The next recession: What are the warning signs? What might it look like? How will markets react? The nearly decade-long U.S. economic expansion may look a little long in the tooth, but it is not about to end due to old age. Economic expansions need a catalyst that triggers a downward spiral of consumer and business retrenchment. The most common recession catalyst for the United States has been the collision of rising interest rates with heavy debt loads, corporate valuations that appear to have run ahead of free cash-flow generation, or both. Add trade tensions and geo-political uncertainties, which may work to slow global growth and – at first glance – it might seem like the current situation has the potential to trigger a recession.

While the current environment ticks off all the items on this list, that does not mean a recession is in the cards. Indeed, equity markets have been placid thus far in 2018. After a brief volatility spike in January, implied volatility has subsided to near record lows for equities, many related financial products and precious metals. So far, neither markets nor U.S. macroeconomic data for labor markets or consumer confidence are flashing any signs of concern.

Our focus in this report is three-fold. First, we want to examine the recession risk signals and evaluate the probabilities of a downturn coming in the next year or two. Our conclusion is that recession risks are steadily rising, with a 33% probability of a recession coming in the next 12-24 months. Second, based on our understanding of possible catalysts, we will look at the likely character of the next recession. In this regard, the next recession is unlikely to look anything like the last one with its financial panic, mortgage crisis and failing banks. The next time around, there might be parallels with the late 1990s when rising rates, emerging market currency disruption, and over-stretched corporate valuations led to a set of feedback loops that upended consumer confidence and resulted in sharp pullbacks in business spending. Finally, we will review how markets might react – equity correction, bond rally despite debt loads, commodity weakness, and possibly a shift to a weak-dollar environment.

33%

Our conclusion is that recession risks are steadily rising, with a 33% probability of a recession coming in the next 12-24 months.

Three critical warning signs on the horizon

1) Yield Curve

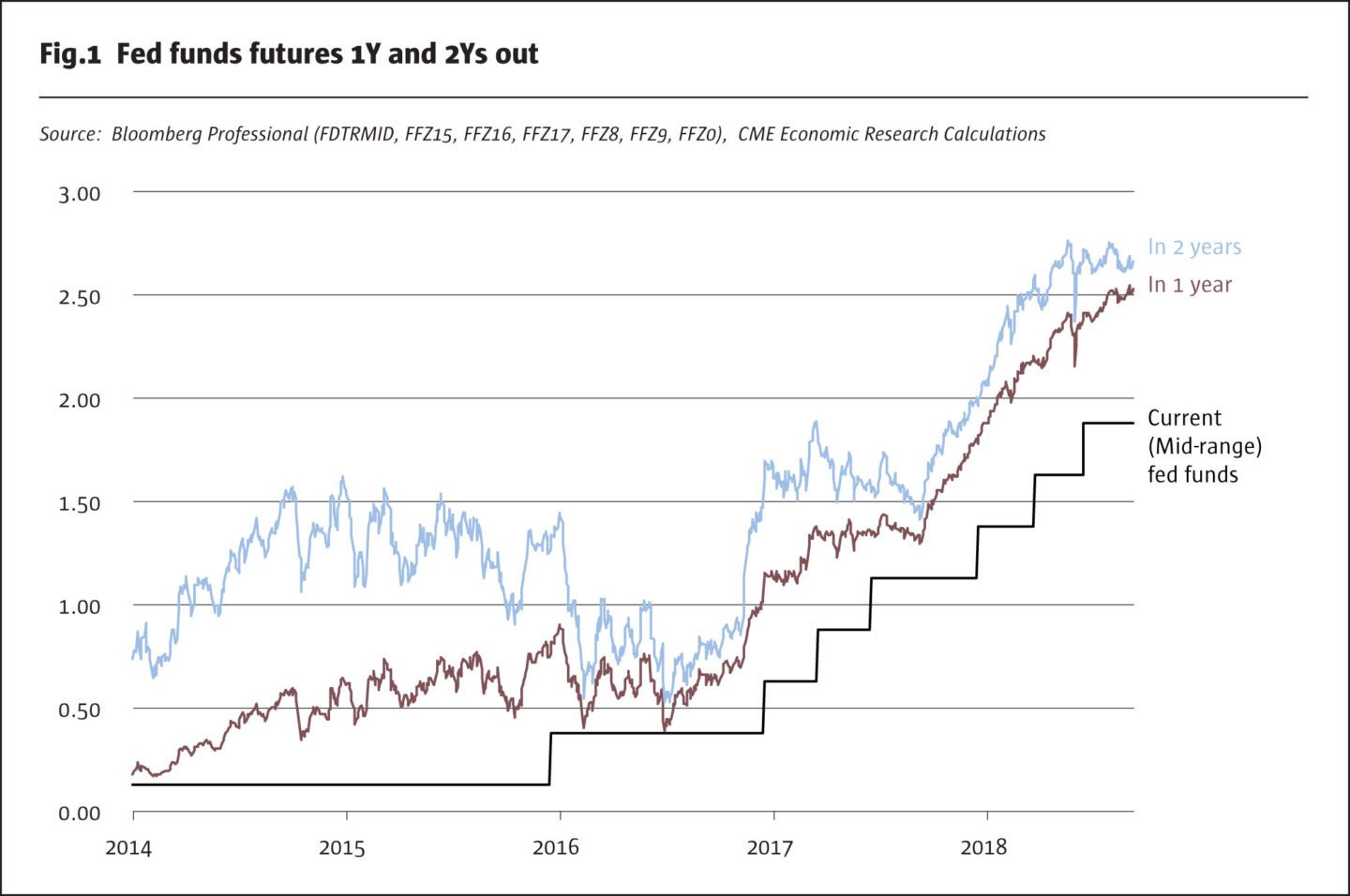

The Federal Reserve (Fed) has been raising rates in its desire to shift gears, from accommodative to neutral. Given that the Fed is signaling more rate hikes to come, there is a real risk of unintentionally shifting into a high tightening gear.

The metric most clearly signaling that the Fed may go beyond neutral and into the high tightening gears is the shape of the yield curve. As the Fed has lifted short-term rates, longer-term Treasury bond yields have hardly moved, resulting in a major flattening of the yield curve. Economic theory argues that a neutral monetary policy is associated with a modestly positive yield curve. The logic for a slightly positive neutral curve is that short-term rates have less inflation risk than longer-term yields, so risk premiums rise with maturities. As short-term rates rise relative to long-term yields, financial institutions can no longer earn profits from borrowing short and lending long. Commercial businesses depending on short-term credit will face higher interest payments. Consumer debt is not particularly interest rate sensitive, but home mortgages are. Rising short-term rates make floating-rate mortgages less attractive, reducing mortgage choices and decreasing the affordability of buying a new home. All of these impacts are exacerbated if the yield curve actually inverts – short-term rates higher than long-term yields. And, inverted yield curves are an especially good indicator of future recessions 12 to 24 months down the road.

It does not matter why the yield curve flattened or inverted, it only matters that the shape is no longer positively sloped. The cause of the yield curve’s shape change does not matter because economic agents – governments, businesses, consumers – face the change in interest costs and have to react no matter the reason. Aside from the Fed pushing short-term rates higher, this time around, one reason the yield curve has flattened has been that long-term yields did not shift upward with the Fed rate hikes. Long-term yields were constrained due to competition from low yields in government bond markets in Europe and Japan helped by their central banks’ asset-purchase policies. This is certainly true, but just because the cause was different does not mean the outcome will be too.

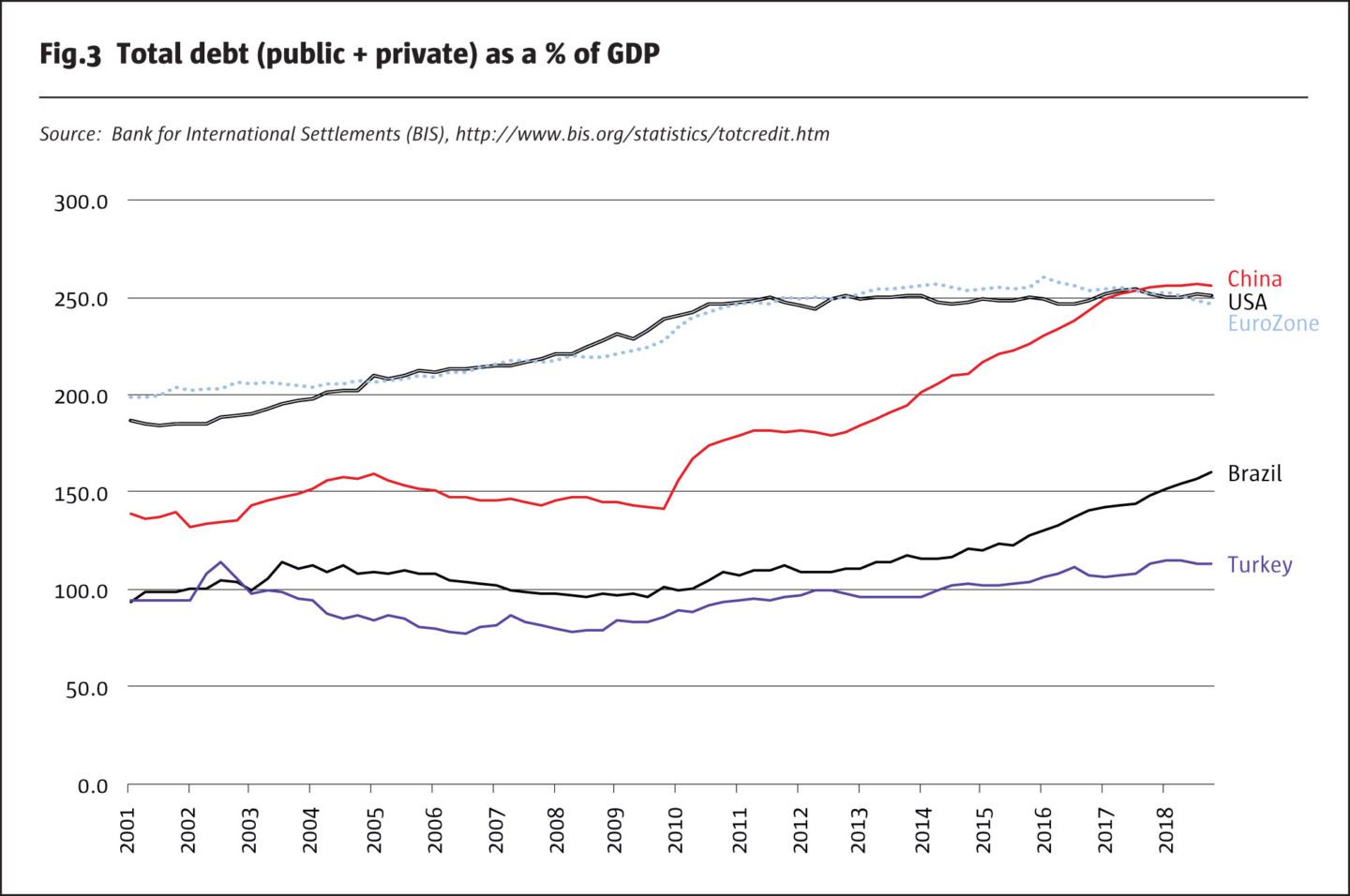

Then, there is debt. Debt levels have been rising in the U.S. and China, the world’s two largest economies, although not in Europe. Rising debt does not mean an impending recession. Indeed, moderate increases in debt fuel sustained economic expansions. The issue is that higher debt loads mean higher interest payments when interest rates do rise. So, as debt loads increase, the fragility of an economy to rising interest rates increases. Talking just about the U.S., the biggest increases in debt are coming from the Federal government, which means that as interest rates rise the interest expense item in the government budget is going to grow quite rapidly. Consumer and housing debt was way too high in 2007-2008. Consumers cut back for a while but have now returned to the debt loads of 2008. We expect slowdowns in both U.S. auto and home sales due in no small part to rising interest rates hitting high debt loads.

2) Emerging Market FX Disruptions

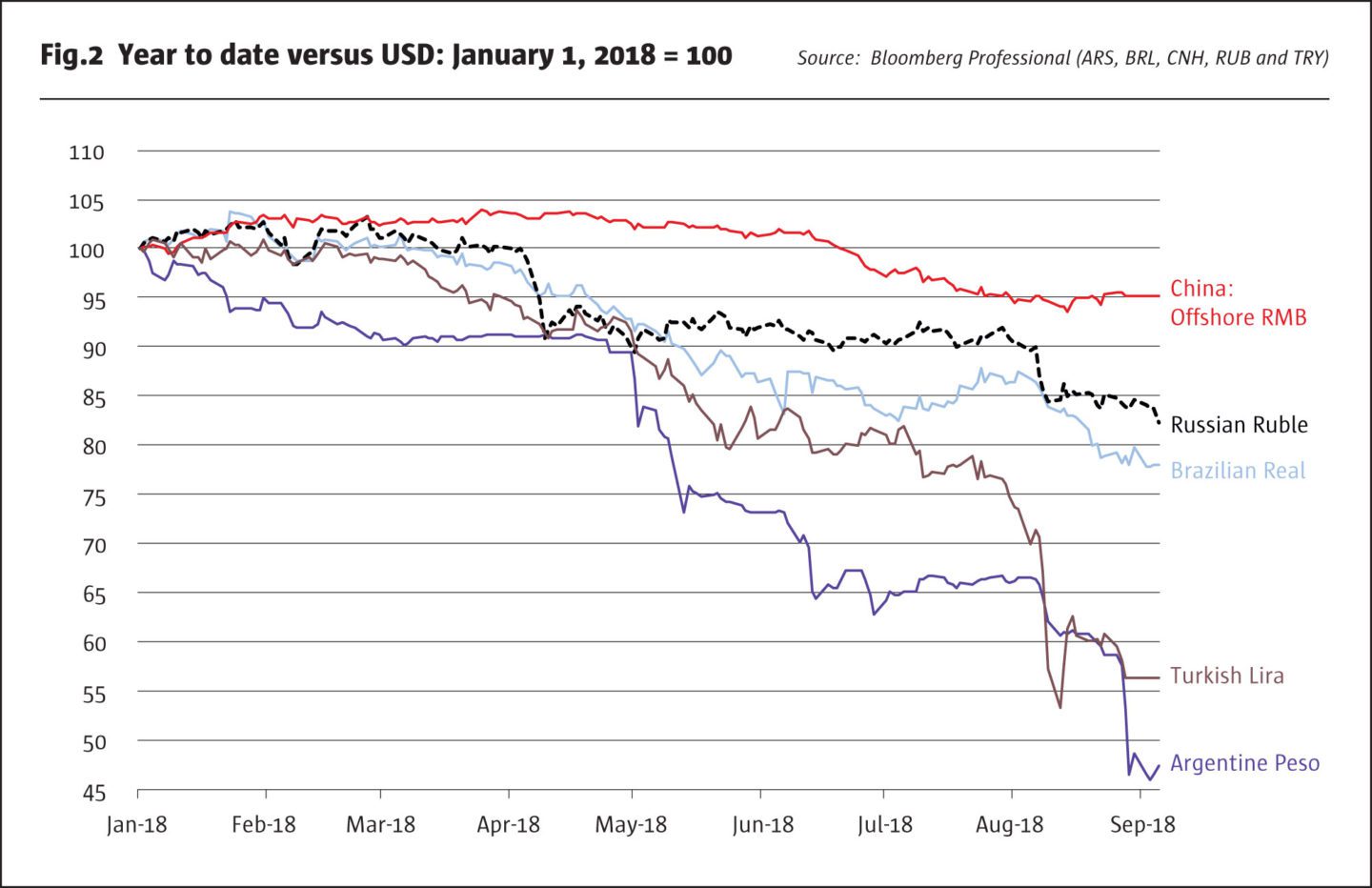

Plunging emerging market currencies should not come as too much of a surprise. Emerging market currencies often have problems following the Fed’s tightening. Most famously, Latin America was plunged into a deep, decades-long economic depression following former Fed Chair Paul Volcker’s massive rate hikes between 1979 and 1981. Following the Fed’s 1994 rate hikes, the Mexican peso wasted no time in collapsing and was followed a few years later by the Thai baht, many other Asian currencies, and then the Russian ruble. Currency disruptions in emerging market countries are growth killers. Existing borrowings in US dollars or other hard currencies become extremely hard to service. Domestic businesses and consumers pull back spending in a downward spiral. Political uncertainties, often already high, get even more convoluted as emergency policies are enacted and interest rates go sky high. As emerging market countries have taken an increasingly larger share of global economic activity over the last few decades, their impact on global growth and the knock-on effects to the major industrial countries has increased.

Between 2009 and 2016, investors grew accustomed to financing long positions in emerging market currencies with interest-free loans in the U.S., European, Japanese or other zero-rate currencies. Now that the Fed has hiked repeatedly and plans to increase rates even more, these currency-carry trades are unwinding in a hurry.

Moreover, high debt levels exacerbate emerging market stress. China has taken on extremely high levels of debt that resembles those of developed nations (Fig.3) and is currently trying to deleverage. The problem for China is that its deleveraging plan is not a deleveraging plan at all. Basically, China’s so-called deleveraging plan moves debt from point A (the shadow banking system, non-financial corporations and local governments) to point B (the official banking system, the central government and, indirectly, household balance sheets). Moving debt from one place to another doesn’t achieve deleveraging but it can make debt more manageable. The Chinese government is trying to stave off an economic slowdown with an upcoming tax cut, scheduled for September 2018, while the People’s Bank of China is reducing its reserve requirement ratio to spur lending. Given China’s debt burdens and the cost of the trade war with the United States, it seems unlikely that these measures can ward off slower growth. Finally, China’s debt levels may be understated by as much as 10-20% of GDP once local government debt is accounted for.

A clear consequence of economic disruption and slowing growth in emerging market countries is the plunging prices for industrial metals. Copper prices fell by almost 20% in June and July 2018. Oil demand has held up so far, but downward pressure on prices is typical in an emerging market currency disruption period.

3) Trade War

Trade wars were a big deal back in the 1700s and early 1800s. The Mercantilists argued for tariffs to protect the local economy, but free traders eventually won the economic theory and practical arguments of the day. Trade issues got a lot of attention during the Great Depression of the 1930s, too. The US enactment of the Smoot-Hawley tariffs was widely believed to have made a major contribution to deepening the global depression. We would put much more of the blame on the Fed for not serving its duty as a lender of last resort, however, so we do not think the Great Depression has much to say about the current trade war, and if it says anything it gives a misleading impression that the current trade war guarantees a recession.

Our much more modest take on the current U.S.-initiated trade war is that it has two effects that raise recession risks. First, the trade war disrupts business planning and potentially raises costs related to supply chain management, and in so doing, decreases corporate profits overall (although a few specific companies will benefit). Second, the trade war hurts the Chinese economy and exacerbates the slowdown in growth.

If the trade war occurred in isolation and not at a time of rising U.S. rates and emerging market FX disruptions, we would be less pessimistic. And while economists like to analyze issues by assuming all things are equal or stay the same (i.e., ceteris paribus), the reality is that the trade war is coming at a very bad time. The U.S. economy may look quite healthy in the rear-view mirror, appearing more than able to withstand some trade challenges. However, with risks of recession already rising from rate hikes and emerging market FX disruptions, the next bump on the road could prove critical. And, the trade war may simply be the straw that breaks the camel’s back.

We are already worried about China’s slowing growth, its debt load, and the overall situation in emerging markets. The key takeaway from our perspective is that while the trade war may hit China much harder economically than the United States, the politics in China argues against quick concessions. China’s long-term objective is to regain its place as one of the most powerful and influential countries in the world. Compromise with the U.S. is possible but Chinese leaders are going to try to show they stood up to America and negotiated a mutually beneficial deal, not an unfavorable lopsided one. Trade war tensions between the US and China may well last into the 2020s.

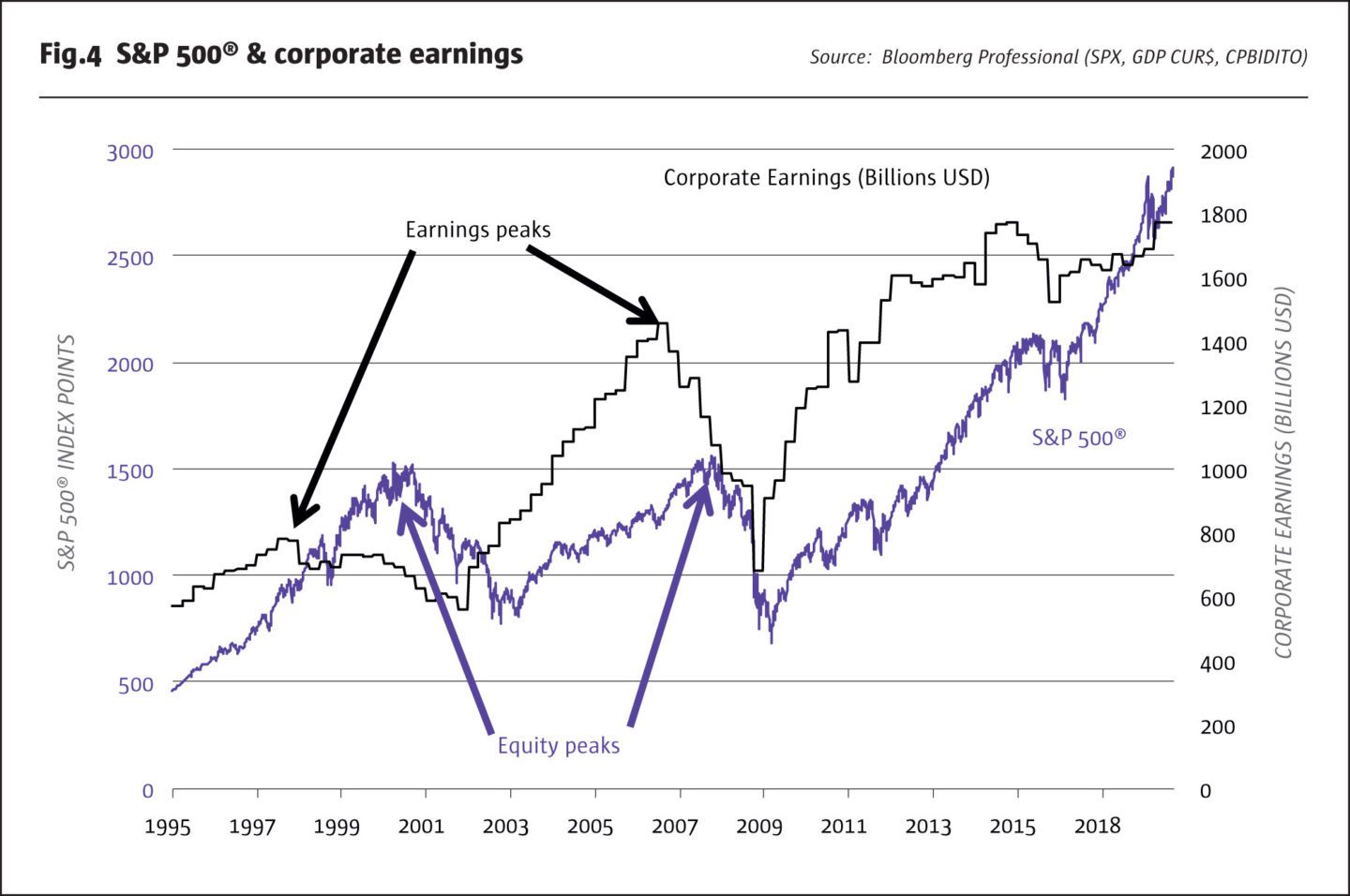

Now let’s look at corporate profits, which are likely to come under downward pressure. Falling corporate profits do not necessarily doom the equity bull market, at least in the short-run. The previous two bull markets went through two phases. In the first phase (1990-1997 and 2003-2005), earnings and equity prices rose together. In the second phase (1997-2000 and 2006-2007), earnings fell but equity prices rose anyway (Fig.4). Earnings essentially have plateaued since 2014, before being goosed up by the corporate tax cut. With the tax cut impact fully priced into the market, earnings may begin to decline in the second half of 2018. Even so, the actual peak in the equity market might not come until 2019, 2020 or later, depending on whether a recession materializes.

In addition to falling earnings and rising prices, late-stage equity bull markets usually exhibit three other features: 1) rising volatility, 2) widening credit spreads and 3) a narrowing of the number of stocks leading the rally. During the 1990s bull market, credit spreads achieved their narrowest point in 1997, right around the peak in earnings, but stocks didn’t peak until March 2000. During the 2003-2007 bull market, credit spreads got to their narrowest point in May 2007, five months before the peak in the equity market. Widening credit spreads may cut off the flow of share buybacks to companies that use debt. Their stocks may underperform.

Stock market corrections are not good predictors of recessions, as there are many more corrections than recessions. Nevertheless, a stock market correction in the context of rising rates, emerging market FX turmoil, and a trade war would probably strike fear into the hearts of corporate leaders and result in substantial reductions in planned investment, tilting the odds toward a recession.

What will the next recession look like?

The next recession probably will not look much like the most recent one. This time there is no subprime mortgage problem. US banks are quite well capitalized. Most US housing markets are not at extreme valuations. European banks still have some issues but with European Central Bank (ECB) rates at zero, the likelihood of bank failures is low. Moreover, unlike the US and China, Europe has entered into an impressive phase of deleveraging. The next recession is more likely to see general business and consumer pull backs that feed on each other, rather than the financial panic of 2008.

In this regard, the next recession may resemble the succession of problems that rocked global financial markets between 1997 and 2003 that began as an emerging market currency crisis and ended as a tech wreck. With soaring tech shares and a slowdown in China, it is easy to imagine the next downturn as a distant echo of the 1997-98 Asian and Russian crises followed by the 2001-like bear market in tech stocks. In fact, emerging market currency turbulence is already with us. (Fig.2).

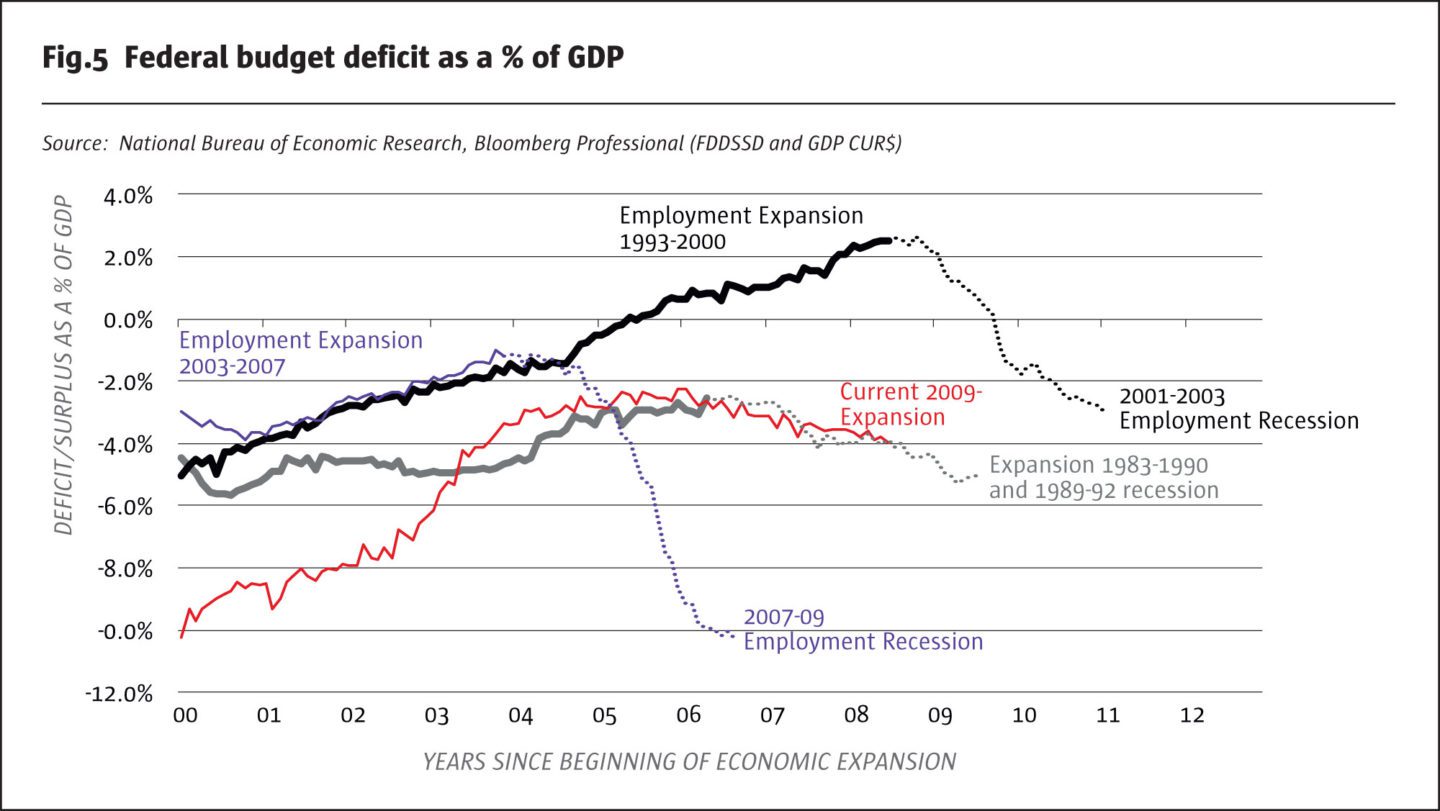

A key casualty of the next recession could be the US budget deficit. If you think that debt issuance is big today, just wait until a recession begins, tax revenues shrivel and pressure builds for more countercyclical spending. The 1990-91 recession expanded the deficit by 3% of GDP. The combination of the tech wreck recession and the 2001 tax cuts ballooned the deficit by 6% of GDP between 2001 and 2003. The 2008 recession expanded the deficit by 9% of GDP. If we have another recession in the next year or two, we could easily by looking at annual US Federal budget deficits of 8-12% of GDP.

Market reactions if a recession were to occur

Equities

While not necessarily a predictor as discussed earlier, a recession will almost certainly be accompanied by a sharp drop in equity prices. Indeed, they will keep dropping until policy changes, such as sharp rate reductions, improve the economic outlook.

Bonds

The bond market reaction is less obvious. Why wouldn’t 8-12% of GDP Federal budget deficits be a catastrophe for the bond market? Would yields soar? The answer to these questions is, probably not. Bond yields plunged during the past three recessions even as deficits expanded. The same could happen again. The irony of rising debt levels is that they tend to lower interest rates for the simple reason that high debt burdens can only be sustained with easy money.

High yield debt

The combination of rising rates and a stock market correction will not be good news for low credit quality debt. For the moment, U.S. domestic credit spreads remain tight. High-yield bonds yield just 3.5% more than Treasuries and investment grade bonds, trading at tight spreads to government debt. Long-term interest rates remain low and largely unmoved by the Fed hikes. Cheap long-term financing is fueling a corporate borrowing binge whose proceeds are being used, in part, to buy back shares, supporting the nine-and-a-half-year bull market in equities that has rallied the S&P 500® by more than 300% and the NASDAQ 100 by over 600%. Equity valuations have not been this high since 2000 and may continue to go higher.

The Fed

Once volatility shifts to a higher state, credit spreads widen and unemployment begins to rise, the Fed will likely respond as it has in the past: by lowering rates and steepening the yield curve in a bid to calm markets and generate an economic recovery. Even if short-term US interest rates go 50 basis points (bps) higher over the next 6-9 months and maybe higher still, it is quite possible that the Fed will have its policy rate back at 1% or even 0% before 2022 if there is a recession.

Primary metals

Primary metals might not care much about the fate of tech stocks but what happens in emerging markets is of great importance. As such, if China stumbles and if we experience a generalized emerging market crisis, watch for commodity prices to plunge and retest their 2016 lows. The most vulnerable commodities are industrial metals, which are the canary in the coal mine for changes in China’s growth rate. Their prices have already fallen sharply.

Agriculture

Agricultural goods prices follow the fate of certain emerging market currencies closely, especially those of big producers like Brazil and Russia. China also exerts an extremely strong influence on these prices, if an indirect one. If China slows, the prices of metals and often energy decline with it. In turn, this negatively impacts the currencies of Canada, Russia, Brazil and other food exporters, making their farmers more competitive with respect to their US counterparts. This in turn may lower the global cost of production for agricultural goods which in turn may lower the floor to which the prices of corn, soy and wheat can fall when seen for a US dollar perspective.

Energy prices are the wild card

The Asian crisis was toxic for oil prices. The price of oil was battered during the 1997-1999 period, falling from $25 to $12 per barrel. If emerging markets slow, the economic risks for oil will be to the downside. That said, political risks (both for conflict between and within oil producing nations) remains to the upside. So, there is no guarantee that oil prices will actually fall in response to a slowdown in emerging markets if there is a problem on the supply side.

What about the US dollar?

At the moment, the dollar is caught in a tug of war. Rising US interest rates and problematic risks abroad are pushing the dollar higher. A deteriorating US fiscal situation is serving as a counterweight. For the moment, the forces sending the dollar higher appear to have the upper hand. So long as investors remain convinced that higher US rates are in store and so long as other central banks fail to keep pace, the US dollar might work its way higher.

Once the US expansion ends, however, watch out. The Fed will shift from tightening to neutral and then, when faced with no other choice, to easing. The already sizeable Federal budget deficits currently preventing the dollar from soaring will explode. The monetary and fiscal forces that are currently opposing one another will align and the dollar could crash. The combination of the Fed cutting rates and exploding deficits could also prove extremely bullish for gold and silver. That said, precious metals might not evidence much upside until the Fed eases back on its rate hikes.

Options markets

The outlook is for calm now, then a sudden evolution to a higher state of volatility. Over the past six months we have published a number of papers documenting the cyclical relationship between monetary policy and implied volatility on all sorts of options (FX, gold, equity, interest rate and credit spreads). We include credit spreads since corporate bonds are essentially a short put option on the value of a corporation.

Periods of easy monetary policy typically reduce implied volatility on options to low levels. Tightening cycles have little impact on low volatility markets in the short term. As the central bank continues to tighten and eventually overtightens, however, volatility (and credit spreads) will eventually explode. Historically, the average lag time between a move by the central bank and a reaction by the options markets is probably around a year and half (give or take six months).

The fact that options markets haven’t shown much reaction to the Fed’s sequence of rate hikes to-date is hardly a surprise. In fact, it would have surprised us if market volatility had reacted quickly to the Fed tightening. That said, we think that there is a substantial risk that the Fed’s tightening cycle results in much higher levels of volatility around 2020, give or take a year. The average level of implied volatility on equity index, FX, gold and fixed income options could easily double from current levels. Credit spreads could easily widen three times (or more) than where they are currently trading. Markets may be without high volatility today but nothing lasts forever when causal factors are in play.

Bottom Line

- Recession risks are rising above 33% due to Fed rate rises, emerging market FX disruption and the US – China trade war.

- The next recession will not look like the 2008 financial panic, but more like the one in 1997-2002.

- Market reactions may include an equity correction, high yield bond sell-off, and falling Treasury yields.

- A continued crash in emerging market currencies could derail commodities.

- The US dollar could remain strong so long as the Fed continues hiking rates, but the US dollar could go into a bearish cycle if a recession causes the Fed to lower rates abruptly.

- Gold and silver might suffer in the short term but a dollar crash would be hugely bullish.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 135

Critical Recession Warning Signs

Three to watch for

Erik Norland, Senior Economist, and Bluford Putnam, Chief Economist, CME Group

Originally published in the October 2018 issue