Equity Investing in 2013

How will it be different?

CHRIS RICE and STEPHEN LUCAS, CAZENOVE CAPITAL

Originally published in the December 2012/January 2013 issue

Many investors seem to have fallen out of love with equity investing, particularly European equities. Is this correct and, if so, why and how will the environment be different in 2013?

Global hedge funds now oversee c. $2.19 trillion (as at 30 September 2012: HFR, Chicago) in assets, up from $2 trillion at the end of the 2011 and more than double what they invested for their wealthy clients in 2005. Strong returns during the third quarter boosted the hedge fund industry to its largest size ever, offsetting a more muted appetite among investors for these types of funds. As at 30 September 2012 pension funds, endowments and wealthy individuals invested only $31 billion net new capital into hedge funds this year compared with $70.6 billion in 2011, when funds mostly lost money and $194.5 billion in 2007. If Q4 2012 shows the same pace of activity then 2012 will have the lowest inflow total since 2009, when investors withdrew $131 billion from the hedge fund industry.

Figures about to be released by Hedge Fund Research (HFR) for full year 2012 will show that the average hedge fund returned c. 5.5%, versus 5% for 2011, and equity long/short funds returned c. 4.81% for 2012. Notwithstanding this return to positive returns there have been disappointing volumes into equity markets in 2012 despite Quantitative Easing (QE) driving down bond yields and witnessing a strong double digit rally in European stocks since June 2012.

So why have volumes and liquidity in equity markets collapsed?

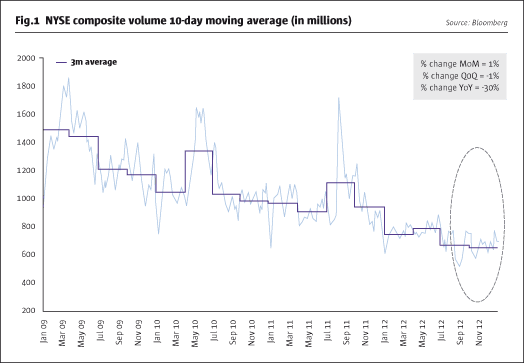

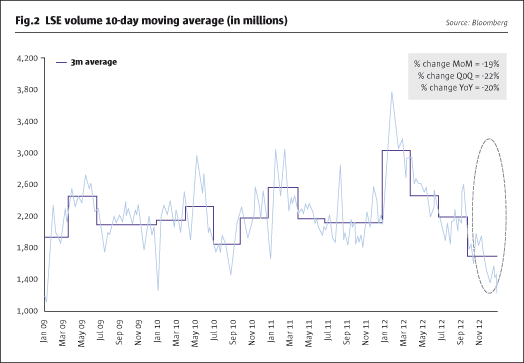

Since the onset of the global financial crisis in 2008 there has been significant volatility in equity volumes. Through 2012 (see Fig.1 and Fig.2) year-on-year equity volumes of the NYSE and LSE declined by 30% and 20% respectively.

November 2012 is an interesting case in point with US presidential election and the imminent threat of the US fiscal cliff providing both a market rally, a sell-off, and a rally again to end marginally up for the US and 2.2% for Europe – and through all of this volumes continued to slide. One explanation may be that most investors in European equities have been cowed into secure growth and yield stocks by a combination of market manipulation of QE and fear of the ‘stock’ problem (unsustainable debt). To that end they are unwilling to liquidate their inventory of safety in order to expose themselves to value and risk as they normally would at this stage of the cycle. German monetary conditions are ultra-loose; Italian bond yields have almost halved year-on-year; corporate margins are hitting the highs of the previous cycle. Yet investors don’t seem to ‘believe’ this cycle and happily sit in the popular commentary of this cycle – growth stocks in a low-growth world, high dividends in an era of financial repression. Yet value and risk have continued to outperform since the summer months (on low volumes of course) but this has not shaken the ‘safety bulls out of their tree’.

2012 will go down in market history as a price-to-earnings ratio (PER) expansion year, a year in which positive market returns were driven by a rise in valuations rather than strength in fundamentals as measured by corporate earnings.

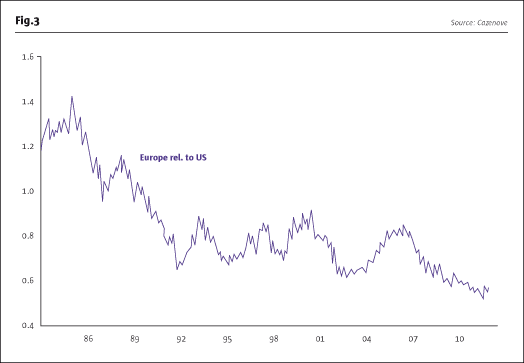

Notwithstanding this PER expansion of 2012, there has been a collapse in valuations of the overall market in 2010 and 2011 has left overall market valuations at the level of the early 1980s. The devaluation of European equities is a function of investor concerns that the single currency will break up.

The cheapness of Europe relative to the US can be seen in the Fig.3, which shows the “Shiller” (or cyclically-adjusted) price-to-earnings ratio of Europe relative to the US at 30-year lows (source Goldman Sachs).

So what does 2013 hold for Europe, given 2012 turned out a lot better than investors feared at the start of the year? The ‘stock’ view of the world still looks like a nightmare, especially in Europe. Under this world view, high debt levels have not even begun to fall as asset price discovery has been delayed by special interest groups ranging from Spanish bankers to ageing home owners. What’s more, the distribution of the problem is horribly lopsided between an insolvent south and mercantilist north.

However, look at the world from a “flow” perspective and this cycle looks disconcertingly like most previous cycles. Ultra-loose monetary policy has provided the breathing space for the imbalances of the previous cycles to correct themselves – namely large current account deficits and surpluses. It’s hard not to believe that the “flow” problems which we were so worried about last year are not going to be somewhat better in 2013 – the correction in European imbalances has been the real story of the last 12 months. Italian interest rates are now nearly half the level which caused Italy to fall into recession in 2012. The country now runs both current account and primary budget surpluses.

Meanwhile Germany has an election in 2013 which has allowed Merkel to push the Greece problem into 2014 and Spanish risk has been neutralised by the ECB having Merkel’s blessing to ‘do whatever it takes’ via the Outright Monetary Transaction (OMT). Additionally credit conditions have never been more accommodative for corporates. As a result, European growth is hard-coded to be better in 2013 than it was in 2012.

With volatility lower and growth expectations rising slightly, we would anticipate that 2013 is likely to be a year where returns are driven more by earnings revisions than by the PER shifts we saw this year – either at the total market level or at the stock and the sector level. We believe that excess returns are more likely to come through earnings revisions and we expect to take more specific stock risk as opposed to the style risk of 2012.

Chris Rice joined Cazenove Capital in 2002. He is head of Pan-European Equities, responsible for all aspects of pan-European equity strategy and portfolio construction. Rice manages the Cazenove European Equity Absolute Return Fund and has 22 years' investment experience. Stephen Lucas joined Cazenove Capital in July 2012 as head of the European Sales team responsible for delivering onshore and offshore long-only and absolute products into Continental Europe. Prior to Cazenove he was at GAM, Julius Baer and Citibank.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical