CME Group (which includes four exchanges: CME, CBOT, NYMEX and COMEX and the recently acquired NEX Group) is, as their slogan declares, “the world’s leading and most diverse derivatives marketplace”. It also scores well on various employee diversity metrics, including the fact that roughly 50% of its senior management is made up of women including the Chief Commercial Officer, Julie Winkler. Here Winkler shares insights into her career and role with The Hedge Fund Journal.

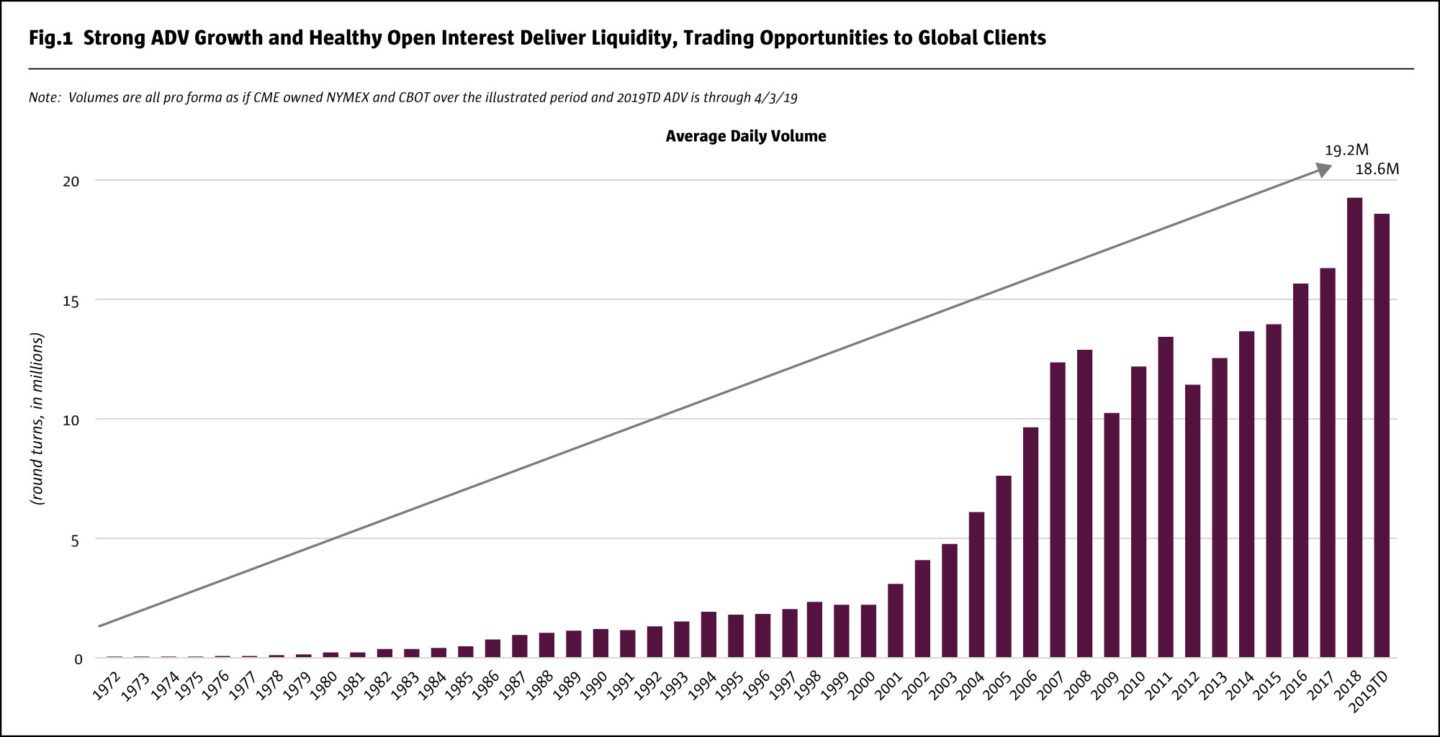

“The buy side is key for CME Group, and within that, there are c.1,800 hedge fund clients globally of which c.400 are in Europe and c.200 in Asia,” she says. “Though 2018 was generally a difficult year for hedge funds, CME Group saw its largest three clients – multi-strategy funds – grow volumes by 25%.”

She has organised sales and marketing by customer segment and CME Group has strategically devoted special attention to hedge funds, holding joint events with industry associations such as AIMA and MFA. CME Group also co-hosts events with Futures Commission Merchants (FCMs), which provide customers access to CME Group. “The message is well understood: CME Group is a large, diverse marketplace; offering global access, with strong liquidity and risk management,” she continues.

Though 2018 was generally a difficult year for hedge funds, CME Group saw its largest three clients – multi-strategy funds – grow volumes by 25%.

Julie Winkler, Chief Commercial Officer, CME Group

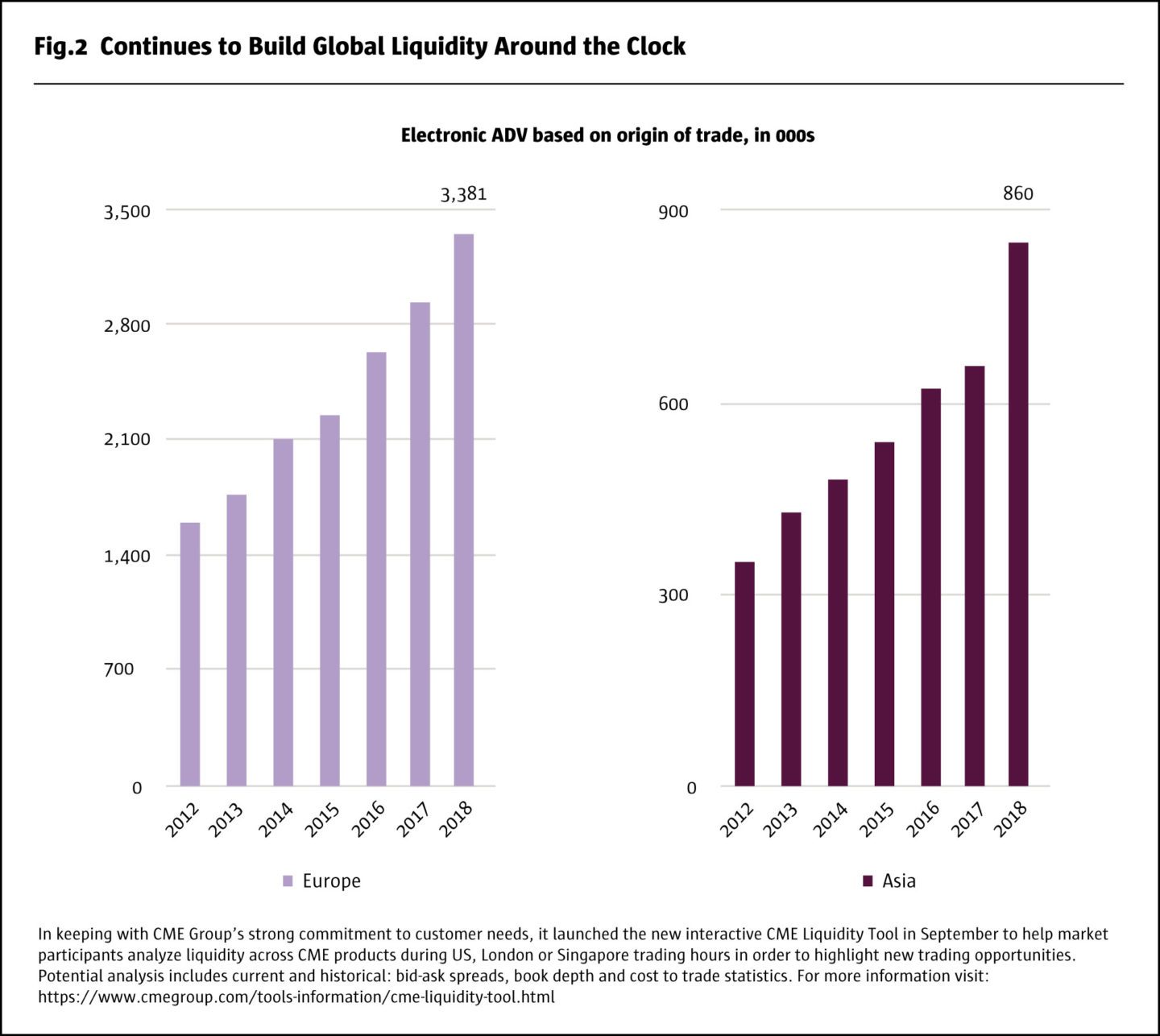

“Business is growing fastest outside the US, with non-US clients contributing 25% of volume and 30% of revenue. In 2018, Europe registered over 3 million contracts per day, up 14% over the previous year, which is no small feat given the headwinds of Brexit and other regulatory issues.”

CME Group is spreading its wings and building bridges globally: across borders; between physical and futures markets; between cash and futures markets and between OTC and futures markets.

NEX founder Michael Spencer described CME Group’s tie up with NEX as the first alliance between a major exchange group and an OTC trading group. “The acquisition of NEX is opening doors as its cash-trading clientele are very complementary to our futures franchise,” comments Winkler. Arbitrage and basis trading amongst platforms have taken place for decades, but the merger now holds out the hope of facilitating and expediting this activity, by streamlining the technology and access points to different global exchanges and clearing houses. “This will be best of breed once it is migrated to our trading platform – CME Globex – and we are very excited about delivering these efficiencies,” she adds.

Her remit as CCO includes, “pulling together sales, marketing, product development, data analytics and innovation groups and capabilities – in a client-centric manner, all of which involves several hundred staff globally – and reporting to CEO, Terry Duffy.”

Client development and sales

Winkler continues, “The biggest part of my team is global client development and sales. We need front line, client relationship managers located in key financial centres to be close to client needs and for new client acquisition. Buying NEX Group has enlarged the global footprint and will bring new customers to CME Group.”

“CME Group spans every single asset class which opens up opportunities for cross-selling. The data and analytics team build a profile of hedge fund clients, and searches for other angles: for instance, a trader of US Treasury bond futures, might also be interested in options or STIRS (Short Term Interest Rates) including CME Group’s growing suite of interest rate futures, such as SOFR and SONIA futures,” she adds.

Product marketing and education

Winkler’s oversight of product marketing involves creating content for marketing products, the website, and CRM (customer relationship management) tools. A full-time education team and a cohort of over 30 professional education resources around the globe enables CME to deliver in person education in a variety of languages. “Education is a critical part of the sales process. We use it extensively in roadshows, teaching investors and allocators how futures are a liquid alternative instrument,” she explains. For instance, a well-received client-facing analytical tool launched in October 2018 has been the CME Liquidity Tool, which helps participants to gauge potential trading costs holistically, considering exchange fees, bid/offer spreads, book depth, liquidity, market impact and price slippage in markets. “The cloud-based tool lets anyone set their own parameters, based on key benchmark products traded at CME Group, and stress test various scenarios for costs in their time zone and region, relative to norms. This helps to unlock a lot of questions so clients can measure what their experience might be with various order types under different market conditions,” she explains.

Electronification and open outcry options

One of the biggest milestones during Winkler’s more than 20 years’ career at CME Group has been the electronification of most CME Group markets, so that now 90% of trading takes place electronically. Though the New York trading floor has closed, it remains open in Chicago, partly to facilitate the trading of options. There are still “locals” trading on their own account. “Electronifying options is a much bigger task, due to greater complexity in terms of more expirations and strikes; more instruments, more customisation, and more complex spreads. The market is driven by what customers are comfortable with,” she declares. “We are letting the market decide on the future of the trading floor.” Winkler herself has fond memories, saying, “my career at CME Group began as a trade floor investigator, trying to identify bad behaviour, like a police officer. This trained me in analysing behaviour and relationship interactions.”

Yet some subsets of options are electronifying, with 33% of Eurodollar options and 80-85% of treasury options now electronic. “User-defined spreads and fine-tuning of the listing process have helped,” she says.

Research and product development

CME Group has innovated to stay relevant as financial markets evolve. “At regular intervals, all teams handling research and product development, for listed and cleared marketplaces, huddle to understand gaps in the offering – and work out whether these should be filled by launching new products or refining existing ones,” says Winkler. This product design and incubation process involves careful coordination: validating design needs with clients, ensuring the right liquidity conditions, and liaising with regulators.

Not every potential product that’s researched materialises. “The ideal new product has strong liquidity provision, a balance between buyers and sellers, a need for hedging, and reliable pricing sources that are not susceptible to manipulation,” explains Winkler. A failure to satisfy any one of these criteria can be a deal breaker and the ultimate test is whether sufficient client demand eventuates. CME Group generally want to be one of the top players in a market, and offer clients potential for capital efficiencies and margin savings. The aim is often to round out a product suite, and where incumbent products exist, CME Group will seek to differentiate its offering.

Below we highlight some notable launches.

There can be some trial and error involved in finding the right format for a market and Winkler believes that perseverance builds credibility in the market.

50%

CME Group scores well on employee diversity metrics: roughly 50% of its senior management is made up of women.

Foreign exchange

A learning process was also involved in building a franchise in Chinese currency futures. Some EM FX futures, such as the #CNH Chinese renminbi, are now breaking records on volumes – but it took some time to work out the right product design. “Our first two formats for the renminbi were physically settled, causing some constraints on the delivery side. We decided that a cash-settled contract would work better than the earlier physically settled versions and developed a good liquidity provision programme to support activity,” explains Winkler.

Realistically, CME Group does not expect to launch futures on every single emerging market currency however. Obstacles to adding certain emerging market currencies or interest rates have included: capital controls precluding physical delivery; prohibitive benchmark licensing costs; and absence of permission to use official or central bank rates.

Clearing is another option. Clearing NDFs is not mandatory, but can bring benefits – for buy side and sell side alike – in terms of netting and compression, reducing line items, gross notionals, leverage ratios, and margin requirements. CME Group’s OTC “coupon blending” solution can allow participants to maintain the same cashflows and risk profile, but with fewer trades, and educational videos explain the mechanics in detail.

“We worked closely with clients to figure out a solution and partnership. There are still some hurdles in client adoption to get more customers using the service each month,” says Winkler.

Another vantage point for currency trading is that eight of CME Group’s FX futures are now linked to the OTC currency markets. “The CME FX Link between futures and spot FX is another very innovative product offering that the market had been looking for,” says Winkler. It creates a spread position between FX futures and the spot FX market offering flexibility to offset existing FX hedges or convert non-IMM dated forwards to IMM dated basis. Anonymity is one potential advantage, in addition to capital efficiencies, netting benefits and mitigation of counterparty risk.

Bonds and rates

The ten year ultra Treasury note futures contract has been one of the most successful launches, reaching 95 million contracts within three years. This simply plugs a maturity gap in the Treasury curve caused by a hiatus in Treasury issuance between certain years, but the development process was an extensive exercise. “We consulted with the buy side community including large asset managers, dealers, and liquidity providers to get a broad perspective of client viewpoints and analyse the market from many different angles. This included over three hundred one-on-one interviews with clients to validate the design ahead of the product launch,” recalls Winkler. Thanks to all this careful preparation, liquidity providers hit the ground running on day one. The physical delivery design allows for various Treasury notes to be utilised to meet the delivery requirements of the contract. Key buyers of notes and bonds at specific maturities include pension funds and insurance companies seeking to match liabilities.

CME Group was an early mover in the interest rate benchmark debate, actively participating in working groups and discussion groups and rolling out products to navigate the post-LIBOR environment. Clients now have a head start in getting comfortable with the mechanics of using alternative Secured Overnight Financing Rate (SOFR) USD and SONIA (Sterling Overnight Index Average) GBP benchmarks. “We were part of the solution building from the beginning. It will take time for participation in these products to build, and we are mindful to try and make the transition as smooth as possible. We need to bring liquidity provision to the market from buy side and sell side,” she highlights.

SOFR futures complement CME Group’s well-established Eurodollar and Fed Funds futures at the one-month maturity. Launched in May 2018, volumes of one month and three month SOFR futures grew to over 42,000 contracts per day in March 2019. SONIA futures volume – at quarterly maturities and in coordination with the Bank of England Monetary Policy Committee (MPC) meetings – posted a single day record in April 2019 of over 28,000 contracts traded.

Emerging market interest rates

CME Group offers a growing suite of emerging market interest rate products. Clearing OTC interest rate swaps including many EM FX – in the form of 26 cash-settled forward pairs and 11 Non-Deliverable Forward (NDF) pairs – is a huge growth area. Winkler is, “really bullish on the opportunities, where NEX has made tremendous progress. This has already grown more than tenfold and we now have more to offer clients.” For instance, Chilean and Colombian peso swap clearing at CME is growing rapidly with dealers and the buy side embracing clearing.

The company is also growing its suite of cash-settled forwards in emerging market currencies, with the latest addition being the Israeli shekel (ILS). “This is about rounding out the suite, so that participants can come to a single place and develop liquidity in those products,” says Winkler.

Equities

“In equities, Basis Trade or Index Close (BTIC) and TACO (Trade Against Cash Open) allows for customisation and fine tuning of exposure in the past only possible in OTC markets,” says Winkler. Fund managers, equity finance traders, index arbitrageurs, stock loan traders, and equity option traders, can trade the future at a fixed, pre-agreed, spread versus the equity index cash closing or opening level. “This blurs the line between exchange traded and OTC markets and has exceeded expectations,” she continues.

Total Return index futures – on the S&P 500, Dow Jones, Nasdaq, Russell 1000 and Russell 2000 – are in contrast a standardised product that aims to offer better capital efficiency than the equity total return swap market, and are gathering some traction. S&P Total Return Index futures open interest continues to pick up in 2019, reaching a record 275,000 contracts on March 1st, 2019.

E-mini S&P Select Sector futures, tracking S&P Sector Select indices in: Communication Services; Consumer Discretionary; Consumer Staples; Energy; Financial; Healthcare; Industrial; Materials; Real Estate, Technology and Utilities, can be useful for sector trading or hedging,

Slated for launch in May 2019 are Micro E-mini futures on US equity indices, which are one tenth of the size of E-mini futures, will make these equity benchmarks more accessible to active traders.

The most challenging products to design have included emissions and bitcoin.

Julie Winkler, Chief Commercial Officer, CME Group

Commodities

Transport, infrastructure and refinery capacity locations and constraints are to some extent geographically segmenting oil markets; the deep discount for Canadian heavy crude is the most striking example of this.

Therefore, “CME Group’s WTI Houston futures and options launched in November 2018 meet the demand for price discovery in a particular geography, which was increased due to lifting of the US export ban,” explains Winkler. They can be used for physical delivery, or for relative value spread trading versus WTI and Brent oil benchmark futures.

(“For the purposes of hedging and risk management where deep liquidity is not required, Clearport already offers a high degree of granularity that lets users pinpoint particular specifications,” she clarifies.)

Elsewhere in the energy complex, CME Group launched products in marine fuel and methanol late last year and announced plans to launch a liquid natural gas contract later this year.

CME Group’s COMEX copper futures are competing mainly with the LME. “CME Group copper options on futures, launched in 2015, have attracted liquidity (open interest around 40,000 contracts) now that we have got the story out,” she says.

Esoteric markets

“The most challenging products to design have included emissions and bitcoin. One challenge was that the benchmark could be rendered obsolete if the government in the case of emissions, or the community for bitcoin, decided to switch or ‘fork’ to a different one,” reflects Winkler.

But CME Group believed that there was a need for a regulated, exchange-traded future. “This is just a risk management problem that we can help solve,” said CME Group CEO Terry Duffy.

As usual, thorough research laid the ground for the launch. “We set up an advisory group and met with hundreds of firms including FCMs to understand how trading would work, how to design the product, and how the product could appeal to the institutional marketplace. Though volatility has somewhat declined since the future launched, the objective was never to dampen down volatility. I found it refreshing to meet a completely new client base,” she reflects.

Customisation versus liquidity trade-offs

“In all of CME Group’s product refinements and innovations, there is a fine balance between customisation – and fragmentation of the deep central limit order book liquidity that is the key benefit of a futures benchmark. We do not want to dilute what is happening in the core central limit order book, but there is some scope to offer more customisation in other products,” points out Winkler.

“ClearPort is unusual in that it has no central order book and acts as a bilateral service for negotiating energy swaps,” she clarifies.

Capital efficiency

A common theme running through nearly all CME Group products is the desire for capital efficiency and margin savings, often relative to OTC products, and sometimes also relative to other exchange traded products such as ETFs. Drivers for capital efficiency include: margin offsets within CME Group’s suite of products and with their cleared OTC markets – in addition, multilateral compression delivered by TriOptima, which serves CME Group clients as well as the clearing house ecosystem, where TriReduce has saved $250 billon in margin, and Triaiana, which operates in the FX space where CME Group has room to grow.

“TriOptima has developed great technology and infrastructure to get everyone ready before UMR (Uncleared Margin) applies,” says Winkler. Since 2016, the UMR rules have been phased in with the final stages – initial margin for gross notionals above USD 750 billion and USD 8 billion – scheduled to start from September 2019 and September 2020, respectively. CME Group research suggests that UMR may be margin-neutral under some scenarios, but there are many cases where it is expected to increase initial margin rates, not to mention infrastructure investment costs.

Compression is one way to find margin efficiencies and over the last 20 years CME has continued to innovate with new approaches in this area such as introducing low touch compression. “Clients have come to expect, desire and need margin compression, and this continues to evolve as it becomes easier to use and larger cycles are run more frequently. Savings are up 18% year on year and for instance, multilateral coupon blending has recently involved 40 trillion line items and generated $3 billion of capital savings for 700 participants. Cross-margining OTC and listed products has also delivered billions of dollars of capital efficiency savings,” she adds.

“Compression started on the interest rate side, but the principles are now being applied to the listed marketplace. The biggest innovation of the past year has been applying compression to equity options, an area where the largest options market makers were constrained by their capital lines from existing FCMs. This took over a year to build out and we ran four cycles last year involving multiple FCMs,” she says. Market participants should watch this space for further roll outs and ramp ups of compression capabilities.

Other exchanges

Margin netting and offsets with other exchanges and clearing houses – is also a driver of capital efficiency where Winkler sees scope to expand the range of relationships that can enhance capital efficiency. For instance, “we are committed to looking at offsets between our clearing house and the FICC, which clears the cash part of the Treasury business,” she says.

A runway towards growth lies ahead for CME Group. Though trade wars are one threat to the trend of more international trade in product markets, interconnectedness suggests that the trend towards more connectivity, within and between countries, is inexorable in financial markets.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical