slices of loans, to buying whole loans, in areas that are now non-core for banks, such as leasing, mortgages and consumer finance – and the fund has also invested in operating portfolios of loans. Among operating deals publicly reported as funded by Chenavari were the acquisition last year of a leasing subsidiary of Dexia; and also the purchase earlier this year of a former BNP Paribas unit involved in credit card finance in Belgium. Fery explains that “although specialty finance units tend to be profitable, banks are generally re-assessing their involvement in these activities, considering that the cost of capital for non-rated exposure is prohibitive under Basel III.”

Consumer finance is an attractive investment opportunity, Fery says. But that does not mean Chenavari are chasing after the triple-digit annualized interest rates levied by some doorstep and payday lenders. To the contrary, Chenavari accurately foresaw that such high rates could carry regulatory risk, and indeed UK and US regulators have clamped down on some lenders. Instead, Chenavari prefers to focus on countries that have not just a usury rate ceiling, but specifically the lowest such cap – for example, Benelux.

Loan servicing can be labour-intensive. Chenavari outsources loan servicing, but has also recently acquired what Fery calls “advanced consumer finance servicing capabilities”. Some 400 people are on the ground, originating credit and collecting payments. Chenavari also has teams focusing on leasing activities, and handling non-performing loans in Spain. This seems quite novel in Europe, but in the US hedge fund managers have been involved in loan servicing for some years – Fortress, for instance, owns most of mortgage servicer, Walter Investment Management Corp. These servicing capabilities help to make Chenavari one of the more versatile credit managers, and they may allow Chenavari to do deals that some other asset managers cannot.

But loan servicing is really just the icing on the cake. Chenavari has for some time been particularly well positioned to take advantage of deal flow through sourcing, analysis, structuring, and origination. On sourcing capabilities Fery says, “Our origination teams are well plugged in to 80 to 100 banks in Europe, including regional banks. Our team is quite knowledgeable of the details of capital constraints and specificities arising from new regulations.” He adds, “Deep fundamental, structuring and origination expertise is required to plug into the new landscape and roll out attractive transactions.” Chenavari team members have executed in excess of $20 billion of regulatory capital transactions with more than $600 million currently invested in these transactions.

But loan servicing is really just the icing on the cake. Chenavari has for some time been particularly well positioned to take advantage of deal flow through sourcing, analysis, structuring, and origination. On sourcing capabilities Fery says, “Our origination teams are well plugged in to 80 to 100 banks in Europe, including regional banks. Our team is quite knowledgeable of the details of capital constraints and specificities arising from new regulations.” He adds, “Deep fundamental, structuring and origination expertise is required to plug into the new landscape and roll out attractive transactions.” Chenavari team members have executed in excess of $20 billion of regulatory capital transactions with more than $600 million currently invested in these transactions.

Fery states that Chenavari is not a “one-man show” and relies on numerous experts in the field of regulatory capital, particularly highlighting the roles of co-CIO, Frederic Couderc, as the senior structured finance specialist involved in a large number of Spanish balance-sheet capital efficiency deals in his former pre-crisis positions at Bear Stearns and Natixis, and senior portfolio manager, Hubert Tissier de Mallerais, who led the Credit Suisse balance sheet securitization team for a few years before helping set up the RBS non-core division. Fery headed up global credit markets at Calyon, with responsibility over structured credit, asset-backed securities and high-yield, and as such he was part of Credit Agricole’s Credit Portfolio Management group (CPM), one of the largest issuers of balance-sheet capital efficiency transactions between 1999 and 2007.

Having their fingers on the pulse of deal flows has helped Chenavari to deploy capital within their stated time frame, which is usually a two-year ramp-up period. Investors are close to fully exposed by the end of the investing phase, which may help to explain why Chenavari’s LSE-listed closed-end fund, Chenavari Capital Solutions Limited (ticker: CCSL), trades at a good premium to NAV. Regulatory News Service (RNS) statements show that the seed investors for this vehicle included Chenavari’s own European Opportunistic Credit Master Fund LP, in keeping with the firm’s “eat your own cooking” philosophy that has seen the portfolio managers invest tens of millions into their own funds. Other anchor investors disclosed in RNS were Arbuthnot Latham, Baring Asset Management/Baring Fund Managers Limited, BNY Mellon, COIF Charities Investment Fund, COIF Charities Ethical Investment Fund, CBF Church of England Investment Fund and Sarasin and Partners. The new closed-end fund, Regulatory Capital and Deleveraging Opportunities, which is not LSE-listed, already has two anchor investors and is targeting assets of up to €1 billion.

Direct lending in niche segments

The direct lending and leveraged finance bucket, at $1.6 billion, is larger than the regulatory capital assets, which were close to $1 billion as of the end of August. Some 28 investment professionals are working on direct lending, although some of them straddle other strategies – Fery and Couderc are co-CIOs of all strategies.

“The direct lending strategy differs from regulatory capital as it is seeking to originate new loans – doing what many banks do not do any more because of lack of capital,” says Fery. A full picture of historical returns has not been disclosed to us for the direct lending strategy, but a selection of trade examples gauge the potential in broad-brush terms.

Although tens of billions have been raised for direct lending funds, spreads per turn of leverage – a key metric – are still “two or three times as high as on liquid high-yield bonds,” Fery claims. Put another way, one study said that direct loans offer yields comparable to several levels of subordination. In other words, a senior direct loan, with first claim over borrower assets, might pay the same yield as a much more junior tradable loan that would likely experience far lower recovery rates in the event of default. Some 77% of the Chenavari direct lending book was senior/first lien as of July 2014. “The yield gap partly reflects the fact that small businesses cannot access leveraged loans or high-yield bond markets, and are also too small for banks,” argues Fery.

On top of these hefty yields, borrowers are sometimes prepared to cough up arrangement fees as high as 5.5% for a five-year deal, and Fery says this is available capital for SMEs, which usually struggle to obtain adequate funding from banks. Further sweetening the deals, loans can also contain equity kickers, in the form of warrants or profit shares. But as any credible investor, Chenavari demands sticks as well as carrots. The package of negotiated covenants includes maintenance covenants, negative pledges and cross defaults. There is already evidence that Chenavari are watching the covenants like a hawk. “Some borrowers have breached covenants but these situations are usually swiftly remedied by mutual agreement. While SME loans sometimes entail complex credit situations to efficiently manage and impair when needed, what matters eventually to our investors is the total portfolio performance,” says Fery.

Historically US private equity has greatly outperformed European private equity, but now US private equity firms are moving into the European direct lending space. The Chenavari managers, who have spent their entire careers in Europe, are presently focused on three main segments: European real estate commercial loans opportunities, with a focus on the UK and Spain; European specialty finance; and smaller and medium-sized enterprises in Europe and in Asia – with a new team brought in to do developed Asia since early 2014.

Niche commercial real estate was, in July, the largest allocation of the Chenavari Direct Lending Opportunities Fund at 43%. This incudes originating new loans and buying secondary loans, activities that Chenavari managers have been doing for many years. Trade examples suggest internal rates of return have generally been between 10% and 30%, with IRRs as high as 30% on bridging loans, where Fery argues that the fund offers “more flexible terms than many banks,” lending against some of the most expensive properties in London. Real estate specialists, Sam Mellor and Andrew Haines were hired from a specialist real estate boutique and they have done $10 billion of deals over their banking careers, including $1 billion of work-outs, with $600 million so far at Chenavari and a pipeline of $200 million meeting their criteria, including net IRRs of 10-12% and resilience to stressed scenarios.

SMEs are another core sector. The UK is currently the biggest country weight for direct lending as a whole, at 56%. Policymakers in the UK have been trying for years to encourage more financing for smaller companies, through the Funding for Lending scheme, and various tax advantaged investments such as Venture Capital Trusts (VCTs), Enterprise Investment Schemes (EIS) and the new Seed Enterprise Investment Scheme (SEIS). But British Bankers’ Association data seems to show that even as the UK economy recovers in 2014, bank lending to small and medium-sized businesses has been trending down since 2011. Chenavari even estimates the availability of finance to UK SMEs from banks has drastically contracted by 70% since 2008! The target market is companies with enterprise values under $100 million, which is well below FTSE 350 territory. Clearly this is another group of borrowers who are forced to pay high interest rates, as they cannot go anywhere else. As well they have to make do with lower leverage and put up more collateral against the loans. On a risk-adjusted basis, Fery says, “Deals are very attractive compared with the fundamentals.”

Within the specialty finance segment, Chenavari is active in more diverse types of collateral involved in leasing and trade finance, but will generally not lend against intangible assets. In this space Chenavari sticks to Europe and Asia and tends to finance receivables. Chenavari also lends against onshore receivables – a strategy that effectively involves buying invoices at a discount, sometimes known as factoring, whereas trade finance is called forfeiting.

Up to 20% of the direct lending strategy could be allocated to developed Asia. For Chenavari the focus is on higher-income countries of Hong Kong, Singapore, Australia and New Zealand. The team is led by the one-time head of Merrill Lynch’s Principal Capital Group in Asia and Europe, Mark Devonshire, who has structured a large variety of lending deals over many years in the region. Fery himself is no stranger to Asia, having spent four years in the late ‘90s in Hong Kong running credit derivatives for SG.

The new landscape

Although the big picture is deleveraging in Europe, a persistent and secular trend pre and post-crisis has been the diversification of lending sources from banks and towards capital markets, and now regulatory capital and direct lending add further diversity to the mix. A generation ago bank lending was as dominant in the US as it is today in Europe, but there was a steady shift towards capital market and private equity financing of the corporate and other sectors so that now more corporate funding comes from outside the banking sector. Europe may be going through a similar transition, rather later and slower, but corporate bond markets are still only around one-tenth of the size of bank assets. European bank assets still appear enormous at around three times GDP, partly because capital markets and securitization markets are correspondingly smaller, but that balance is slowly being redressed, partly due to regulations. The deals Chenavari is doing were being done pre-crisis, but it is the shortage of bank capital that makes the space more lucrative now. “The landscape of European finance is being transformed: that summarizes the market opportunity,” says Fery, and Chenavari is at the heart of this action.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical