In 2014 Finisterre was largely watching Argentina’s default from the sidelines, but Argentina’s 2001 default was pivotal in galvanizing the launch of the firm. The 2001 default gave the four founding partners – experienced EM investment bankers – confidence that the credit default swap (CDS) market, that had existed since they started their careers in the early 1990s, was finally functioning properly, having signally failed to do so in relation to Russia’s 1998 default, to name but one instance. This comfort over CDS being fit for purpose was crucial, because Finisterre has always operated a genuinely long/short strategy, with portfolios comfortable running net short where appropriate. As it happens, at launch date in 2002 Finisterre found the macro outlook for emerging markets was broadly benign, with the IMF successfully proselytizing the “Washington consensus” and budget and current account surpluses superseding the endless crises of the ‘80s and ‘90s.

Finisterre is happy to acknowledge that long-only or long-biased investors have done well over the past decade, although some investors might be surprised by the extent to which their gains are attributable to the, partially QE-fuelled, Treasury rally. Right now simple arithmetic, that we illustrate later, stunts scope for gains from any further compression of risk premiums – so that in many cases the risk/reward profile for long-only looks distinctly asymmetric. And over the past few years the synchronized growth story has given way to gaping divergences in the fortunes and economic policies of emerging countries, which expands the opportunity set for fixed income specialists Finisterre, who are confident about making long and short calls on behalf of their mainly institutional client base.

Acceleration and institutionalization

As the hedge fund industry has institutionalized, Finisterre has repeatedly raised its game in response, in order to attract big tickets from giant insurers and sovereign wealth funds. Finisterre started with $70 million in April 2003, including $50 million seed capital, but they think start-ups today need far more to be on a sustainable footing, and two new products have helped to propel assets to the $2.8 billion managed in late 2014. Back in 2007 Finisterre was frustrated that their strong performance had not yet earned them entry to the billion dollar club. Offering Bermuda-based reinsurer XL some 20% of the firm (in return for a substantial investment with a multi-year lock-up) helped Finisterre to grow from $350 million to $800 million by the summer of 2008.

Credit apart, investment performance stayed steady in 2008, with 10.1% of the Sovereign Debt fund’s 10.3% loss for 2008 attributable to CDS and repo exposure to Lehman Brothers; for the Global Opportunity fund, 2.5% of the 5.87% loss was Lehman exposure. But Finisterre became a victim of its prudent liquidity management and absence of gates, as crisis-stricken investors withdrew capital that roughly returned Finisterre to assets of around $400 million. As performance recovered, and Finisterre had a stellar 2009 in all strategies, ending the year well above high-water marks, it only took two years to quadruple assets to $1.6 billion by July 2011, which might well beg the question of why the firm felt the need to sell 51%, including XL’s 20%, to a second accelerator – Fortune 500 list member, Principal Global Investors (PGI).

The answer is that Finisterre had become acutely aware of how the institutionalization of the industry was intensifying. As well as capital, mammoth PGI supplies superb infrastructure that has boosted Finisterre’s credibility with, and access to, allocators such as sovereign wealth funds – without cramping Finisterre’s style.

Says co-founder and CIO, Paul Crean, “PGI runs a hands-off model, so they allow us to run our own business and investments.” At the same time, two board meetings per year and an internal audit annually provide extra oversight, which appeals to allocators. “An autonomous operating unit combined with the backing of a big balance sheet gives comfort,” says partner and head of business development, David Burnside, who joined Finisterre in January 2014 from Bluebay, where he was head of alternatives. On the IT front, PGI helped vet potential suppliers when Finisterre upgraded systems, with the help of a dedicated team in Iowa. And Finisterre’s new UCITS launched on PGI’s Dublin-based platform in 2013, getting it to market quicker.

A sub-allocation from one of PGI’s regulated US vehicles has also given Finisterre its first taste of the ’40 Act fund structure which it expects to expand in 2015. PGI has also opened others doors on the asset-raising side, particularly in Asia and the Middle East, where PGI has staff in Japan, Hong Kong, Singapore, Australia, and the Gulf. Burnside notes that Finisterre’s asset growth has spanned the liquidity spectrum – from onshore, liquid regulated funds to longer-liquidity credit co-invest opportunities, as well as classic unconstrained offshore regulated funds.

Illiquid credit opportunities

Most of what Finisterre does today is liquid, but some institutions are seeking longer-dated assets to match their more distant liabilities. To cater for such investors, Finisterre offers “sidecars” that are very much tailored to individual investor preferences. Opportunities here can include stressed listed securities, as well as direct lending and various types of bespoke, bilateral and structured deals. It is difficult to generalize about these opportunities, and their performance is not part of Finisterre’s reported fund performance, but Finisterre can tell us that US institutions have a far greater appetite for trying to pick up illiquidity premiums than do typically more cautious European investors. So, rather than trying to spice up core products with a dash of illiquids, the latter are an off-menu item that has to be specifically requested.

Sustainability and succession

PGI has experience of nurturing all kinds of asset management businesses, having for years been operating what it terms a “multi-boutique” business model, with Finisterre now among 14 PGI investment management boutiques, of which a few share Finisterre’s unconstrained, benchmark-agnostic approach. PGI has no ambition to fully take over these companies, and wants to preserve their entrepreneurial energy. So PGI now owns 53.5% of Finisterre’s management company, but it has committed to not owning more than 70%, as it is important for partners to have “skin in the game and run money on a hands-on basis”.

This is an essential part of the succession plan that PGI and Finisterre developed, which co-founder and CEO, Frode Foss-Skiftesvik, thinks is vital to the longevity of Finisterre as a business. He observes that “very few hedge funds have a realistic succession plan in place; many are one star trader that owns most of the equity.” In contrast “Finisterre is a partnership with people at different stages of their business lives.” The partnership roster is fluid, with Tom Priday having been bought out before the PGI deal and Yan Swiderski, who recently retired, putting his equity to PGI as well as to other partners. Priday and Swiderski are still involved, on the advisory board, while portfolio managers Rafael Biosse-Duplan, Xavier Corin-Mick and Darren Walker, who joined in 2006, 2008 and 2012 respectively, now own about 25% of the equity.

Finisterre has a collegiate culture where prima donnas need not apply. Each fund has three portfolio managers with their own buckets of capital, and the open forum goes beyond the open-plan office, in that all PMs can see each other’s trades, in real time, via the Bloomberg messaging system, and the entire office (including the receptionist) has sight of daily PM attribution reports. All PMs attend a weekly macro meeting (daily for the Credit fund) where interactivity is encouraged. Yet none of this means that Finisterre is forcing consensus upon its PMs, who can and do take offsetting and opposite positions. Paul Crean explains that “PMs could have different time frames, or might be using a trade such as Turkey to pair against Russia, rather than expressing an outright view.”

Finisterre appreciates that the whole is greater than the sum of the parts, because each PM has special expertise in particular sub-segments of the emerging universe – foreign exchange, rates, sovereigns, quasi-sovereigns, corporate credit – so everyone can bring something to the table. As well, the culture is intended to “avoid the key man and star risk in terms of sustainability,” stresses Crean. “No individual should have a put on the franchise and no one person is bigger than the franchise.”

Recent hires have included Ying Zhang from the J.P. Morgan CIO office, Bartosz Pawlowski, who had been global head of emerging market strategy at BNP Paribas, Kevin Bespolka from Napier Park, and Chris Buck, who was head of Latin American credit research at Barclays Capital. These specialists have backgrounds both in macro and in company analysis, and Finisterre finds that twinning top-down macro perspectives with bottom-up micro angles fosters an interplay identifying opportunities that can be overlooked by those with a purely macro or micro mind-set.

For instance, shocks at the macro level, in countries such as Argentina, Venezuela and Greece, can throw up opportunities at the corporate level. A dislocation between market value and fundamentals is ideal for Finisterre, and peripheral Europe provided just that in 2012, when the Finisterre Credit Fund made 18.01%, twice its annualized average of 8.93%. Partner and Credit Fund manager, Biosse-Duplan, homed in on financials in Italy, Spain, Greece and Cyprus – but did so cautiously, and did not buy the most junior instruments. “Spanish covered bonds were underpinned by collateral and regulations, while hybrid bank capital was orphaned by regulations,” he recalls. As well, “Greek government bonds trading in the low single digits post-restructuring were well below typical recovery values of 25% on sovereigns, and we had seen similar deals over Argentina, Venezuela, Mexico and Russia over the decades,” he reflects. Biosse-Duplan argues that traditional bond investors had difficulties assessing these types of opportunities.

Liquidity and hard stops instead of hedges

Sharing ideas does not imply sharing responsibility, however; although PMs do collectively bear performance fee netting risk, particularly if overall fund performance is zero or negative. Each PM has a personal risk budget that can be cut in response to losses. A 3% intra-month loss on the PM’s book normally requires a halving of positions, with a further 3% leading to a close-out and a minimum two-week break from the desk. “Responsibilities are then assumed by the lead portfolio manager or by me, and the PM is only invited back at Finisterre’s discretion,” warns Crean. A peak to trough loss of 10% can lead to a suspension or parting of the ways, although there is latitude if the loss occurs from a high base.

“We pay enormous attention to the size and nature of liquidity,” says Biosse-Duplan, and there are no “level 3” or “marked to model” positions in any of the funds – they are all marked to market prices or dealer quotes, while Finisterre estimates that nothing in the Credit Fund would take more than 90 days to liquidate, under current conditions. That caveat matters, because Finisterre has witnessed deterioration of liquidity, so this scenario is stress-tested both in-house and externally, and Finisterre reports portfolio risk measures to investors using standards including Open Protocol Enabling Risk Aggregation (OPERA). Lower broker inventories are a concern for credit investors that has been heightened by the 2014 sell-off, and Finisterre acknowledges that the proportion of credit inventory owned by international banks has dropped to roughly 10%, from 50%, over the past decade, due to regulations discouraging banks from taking this type of risk.

Finisterre admits that trading volumes in EM credit make for “mediocre liquidity” – but the picture in emerging markets is tempered by two factors. Firstly, the volume of issuance – around $300 billion to $400 billion a year – means that emerging market corporate credit is fast approaching the size of the US investment-grade market. Secondly, Finisterre has been adept at ferreting out extra pockets of liquidity by expanding its range of local counterparty relationships in the emerging markets. “The old model of 10-12 global banks dominating trading no longer applies as alternative providers of liquidity emerge,” explains Crean. Local banks in countries such as Brazil and Russia have big balance sheets for their own markets, and new brokerages are operating daily auctions to match buyers and sellers. Dealing with these counterparts can entail some DVP (delivery versus payment) settlement risk of the order of two to three days, but Finisterre’s main counterparty risk is still in the form of ISDAs facing the main banks.

Liquidity matters all the more because Finisterre eschews the use of hedges as the primary risk management tool. Finisterre’s philosophical objection to hedging is that longs and shorts are both designed to be profit centres. Finisterre also has several more practical concerns. “Adding hedges increases the size of your balance sheet,” whereas Finisterre in 2008 preferred to batten down the hatches and raise cash by shrinking their balance sheet “at huge cost as we hit clearing levels on illiquid assets,” emphasizes Crean. Hedges can also introduce basis risk, so that shorts may recover before longs, particularly if shorts are more liquid. Cash versus CDS basis has caused losses for apparently well hedged managers in 2008 – and again in 2014 – but Finisterre aims to avoid basis risk. A third danger of hedges is that they can hide the fluidity of bid offer spreads; “We believe in taking the pain early to understand the gap risk which can be obscured by hedging,” says Crean, and the firm clearly took seriously its obligation to meet redemption requests in 2008. Where broker quotes may only be indicative, and may not be good for large size, the true price is only discovered by doing a real trade.

The way in which Finisterre handled its credit fund in 2008 illustrates the quality and openness of dialogue with investors. The fund, which was then called Finisterre Special Situations, was mainly invested towards the lower end of the capital structure. Finisterre did their best to sell holdings in 2008, but when liquidity really disappeared Finisterre explained to investors that time was needed to permit an orderly wind-down. An adroit and elegant solution was swiftly orchestrated. Some $45 million of fresh capital was raised and used to transfer six less liquid assets from the Special Situations Fund into a closed-end fund, which was named the Recovery Fund and given a three-year life. This influx of capital re-liquefied the Special Situations fund, which was able to go on a bargain hunting spree – but this time, at the top end of the capital structure. The renamed Finisterre Credit Fund delivered 45.45% to investors in 2009.

Onshore regulated vehicles: complements not substitutes

“Product development has to be judged through the prism of consistency with our existing business,” says Burnside. Essentially, any regulated products need to complement, rather than cannibalize, Finisterre’s capacity-constrained (but strategy-unconstrained) offshore funds. Finisterre sees no point in simply replicating their offshore strategy in a product that may have lower fees and will almost certainly offer shorter liquidity terms.

Finisterre set up a UCITS for an existing insurance company client, which needed to exit Cayman structures and so economize on regulatory capital under the Solvency II regime. Finisterre carefully researched the UCITS world to devise an appropriate structure for their strategy. So the Value at Risk approach was chosen for risk management to avoid a hard leverage cap restricting room for manoeuvre, particularly in shorter-dated debt; like most hedge funds, the UCITS is miles inside the 99%, 20-day VaR limit of 20%. That the UCITS cannot do physical bond shorts is a relatively minor constraint, as its instrument menu of CDS, rates and FX allows for views to be expressed.

The UCITS fund has its own team – Christopher Watson and Kevin Bespolka. The largest constraint is that weekly liquidity requires some positions to be sized smaller. Consequently, the UCITS is more diversified than Finisterre’s other funds, and separately from the UCITS rules it tends to have longer holding periods. Fees are 1.5% and 15%. Although $400 million of the $480 million in the UCITS is sticky money from institutional insurance clients, Finisterre still aligns portfolio liquidity with the fund’s weekly terms.

The UCITS was “obvious and easy” but a ‘40 Act fund has required more contemplation. Finisterre is already part of the Principal Global Multi Strategy Fund, a $2 billion ‘40 Act vehicle, sitting alongside managers including York, AQR and Wellington, which are clearly not PGI boutiques; the open-architecture nature of this vehicle meant that Finisterre was competing with many other EM managers for the allocation. Next year Finisterre expects to launch its own ‘40 Act. It has taken a year to work out how to enter the ‘40 Act space in a “scalable, sustainable and complementary way,” says Burnside. So they hint that the ‘40 Act launch will be more “smart beta” or “enhanced beta”-oriented, and they think this will find its own niche simply because so few ‘40 Act funds offer access to emerging market debt. “The ‘40 Act space is so dominated by equity long/short and systematic strategies,” thinks Burnside. “Feedback to date suggests that by its nature, our different, and diversifying, asset class should attract interest.” The ‘40 Act product will naturally reflect Finisterre’s higher-conviction views and be subject to their usual risk controls.

The new age of EM alpha

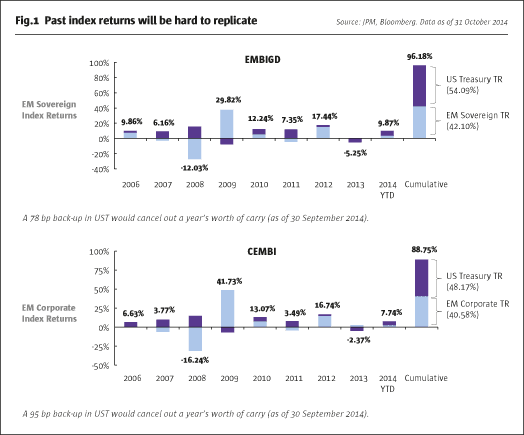

A liquid trading style lets Finisterre take long and short positions in multiple sovereigns and credits. This flexibility is crucial for two reasons spelled out in Fig.1.

First, roughly half of the appreciation in emerging sovereign, and corporate, debt has come from the Treasury component of yields – and clearly at the short end, Treasury yields cannot fall much further. Secondly, current levels of yield offer very little compensation for interest rate duration risk – so Finisterre estimates that just a 1% jump in Treasury yields would wipe out more than a year of carry, for either sovereigns or corporates. And any true normalization of US monetary policy implies far more than 1% of rate rises. Historically when rates rose in 1994, or 2004, there was far more yield to cushion and even outweigh the duration impact. Now most emerging credit looks like Treasuries plus a single-digit spread.

Predominantly long-only emerging market fund managers also have long/short products, but Finisterre insists that its long/short managers are fully focused on running long/short money. Finisterre thinks that even some emerging market “hedge funds” are variously long-biased, levered long, and only paying lip service to their short books – and this may be why some of them have shut down lately. In contrast, Finisterre takes shorting seriously. “We can stomach the negative carry of being net short and with high conviction we have been net short on a number of occasions,” says Crean.

As well as preferring long/short to long-only, Finisterre thinks emerging market macro offers a richer opportunity set than developed market macro. If Alan Greenspan took pride in opaque and obfuscatory communication, today’s G4 central banks are Plain English disciples who pre-signal forward guidance, which may mean that policies are already factored into forward curves, whereas there are far more policy surprises in emerging markets. Just as equity investors seek to anticipate earnings surprises, so macro investors watch out for such policy surprises. Finisterre reckons that the giant macro funds are bulking up their emerging teams to take advantage of these opportunities, but their assets of above $10 billion and far above are multiples of Finisterre’s capacity targets for its EM-focused strategies.

So Finisterre’s unconstrained strategies are not generally purveyors of any beta opportunity in emerging market debt, even though they concede that the asset class could still be “relatively attractive in an unattrative overall universe”, and more specifically Biosse-Duplan reckons high-yield corporate debt in emerging markets is better value than US high-yield to the international investor. What excites Finisterre far more is precisely that the breakdown of beta provides the alpha, because the “tremendous dispersion provides opportunities to invest long and short, in improving and deteriorating stories,” explains Crean. Policy divergences are quite recent in developed market rates, as the UK and US seem set to normalize policy while the Eurozone and Japan ramp up QE. But these divergences have been present in emerging markets for years, “and may even increase as the G4 picture becomes more complicated,” opines Crean.

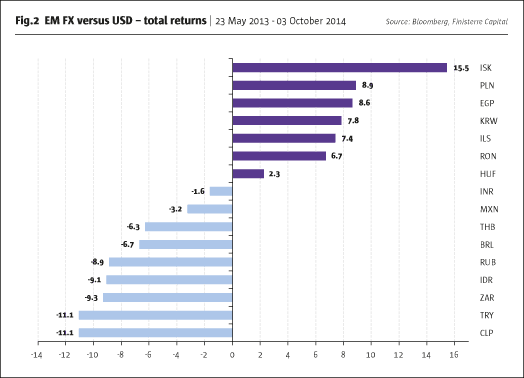

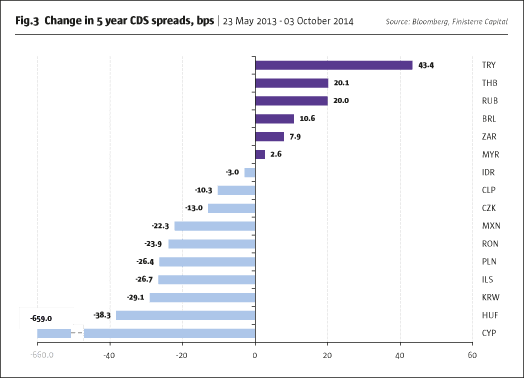

Recently Russia, Brazil and Turkey have hiked rates while Mexico, Chile and Hungary have cut rates – and Fig.2 and Fig.3 show how sharply performance for emerging market sovereigns and currencies has diverged. On the corporate credit front, Biosse-Duplan also looks forward to greater dispersion, foreseeing that “A better climate will come later on when there is not an endless supply of liquidity propping up bad stories – then there will be falling angels and fallen angels,” he hopes. The ballooning of corporate debt in some emerging markets, such as China, means that headline sovereign debt figures are no longer a good guide to overall indebtedness, and Biosse-Duplan thinks that China’s recent rate cut was motivated at least partially by relieving pressure on corporates.

Finisterre is very selective in choosing trades. Argentina’s default may have been the first major one in some years in EM, but Finisterre has not been involved. “It is too expensive to buy, trading in the high 90s, and too expensive to short, with a high coupon,” says Biosse-Duplan, who reminds us that being unconstrained means Finisterre is under no obligation to hold any position in any sovereign. Benchmark-constrained managers subject to tracking error limits may be forced to hold the largest weights in the countries with the largest absolute amounts of sovereign debt – as these are the biggest index constituents. In contrast, Finisterre’s top four contributors in October 2014 were positions in India, Chile, Poland and Bahrain, which are far from being the largest sovereign debt issuers – and this just shows how Finisterre scours the globe for opportunity.

Successful short trades

Finisterre has not been on the right side of every move but has captured some of the big moves. For much of 2014, Finisterre has been short of Russian sovereign risk, with a constellation of factors behind the position. Crean enumerates: “Russia was expensive versus other credits; no economic reform was going on; massive capital flight occurred, especially in the first quarter; the economy is still heavily commodity-based, and technically everyone was long as a way to avoid the Fragile Five that have had large current account deficits.” On the corporate front, Biosse-Duplan contends that Russia will stand foursquare behind the quasi-sovereigns as they were “defended to the end in 2008”, but he has also identified some shorts amongst Russian corporate debt.

Elsewhere in emerging Europe, Finisterre was staying short of at least two sovereigns. “Turkey is one of the Fragile Five, with a very large current account deficit and fiscal deficit pressuring the currency, and is vulnerable until the twin deficits are corrected,” explains Walker. Near-term, the team at Finisterre worries that a normalization of USD rates could put Turkey under further pressure, and are also concerned by Erdogan’s “authoritarian and hubristic” politics. The view on Turkey was implemented via a triple short stance – via rates, CDS and the currency – in late 2014.

Finisterre has more serious concerns about the Ukraine: “We have thought for two years that Ukraine is running out of money and ignoring IMF advice because the previous regime had substituted the IMF for international bond investors,” says Corin-Mick. For instance, the IMF counselled that Ukraine should cut gas subsidies and let the currency depreciate, whereas Ukraine last year did the reverse, spending 30% of its FX reserves. The precipitous contraction of Ukraine’s economy means that the IMF admits its initial support of $27 billion will need to be $36 billion, and Finisterre thinks the total bill could now reach $45 billion. Although Ukraine does not have a high debt to GDP ratio, Finisterre sees a high risk of debt restructuring that could entail one or more of maturity extensions, haircut write-offs, and coupon cuts. Consequently, Finisterre has a basket of short-biased positions involving the sovereign, CDS and Naftogaz, but as always all of these are actively traded around.

Arbitrage opportunities

The core strategy is taking directional views on sovereigns and credits – but Finisterre also have the expertise to construct relative value trades revolving around some sovereigns. Despite the oil price collapse, Finisterre managers do not think Venezuela can afford to default, “because almost all of their exports are oil, and it would be immensely disruptive if creditors started chasing assets onshore and offshore,” says Crean. Additionally, Finisterre argues that the Argentina judgement this year sets a precedent in favour of foreign creditors, so that a non-consensual restructuring would be hard to achieve. The Harvard professor who recommends default is associated with the opposition party – not the current administration.

So, Finisterre thinks that the debt will perform and yield 20% – but they are not simply taking a long position. Instead, Biosse-Duplan has used the hugely distorted Venezualan yield curve to structure a trade that is “carry positive, jump to default positive and contains positive convexity.” Finisterre has cautiously constructed a series of positions that should be profitable under several scenarios – the status quo provides positive yield; volatility can extract value from the convexity, and even the very remote prospect of default would make money. While the Finisterre team is confident about their analysis, their risk framework in terms of Value at Risk and stressed scenarios is used to determine appropriate position sizes for the Venezuelan exposures, which are smaller in the UCITS.

As well as the institutional infrastructure, investment returns and risk controls, Finisterre thinks their unique selling propositions revolve around their distinctive culture. It is a “low or no-ego culture,” says CEO, Foss-Skiftesvik. “While we are demanding in terms of accountability, we are not a sweatshop or fear-bound organization,” he says of the balance that is struck. The name Finisterre is derived from a Latin word meaning the end of the world, but for Finisterre the brave new world of divergence could mark the beginning of many more decades of successful EM investing.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical