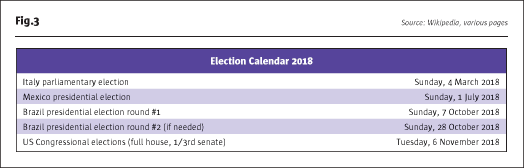

The year 2017 saw the juxtaposition of heightened policy uncertainty with relatively complacent markets and low volatility, especially in equities. Much of the policy uncertainty may find some answers in 2018. It is decision time for NAFTA and Brexit. Elections will be in the spotlight, too. Italy in March, Mexico in July, Brazil in October, and November 2018 will see a ferociously contested US election for the entire House of Representatives and one-third of the Senate. At the Federal Reserve (Fed), the focus will be on inflation and the shape of the yield curve as it decides how aggressively to push rates higher or not. The weather will play a role, too, as we find out if La Niña deepens and brings droughts to Brazil and Argentina or fades away quietly.

Event risk can present some interesting risk management challenges. The two possible outcomes are typically binary in nature, like an on/off switch. Before the event, markets may price an average of the two vastly different outcomes in terms of their impact on selected products or securities. After the event, the market’s ‘average’ of the two outcomes will definitely not survive the outcome, as markets move quickly to price the actual outcome as it becomes known. In these types of market environment, options can be a favored risk management tool. In addition, if the probability of a price break or gap is substantial around the time the outcome becomes known, the options prices will add a premium for price gap expectations in addition to the typical estimate of future volatility. This means that implied volatility calculations using models that assume price gaps/breaks do not exist (i.e., basic Black-Scholes-Merton) may over-estimate volatility by the amount of the potential price break premium.

There are also risk management considerations relative to different types of event risk. For example, political elections have known dates and unknown outcomes. Weather events, such as droughts, do not have known dates, but the general conditions that could result in a drought are known and can be monitored. In these cases, markets will price potential outcomes as probabilities shift.

Here are our favorite event risk challenges for 2018.

Brexit, trade, and the Irish border

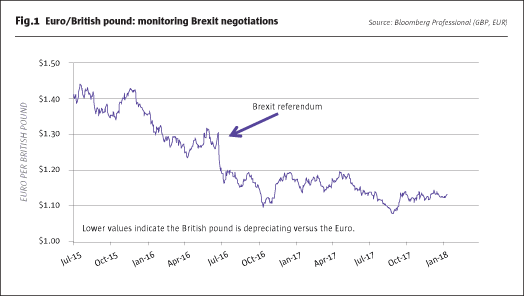

Now that the UK has agreed to pay a substantial sum to the European Union (EU), the Brexit negotiations shift to trade relations and the Irish border. On trade, both sides have a lot to lose, and while they may seem far apart on many details, the will to find a compromise seems to be gaining traction. On the Irish border question, it is less clear. The Democratic Unionist Party (DUP) in Northern Ireland provides the votes in Westminster that Conservative Prime Minister Theresa May needs to remain in power.

DUP wants both an open border with Ireland and that Northern Ireland is treated exactly like Scotland, Wales, and England as part of the UK. This presents May with a conundrum. A workable compromise is not in sight. If a compromise cannot be achieved, a new election in the UK and substantial FX volatility may follow.

Trade & immigration

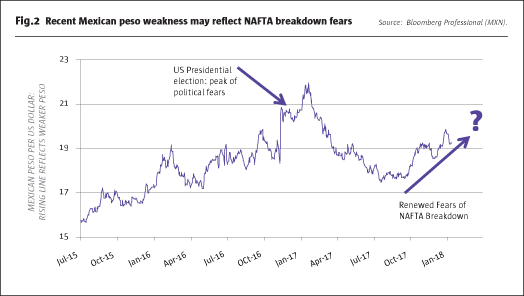

NAFTA will be front and center in Q1/2018, and any deal or no deal impacts US exports of corn, beef, and natural gas to Mexico, as well as potentially destabilizing the auto industry that is tightly inter-linked across all three countries that includes Canada. Mexico faces a critical presidential election on July 1, 2018. It is hard to see the current Mexican government making any concessions before the election. Canada does not face elections in 2018, but Prime Minister Justin Trudeau still must look to his future and not appear weak relative to the rhetoric coming from Washington.

For the US Administration, the achievement of passing major tax legislation in December 2017 may lead to a desire to push harder on trade and immigration issues to notch another victory or two. Thus, the probability of the US triggering the 6-month unilateral withdrawal notice clause in NAFTA has risen.

And, how the immigration dispute is settled may determine whether the Federal Government in Washington is shut down or stays open as the January 19 funding deadline approaches in the US Congress. All sides are digging in their heels; event risk is heightened. Any last-minute theatrics around a Federal Government shutdown would activate volatility for markets in US Treasury bonds, equities, and the US dollar (versus euro, especially). Market participants have grown complacent in dealing with uncertainty, so it would be the actual event (ie a temporary shutdown) and not the uncertainty that would create volatility in markets.

Elections around the globe

As noted, there are a slew of critical elections in 2018.

The Italian elections in March will focus on the issue of budget austerity and EU policies. This will put the euro in the headlights.

The Mexican election could put the country between a rock and a hard place, with no NAFTA compromise possible. Here the focus is on the Mexican peso, natural gas, cattle, corn, and the Canadian dollar.

The Brazilian election could set the country on the path to further reform and economic growth or spiral the country back into political uncertainty. Brazil’s presidential election is potentially a two-part affair. If no candidate gets 50% of the vote in round one, then three weeks later there is a second round pitting the top two vote-getters against each other. The Brazilian election potentially impacts the Brazilian real, as well as commodities such as corn and soybeans.

In November, the Democratic Party in the United States will make a concerted run to take back control of the House of Representatives and deny the Republicans gains in the Senate. A Democratically-controlled House would spell even more theatrics from Washington, impacting equities, bonds and the dollar. In short, political event risk is back on the calendar for 2018, with a vengeance.

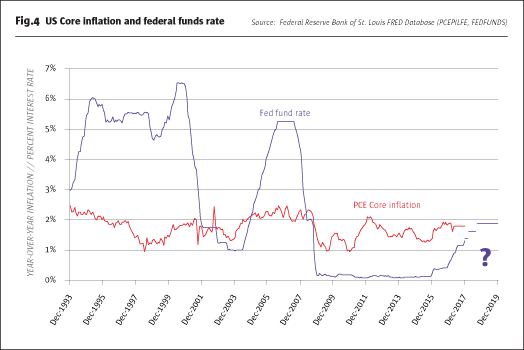

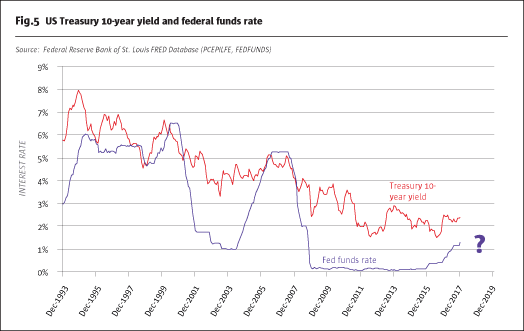

Fed, inflation, the yield curve and rates

With the political election rhetoric flying in Washington, the Fed will probably want to lay low, and certainly will not want to be blamed for causing a recession. The Fed will be debating and eyeing the shape of the yield curve. Statistically, the yield curve is the best predictor going for future volatility and a recession should the curve flatten or become inverted. So, unless core inflation flashes a warning sign, the Powell-led Fed may take its cues from the yield curve and halt the tightening after one or two more increases to avoid flattening the curve too much.

And now for the weather…

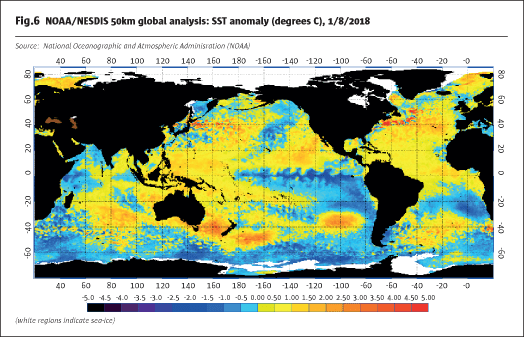

La Niña is here. From an ocean surface temperature perspective, La Niña is colder than usual waters along the Pacific equator – the opposite of the warmer than usual waters occurring with El Niño. While these two phenomena are opposites in definition, one should not assume the effects are opposite, as each event has its own special character.

This La Niña is not too strong yet, and some experts suggest it may weaken sooner than previous episodes.

Even so, meteorologists and farmers alike will be watching for signs of deepening La Niña and with it, increased possibilities of drought in the corn and soybean regions of Brazil and Argentina. La Niña, or more correctly the absence of El Niño, also increases the risk along the east coast of the US and in the Caribbean of more severe hurricanes in the Fall of 2018, as was witnessed in 2017.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 129

Five Reasons Event Risk to Take Center Stage in 2018

Looking ahead

BLUFORD PUTNAM, CME GROUP

Originally published in the January 2018 issue