It may be a truism that investors and fund managers would want to avoid going down the road that the Japanese equity market has followed for almost a quarter of a century. The Nikkei 225 peaked at 38,957 during trading on 29 December 1989 and has since alternated sharp declines with range bound trading, leaving it around the 8,500 level in late July 2012.

Many are the fund managers and financial journalists who have proclaimed that a rebound is on the horizon for Japanese stocks. But instead of offering up a sustained rally, the Japanese market has remained a value trap for any investor with a finite time horizon. In theory, however, this shouldn’t discourage hedge funds using basic long/short techniques to trade the market. It remains among the leaders by market capitalisation. But because Japan is of low interest to most investors, the competition among hedge funds trading Japanese stocks is far less than in London or New York.

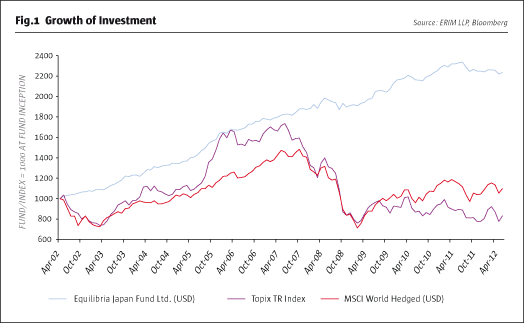

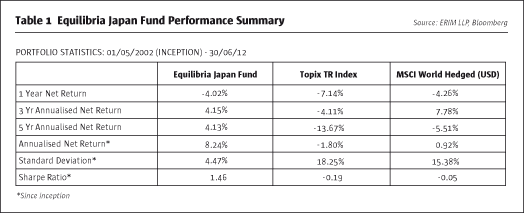

Eikoh Research Investment Management, spun off from Deutsche Asset Management in early 2012, has forged ahead trading Japanese stocks with an equity market neutral strategy that has generated annualised returns of 8.24% (see Fig. 1) over a decade with volatility of 4.47% (see Table 1). Indeed, the track record of James Pulsford, the chief investment officer and CEO, in researching and trading Japanese equities extends even further back to the late 1980s.

Out of favour

“My impression is that Japan is a slightly less well-covered market than some others,” says Pulsford in an interview at Eikoh’s elegant and spacious offices around the corner from Cannon Street station in the City. “The reason for that is quite straightforward. If you talk to investment bankers or brokers and ask for an exciting area where you want to be strategically positioned for the next 10 or 15 years, you won’t find many people telling you Japan.”

For a market neutral equity fund like Eikoh this translates into a market that is under-traded by other hedge funds and under-researched, too. In fact, the firm estimates that there are only a handful of Japan-focused equity hedge funds with assets in excess of $500 million. It makes the Japanese market less efficient than its New York or London counterparts where hedge funds are leading traders and have well established equity research teams.

The high cost of operating in Tokyo has also contributed to Japan-only research departments being shuttered. Companies’ analysis is often subsumed into pan-Asian operations with little experience or specialist Japan market ability. In comparison, firms have committed substantial new resources to China and Hong Kong owing to the perception of it being the market of tomorrow.

Trading strategy

Eikoh runs the Equilibria Japan Fund, a low net exposure cum market neutral equity long/short fund with 1X and 2X fund versions. It also operates a long only fund. Total assets are about $950 million with the 2X market neutral strategy having the most AUM with $600 million (or $1.2 billion including gearing).The fund management team’s approach is to add value primarily through bottom-up stock selection. Discounted cash flow projections are the key focus in dividing stocks into two groups: the one where valuations are attractive provides material for the long book; while the one where valuations are expensive supplies candidates for the short book. Long positions are characterised by companies with quality business models having sustainable or improving earnings at compelling valuations. This could also include a company in a turnaround situation or facing a possible value event with an identifiable catalyst. Short positions generally come from one or more situations identified in the investment research: companies with deteriorating fundamentals; instances where industry growth is decelerating or product pricing is falling; and companies trading at unsustainably high valuations.

Better access

Having been a portfolio manager in Tokyo, Pulsford says that being based in London actually gives Eikoh better access to the heads of large Japanese companies. During road shows here corporate leaders meet investors, whereas in Tokyo they are tied up running their businesses and leave specialist investor relations departments to handle most investors.

“Meeting the corporate heads is a great opportunity to sit down and really understand some of the strategic issues that these companies face and to understand properly the way that the senior management think about the direction of their business,” says Pulsford. “That should help us understand how they may react to certain events in the future, which is incredibly useful.”

Eikoh researches and models the 200 biggest Japanese companies. Out of the next 150 or so companies, it covers around 80%. It also covers another 40 odd small cap companies that are of interest for a particular reason. This is augmented with externally contracted research, business trips to Japan and meetings with company executives.

Pairing trades

The portfolio run by the team led by Pulsford and Sara Gardiner-Hill, the senior portfolio manager and co-founder, features around 80 companies they find attractive and 70 others that they find least attractive. These are put together on a paired basis to try and eliminate most of the sector and factor risk of being long one group of companies and short of another group.

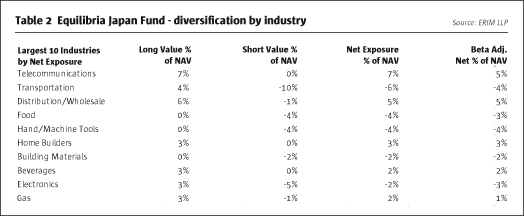

“We’re running a portfolio that is fairly market-neutral,” says Pulsford (See Table 2). “We spend most of our time between flat and 10% market exposure, and we’re always within -20% or +20%. This produces a very limited correlation to the market.”

Most pairs are selected to be broadly factor neutral by taking a long and short position in two companies that are in the same specific or broadly similar industry groups. The portfolio managers look to leverage differences in fundamentals or valuations. On occasion, but no more than 20% of the book, when a pair is structured with a long and a short position in two companies from different sectors, they will probably share some key characteristics and valuation criteria.

Pairs are monitored on an ongoing basis. Particular attention is paid when the spreads narrow materially to a minimal level or when they widen meaningfully from the point where the pair was initiated. The investment horizon can vary from a matter of weeks to over one year with an average holding being a few months.

“In that first couple of years, we started from a position of selecting stocks that we liked and ones that we didn’t like,” says Pulsford. “We then began looking to control the whole portfolio and pairing up stocks that had similar or close to identical characteristics. We sought to extract value from our bottom-up research through this, whilst controlling the sector and factor risk.”

Observing the bubble economy

Pulsford joined what was then Morgan Grenfell in 1984. He spent two years researching UK companies before switching to the Japanese company research team in 1986. Moving to Japan in 1987 saw Pulsford begin learning the Japanese language (he’s now fluent) and observe the final excesses of the bubble economy at first hand. In Tokyo, he started with small company research and built up assets in several funds.

Coming back to London in 1999, Pulsford moved into the large cap Japanese sector. It coincided with a push by the then corporate parent, Deutsche Asset Management, to launch a range of geographic long/short equity funds. Pulsford’s Japanese fund was set up in 2000 and opened up to external investment in 2002.

Multiples contract

In terms of price/book ratio, the Japanese market traded at over four times book value in the late 1980s with the price/earnings multiple close to 50x. The de-rating since has taken the figure below book value to around 0.85 and corporate balance sheets have strengthened considerably with many companies holding substantial net cash.

The dividend yield of the Japanese equity market is around 2.5%. This compares with a 80 basis point yield on Japanese 10-year government bonds.

“When you look at the valuation of Japan relative to other markets, my impression is that whereas historically there was a premium, whether justified or not, valuations in Japan have come down,” says Pulsford. “They don’t look out of place in an international framework even if the return on equity isn’t going to be as high as in some other markets.”

Agnostic on value

Yet even with this broadly supportive backdrop, Pulsford is nonetheless careful to refrain from judging whether a particular market or stock is cheap or expensive in absolute terms. Thus he is relatively agnostic about whether, for example, Japanese stocks are under-valued or over-valued as a whole.

“You can make judgments, but your scope for getting that wrong is great,” he says. “It becomes then a little bit easier judging whether an individual stock within the Japanese market is cheap relative to another stock, even if it’s in a different sector. And it becomes easier still judging whether one Japanese construction stock is cheap relative to another Japanese construction stock, or one bank is cheap relative to another bank, or one internet company is cheap relative to another one.”

Extensive modelling

The upshot is that the managers don’t necessarily have to be right about the direction of the Japanese market. Instead, Eikoh carries out a very intensive modelling process setting up forecasts for the balance sheet, cash-flow and earnings. The cash-flow return on investment is applied to work out in an objective sense the financial value of the companies. The Eikoh database shows the various inputs from the analysts’ work. It also monitors the pairs and tracks the price relationship between them, helping the managers determine when trades should be closed out.

As a rule, Eikoh look to open a pair when a valuation differential between two companies exceeds 15%, but ideally the difference is 20% plus. If the differential is less than 15%, it is unlikely that a new pair will be set up, while an existing one will likely be closed if the differential slips below 5-10%. Pulsford is keenly aware that much of the risk taken with a pure bottom-up fund is sector risk. For this reason there is an absolute +15%/-15% ceiling on net exposure to any sector. In practice, the net sector exposure is generally inside the +5-10%/-5-10% bands. However, due to the extreme volatility in the current macro environment the sector exposure limits have been cut to +5%/-5%.

Pair trade illustration

One pair trade Eikoh has run involved going long specialist builder Daito Trust Construction. It builds apartments in ventures with land owners and then lets them. Effectively, it provides landowners with a seamless, one-stop service to turn spare land into a productive asset which also has the benefit of some inheritance-tax advantages. Daito has prospered over a number of cycles, riding out booms and busts.

“It’s very cash-generative and we like the fact that Daito has a clear shareholder return policy,” says Pulsford. “They will pay out half their earnings in dividends and also supplement that through share buy-backs over the long term. They’re able to return about 80% of net cash to investors because the business model doesn’t require much investment.”

Paired with Daito on the short side are a couple of large general contractors which are very much exposed to the overall construction market in Japan. Cuts in public works, which were once high margin projects for these companies, have also occurred as the government has tightened fiscally in recent years.

“It’s become very obvious within Japan that with a shrinking working population, and now a modestly shrinking absolute population, that there’slittle growth,” says Pulsford. “So the demand for factories, and also offices to a lesser degree, is relatively small domestically.”

What’s more, though construction companies know strategically that they should expand overseas, going abroad takes them out of their comfort zone. The scope to be hit by political risk and cost overruns is considerable. Despite this array of negative factors valuations weren’t terrible verses peers, notably Daito. Eikoh’s bottom-up valuation work showed clearly what the companies were worth and the pair trade got put on.

Rising yen

A constant factor in Japanese equities investing is the rising yen. Eikoh’s models have sensitivity to this built in so that as yen and commodities prices fluctuate that gets reflected in earnings forecasts. The models will adjust real-time to what’s happening. But the portfolio managers won’t initiate a trade that aims solely to exploit a commodity or FX price trend.The analyst will carry out modelling and include a macro framework developed from discussing business conditions with a company. But the fund is not aiming to generate alpha from a macro forecast.

When the outlook for a company is being modelled the analysts will take into account macro assumptions in, say, divisional sales forecasts. They may also consider balance sheet risk and whether a stronger or weaker yen might affect an indebted company’s ability to survive. But at a certain point, the valuation will be strictly calculated through the cash flow-return on investment methodology.

“Effectively, we’re trying to model things looking out over the next three to five years,” says Pulsford. “We look at how we expect companies to change over those periods of time, and based on current market-levels, we come up with an appropriate valuation. That’s the basis of our system.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical