Greenwave Capital Management, LLC runs one discretionary macro strategy, offered at a range of risk levels, through funds or managed accounts. The strategy is predominantly focused on seeking out the best opportunities in G20 foreign exchange. Though themes are medium to long term, the manager is highly selective in picking which ideas to trade at any time, and the core views are managed through tactical trading and robust risk management. Greenwave received The Hedge Fund Journal’s CTA performance award for best risk adjusted returns over three- and five-year periods ending in December 2018, in the discretionary CTA (assets between $250 and $500 million) category. The performance rating measurement is strictly formulaic – 50% Sharpe, 25% Sortino and 25% Calmar.

A surfer can’t move unless he has either a wave or a current, and a trader can’t profit unless he has either volatility or a trend.

Jamie Charles, CIO, Greenwave, Capital

Return profile

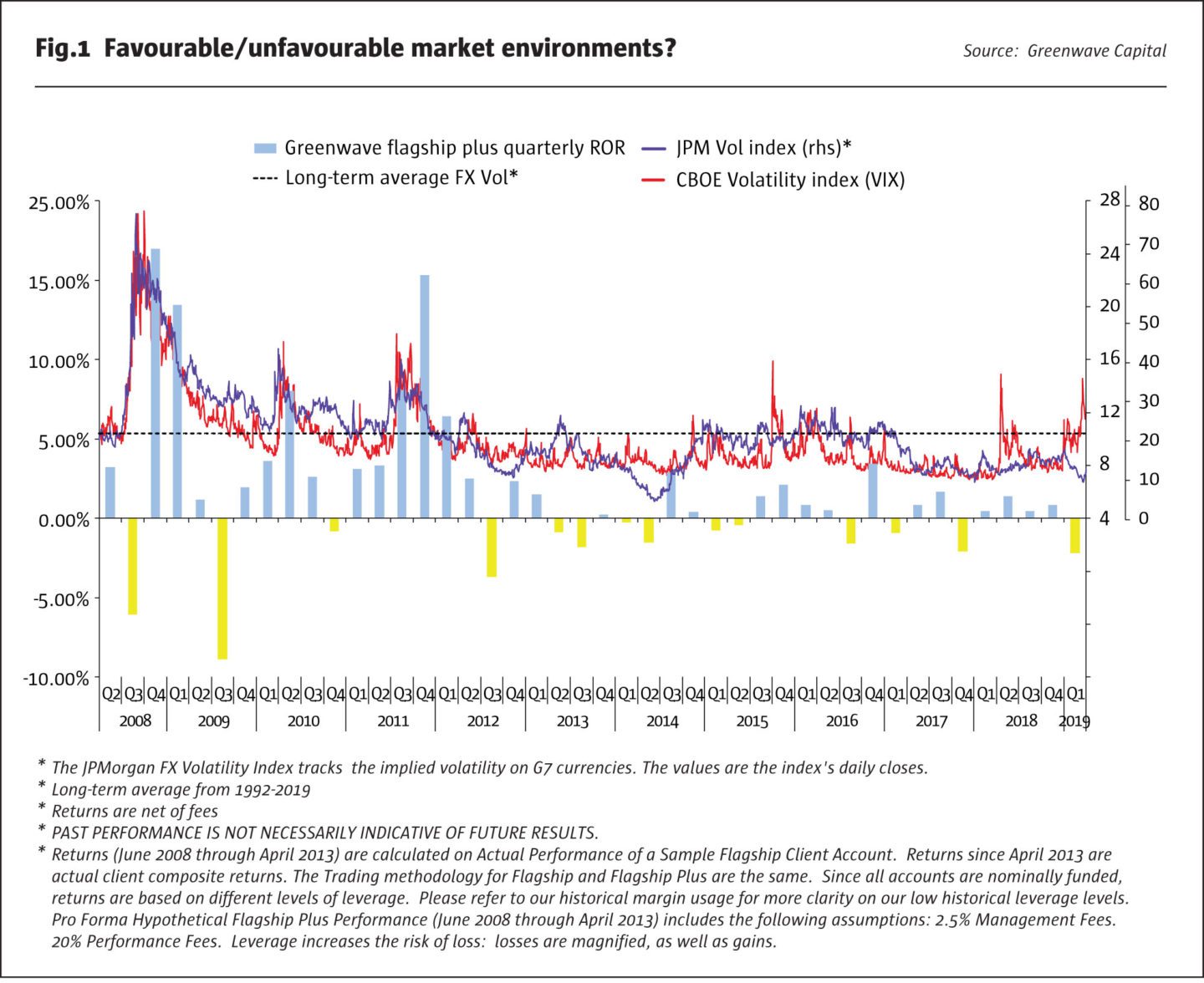

The CIO, Jamie Charles, has been remarkably consistent for a macro trader, having only had two losing years in the past twenty (which are made up of 12 years at Greenwave, and eight previous years while managing capital for individual clients and macro fund Denali Asset Management). There were no losing years prior to 2013. The only two down years have been 2013 and 2017, both of which saw sharp declines in implied and/or realised volatility in currencies – an environment that can present headwinds for Charles’ approach. When he has been able to foresee periods of low volatility, the trading style has been modified accordingly.

Charles is distinguished in having been among few managers to have profited in the three very different years of 2007, 2008 and 2009, characterised by bubble, bust and recovery. Similarly, Greenwave delivered positive results in February, October and December of 2018 – months that saw both equity stress and poor performance for many diversifying strategies such as traditional trend-following CTAs. Returns have averaged c.7% with c.12% volatility, which is a reasonable ratio for a liquid strategy trading through multiple cycles. But it is the pattern of returns that is most interesting from a portfolio diversification perspective: historically, Greenwave has been negatively correlated to equities (-0.33 vs the S&P since inception/-0.55 when the S&P is down) and positively correlated to market volatility. In addition, most of Greenwave’s volatility is on the upside, and the return profile has a huge positive skew, with stand-out months including +23.82% in October 2008, and +18.54% in September 2011 (for the Flagship Plus program). Not surprisingly this is also reflected in a very low downside volatility of only 4.73%.

These extraordinary numbers arose partly because the manager had the courage of his convictions. Some strategies – including many currency overlay mandates – target fairly constant volatility and/or gross exposure over time, whereas Greenwave adjusts exposure according to the opportunity set. As Charles says, “typically rising vol or elevated vol environments are more fertile for us, so it is simply not prudent for me to lever up in a less-than-beneficial environment”. Margin to equity normally averages around 3% for the 1x leveraged version, but has ephemerally been much higher when the context supports it. The manager has often been adept at recognising a good environment for the strategy and perhaps even more importantly – a bad environment. “The highs in margin to equity in 2008 and 2011 were substantially caused by his desire to expand exposure to take advantage of fundamental catalysts. Hikes in broker and/or exchange margin rates accounted for only a small part of the increased margin,” recalls Chief Operating Officer, John Apperson, who has previous experience as a macro focused fund of funds allocator and global macro trader. He was invested with Greenwave before joining the team. “As an allocator, I saw Greenwave play two important roles in my portfolio. One was a diversifier due to low correlation, and the second was as sort of a call option on market volatility but with positive carry.”

Opportunity set

“2008 and 2011 were much more profitable years because trading ranges were far wider. In 2011, the Swiss pegged their Franc, the European sovereign debt crisis was in full swing, and it is easy to forget that currency pairs such as EUR USD gyrated by as much as 15% in a week. Recently, 4% would have been a big move,” he adds.

It is harder, but not impossible, to profit in a lower volatility climate like in 2018 where vol in rates and FX remained subdued despite the stress in equity markets. “The key,” says Charles, “is correctly identifying the condition of the market. Trading on technical breakouts is common in this industry, but I may have made more money over my career on false breakouts. A high or rising volatility environment is better.”

“A surfer can’t move unless he has either a wave or a current, and a trader can’t profit unless he has either volatility or a trend,” he continues. Trends and volatility are the two key determinants of returns – and the two together are the ideal cocktail. “In a low volatility, trending market, we may capture some part of the move, but sometimes will not get to the necessary reward-to-risk to make it worthwhile re-engaging. Random vol/market noise is somewhat harder to account for in a calmer market,” he adds.

Fundamental and tactical

“We trade in the direction of fundamentals, but use technicals to gauge optimal timing, trade entry points, and exposure. Top-down macroeconomic analysis identifies long term themes, and quantitative, mathematical, and technical filters help us to navigate the short to medium term behavioural influences on price. One strength of this process is that it minimizes the emotion of trading. Apperson points out “of six or twelve themes, only two or three are likely to be active in the portfolio at any one time”.

“For instance”, he continues “a core theme recently has been short the Euro, partly because the Eurozone has the world’s second largest trade surplus with the US after China, and could therefore be vulnerable as the Trump administration’s likely next target on trade. Given that the ECB has few arrows left in its quiver, Charles also sees an outside chance of fiscal easing in Germany. The quantum of the anticipated move depends largely on the prevailing volatility climate. If volatility remains subdued, the Euro might simply establish a new lower but still narrow range of 1.08 – 1.12. If volatility picks up it might move more meaningfully – eight or 10 big figures lower. But we have been tactical in sometimes stepping aside from this trade when technicals did not look good.”

Fundamental trades are typically multi-week to multi-month and have longer time horizons than tactical trades, which might last a few days. But timing is of the essence for both types. As Charles says, “to be right at the wrong time is the same as being wrong”. Both top down, fundamental ideas and tactical trades are only implemented when the second stage of the process – a proprietary multi-layered mathematical, quantitative and technical filter – provides trade validation and indicates a minimum of a three to one reward to risk ratio. These indicators are calculated in house because, as Charles explains, “it is very important to generate our own ideas, create our own research, and I can’t stress this enough – cross-check our own data, as without doing this we would have to call the process into question”. Managing director and analyst, Sean Callaway, assists Charles with research and trading.

Combining the fundamentally driven first step with the quantitative step two forces patience and discipline on investment decisions. “It’s the second mouse who gets the cheese,” says Charles, who will sometime wait for months or even quarters before getting the necessary confirmation to engage in a theme. Nobody pays us to be right long term. The objective is to make money for our clients, and we believe the optimal approach is to capture the best risk-adjusted part of a trade. If a key trend lasts a year, we may be involved several times along the way,” says Charles.

Longer term trades typically last six weeks or more, with exposures managed tactically over time. Losing trades tend to get stopped out more quickly. Every trade has a stop, and stops are calibrated to market volatility with a goal of being placed outside of what is deemed to be market “noise” or random movement.

Greenwave will always exit trades completely if the fundamental view changes, and at other times trade around a core thematic exposure based on technicals. Separate, purely tactical trading often complements the fundamentally driven positioning. Recently, Greenwave had a bullish stance on the US Dollar, and the US Non-Farm Payroll number came in below expectations. “Thematic exposures lost 0.50% to 0.60% on the day, but tactical trading made about 0.20% or 0.30%, mitigating the loss on fundamental trades. It is fairly rare for us to pursue tactical trades on the opposite side of its fundamental position, but we often find short-term opportunities in other markets,” says Apperson.

20

Greenwave monitors about 40 currencies but actively trades 20, in the US, Canada, Mexico, Asia, Japan, UK, Europe, Scandinavia, Australia, New Zealand, and emerging markets such as South Africa.

Investment universe

Greenwave monitors about 40 currencies but actively trades 20, in the US, Canada, Mexico, Asia, Japan, UK, Europe, Scandinavia, Australia, New Zealand, and emerging markets such as South Africa. “The global synchronisation of central bank policy post financial crisis and the perversion of negative interest rates have been the biggest changes over Charles’ near 40-year career, which included 17 years of experience proprietary trading and market making at banks (Bank of America; Citigroup; Dresdner; First Chicago; Credit Suisse First Boston and ABN Amro, at various times in New York, Chicago and Frankfurt) before he moved to the buy side,” says Apperson.

The other key change has been evolution of market liquidity. “We define G20 in terms of liquidity, which is not necessarily correlated with the size of the economy. New Zealand may be only the 50th largest economy, but its open and trade-intensive economy has a very liquid currency. Liquidity in the offshore Chinese Yuan has also attained the thresholds we need,” says Apperson and is now part of Greenwave’s tradeable universe. “Liquidity is essential to our risk management,” says Charles. “Your risk management plan is only as good as your ability to execute that plan.” Greenwave trades a mixture of OTC FX and FX futures; with OTC trades converted to futures using a mechanism called EFRP (Exchange for Related Positions). Options are occasionally traded.

Greenwave is most active in currencies but does make opportunistic excursions into other asset classes. For instance, the fourth quarter of 2018 saw some of the lowest realised volatility for currencies on record, which limited opportunities in FX. However, vol was rising in equity markets late last year creating an exploitable window, which contributed most of the profits for the quarter. As usual, the fundamentals needed to dovetail with the technicals: “We formed a fundamentally bearish view in September and October 2018, based partly on the rise in US Treasury yields. This view was then validated by a technical market formation in early October, which saw a reversal pattern in all three major US equity indices,” recalls Charles.

Greenwave can also trade: selected US, German, UK and Japanese government bonds; US, German, UK and Japanese equity indices; oil, gold and occasionally copper. The manager views gold as being effectively “a currency without a country, and oil is truly the world’s global currency”.

Vehicles

Assets are c.USD 380 million across all vehicles and capacity is estimated as being at least $1 billion (calibrated to 1x leverage), though it is probably much higher given the liquidity of the markets traded. A significant share of assets is internal. Staff, including co-founder and CFO, Raj Idnani, are personally invested in the strategy. Idnani’s family office also owns a minority stake in the management company, which is majority owned by Charles.

The fund – administered by the most popular CTA administrator, NAV Consulting – currently offers very competitive risk-adjusted fees: its founders’ class charges 0.5% management fee and 15% performance fee and is a four times leveraged version of the Flagship Plus strategy.

Most of the assets are in separately managed accounts, where the back-office function is outsourced to CTA Services, but individual investors specify where their managed accounts clear – hence Greenwave works with a large number of counterparties (brokers RJ O’Brien; Morgan Stanley; Deutsche Bank; Bank of America; ADM Investor Services and Wedbush Securities and FCMs Société Générale and Deutsche Bank.

The strategy can also be accessed through several managed account platforms. “Two of them, Gemini Galaxy Plus and RJ Oasis, which are Chicago based, are structured like a fund – a limited partnership with on and offshore vehicles. Deutsche Bank’s DB Select, which is based in London, structures investments through a swap, option, or note,” says Apperson.

“The strategy is normally very low margin – around 3% for the 1x leveraged strategy – and so highly cash efficient in a managed account. Margin usage does vary with perceived opportunity set however and therefore can run much higher.

10th

Austin – where Greenwave has its headquarters – is the capital of Texas, a state with a GDP that in 2018 ranked as 10th in the world just ahead of Canada.

UCITS

Greenwave is working towards the launch of a UCITS fund. Apperson expects that, “given the concentrated portfolio and low net exposure, the strategy can easily fit into a UCITS structure without dilution or carve outs. The risk level for the UCITS remains to be determined. Given that the 1x leveraged version of the strategy is at the lower end of the vol spectrum for macro strategies, the UCITS might be a 2x version”.

Austin, Texas

Austin is the capital of Texas – a state with a GDP that in 2018 ranked as 10th in the world just ahead of Canada. It is no accident that Greenwave has chosen this city as its headquarters over more common hedge fund bases like London, Chicago or New York. “We are here primarily because of the amazing quality of life,” says Charles. “But there are definitely other reasons. It’s a business-friendly environment, which is why the biggest names in tech continue to expand their footprint here. More importantly for Greenwave, the University of Texas has over 50,000 students and one of the top business schools in the country. Most of them are trying to figure out how to stay in Austin after they graduate which makes it easier to compete for talent.” “We have great music, a great food scene and the only Formula One race in the US, all of which provide extra incentive to make the due diligence trip,” says Apperson.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical