Transtrend started life in 1989 as a research project in a Rotterdam-based commodity trading house, but swiftlyjoined the ranks of the world’s largest CTAs. It is one of the 20 CTAs making up the BarclayHedge BTOP50 index and is a constituent of two Société Générale Prime Services indices: the SG CTA index and the SG Trend Index. Assets of around $5 billion make Transtrend the most sizeable hedge fund manager in the Netherlands, and the firm belongs to The Hedge Fund Journal’s “Europe 50” ranking of the top 50 hedge funds in Europe (including the UK). “But Transtrend’s aim has always been to be among the best and not the biggest,” says Head of R&D and Managing Director, Harold de Boer. Transtrend is distinguished from other CTAs by qualities including its performance; investment universe; ways of defining markets and trends; in-house research process and preferred statistical and risk management techniques.

Dangers of passive investing

De Boer is an advocate of active management and his iconoclastic perspectives could shift the active versus passive debate into new directions. It is common to argue that active management adds value for less liquid and less efficient asset classes (such as commodities, small cap equities, credit or emerging markets) whereas passive approaches win out for larger and more liquid asset classes (such as large cap equities). De Boer thinks that the entire index mentality is fundamentally flawed however and calls for what might sound like a new paradigm – but is in fact a return to the original way of investing. “The average fund in the 1920s was genuinely active, unconstrained and was in effect what nowadays is called a hedge fund,” he points out.

De Boer believes that allocators need to get back to first principles in defining what investing is. “Active management should involve conscious decisions about asset allocation, security selection, risk and reward. This is how it began centuries ago, followed by organised exchanges, with indices coming many decades later, and passive investing in indices only a relatively recent phenomenon,” he reflects.

De Boer views markets as “a cooperation of traders and other participants that only functions with active investors. Index tracking and index beating undermine the whole concept. Markets are not a train you can just jump on and off without impacting the timetable. Every market participant has market impact.” The benchmark straitjacket is most obviously at variance with investors’ objectives because it rejects absolute returns in favour of relative returns, and thereby asks investors to tolerate any losses just because they are index losses. De Boer thinks it is axiomatic that “trading for absolute return after costs should be the only criterion of investing.”

Though De Boer views index tracking as a misguided objective, he contends that passive investing does not deserve its name. The paradox of index tracking that indices do, in fact, imply taking active bets – and bets that investors who started with a clean slate would not necessarily choose. It is well understood that cap-weighted bond and credit indices give the highest weightings to the most indebted countries, industries and companies and De Boer points out that equity indices share similar biases, stating “the composition of indices changes. And even if it doesn’t, the activities of the individual constituents of an index change. For instance, in 2000, owning a broad equity index included a huge weighting in highly valued technology, media and telecoms (TMT) sectors. In 2007, owning the index implied holding a big bucket of banks that were effectively highly leveraged and had roughly quadrupled their leverage in a few years. Therefore, ‘tracking error’ relative to an index is utterly inappropriate as a measure of genuine active investing risk.”

De Boer further argues that index tracking has insidious effects in creating perverse incentives to batter down index performance so that outperformance can be more easily attained. This also applies to wrongly-defined active strategies. Explains De Boer: “Defining ‘beating the index’ as the goal of an active investor is at odds with the aim for return. If an outperformance of the index by 1% is accomplished by battering down the return of the index by 2%, what real benefit does this bring for the investor? On the contrary, if an investment strategy makes a 1% higher return and by its market impact lifts the return of the index even more than that, the investor is actually better off. If the whole investment community strives to beat the index and pays investment managers for doing so, we should not be surprised that the performance of indices will indeed be beaten down. Who wins?” His view is clear. “The market impact of synchronised index purchases ultimately depresses returns for all investors and undermines market functioning for all asset classes,” De Boer claims, but in the debate on passive versus active, he regularly reads about costs, but rarely anything about market impact.

Transtrend applies its active philosophy to execution, which, like all key functions, is kept in-house. De Boer observes more extreme short term spikes up and down in prices in recent years (sometimes associated with “flash crashes”), but he does not attribute this to HFT. He views investors’ passive execution approaches as the main cause of these wild price gyrations. Though an active approach to execution, specifying limit prices before placing trades, might appear to be common sense, such safeguards can be overlooked by many market participants including many passive investors. “A huge proportion of the orders being sent to trading platforms nowadays are effectively price insensitive. Among those are the popular VWAP based execution strategies. This is fundamentally at odds with the market equilibrium theory,” De Boer observes.

Systematic investing should be active investing

While systematic trend following may be perceived, and nowadays sometimes marketed, as a passive strategy, Transtrend are adamant that their approach is active. “It is a misconception that the 100% systematic and technical nature of our trading activity means that we would simply be running the same ‘engine’. The systematic element refers to the use of the chosen techniques. At least as important, however, is the choice of the techniques used and the markets traded, including when and how to adjust them and when and how to replace them. Without these active choices, systematic trading does not work. And the research process leading to these choices is definitely not systematic and technical, but discretionary and fundamental,” elaborates De Boer.

Therefore, Transtrend is rather sceptical about CTA replicators, which De Boer sees as attempting to have a “free ride” on the historical performance of the active CTA industry. “CTA replicators are based on back-tests and simulations that benefit from hindsight, assuming technology and infrastructure that was not available back then in real life,” he observes.

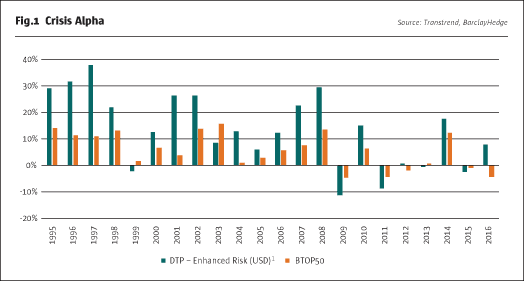

De Boer also questions the replicators’ premise that they can match CTA returns because their historical, hypothetical simulations are correlated with actual CTA returns. “Correlation only reveals style, not skill,” he elucidates. For instance, in 2016, the firm’s Diversified Trend Program (DTP) returns were more than 90% correlated with the BTOP50 index, yet the programme outperformed by more than 10%. He acknowledges that “in backtests it seems relatively easy to identify and profit from trends in crisis years like 2001, 2002 and 2008, but in reality, the dispersion among trend following CTAs in those years was huge. So apparently other qualities are required to really do well in such market environments. The same again applied in 2016 with events like the Brexit referendum.”

Meanwhile, the noisiness of markets has made it more difficult to produce performance. Active CTAs have always been adapting to continuously changing markets. De Boer questions whether a replicator using a static strategy can keep up with the pace of progress. In summary, De Boer submits “there is nothing wrong with CTA replicators being cheap, but stating that generating returns in turbulent markets can be done in a simple way is extremely naïve.”

How and why Transtrend has outperformed in 2016

Transtrend recognises that post-crisis CTA performance is not a reason to invest in CTAs, but their “crisis alpha” over the decades probably is. Transtrend has tended to outperform the industry during crisis years (as shown in Fig.1).

Though it may surprise some allocators, 2016 was potentially a good year for trend following strategies. According to Transtrend’s proprietary, backward-looking, trend indicator, since 2008 only 2010 and 2014 were better environments for a medium to long term trend following strategy. Indeed, many CTAs did well in the first quarter and around the Brexit vote. Yet average CTA performance ended the year slightly down (with the SG CTA Index down 2.89% in 2016). While the Enhanced Risk (USD) profile of DTP posted a decent +7.65%, De Boer would have liked to have seen double digit returns in a year like this. The Hedge Fund Journal has observed returns for medium term trend following CTAs in 2016 ranging between approximately +18% and -18%.

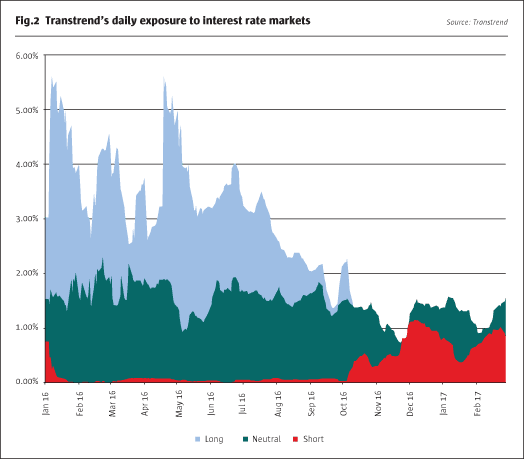

In broad brush terms, De Boer judges that the year was underwhelming for many CTAs “because market behaviour changed after 2008, with more uninformed market moves, among others caused by passive investment styles and misconceptions about market liquidity.” Consequently, in general terms, Transtrend has been working on techniques that are designed to make it become less vulnerable to uninformed moves. These are applied in technical filters, constructing “synthetic markets”, portfolio construction and improved trade execution strategies. More specifically, 2016 threw into sharp relief the differences between CTAs’ bond strategies. In the past few decades bonds have mostly shown uptrends. But Transtrend has always been careful to avoid building in any directional biases in its programme. A long bond bias may have been a tailwind for some CTAs in years like 2014, but in the second half of 2016 this certainly turned into a headwind. “I was really surprised as it seemed that some CTAs were still long bonds in October and November,” observes De Boer.

Sidestepping some markets is easier for Transtrend than for some CTAs. Whereas some CTAs always have a position in all the markets traded, Transtrend is selective and can have no position at all in certain markets.

Transtrend was net long for the first 10 months of 2016 but had by November gone net short of selected bond markets in time to capture part of the post-Trump selloff. Transtrend’s profits were increased because the breadth of its investment universe included those markets, such as Italian and Korean bonds, that showed some of the most persistent downtrends. In addition to trading outright markets – including bonds – directionally, Transtrend follows trends in certain carefully constructed spreads between bond markets. Such “synthetic markets” are more neutral to the general direction of interest rates. Some of these, such as US Treasuries versus German Bunds, demonstrated clearer and stronger trends than individual bond markets.

Transtrend’s dynamically changing bond positioning in 2016 and early 2017 is shown in Fig.2 and at times the “neutral” sleeve was larger than the outright long and short buckets. This neutral bucket refers to positions in bond spreads that are long bonds of one country and short those of another country (such as US Treasuries in 2016).

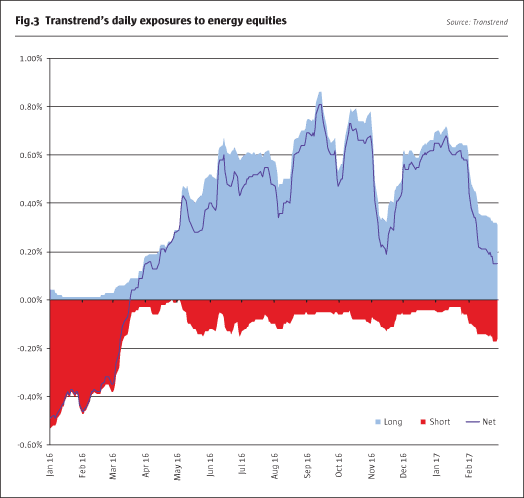

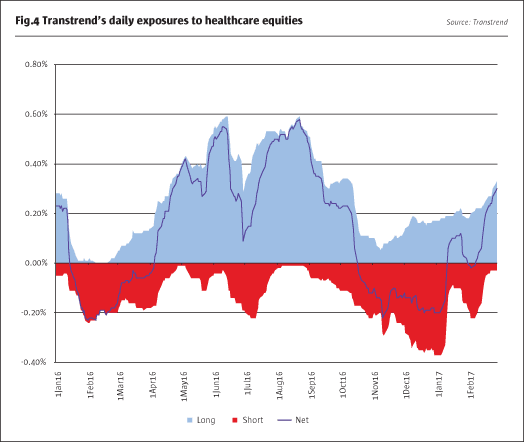

Transtrend also made profits from certain equity sectors, where the firm is distinguished by trading futures on single stocks and sector indices. Transtrend was net short of healthcare stocks for most of the first quarter and fourth quarter of 2016, and net long in between. In the first quarter of 2016 the best stock market trends could be profited from simply by trading broad-based indices. But this was different in the second half of the year. For instance in healthcare, trading single stocks and sector indices offered the opportunity to participate in the various trends driven by Obamacare, anticipated Clinton policies towards pharmaceuticals and anticipated Trump policies. In energy equities, Transtrend was net short the sector in 2016 until mid-March and net long for the rest of the year; in this sector “profiting from an OPEC-driven uptrend in the second half of the year turned out to be more rewarding than directly in oil futures,” De Boer recalls.

Investment universe additions and deletions

These single stock futures are just one example of how “the choice of markets to trade is one of the most visible active decisions,” De Boer states. As many markets seemed to be clustered into the same causal trends, Transtrend has sought new markets for balance and diversity. “We do not distinguish between interest rate, currency, commodity and stock markets. When there is a trend in oil, we strive to profit from that trend. We don’t mind whether we do so through positions in commodity markets, stock markets, oil sensitive currency markets, or a combination of those.” The firm’s size, and counterparty relationships, have, in some cases, helped it to access markets, data and clearing – for instance, Transtrend worked with OneChicago to start trading single stock futures.

Transtrend trades over 700 markets, including single stock futures, more esoteric markets such as emission rights, and synthetic markets made up of more than one market. Transtrend’s investment universe regularly changes, with new markets entering the programme and others exiting it. “One in seven markets of the 70 markets traded in 1995 no longer exist, while six in seven of the 600 outright markets traded today did not exist before 1995,” De Boer tallies.

Equity indices were once novel, with the first futures (on the S&P 500) traded in 1982 and De Boer recalls how investors were surprised when Transtrend started trading Nasdaq futures, now a huge market. Conversely Transtrend has also made active decisions to remove markets where liquidity dried up. For instance, Azuki beans – a popular ice cream ingredient in Asia – was once one of the largest commodity markets but liquidity has melted away.

A wider spectrum of markets matters. A broader investment universe increases the chance of capturing trends, which may come from unexpected places. In June 2016, in the Brexit-induced volatility, long bonds might have been the obvious trade. But Transtrend garnered its largest profits from Brazilian currencies, interest rates and equities and less from the UK markets that it trades. “However, just enlarging the spectrum of markets doesn’t do the trick. The Brazilian profits could only make the difference because of the size of these positions. To achieve this despite the large universe and the higher correlations, the portfolio construction layer of DTP had to be upgraded,” De Boer explains.

Transtrend ideally wants its clients (mainly institutions) to trade all of the markets in DTP’s universe. The firm can accommodate some degree of customisation in managed accounts, because certain clients may face particular regulatory or tax constraints. But Transtrend is very reluctant to carve out parts of the strategy as De Boer feels this would undermine the programme, due to its integrated nature. For instance, the systems that generate trading signals have been designed with this large universe in mind, allowing them to be highly selective and sidestep markets where trends are less clear. “We would not want to offer only one asset class as this would be like ripping out a Porsche engine and transplanting it into a Lada,” jests De Boer.

Defining markets and trends

While Transtrend trades hundreds of markets, the number of independent factor exposures – and tradable trends – is much smaller (and has shrunk post-GFC). And it fluctuates. For instance, in January 2016, the program recognised equities, oil, commodities, bonds and currencies as being all engulfed in one big risk-off trend around fears of recession driven by the gloomy outlook for China. These market conditions saw unusually high correlations, but even in normal markets, multiple currency, commodity and equity positions can still be categorised as a long or short US Dollar risk concentration. Thinking laterally across asset classes, a long oil stance can be manifested in oil itself, currencies such as the Russian Ruble or Norwegian Krona, and energy equities. “Risk transcends sector boundaries. Asset classes do not play any role in our investment process,” De Boer stresses.

Transtrend’s approach of viewing markets through the prism of factor exposures can also help to identify trends that could be obscured by intra- or inter-asset class factors. Trading oil in 2016 was difficult, as the price action was choppy, but this was partly because the US Dollar is the unit for oil futures contracts. Thus the uptrend in the oil numerator was at times offset by the strengthening of its denominator, the dollar. Expressing oil in Euros held constant the dollar factor and isolated the commodity price action.

When viewing markets via this lens of factor exposures, “every long position is short of something else,” says De Boer and the notion of “long only” investing is then an oxymoron. Of course, currencies nearly always need to be traded against another currency. But being long of commodities such as oil also implies being short of the US Dollar in which they are denominated. “So every trade is precisely that: a trade. An exchange of one value versus another. A factor based prism also helps to focus the choice of markets on those that add potential diversification to the existing suite,” De Boer points out. Transtrend is aware of regional commodity markets in countries such as China but is not currently trading them. De Boer says “the strategy does not need to be in China to get exposure to China-related trends. We can access these trends through markets such as in copper, the Chinese currency, or via Chinese equity indices traded in Hong Kong and Singapore.”

Philanthropy expression

Luminaries of the quantitative hedge fund industry, including David Shaw of D.E. Shaw and Renaissance Technologies founder Jim Simons, are actively pursuing philanthropy to promote Mathematics education. Transtrend is also involved, partly because the firm is concerned that the number of children choosing to specialise in STEM (Science, Technology, Engineering and Mathematics) in the Netherlands wentdown at one point. Microsoft, and others, have raised more specific concerns about fewer females studying STEM. Here De Boer has seen that peer pressure can deter girls from choosing STEM. The Dutch Mathematical Olympiad aims to show youngsters what can be done with Mathematics – the foundation of all the sciences – and helps talented children to realise their potential. Some children can enjoy recognition on television. De Boer spent part of his weekend teaching children a four dimensional SUDOKU game, starting with two and then moving to three dimensions. De Boer is pleased to say that his young niece has recently defeated his former Maths teacher at the game!

Views on conventional VaR and correlation measures

Measuring risk factors in different ways is a distinctive part of Transtrend’s risk approach. Unlike some CTAs, Transtrend has never targeted a constant volatility level, and eschews conventional Pearson correlation measures of linear correlation and standard VaR measures. Transtrend has found these measures to be unreliable estimators and instead uses estimators that are not affected by kurtosis or fat tails. “Since 1963 it has been clear that financial markets do not follow a normal distribution,” De Boer says, alluding to Benoit Mandelbrot’s seminal paper, “The Variation of Certain Speculative Prices”, published in October 1963.

Transtrend’s January 2016 paper “VaR measures for dynamic long/short investment portfolios” sets out Transtrend’s concerns about conventional VaR. It can be unstable and may throw up false alarms while also underestimating extreme moves at other times, Transtrend has seen. De Boer suspects that either this risk approach, or discretionary decisions, may have led some CTAs to reduce risk around events such as the Brexit and Italian referenda in 2016. Of particular concern is the risk of a synchronised exodus if many investors heed the same VaR measures, possibly at the behest of some regulators. “Since standard Value at Risk measures overreact to short term price moves, it could lead to trading at expensive moments,” warns De Boer. Transtrend’s risk philosophy is to be proactive rather than reactive and to manage risk “by anticipation, not by response” De Boer explains. The intention is to size positions appropriately so that the impact of a large price move on the portfolio should be within the programme’s risk tolerance. “Managing money starts by not losing too much. While that may be easy in normal market circumstances, it is the extreme events that really matter,” De Boer says.

Transtrend has developed its own risk measures, especially designed for the specific strategy, focused on gauging extreme risk by looking at joint tail distributions. Transtrend’s proprietary extreme risk measure is usually much higher than conventional Value at Risk. With a variety of risk measures, the programme dynamically controls position sizes, seeking to avoid overly high factor exposures or extreme risk concentrations. Transtrend’s approach to correlation is multi-dimensional. De Boer observes that there are many ways to measure correlation; patterns of correlation change over time and the coefficient is in practice both asymmetric and nonlinear. Hence more sophisticated techniques than plain vanilla Pearson correlation are needed.

Structural shifts

These wrinkles – which were not discernible from analysis of Transtrend’s returns during correlated market phases such as 2009-2013 – are only a few of the many changes Transtrend is continually making to the programme. Transtrend has made multiple, incremental, changes, fine tuning models, and responding to structural changes in market dynamics, without changing the essence or the style of the programme. While some CTAs have added shorter termmodels or moved to slower models in recent years, Transtrend continues to follow medium to long term trends and this has been a constant for 25 years. “Many small advances in all areas, including execution, entry and exit rules, data, measuring correlations and risk budgeting – and ensuring all these elements interact with each other in the most efficient way – may each have made marginal contributions to returns, but together made the difference in 2016,” De Boer enumerates.

Yet the changes should not be viewed as mere tinkering and tweaking, because Transtrend does think that financial markets have morphed in potentially permanent ways. Some CTAs argue that the QE era is an ephemeral change for markets, but Transtrend has identified structural shifts that predated – and could outlive – Zero Interest Rate Policy and Negative Interest Rate Policy. Most important is the move to passive asset class investing, which indiscriminately buys and sells all constituents of an index. Such floods of money can overwhelm the fundamental reality and obscure individual trends, which made the 2009-2013 period challenging for most trend following CTAs.

Financial markets’ recent episodes have not changed Transtrend’s investment philosophy however. The convictions that investors’ irrationality and behavioural biases, combined with imperfect information diffused among participants at different speeds, make markets inefficient − and therefore prone to bubbles and crashes − will be shared by most trend following CTAs. What differentiates Transtrend is the devil in the details of its programme’s progress.

Organic Dutch research

All of these developments have emanated from Transtrend’s Rotterdam office, which remains its one and only location (apart from backup facilities for business continuity reasons). Transtrend operates autonomously. The firm (which is regulated by the Dutch AFM and the US CFTC/NFA) is wholly owned by Robeco Group, which in turn is owned by the Japanese Orix Corporation, but Transtrend maintains its own, separate, offices, decorated with local abstract art. Transtrend’s Rotterdam location is no accident. “The financial centre of the Netherlands has always been Amsterdam while Rotterdam is the biggest commercial trading harbour of Europe,” De Boer points out.

Transtrend’s name comes from its roots in a Rotterdam-based commodity trading house that prefixed each brand with “Trans”. Transtrend was the research project into systematic trend investing in commodity markets. The first futures markets were in commodities and De Boer pays homage to the CTA industry’s commodity heritage, which provides analytical anchors for all asset classes. “In commodities it is logical to see the old crop and the new crops and be aware of seasonal factors, and non-linear relationships. Commodity investors know that spot markets and futures markets are two different things that can move in opposite directions. It is only financial people who view one as a substitute for the other.” An awareness of the term structure naturally runs across all of the markets that Transtrend trades.

De Boer has led Transtrend’s research since 1992 and acts as a mentor, guiding research projects around data, trading or liquidity, for instance. His Masters – on cointegration in commodity markets – would seem to be highly relevant but he almost plays it down by saying “it did not have to have been studied in university and could have been done in a job.” Learning by doing, rather than applying academic research or collaborating with universities, is the Transtrend approach. All research is done in-house and human resources are developed internally. The firm hires creative quants after their Masters or PhD. Most have studied Maths or Physics, and could have pursued either theoretical or applied disciplines. “But reproducing knowledge is insufficient as we test them on their creativity,” De Boer stresses. Aspirant trainees also need some degree of “geeky” passion for research and De Boer has, on more than one occasion, told an unsuccessful job applicant “you are not enough of a nerd!”

While some Dutch financial companies do have an English-speaking office environment, at Transtrend Dutch is spoken and new hires need to be proficient before starting work. Most of the staff are also Dutch nationals, but the team includes people from overseas who have studied in the Netherlands or married locals. Nonconformists are welcome to apply but those who prefer to work alone are not suited to the communicative and collaborative Transtrend climate, in which an open plan office encourages open dialogue throughout the day. While the 35 research staff are the largest group out of 67 employees De Boer emphasises “our strength is that everyone is aware of everything and we all hear things in the open plan office. Interaction is crucial as money management, data management, execution, IT and operations are all interrelated.”

Transtrend’s organisation chart should be visualised as a Venn diagram of overlapping ovals, rather than the usual siloed lines and boxes.

The team is stable – with more than half having worked at Transtrend for over 10 years – and De Boer believes the staff turnover is lower than would be typical in major hedge fund centres such as London or New York. Nobody has left for a competitor and people only tend to leave for a career change or a major life event. “Fishing in a different talent pool is a deliberate policy that contributes to our distinctive investment process,” says De Boer.

Transtrend does not exist in a complete vacuum however. The firm attends industry events such as the Managed Funds Association (MFA) one in Miami, but De Boer finds “content-driven events, such as Société Générale Prime Services’ thought leadership seminars, are most useful. These are very selective events where invitees from managers are only research and not marketing people, and the investors are also very research driven.”

De Boer is also open to participating in panels discussing the role of CTAs or market disturbances and he views the dynamism of the space – which spawns dozens of new CTAs each year – as healthy, remembering that Transtrend was once an emerging CTA. De Boer has spoken at the FERI Investor Day in Bad Homburg, Germany, and the inaugural 2016 Legends4Legends A4C event in Amsterdam (a conference jointly held by Theta Capital’s exchange-listed Legends fund of funds, which is invested in Transtrend, and the Alternatives 4 Children charity). With all of these public or semi-public communications, De Boer strikes the right balance: “educating investors about active trend investing without educating competitors who might seek to reverse engineer it.” Transtrend expects to continue its active, innovative style of investing for at least another 25 years. But no bets are being placed on which markets will be traded in 2042.

1. Disclaimer: The explanatory notes are an integral part of the performance data used. Please contact Transtrend to obtain a copy of the full explanatory notes. The value of your investment can fluctuate. Past performance is not necessarily indicative of future results.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical