CME Group’s cleared offering to the OTC marketplace continues to gain momentum in voluntary clearing in 2015, with industry-leading innovation in the form of new interest rate swap (IRS) currencies available for clearing. When mandatory clearing began in the US, firms were primarily focused on being compliant with regulation. Now that clearing is part of the normal course of business, clients are increasingly looking to maximise the efficiency of their portfolio by choosing to clear additional swaps on a voluntary basis.

CME Group is well suited to benefit from this trend with their market-leading suite of 19 currencies, including 15 that are clearing on a voluntary basis. “In 2014, less than 5% of the overall client clearing volume across all central counterparties was in voluntary currencies,” says Jack Callahan, Executive Director of OTC Products at CME Group, “and in 2015 that’s nearly doubled as clients are seeking the transparency, operational efficiency, and counterparty credit risk mitigation provided by clearing.”

Other global regulatory factors such as the addition of Swedish krona (SEK), Norwegian krona (NOK) and Polish zloty (PLN) interest rates swaps to the European clearing mandate that applies from 21 June, 2016, and local mandates in the Asia Pacific region (APAC) will impact the speed of these currencies toward voluntary clearing on a global scale. “Some market participants were surprised by the inclusion of SEK, NOK, and PLN in the European clearing mandate, particularly since not every European clearing house is able to clear these contracts,” Callahan asserts. CME Group has been clearing these three currencies since 2013 and has 34 global clients who are already clearing them on a voluntary basis.

Donde está liquidity?

Voluntary clearing IRS is in part being driven by hedge funds that are actively trading interest rate swaps in emerging markets currencies such as Mexican peso (MXN). Mexican peso is now the third most actively cleared IRS currency at CME Group, and a diverse ecosystem of more than 70 market participants is actively clearing it.

The clearable CME MXN IRS is referenced to the 28-day TIEE (the Interbank Equilibrium Interest Rate) published by Mexico’s central bank, Banco de Mexico, with duration out to 21 years. This market has become particularly popular due to the volatility of the Mexican peso currency, and the search for yield in a zero interest rate world.

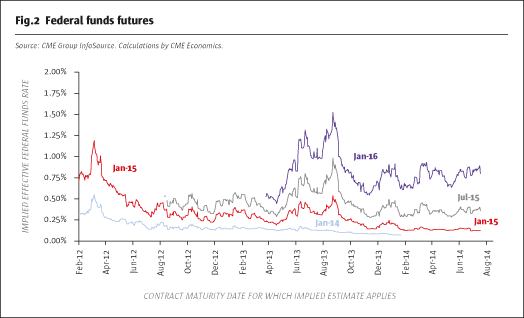

The MXN contract illustrates just how quickly market participants can migrate to clearing, with 2015 volumes already double those of 2014, as shown in Fig.2. It was introduced in 2014, but already makes up close to half of global MXN volumes, by CME Group estimates. In the third quarter of 2015 the average notional volume of cleared MXN swaps was $4.355 billion, representing 47% of the Mexican Peso IRS market, according to the last BIS triennial survey, which reported $9.285 billion per day. Of the 61 CME Group clients thatare clearing MXN IRS, over 50 participants began clearing it in 2015. As the liquidity in Mexican interest rate swaps continues to migrate to CME the old adage, “liquidity begets liquidity”, rings true. In November 2015, a daily volume of $5.5 billion in US dollar-equivalent on cleared MXN IRS demonstrated a 20% increase over the third-quarter average and over 50% of the global MXN market.

Why clear voluntarily?

Being able to clear markets can open firms up to a centralised liquidity pool with added transparency, and can remove the need to sign individual ISDAs in a local market. There are supply-side and demand-side drivers for clearing. The biggest reason for clearing Mexican peso IRS is simply that “many participants are telling us they’re getting better pricing on cleared versus un-cleared Mexican peso swaps,” Callahan asserts, and he ascribes this to the increased capital requirements and bilateral collateral arrangements that are making uncleared swaps more challenging to hold. The precise capital rules do vary between jurisdictions, but the big picture is market participants are migrating to what seems to be a more liquid and capital-efficient ecosystem in a cleared environment.

On the end-user side, sometimes the motivation has related to practical, operational bottlenecks. Explains Callahan, “some clients have experienced challenges doing a bilateral novation in the uncleared world, which can prevent traders from executing with one counterparty and terminating with a different counterparty.” In contrast, standardised IRS in the cleared world can be seamlessly traded amongst multiple counterparts with netting available on a unilateral basis.

BRL: the first of many IRS in Non-Deliverable currencies

The latest addition to CME Group’s voluntary IRS offering, Brazilian real (BRL), is set to attract market interest for many reasons. BRL offers powerful diversification benefits for investment strategies including macro, algorithmic CTAs and emerging market; Brazil’s monetary policy cycle sometimes moves in the opposite direction of other countries’ cycles, with 2015 seeing repeated rate rises in Brazil whilst other currencies have seen rate cuts. Brazil also displays much more volatility than most other markets, with daily price moves being a multiple of those typically seen in the US. Daily price moves of 3-4% are unusual in US Treasuries but commonplace in Brazilian bond markets.

The growth of voluntary clearing seems set to accelerate as CME Group continues to expand its IRS offering. When the Brazilian real CDI became the 19th IRS offering in August, 2015, an important milestone was passed. “This was the very first interest rate swap we've launched in a Non-Deliverable currency, which represents a very important innovation,” says Callahan. “We have already seen strong demand from clients and dealers, and we’re working closely with infrastructure providers so BRL IRS can begin clearing in earnest in early 2016.” That paves the way for other Non-Deliverable currencies to be offered as cleared IRS, and a number of Asian currencies are being lined up as the next additions to the CME product scope.

The three Asian IRS currencies that CME Group is looking to add are Chinese yuan (CNY), Korean won (KRW) and Indian rupee (INR). These areNon-Deliverable currencies that will make use of the same advances that allowed CME Group to add BRL. “We actively seek client feedback on which new products they’d like to see cleared, and we supplement that feedback with data from BIS and the Swap Data Repositories to get a more complete understanding of market size,” Callahan states.

With regulation continuing to favour cleared environments and balance sheet efficiency becoming ever more important for banks, it would not be surprising to see the majority of the IRS market going completely cleared. With these changes, clearing houses will need to be incredibly innovative and competitive with their offerings. CME Group seems poised to take advantage of voluntary clearing, with emerging markets and the expanded currencies in the European mandate. As we see voluntary clearing grow in the IRS market it begs the question of whether this trend will cross into other asset classes, notably FX Non-Deliverable currencies.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical