Outsourced CIO models (“OCIO”) have become increasingly prevalent among institutional investors with over a trillion dollars currently managed by outsourced managers. Some surveys estimate that outsourced assets should increase from $1.1tn in US assets to $1.7bn by 2023 which would mean an increase of over 120% since 20141.

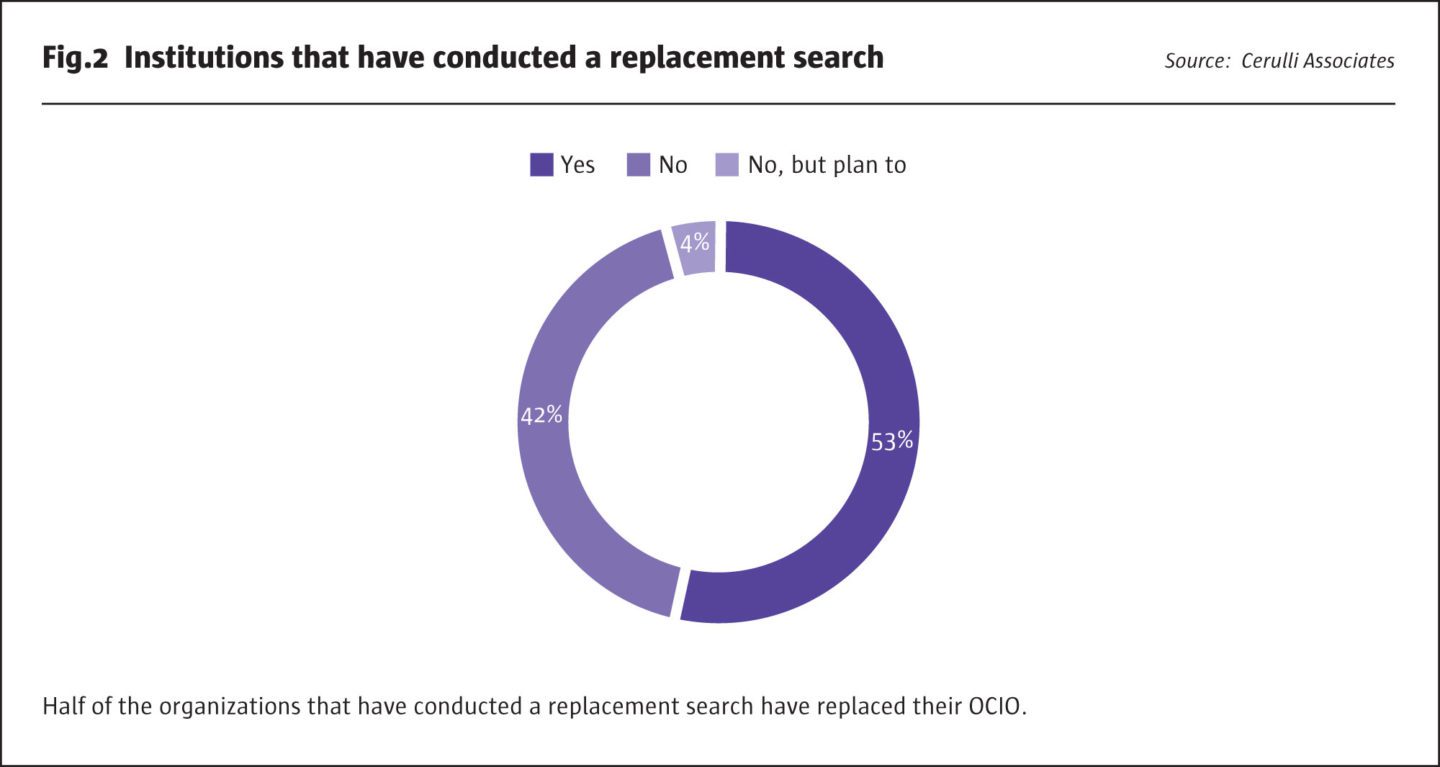

It is easy to understand the attraction of the model, as running an internal asset management effort can be both expensive and time consuming. The initial trend was for institutions to completely outsource their asset management to a third party, and for those third parties to often use co-mingled funds or model portfolios to gain economies of scale. This meant a somewhat “one size fits all” approach based on the idea that many investors are faced with similar problems and hence should be content with similar solutions. It however left a gap in the market for institutions with either much more specific needs or existing internal resources which made sense to continue using but which would be complemented with external specialist skills sets. Recent investor surveys confirm this trend as well, with 57% of organisations apparently looking to conduct replacement searches, with access to more specialist knowhow and more bespoke solutions being some of the drivers for this1.

To address this, a newer breed of OCIOs has emerged which tend to be a lot more bespoke and customized in their approaches, aiming to support investors in very specific ways by filling skill gaps or amplifying existing capabilities in a smart and cost-effective manner.

This is pronounced with regard to more specialist or niche strategies, whether they be alternative credit, private equity, lending, venture capital, direct/co-investment or hedge funds, all of which often represent a smaller, yet still important, part of an investor’s portfolio. These strategies, which require specialist skill sets acquired only through experience over several market cycles, are less transparent in terms of identification of investment opportunities (one cannot simply do a Bloomberg search) and have additional requirements such as operational due diligence.

These considerations are not usually present or exist in a different form in the construction of a traditional investment portfolio and alternative investment strategies therefore necessitate professionals with very targeted experience. The corollary is that the pool of these investment professionals is not as deep as it is for traditional investments, compensation tends therefore to be higher, as are ancillary costs for research and operational due diligence (travel being a large one). The global nature of alternative investments, the niche nature of some, and the associate costs propels even some of the largest traditional OCIO providers to look outside of their own organisations to supplement internal resources with external, specialist Alternative OCIO (“AOCIO”) providers.

Many investors have come to the realization that it rarely makes sense to build out expensive teams to cover all asset classes and investment opportunities, and that strategically it makes sense to focus on core competencies instead. When it comes to hedge funds, which often represent a smaller portion of the overall asset allocation, the cost associated with a robust analyst team can be hard to justify relative to the assets committed. The breadth of the opportunity set in hedge funds necessitates a team that can understand a multitude of underlying investment strategies and operate globally, which necessitates a commensurate staffing and travel budget. Drawing from experience across firms, one conclusion is that it is sub-optimal for an institution to properly run a hedge fund portfolio with less than five specialists (including investment and operational analysts), which means that unless a hedge fund allocation runs into several hundred million dollars it is very difficult to justify this level of staffing commitment. Even if an institution has this amount of AUM invested in hedge funds, this still does not guarantee access to preferred hedge funds and if accessed, likely without any fee/term negotiating power from allocation size. Given that hedge fund evaluation talent is scarce, there is a real risk of ending up with a portfolio that underperforms by multiple metrics. Internal programs also come with the typical employment related issues ranging from HR to management time. As firms that went through the financial crisis can attest, altering an internal program for performance/asset changes, or even firm ownership can be very costly. An outsourced solution, on the other hand, is easier to quantify from a cost/resource perspective and can also more easily be terminated or rightsized should requirements evolve.

$1.7bn

Surveys estimate that outsourced assets should increase from $1.1tn in US assets to $1.7bn by 2023 which would mean an increase of over 120% since 2014.

A clear needs assessment should therefore be a logical first step. Investors should ask themselves what they want to achieve, what resources they have in place internally, and where they may benefit from assistance. Perhaps they simply want access to due diligence reports to act as a “second opinion” and to provide some additional level of security with regard to funds selected internally, in which case a simple subscription to one of several such services may be sufficient. Or is it a much more comprehensive and hands on solution which is required? Does the investor really have the capabilities in-house not only to select the right managers, but to also construct cogent and coherent portfolios in the context of the overall portfolio? Investors may also lack access to specialized portfolio management tools specifically designed for more complex investments or access to specific industry databases to feed these analytics. The ability to properly utilise these tools may be an additional area in which investors need assistance, and where they are looking to leverage third party infrastructure instead of insourcing these often expensive and non-core capabilities.

A further point to consider is the amount of support the institution may need at different levels, and what ancillary benefits they may want to get from their hedge fund investments. In the case of a private bank or wealth manager, staff training (e.g. bankers, relationship managers) and having the need for “product specialist” support vis a vis end clients is an important consideration. It is also key to discern whether an approved list of managers, to use on a stand-alone basis, as components of discretionary mandates, or as part of customized mandates for larger clients, would be beneficial to the firm and ultimately to the clients served. The functionality of an AOCIO should be malleable to the needs of the client and their portfolio objectives. For a pension there may or may not be a need to train trustees but having the option may be impactful. Prop desks of banks may want to use their hedge fund allocations to gain certain market insights and allow for a synergistic exchange with fund managers in addition to just generating returns. Certain family offices and wealth managers may also be looking for active participation of their AOCIO at the investment committee level and may feel that using such a service is something they want to communicate to their clients to show credible expertise in this area. It may therefore be important to understand these investments in a broader organizational sense that goes beyond looking at them simply in a portfolio context and to take into consideration other institutional aims and constraints that may be just as important.

It is only once these critical aspects are fully understood that investors can fully explore the different options that are available. The simplest solution may be to pick one, or several, fund of hedge funds and let them manage the hedge fund allocation. While this can make sense for some investors, it certainly won’t work for all. The main problem, besides cost, presented by this approach, or any off the shelf solution, is that it often fails to take into consideration an investor’s specific needs and the role of the hedge fund allocation in the overall portfolio. Though many funds of hedge fund providers offer bespoke solutions, which have mushroomed post 2008, there is still frequently a bias towards using already existing, co-mingled in-house products and a real or at least perceived residual conflict of interest that can be hard to fully quantify or eliminate. The other option is of course to let any existing OCIO also provide advice on hedge funds. Depending on the depth of expertise such an OCIO may have, and their willingness to customize solutions rather than invest them into their own co-mingled funds, which many have created to create economies of scale, this may also not be the optimal solution. Often times it is hard to distinguish these types of offerings from traditional fund of hedge funds offerings, with the exception of cost, which tends to be lower. As mentioned earlier, another option is to simply opt for a provider of due diligence reports, but the limitation there is that this generally means very little support in terms of idea generation and portfolio specific inputs. This solution may also not provide access to funds that are closed or provide any benefits when it comes to preferential terms, as this tends to lie outside the remit of these providers. It also often means little to no support from a staff training or product specialist standpoint, and therefore typically makes most sense for large institutions that have decided to invest in a fully-fledged hedge fund investment team with the requisite assets to justify the expense, but want further “insurance” for the program.

Particularly in a low-rate/lower return expectation environment, cost is a central element to deciding upon which approach makes most sense. Funds of hedge funds usually add a second layer of cost on top of hedge fund fees, though many of them, especially the larger ones, are generally able to negotiate preferential terms with their underlying managers, in effect thereby offsetting their fees to some extent. Providers of due diligence reports tend to either charge a one off, monthly or annual fee for their services, which depending on how frequently they are being used can either be very good value or very expensive, and in some instances is seen more as “insurance” than a real value add. Traditional OCIOs tend to charge a management and sometimes also a performance fee, and it is important to understand whether they will be allocating to internal products, which may carry additional management and performance fees, or whether they have a completely open architecture. Specialized AOCIO firms don’t tend to run their own products and so usually have a completely open architecture which takes away one area of potential conflict of interest. In terms of fees, their models tend to be similar to those of traditional OCIO providers, but should be able to leverage their overall assets to allow clients to benefit from preferential fees/terms with underlying managers, thereby offsetting their own fees to a large extent, or in an ideal scenario even saving their clients’ money versus them doing it themselves. They should also be able to provide access to otherwise difficult to access opportunities and to leverage their relationships in order to get better overall terms for their clients (e.g. future capacity). It is also possible to have managers create bespoke product to meet specific objectives, or to take advantage of idiosyncratic opportunities, if the scale is available.

Many investors are not seeking to fully outsource their investments, but rather are looking for a competent partner that can act as an extension of internally available resources and help to improve processes and performance. The ideal partner does not have the appearance or functionality of competing with internal staff, but rather integrates with the team allowing internal capabilities to be augmented in a smart and cost-effective manner. For investors that have some sophisticated, existing in-house resources which they wish to amplify, and seek a more bespoke approach (not just an off the shelf product but also access to managers, staff training, product specialists support or a member to be added to their investment committee), a specialist hedge fund AOCIO may be the best solution. AOCIO solutions offer the most flexibility and targeted access to experienced specialists while being meaningfully more cost/resource efficient versus a robust in-house effort. The evolution is likely to continue to the benefit of the investor, but the current offerings already require serious consideration.

Footnote

1 Cerulli Associates. (2019). OCIO at an Inflection Point: Strong Growth Ahead, but Institutions Are Demanding More. Available here.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 145

Evolution of the Outsourced CIO Model

A flexible approach to alternative investment advisory

Patrick Ghali, Managing Partner and Co-Founder, Sussex Partners

Originally published in the November | December 2019 issue