GAM’s parent company, GAM Holding, has a stock exchange listing in Switzerland – a country seen as a loose confederation of relatively independent cantons, where hardly anybody inside or outside the alpine state has heard of the President or the Prime Minister. Nobody has heard of a GAM chief investment officer, because no group CIO exists and there is no “house view” on specific markets. David Smith is CIO of GAM’s Alternative Investment Solutions unit, and does not interfere in investment decisions of individual single-manager funds. GAM is a growing group of investment professionals, some in-house, some external, who have a lot of autonomy over how they invest – and who display differing individual styles, just as the cantons have different characters.

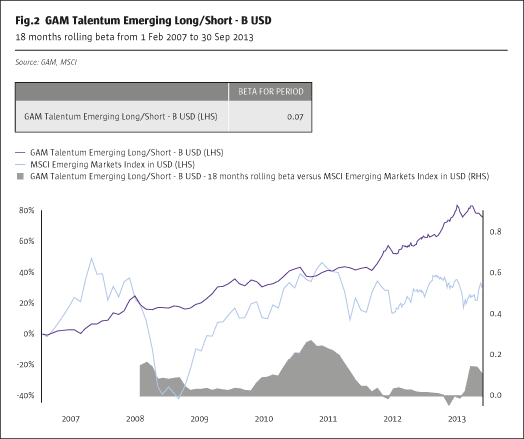

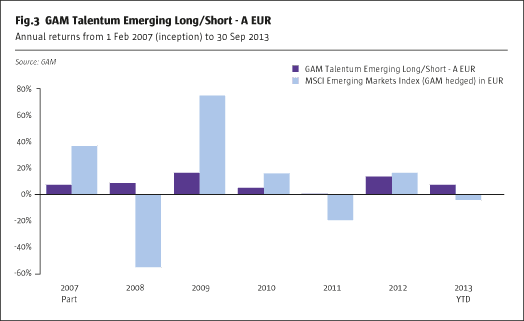

GAM offers a range of actively managed strategies – from long only to sophisticated absolute return products – across a range of asset classes and using different techniques. Some of the hedge funds, such as Mark Hawtin’s, have a structurally net long equities bias while funds like the Talentum range have very much lower equity betas. Others, such as Adrian Owens’ fixed income and currency funds, set store by their low correlation to equities, and indeed bonds, with Paul McNamara’s emerging market rates product also lowly correlated to its asset class. Another example of products with low correlation to traditional asset classes is GAM’s cat bond and insurance-linked securities offering, managed by “arguably the world’s leading and most experienced manager in this space, Fermat Capital Management LLC,” says GAM group head of distribution and marketing, Craig Wallis. While several funds in the range are shooting for double-digit returns – and expect similar levels of volatility – others are aiming at a single-digit spread over cash, and in fact most of the strategies can be tailored to investor risk appetites. Some funds are run not just by boutiques but by single-minded individuals, such as Gifford Combs, while others take a more team-based decision-making approach. Although most of the funds use some form of fundamental analysis, some such as Sushil Wadhwani’s also employ technical inputs. GAM’s range runs the gamut from discretionary to systematic, with “quantamental” hybrids in between, and there is even a new product that takes active asset allocation views using a spectrum of traditional and alternative risk premia – and applies an innovative form of risk parity which GAM calls “Expected Drawdown Parity”.

Active management

What these funds do share in common is the one constant house view: a belief that active management can add value. Wallis, who joined GAM in the 1990s, says, “We expect to add value over and above betas over the medium term”. This does not mean every month, or even every year, but through a multi-year market cycle the managers are expected to earn their keep. This year almost all of the discretionary absolute return UCITS were in profit when we spoke. Broadly speaking GAM funds have been on the right side of macro beta moves this year: capturing some of the upside in developed market equities, and largely avoiding (or in some cases profiting from) the sell-offs seen in bonds, credit, and emerging markets. Alpha has also been extracted.

Whistlestop tour of range

So, for instance, Wallis says 2013 has been “a good year for active equity as correlations between securities and sectors have come down,” increasing scope for stock and sector pickers to add alpha. On the long side, GAM managers like Michael Lai in China, the number one UCITS China manager on a five-year basis, Gordon Grender in the US, who is the number one US manager in the IMA sector on a five-year basis, and Mark Hawtin, who is the number two fund in the IMA technology sector since launch, have all beaten their benchmarks this year. We profiled Jamie Rosenwald’s Dalton earlier this year, and one of its managers, Gifford Combs’ GAM Global Selector, won the 2012 UCITS Hedge award for Best Performing Long/Short Equity Global – Developed Markets fund, leading to a profile published in March. This year Combs has made more than 8% from his concentrated positions mainly in US financial stocks that he views as undervalued; yet his general caution on valuations leads him to retain a high cash weighting. The stock pickers of former Arkos, acquired by GAM in 2012 and profiled below, have also done well across all of their equity long/short products, which focus on European, emerging, and financial sector equities.

The Hedge Fund Journal has previously profiled many other funds from the GAM stable. We take a quick canter past each fund, before flagging up in a little more detail three of the past year’s additions: GAM Barclays Dynamic, Arkos, and QFS.

That Adrian Owens has never had any bias to carry trades – either in currencies or fixed income – has been particularly helpful this year, as he has made around 2% in both his GAM Global Rates, and GAM Discretionary FX, both of which have won UCITS Hedge awards before. Tim Haywood and Daniel Sheard’s GAM Absolute Return Fixed Income strategy has also preserved capital amid the bond sell-off that has inflicted losses on unhedged bond funds. The strategy, which dates back to 2004, can allocate to all forms of fixed income, and has at times even been slightly short of interest rate duration, helping to produce positive returns this year. Paul McNamara’s Emerging Market Rates fund is slightly down on the year, but it made money during the sell-off of emerging markets debt and in former years it has profited from the under-researched nature of many emerging markets. Ben Helm and Alex McKnight’s GAM Star Global Convertible Bond fund was one of the products acquired when GAM bought Augustus some years ago. In the convertible space they continue to generate returns from their three sub-strategies: classic arbitrage of mispriced convertibles, which can contain “free options”; directional trades with asymmetric risk/return profiles on equity and credit ; and event-driven trades including those where convertibles profit from takeovers. Sushil Wadhwani’s GAM Star Keynes Quantitative Strategies has, like many CTA strategies, found financial markets challenging for some time. Unlike some CTAs, Wadhwani has preserved capital since 2008, and he told us earlier this year that he thinks trend-following could enjoy a resurgence as global macroeconomic imbalances are unwound.

Introducing QFS

GAM’s latest fund addition on the quant side is, as usual, designed to add something new to the range. In common with all the others, it was vetted by David Smith’s fund of funds team. Everyone knows that systematic strategies have generally had a hard time since 2008, but GAM think that the analytical approach taken by QFS, who were founded in 1988 by Sandy Grossman, differentiates it, both in terms of process and return profile. Its fundamental research emphasises capital flows. QFS is not just uncorrelated with conventional asset classes like bonds and equities (as are many CTAs ), but is also uncorrelated with generic types of alternative beta, such as trend and value. It has one of the longest track records in the space, dating back to 1988. And unlike some UCITS with somewhat subdued volatility targets, Wallis says that the 12% volatility target is unusual. Although Wallis admits that the strategy has continued to struggle this year, he tentatively ventures that replacing quantitative easing with tapering could help to engender a normalisation of markets that might benefit quant funds.

Introducing GAM Star Barclays Dynamic Multi Index Allocation

The interest in portoflios of cleverly constructed betas or risk premia has not been ignored by GAM. Its fund of funds team has turned their hand to an innovative product, run by David Smith and Chi Lee, that constructs portfolios of traditional and alternative risk premia. The UCITS fund structure charges only a management fee with no performance fees; institutional clients can also access segregated accounts.

What is also unusual about this product is its approach to sizing positions. Portfolio construction is driven by GAM’s Expected Drawdown Parity, which is very different, in theory and practice, from traditional, backward-looking risk parity approaches. Classic risk parity sizes positions inversely to volatility, which penalises position sizes for upside volatility just as much as downside volatility. So conventional risk parity approaches end up with the largest long positions in markets with the lowest historical volatility, namely government bonds, but the GAM approach focuses instead on expected drawdowns which can sometimes come to the opposite conclusion. Taking bonds as an example, earlier this year GAM analysis suggested upside of 1.7% but a potential drawdown of 15%. The conclusion was to go short of bonds, using one of the Barclays indices. Whilst other risk parity funds incurred losses from frequently heavy weightings in fixed income, GAM was on the other side of that trade and profited.

GAM uses the fund of funds team’s techniques, tried and tested over 25 years through the GAM Trading product, to make both straightforward directional bets on asset classes, such as the bond short, and to take positions in alternative risk premia such as currency carry trades, merger arbitrage, trend-following strategies or volatility. Whereas allocating to a hedge fund tends to entail the underlying manager rebalancing amongst a package of multiple risk premia, the granularity of Barclays’ 4,000 indices allows GAM to pinpoint specific risk premia. The fund has increased its number of positions to 20 this year, as declining correlations amongst asset classes and markets have made it more worthwhile to add indices. GAM chose to partner with Barclays as an index provider after several years of dialogue and extensive due diligence that verified the breadth and depth of Barclays’ trading floors.

The fund targets LIBOR +4 to 6%, with volatility 3 to 5%, but the low cash usage of the strategy and the nature of the portfolio construction techniques allows the manager to expand or reduce the amount of risk premia exposure dependent on the client’s requirement. As a result it can be suitably tailored to a client’s requirements, and GAM have found this to be of significant interest for institutional clients.

Introducing Arkos

Lugano-based Arkos was acquired by GAM in June of 2012, and has for nearly a decade been generating steady returns from a low beta, broadly market-neutral approach. The managers basically go long on companies they expect to beat consensus earnings estimates, and go short of those they expect to miss those numbers – but there are filters. Two filters apply, which help to size positions and can in some cases even override the earnings surprise signal. The team are more likely to buy cheaper companies and short those with rich valuations. It also seeks confirmation from price momentum. If a stock expected to trounce consensus estimates has been precipitously falling, the managers may take the pragmatic view that somebody, somewhere, knows something that they do not, and stay away. Similarly, if stocks that they think may miss estimates are showing strong share prices, they are less likely to short them and might stand aside.

To identify companies likely to generate earnings surprises, the former Arkos team, now GAM’s non-directional equity team, uses a discretionary, qualitative and fundamental approach that starts with quantitative screens looking for firms that have seen sharp revisions in either direction. Next they like to talk to sell-side analysts whose estimates diverge widely from the consensus, to home in on variant forecasts of revenues, volumes profits and margins. Further investigation is carried out by talking to company management. Finally they build a spreadsheet detailing the analysis of why the target company is expected to deviate from the consensus.

Until 2009 the process was entirely bottom-up. The two years when they lagged behind their long run average returns had different explanations and different top-down responses. After shorting cyclicals ate into 2009 returns a macro overlay was introduced, which monitors macro indicators such as consumer confidence, and purchasing manager confidence. If these indicators are perking up, the team avoids shorting cyclicals. The reverse also applies – when the leading macro numbers are heading south, they will not buy cyclicals.

Two of the funds – World Invest Absolute Return and Absolute Emerging – are worth examining. Both funds’ focus on stock picking and low market exposure has aided them in delivering alpha and significantly outperforming long indices. The Absolute Emerging fund did this to remarkable effect in 2008, 2011 and 2013 – all years when the strategy was positive despite the long equity indices being materially negative. For example in 2008 the fund gained 8.7% while the MSCI Emerging Market Index lost more than half its value. The investment approach employed by the Lugano-based team has seen strong interest from clients, and as a consequence the Europe strategy recently closed to new investors. The funds are available in both offshore and UCITS format, with the same underlying portfolio of stocks, but with different levels of market exposure. The team also developed a financials-focused version of the market-neutral strategy. It launched in the challenging climate for fundamental stockpickers in 2010 but has still annualised close to 3%. Gianmarco Mondani, chief investment officer of the non-directional equity team, thinks that dispersion in the financial sector offers the managers lots of stock-picking potential and a good opportunity set for the strategy.

Market normalisation for GAM’s non-directional funds, however, does not mean a bull market. In contrast to Mark Hawtin’s constructive stance on European equities, Mondani has a fairly cautious outlook for European equities. He argues that with stagnant earnings, the bull market has been driven mainly by multiples expanding to the point where they estimate that European stocks are trading at around 14 times earnings. According to Mondani, this is not cheap, and with rising interest rates he also sees limited scope for any further multiple expansion. In this climate Mondani thinks that total returns might not include much more than dividends, so it really makes sense to seek alpha.

UCITS driving growth

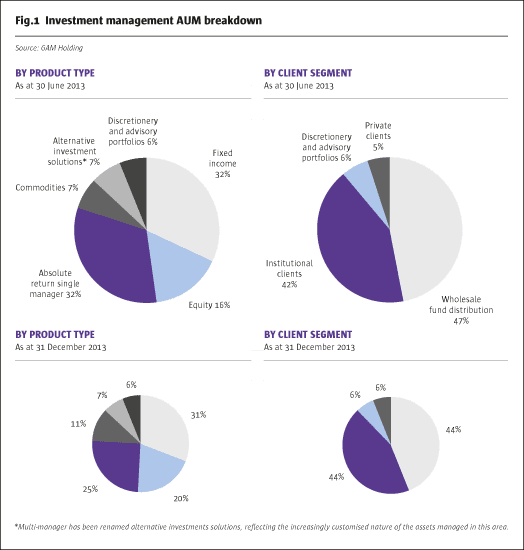

GAM’s shifting asset mix largely reflects broader industry patterns. GAM was once renowned mainly for its fund of hedge funds business, which peaked at assets of $26 billion including products such as GAM Diversity, which has annualised at 8.75% since 1989, and GAM Trading II which annualised at 7.5% since 1997. Today this unit runs just $5.3 billion, but the gap has been more than filled by absolute return strategy assets advancing to $24.6 billion, making up one-third of the assets of $76.1 billion the group manages across its investment management businesses. What was once a predominantly offshore, and private client-driven business running a handful of off-the-peg products has become much more institutionally focused – and even “creates bespoke structures and solutions,” says Wallis – with most strategies available via customised managed accounts. “The institutional business takes longer to build,” he explains, but adds that “ticket sizes can be larger”. GAM will still run offshore structures mainly for institutional clients in the US, Australia and Asia who want them. But the onshore business – UCITS in particular – has grown the fastest in recent years. Wallis thinks this is partly because cash-strapped governments want to encourage investors, particularly tax-paying ones, onshore.

That group assets in absolute return have grown does not mean GAM are insatiable asset gatherers. The group has been disciplined in shutting funds before optimum capacity is reached. Adrian Owens’ Global Rates fund is soft closed, and the Lugano-managed European strategy – only acquired last year – has already hard closed. There is also a waiting list for GAM’s catastrophe bond and insurance-linked security offerings, run by Fermat. These might not be perceived as hedge funds, but they do offer alternative types of risk premia that have shown very low correlations with traditional asset classes and outstanding returns for clients.

Matchmaking hints

As GAM is not a platform, Wallis does not talk about on-boarding new managers, but rather partnering with them. Either GAM or the manager can make the first move, although so far no managers approaching GAM have ended up coming under the umbrella. GAM “tries to find managers who are very differentiated and unusual, with different styles,” says Wallis, adding that GAM is particularly keen to open up access to managers that might be too obscure for investors to easily find. One example here is Gifford Combs of Dalton. Wallis contends that clients buying UCITS would not be likely to hear about a privately owned boutique on the west coast of the US, with a deep value and concentrated approach. Combs is “an unbelievably charismatic individual” who was first discovered by GAM’s fund of funds business. After a successful match-making, GAM’s fund of funds can remain invested, usually via an offshore vehicle, but will not invest in the specific GAM-wrapped fund. This protocol simply avoids conflicts of interest that could arise if GAM used its fund of funds to “double dip” fees by sub-allocating to funds from which it gets an economic benefit.

GAM is “always on the lookout for good strategies,” says Wallis. He is reluctant to be drawn on anything specific that GAM might be scouting for right now, but admits that with one equity long/short fund already hard shut this strategy could be of interest. Wallis warns that newcomers shouldnot assume that the GAM brand comes for free. A drawback for some strategies is the requirement to share some fee income with GAM, which can make potential partnerships uneconomic in some cases – particularly where a constrained return profile makes it hard to justify a level of fees that would make sense for both GAM and a partner. Wallis is prepared to say that the biggest beneficiaries of a tie-up may be managers that are “slightly sub-scale”. These managers can tap into GAM’s relationships with US, Australian and European institutions, for instance. Additionally, some funds have found that GAM can take a knife to certain costs. Wallis says that some smaller funds outsourcing services can find themselves as “price-takers” but GAM’s buying power allows it to act as a “price-setter”.

Back in the 1980s, GAM created a fund offering investors access to Bruce Kovner’s Caxton, which was at that time one of the most sought-after macro funds. As the hedge fund industry has matured GAM has followed suit, and continues to offer investors an eclectic selection of managers, strategies, and fund vehicles.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical