The strain of pulsating market volatility, steep drawdowns and rising investor redemptions have hit funds of hedge funds like so many successive tsunami waves. The contrast is stark with how the absolute return industry ballooned during the boom years leading up to 2007. The scale and speed of the crash means that several key issues now surround funds of hedge fund investing.

The thunder clouds over funds of funds massed quickly and then expended their destructive energy in a couple of cannonading explosions. It may seem long ago now, but in August 2008 most funds of funds were within a couple of hundred basis points of break-even. Then came the crash of Lehman. The ensuing financial turmoil and rapid draining of liquidity from markets saw many funds of funds lose 15% or more in just a few weeks in late September and October.

Bad enough, it seemed. Then just as stability seemed to be returning ahead of the year-end wind down, the Madoff scandal unfolded. For funds invested with Bernard Madoff, the fall-out shows every sign of being catastrophic. Even for bystanders – and that is the overwhelming majority of hedge funds – the consequences of Madoff, both reputational and financial, are grave.

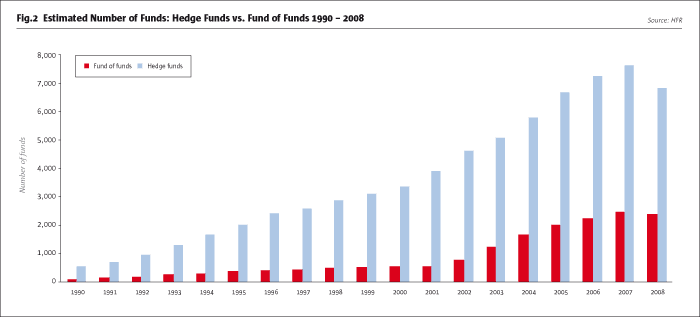

One outcome is that the sheer number of funds of funds – Hedge Fund Research found over 2,300 at the end of 2008 – will contract. “What is happening in hedge fund land is brutal,” says Ken Kinsey-Quick, Head of Multi-manager with Thames River Capital, who sees a fall of 50% or more in the number of funds of funds. “In the dotcom crash some good tech companies went and we will see some good fund of funds go, too. Some funds of funds held Amaranth but survived due to a favourable investment environment at the time. But funds of funds that were in Madoff will find it very difficult to survive given the current difficult investment times.”

Kinsey-Quick’s estimate is broadly accepted among hedge fund practitioners. Too many funds of funds are too small or suffered from a combination of inadequate risk management, unexpected correlation and dismal performance. The casualties will include outright closures like the eight Madoff-hit funds of funds Banco Santander is closing (while providing partial compensation). A long-term phase of consolidation through mergers and acquisitions lasting several years is also expected.

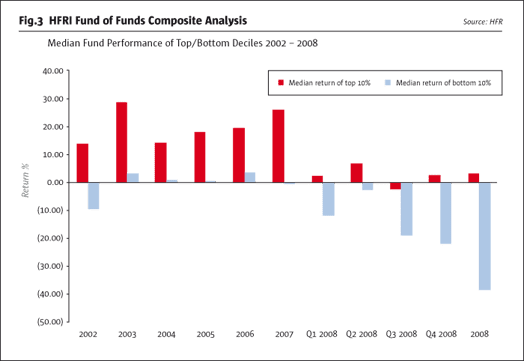

“The funds of funds industry is under pressure because of the exposure some firms and funds had to Madoff Securities,” says Ken Griffiths, President of Hedge Fund Research. “But ahead of that was poor performance. The industry is under pressure primarily due to its performance for the year.” That saw the HFRI Fund of Funds Composite Index fall 20.68% – or over 200 basis points more than the HFRI Fund Weighted Composite Index of over 2,000 hedge funds.

Among funds of funds executives there is consensus that the survivors will be top quartile performers, those that have scale and new firms that are created through mergers with rivals. With the failure of diversification, funds of funds targeting niche directional strategies may move toward centre stage. There is also agreement that funds of funds will be keenly focused on improving manager selection, weeding out correlation and upgrading risk measurement and management. In each area the overhauls will be qualitative and quantitative in scope.

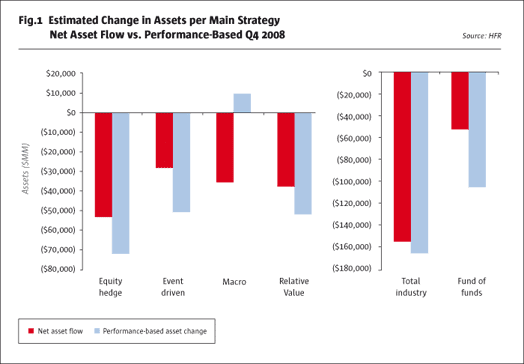

But while all of that is unfolding funds of funds will be operating with far less assets. HFR’s latest figures show investors pulled US$50 billion from funds of funds in the fourth quarter, while drawdowns ate up a further US$103 billion in AUM (See Fig.1). Paradoxically, the 2008 downturn is likely to offer remaining and new investors the opportunity to make better returns with reduced risk levels during 2009 and later as fewer funds and less bank proprietary desk trading make it easier for surviving portfolio managers to trade profitably.

“In terms of consolidation within the industry that is very good news for investors,” says Graham Martin, Managing Director, at Optima Europe. “If you a look back a couple of years ago, the hedge fund industry was attracting a lot of players; there were more crowded trades and also less robust businesses as well. What we saw in 2008 is going to help weed out the industry. Some fund of fund managers had exposure to the high profile problem single managers, some have low asset levels and with regulatory costs rising, they will have to move away from the industry.”

Institutional flows continue

It may be premature to assess the long run impact of the events of 2008 but so far there is evidence that institutional investors are set to build on their relatively recent allocations to funds offunds. Many pension funds, for example, have only begun allocating to hedge funds in the past three years. Consequently, exposure levels are likely to be in the low single digit percentages as part of a long term programme of building, say, high single digit or double digit percentage exposure to absolute return investments.

Omar Kodmani, Senior Executive Officer with Permal in London, is bullish about asset growth from institutional investors. This is a relative game changer for Permal, whose original client base from its founding in 1973 is high net worth clients and family offices. “We have seen institutions becoming much more important to our business,” he says. “Eventually we see institutions and high net worth clients coming into balance.”

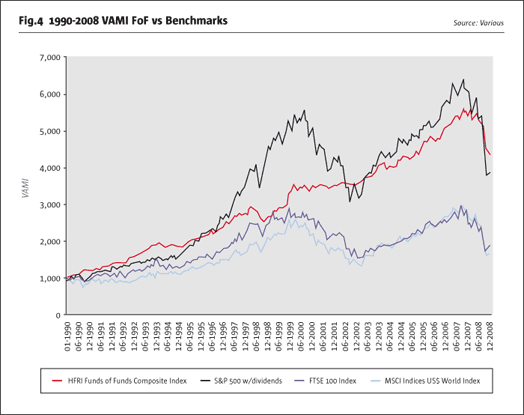

The reasons for this are clear. Institutions have increasingly embraced asset liability modelling since the late 1990s as typical 60/40 equity/bond allocations have struggled to deliver much more than 2% compound annual returns. In comparison, well managed funds of funds have delivered closer to 10% compounded returns, including 2008’s drawdown, with less volatility and less risk.

Randall Dillard, a partner with funds of funds operator Liongate, says institutional surveys show that institutional investors are not attempting to withdraw from funds of funds or the hedge fund market. “Funds of funds are important in what is a complicated market,” he says. Dillard expects funds of funds to bounce back strongly and take 50% of the allocations to hedge funds over the next two years.

Funds of funds also benefit from the complexity and heterogeneity of the hedge fund market. Investors are expected to require the resources of a specialist intermediary, even if their total number shrinks.

“The complexity is not going away, it is growing,” says Eric Bissonnier, Partner and Chief Investment Officer at EIM, the Swiss-based funds of funds and managed portfolio operator. “In terms of asset allocation we can really make a difference. We are not seeing an alternative to intermediaries doing asset allocation and due diligence, especially for institutions. There aren’t alternatives if you want to invest in hedge funds.”

Liongate’s Dillard says the redemptions from hedge funds are like the short term outflows from mutual funds to bonds. “When money flows back into mutual funds it will flow back to hedge funds since they can demonstrate less beta, more diversification and less operational risk,” he says. “In this current market, having assets that capture opportunity and diversify risk better is more suitable than long-only investing.”

Others accept the thrust of this but with caveats. One is that investors are putting a premium on fund transparency. Another is that diversification, on its own, is not necessarily a sine qua non of prudent portfolio management given its failure in recent quarters to outperform cash.

What’s more, now that the crisis may have largely played out, investors can place the downturn in a historical context. After all, hedge funds have suffered big drawdowns before – the mid-1970s, 1994 and 1998 – so there is a pattern to declines and upswings.

“There is a historical pattern of hedge fund cyclicality,” says Kier Boley, the investment manager responsible for GAM’s emerging markets and Asian multi-manager investments as well as managing a commodities-focused fund of hedge funds. “That cyclicality is also drawing institutional attention since they understand it.”

But there are other positives for funds of funds. One is that the rivalry from multi-strategy firms appears to be waning. Citadel, for example, is reconfiguring its business model since most investors don’t want to invest in convertibles or distressed assets. Nor do many investors want the spread of a typical multi-strategy portfolio.

In addition, new opportunities are emerging for funds of funds to develop and market portfolios targeting themes. A directional offering might offer a portfolio spanning global macro and managed futures funds. A market neutral equity long/short fund might assemble a portfolio of low beta, high turnover trading funds. Conversely, event driven funds of funds might target loans or distressed assets albeit with a fund structure that requires a multi-year year commitment from investors.

“We are seeing investors that want to get back to basics and move away from some of the more opaque approaches,” says Optima’s Martin. “A lot of institutions, such as pension schemes, are also looking at situations where they need to invest money into their equity portfolios, because they have dropped so much, to get them back up to their target weighting. Because the expectation is that we are not going to enter into another bull market, where the market does not go up in a straight line, but where stock selection is going to be key, we are seeing these investors considering changes to their statement of investment principles so that some of that equity investment can be put into long/short equity, not just long only.”

Funds of funds are flexible, dampen risk

The ability to damp market risk is one attribute for institutional investors. Another is the flexibility of funds of funds. “Depending on the mandate, a fund of hedge funds can be a good equity substitute or a good bond substitute,” Permal’s Kodmani says. Anglo Saxons, he adds, see hedge funds as an equity substitute whereas continental European institutions see them as an absolute return vehicle and bond substitute.

Clearly, the Janus-like characteristics of hedge funds can be a useful quality in the hands of skilled investors. For the less experienced or less skilled, however, what is a positive attribute can result in misunderstanding. Inevitably, this, too, occurred in the boom as funds were propelled into the market and investors waded in to make allocations.

In short, it wasn’t just Madoff who mis-sold hedge fund products. Though outright fraud was kept firmly at the margins across the industry, there were many cases where investors were mis-sold strategies, especially when it came to expectations about liquidity. How this occurred and a related tightening up of marketing processes is necessarily part of the hedge fund industry’s current purdah.

GAM was one firm that was uncomfortable with the vast flow of money into the industry and actually closed its main funds of funds to new inflows for nearly two years from 2004. The move probably cost it the top slot in assets under management among funds of funds providers, not to mention the attendant fee income. It also raised plenty of eyebrows among rivals and investors who were making unprecedented allocations to absolute return strategies. GAM’s move came in response to the greater than 20% annual gains in hedge fund AUM that occurred for the three years through 2004. “Through that period it became more challenging to fund the right mangers if you were rigorous in your approach,” says Boley. “Clearly we hit a period of long biased investing and also saw mis-matches between money that was invested on short time horizons but was being put in illiquid strategies,” he says. “Now this is causing the fund of funds industry some real turmoil.”

Risk processes recalibrated

Likely the area of most focus in early 2009 for funds of funds is riskprocesses. Investors are reassessing risk management and looking for more transparent and timely data about their allocations. Funds of funds will cater to this or suffer in the market accordingly.

A new process was introduced last year at Caliburn Capital Partners. It aims to measure the total risk of a hedge fund portfolio by capturing changes in the volatility and correlation of markets as well as the idiosyncratic risks and unobserved tails of hedge funds.

“We are broadening from a pure quant target that looks to capture factor exposure to one that is a combined VaR with market risk factor, plus residual, plus tail,” says Jeremy Rowlands, Managing Partner and CEO at Caliburn. “Those tails, which have to be measured and built qualitatively, have caught a lot of people out in an environment that saw deleveraging and assets going down in price. We have tried to incorporate a VaR target that encompasses all those issues. Because of the way it is estimated it tends to adapt more rapidly to changing markets. That would have been helpful in capturing the rate of change in some areas last year.” However because it incorporates an adjustment for idiosyncratic risk it allows for hedge fund underperformance. Moreover, because it incorporates a qualitative estimate of tail risk it allows for the effects of the low probability events and the effects of concentration, liquidity, crowding and leverage.

The unpredictability of 2008 has hurt some reputations in the hedge fund industry. It has also amplified philosophical debates ignited by Nicholas Taleb, and others, about the nature of probability and the difficulty of predicting distributions. Even successful managers acknowledge that the nature of recent events has ushered in industry-wide reviews of the approach to risk.

“I wouldn’t be surprised if everyone is having a look at their risk process,” says Optima’s Martin. “We are constantly reviewing what’s working and what’s not working in our business. Obviously 2008 is a year when you want to see what contribution risk management has made in a nuts and bolts way. The conclusion we drew from looking at 2008 – the analysis of looking rear-view [was that] VaR and conditional VaR, didn’t add as much value as we’d have liked, mainly due to the time lag relating to that kind of analysis. Current in-depth portfolio analysis proved a lot more value added.”

The onset of the credit crisis in 2007 that sparked global deleveraging has passed its initial phase. Among banks, it is accepted wisdom that further contractions in credit will almost certainly be forthcoming. Hedge funds, being more adaptive and dependent on bank financing, have gone through deleveraging rapidly.

“The crisis of deleveraging pressure is dissipating,” says Liongate’s Dillard. “People de-levered very rapidly last quarter. That process is two thirds over for hedge funds and they are not very levered. Hedge funds are less leveraged that banks or private equity.” He says that portfolio assets are around one third in cash after last year’s rounds of indiscriminate selling to raise liquidity. “You are seeing opportunities develop now in the most liquid parts of the higher quality credit markets. The corner is slowly being turned.”

How long it will take for relative normalcy to come back is unclear. After such a large bust confidence is short and risk taking has been dialled way down. With the sources of leverage being much more restricted, it is also clear that opportunities, when they appear, will linger awhile.

Standards to evolve

The tough market conditions and losses suffered by investors have combined with pressures on liquidity to force many firms to look at how their funds of funds are structured. In addition, investor pressure for transparent, timely reports drilling into into all the underlying managers and strategies in funds of funds has jumped. It all means that the terms and conditions investors seek are becoming more onerous – no surprise given the large number of gates that went up during the fourth quarter of 2008. “One outcome of this profound trauma was the fact that hedge fund managers’ options to change investment redemption terms will be more limited,” says Liongate’s Dillard. “In some cases, changes in redemption terms have benefitted investors. The difference is that hedge fund managers will be under more obligation to consult and bring investors into the decision making process in the event that investment terms change. To be fair, many did. The better hedge fund managers consulted with their investors and asked them to approve it, often giving reduced fees as compensation. That is good governance. One outcome of the lessons we learned is that governance procedures on investor participation will become normal – like it is for shareholders that invest in a public company.”

He adds: “If you are going to change the terms of how investor capital is invested you have to consult. Managers that have done this have got support. The one’s who didn’t have had their businesses damaged.”

Standards have risen up the agenda at EIM, even if most of its business is in running customised portfolios for institutions rather than co-mingled funds of funds. “There is definitely some evolution in the structures of the funds and the transparency requirements,” Bissonnier says.

At Permal, this has brought about rapid changes in fund structures. The funds of funds operator has rapidly expanded the number of managed accounts it uses with hedge fund managers. It now has this arrangement with 40 of some 200 underlying managers but is accelerating the rollout of the structure. “It has been an area of activity for us for a couple of years, but we stepped up the pace in 2008,” says Permal’s Kodmani.

Managed accounts offer investors several benefits. The holder of the account avoids co-mingling with other investors. Transparency and liquidity are improved as is the ability to tailor the investment mandate through customisation. Incremental costs may rise but for institutions that could be an acceptable price to pay for greater control and oversight.

Rebuilding investor relations

Now that the boom is in the past, funds of funds mangers need to rebuild relations with investors and clarify the hedge fund industry’s key selling points. A big part of this is educating investors about what hedge funds do and how risk operates.

“Investors are dissatisfied with the industry as a whole,” says GAM’s Boley. “Investors and managers have to realise that investing in hedge funds is risky – just liking investing in equities and fixed income.” A 10%-12% return objective, he notes, has to imply volatility of 5%-7%. “Volatility of less than that isn’t feasible,” he says, adding that Madoff typified the flabby approach to risk that spread through much of the industry. “Investors were led to believe that low volatility could be made risk free. It can’t.”

“GAM says hedge funds have risk but the most important thing is that the risk is non-correlated to equities,” Boley says. “If you want a multi-strategy product, you are going to have a correlation of 0.2-0.5. If you want -0.2 to +0.2 you use trading strategies though volatility will go up to 6%-9%. That is the level or range you need to accept to come back to the industry.”

For EIM, frustration about the credit downturn was made worse by making adjustments that anticipated it, while falling short of adjusting portfolios sufficiently for the magnitude of the changes. “That part is not difficult to understand, especially for institutional clients,” says Bissonnier. “The question now is how can you make money? The answer for the next couple of quarters is you to have stay liquid and focus on trading strategies. Don’t make investments that are based on an assessment of value – value is very theoretical.”

The uncertainty about value has had a knock on impact on risk. With the former uncertain, risk aversion has spread. Invariably, this is a temporary phase but recent market events continue to make most investors and portfolio managers cautious.

“Gradually we are getting to the point where the balance of risk and reward is shifting,” Caliburn’s Rowlands says. “Increasingly we are seeing the emergence of valuations that are pretty extraordinary by any sort of historical measure and it is these opportunities which we expect to feed the thematic strategic asset allocation process going forward. At the same time, there is a very high level of uncertainty on any number of levels. You are dealing with the balance of unprecedented deleveraging and pump priming. How are those going to play out? At present no one can have a high degree of confidence about the outcome or the timing of it. However, I would argue that a research-based thematic approach is best placed to be able to build optionality to, and profit from, these shifting pockets of dislocation as greater levels of certainty emerge.”

In such an environment, close risk management and adept manager selection offer funds of funds operators an opportunity to provide value and regain investor custom. The firms that succeed in reassuring investors through investing in standards and the development of better products will be best positioned for the upturn in absolute return investing when it comes.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 44

Funds of Hedge Funds

2008 reversals spur evolution in risk management, portfolio construction and accountability

BILL McINTOSH

Originally published in the February 2009 issue