The deleveraging environment of the 2010s is a by-product of the excesses in US mortgage finance and poor risk controls at banks spread across the globe. The credit crunch and subsequent economic downturn may have taken sapped real estate values in many geographic areas, but there nonetheless remain pockets where values are steady or growing. Yet the broad outlook for real estate is essentially one of recovery over the next five to 10 years. Accompanying this is an ongoing shift in the real estate market away from direct real asset ownership to a public market model with associated increases in both transparency and liquidity.

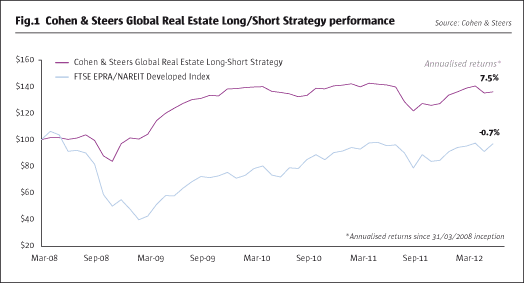

The MS Cohen & Steers Global Real Estate L/S Fund (on Morgan Stanley’s FundLogic platform) is a relatively new product for investors to generate returns from real estate. The UCITS product launched in July 2011 and mirrors offshore and onshore US vehicles that have been in place since 2008. Overall, the strategy has attracted nearly $100 million from investors and generated a net annualised return of 7.5% versus a -0.7% annualized return for the global listed real estate market over the same time span.

“The big picture is that the fund is trying to develop a low double digit net return with volatility that is 60% less than the broader real estate market,” says Todd Voigt, portfolio manager and senior vice president. “We invest across all asset types that are publically traded: REITs; home builders; CMBS; RMBS; and retailers that own their properties to name a few.”

About 90% of what the fund invests in is real estate equities or publically traded debt. A small proportion is also invested in plain vanilla derivatives.

Securitised real estate

The fund’s manager, Cohen & Steers was set up by Marty Cohen and Robert Steers in 1986 and now manages $44 billion. From inception, when the entire REITs market was worth about $5 billion, Cohen & Steers was a pioneer in developing the securitised real estate sector that emerged in the US and subsequently spread to Europe and Asia.

The fund’s long investment process taps into the firm’s macro research for each country with regional analysts evaluating each company’s management, business plan, balance sheet, real estate portfolio and corporate structure. A proprietary valuation model ranks real estate securities using price/NAV ratios and a dividend discount model. The model highlights statistical outliers for further review. The construction of the long portfolio then matches key real estate themes with attractively valued securities.

The short investment process combines alpha shorts and hedge/beta shorts. With alpha shorts, Cohen & Steers’ research may identify changes in macro real estate themes not yet reflected in equity valuations or identify negative catalysts that will drive the value of a shorted security or instrument lower.

The hedge/beta shorts see hedged short exposure structured relative to the portfolio manager’s expectation of upside or downside on a country or sector basis. Hedging is also applied to a variety of risks from interest rates to the market, to a country, or a currency or some industry specific risk. Investment instruments can include exchange-traded funds, currency swaps, custom derivative baskets of securities and other derivatives.

Sector specialist expertise

“Even though the fund's assets under management are small relative to the firm’s long only platform, it taps into the resources of the broader group,” says Voigt. “It also benefits from the expertise that we bring as a sector specialist. It is a truly global fund, invested both long and short.”

The fund’s long book is currently focused on Canada, Hong Kong, Singapore and the UK. It is currently net short of US real estate securities. The fund typically runs gross exposure of 175-225% with net exposure between 25-75% with an average of around 25% to 30%. Portfolio manager Voigt has the option of going net short if conditions warrant it.

The long book’s exposure to Canada is in the west, notably Alberta, where population and income growth is feeding a strong commercial property market. Voigt likes specialist retail mall developer Primaris as a play on demand for retail space, notably from US retailers. “The bigger picture is that Canada from a sovereign perspective is very healthy,” he adds.

In Hong Kong, Voigt likes office and retail space plays, which have fallen since early 2011 on fears of a Chinese economic slow down. One stock, Hong Kong Land, is trading at hefty discounts to book and NAV, which the manager feels aren’t warranted.

“We see China becoming more stimulative from a monetary and fiscal standpoint,” Voigt says. “That will generate follow through to retail and office demand.”

London yields attractive

In the UK, Voigt says 5% yields for well located London office and retail properties, which give an inflationary upside for an asset in limited supply, look attractive to sovereign wealth funds in a low yield fixed income environment. What’s more, with banks deleveraging, financing for new developments is scarce, so new supply will be limited.

The short exposure to US real estate securities comes on the back of the recent rally that Cohen & Steers estimate has boosted valuations to a premium to net asset value. The US outlook is also clouded by uncertainty about whether taxes will rise following the November elections or whether the big fiscal support to the economy will suddenly be cut. In the US, Voigt is positive on student housing, CMBS and providers of facilities to life science companies.

“Increasingly real estate will be held in the public markets where there is more liquidity and transparency,” says Voigt. “With the UCITS fund you have weekly liquidity and when global risks accumulate, the manager can adjust and take exposure down.”

As real estate recovers Voigt expects private equity owners of property to seek initial public offerings. “Many of the REITs did IPOs in the early 1990s (after the late 1980s US real estate downturn) and we expect to see that again, but this time on a global basis.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical