The article went on to argue that periods of stress, such as for example war, bring out the best in terms of human inventiveness and creativity. The article continued arguing that the works of Michelangelo, da Vinci, et al. fell into such stress periods. As a result of the Swiss being so peaceful and dull, the article went on, the Swiss are extremely uncreative. One famous psychiatrist and one partly famous reformist theologian aside, the Swiss have no poets, no composers, no philosophers, hardly any writers, and painters of international acclaim to speak of. So the only creative legacy from the Swiss to the world – according to the mentioned article – is the cuckoo-clock. However, Switzerland-by any standard-is also among the world's most prosperous nations. Has the reader ever thought that there might be a relationship between dullness and prosperity? Potentially there is.

We started examining the hedge fund space in 2000. One of the fund of funds marketing one-liners we came across at the time was something along the lines "we offer dull products". In finance there is a measure for the degree of dullness: the standard deviation of returns or-in its annualized form-the volatility. So a fund of funds could argue that if survival and sustainable compounding of capital (two elements that are arguably related) are major objectives then large erratic swings especially on the downside are to be avoided.

So the bottom line of this analogy is the following. The Swiss – supposedly – are dull, but somehow got compensated for their collective loss of sense of humor by creating an environment that allowed a long-term and sustainable creation of prosperity that has been handed over from one generation to the next. Funds of hedge funds-with volatilities in some cases of less than two percentage points these days-are dull too. But chances are that funds of funds too – when risk is managed diligently – will survive and compound capital sustainably for the foreseeable future.

Making the case for dull

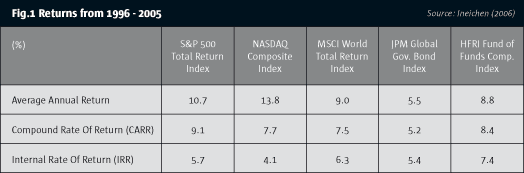

One way to make the case for the dull is the following. Table 1 shows five different investments whereby we calculated returns over the past 10 years. The first row is a simple average of the 10 annual returns from 1996 to 2005. The second row shows the compound annual rate of return (CARR). This is the return that shows if one had invested on day one, in this case January 1996, and held on to the investment until the end of the investment period, in this case 2005 (all proceeds reinvested).

However, this is not really a practical assumption for most investors, institutional as well as private. Most investors continuously add new money to old. Albert Einstein was probably on to something when he said: "In theory, theory and practice are much the same. In practice, they are not."

The third method in Table 1 is more realistic for most investors. It assumes the investor adds an equal amount of capital in regular intervals, in this case 10 equal contributions at the beginning of every year. The rate shown is the fixed rate that matches all cash flows. There are some interesting observations we can draw from the table.

First, the higher the volatility of the investment the more the IRR differs to the average annual return. In case of the NASDAQ, the average return was 13.8%. An investor buying the NASDAQ in January 1996 and selling in December 2005 compounded at 7.7%. However, had the investor added an equal amount every year, his investments would have compounded at a rate of 4.1%. This is probably much closer to many investors' experience with Tech stocks.

Second, funds of funds have by far the highest IRR. Interesting here is funds of funds have underperformed the S&P 500 Total Return Index. Or have they? We don't think so. We do not believe that there are many investors who have put money in the S&P 500 in 1996, left the investment untouched throughout all the turbulences and looked at the performance at the end of 2005. Adding to an existing investment over time is far more realistic. The bottom line of all this is of course that it is risk-adjusted returns that matter to investors, not average returns. The investment with the highest risk-adjusted return is the best investment.

In 1910, the market capitalization of Swiss stocks was smaller than that of UK stocks in Swiss Francs by the factor of 22.5 and smaller than Austria-Hungary by the factor of 3.8. By the end of 2004, Swiss market capitalization was still smaller than that of UK stocks. However, the factor was 3.4, while Swiss market capitalization was 7 times the market cap of Austria and Hungary combined.

Lacking the ambition to build an empire might be dull (and might or might not rob its citizens of a sound sense of humor). However, dullness (read: stability, sustainability, and predictability) is potentially good when compounding capital on a sustainable basis is a major objective. Or as Oscar Wilde put it: "It is better to have a permanent income than to be fascinating."

This article draws on material from Ineichen (2006). The views and opinions expressed in this article are those of the author and are not necessarily those of UBS. UBS accepts no liability over the content of the article. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical