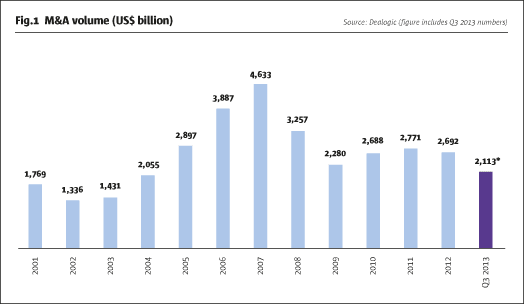

The third quarter of 2013 finally brought some good news for those managers focusing on M&A and corporate activity in general. According to Dealogic, M&A transaction values in the quarter were up approximately 30% versus Q2. This was the second largest quarter in terms of volume since 2008, totalling over $800 billion and bringing the year-to-date increase to 10% compared with the same period in 2012.

The announcement in September of one of the largest deals in history, Verizon Communications’ acquisition of Vodafone’s US wireless operations and its $130 billion price tag, caught the interest of market participants. For investors heading into 2014, an opportunity is now emerging to benefit from a market environment which is becoming increasingly conducive to increased levels of corporate activity and specifically hard catalyst, equity event, market neutral-based arbitrage strategies.

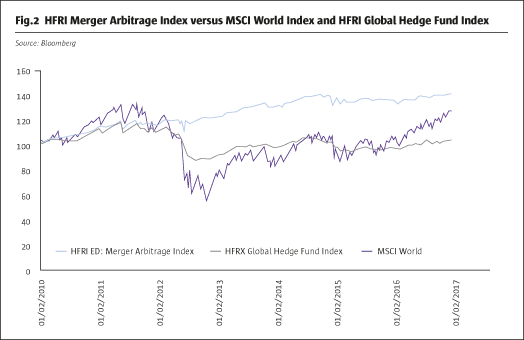

Since the credit crisis, M&A volumes have ranged between $2.3 trillion to $2.8 trillion, down from the $3.9+ trillion which existed in 2006 and 2007. Against this backdrop, arbitrageurs have faced a very challenging environment. Several high-profile deal breaks, coupled with anaemic deal activity, have resulted in market participants focusing on capital preservation rather that aggressive risk taking. Returns have certainly been hard to come by, as clearly illustrated by the HFRI Merger Arbitrage index, up a mere 1.3% since 2011. Macro uncertainties, earnings visibility and market volatility shattered CEOs’ confidence, which was already fragile post credit crisis. 2011 brought worries relating to the Arab spring, and in 2012 the market was plagued by the mounting European sovereign debt crisis and more recently uncertainty surrounding US policy created a significant headwind for corporate activity. Key decision makers postponed their corporate expansion plans. As a result, corporate activity has languished significantly over the past five years. However, the situation has recently changed and the outlook for corporate activity has significantly improved. With several cyclical indicators pointing towards an increase in transaction flow in the months ahead, there is good reason to be optimistic on the space and those hedge fund strategies taking advantage of such activity.

Firstly, the cost and attractiveness of credit markets; bond yields are well below their 10-year averages with both the US Corporate Investment Grade Bond Index and non-investment grade credit below their 10-year average. As seen from the Verizon/Vodafone transaction, investors and shareholders are happy to back leveraged transactions. Appetite to lever balance sheets is increasing, as is the pressure from shareholders to use the currently attractive credit markets to either make acquisitions and/or replace perceived excess cash on balance sheets with relatively cheap credit.

Secondly, the financial health of corporations is increasingly encouraging. Overall, corporates continue to hold record levels of cash on their balance sheets. Since the credit crisis, companies have drastically cut costs, headcount and capital expenditures. Simply put, companies were trying to seek balance sheet stability in the face of an uncertain macro environment. Lower levels of share buy-backs (although picking up this year) and post credit crises dividend cuts have also contributed to a build-up of cash levels. Data compiled by Factset shows that in the US, cash levels are up 65% since 2007. But with a more stable macro environment, cost control is no longer currently the main focus but rather growth, and more importantly, sources of growth. In the context of a slow, albeit more stable macro environment, spending on consolidation can act as an important means to enhance growth, to expand margins and to diversify revenue streams. Now that macro uncertainties are significantly waning, against a low and in some cases negative real cash yielding environment, using cash or credit to acquire “growth” should look more compelling going forward.

Finally, despite the significant global equity market rally this year, valuations are still reasonable compared to historical averages. Obviously, valuations are not as attractive as they were immediately post the credit crisis, but overall equity assets should still look attractive with price/earnings ratios still below those seen pre-credit crisis.

Setting aside the strategic buyer, financial buyers also play an important role in any M&A cycle. According to Preqin, private equity firms have a significant level of dry powder. Data points in the US indicate that approximately $400 billion of private equity capital currently needs to be allocated. Globally, Preqin estimates that $1 trillion of capital is currently un-deployed and will need to be put to work or returned to investors in the next few years.

The above factors are providing a strong “tailwind” which has started to gather critical mass and momentum in the form of a significant increase in newly announced transactions. In terms of regional activity, the US remains the strongest market with a 42% market share in terms of deal value, while Europe represents 29% and Asia including Japan 21% (according to source Dealogic). Since the summer, Europe has also exhibited positive momentum with the announcement of several large transactions including Portugal Tel/Oi ($14 billion), KPN/America Moviles ($13 billion), Omnicom/Publicis ($20 billion), Elan/Perrigo ($7 billion), Invensys/Schneider ($5 billion) and Celesio/McKesson ($4.9 billion). Meanwhile, the US has also observed some large transactions of late. In the context of a recovering consumer market, North America remains a popular investment destination for corporate management. Large recent transactionsincluded Shoppers Drug Mart/Loblaw ($13 billion), Cole Real Estate Investment/American Realty Capital Properties ($10 billion), LEAP Wireless/AT&T ($4 billion), ViroPharma/Shire ($3.1 billion), Santarus/Salix Pharma ($2.4 billion) and Sourcefire/Cisco ($2.2 billion).

The growth prospects of emerging markets also make them an interesting deal location for companies seeking revenue growth. Such transactions include Grupo Modelo/Anheuser-Busch InBev ($17 billion), Elpida Memory/Micron Technology ($4 billion), Asia Pacific Breweries/Heineken ($2 billion) and CGA Mining/B2Gold ($1 billion). Conversely, we have also seen the theme of emerging market buyers acquiring their foreign counterparts as a diversification strategy. Mexican, Brazilian, Indian and Chinese acquirers have all contributed to outbound M&A. America Movil initial plans to fully acquire KPN, although derailed by the KPN foundation, were motivated by a desire to expand outside the home market, looking for growth. The ongoing saga of Cooper Tyres/Apollo Tyres ($2.3 billion) is another case in point.

Above all, we have seen the level of complexity increase in the most recently announced transactions. Cross-border mergers, increased levels of regulatory uncertainty and embedded optionality all point towards a widening of the hard catalyst opportunity set and better risk/reward pay-off profiles. This trend has not gone unnoticed by hedge fund investors who are seeking to increase exposure to the hard catalyst equity event arbitrage space. Despite some compression in historical spreads and returns, the strategy has provided stable returns with lower volatility and correlation than traditional equity markets. On a long-term basis, looking at a period from 2006 to date, the HFRI Merger Arbitrage Index compound annual growth rate is approximately 4.42% compared to the MSCI World Index growth rate of 3.08%.

Uncertainties still exist for this strategy; however, it would appear that now is the ideal time to seriously review this space as global GDP is rising, and macro and equity sentiments are improving. Corporate confidence arguably has turned. Thus it should not be surprising to see levels of corporate activity soon follow suit.

Andrew McGrath is the founder and CIO of Burren Capital Advisors, a Gibraltar and London-based event-driven hedge fund which focuses on global equity hard catalyst situations. Before starting Burren Capital, McGrath was the European head of special situations and risk arbitrage proprietary trading at BNP Paribas.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 91

Corporate Activity Momentum in 2014

Have we reached escape velocity?

ANDREW MCGRATH, CIO, BURREN CAPITAL ADVISORS

Originally published in the December 2013 issue