Nearly all investors divide up the hedge fund universe in a way that reflects how they think about the world: convergence/divergence; directional/non-directional; event driven/equity/macro & CTA/market neutral; or fundamental/trading-based. As a consequence, “The Box” is amongst the first concepts used by investors in the process of following and analysing hedge funds. That is, into which box will the investor put a fund for the purposes of peer group analysis and ranking. The top-down portfolio construction of the fund of hedge funds is often then a function of allocation by box type, with slots filled with the top-ranked funds within each style category.

This classification mostly works, with the odd niche strategy excluded, and a free choice at the margin for the inclusion or not of long-only funds, quasi-private equity, and semi-hedged vehicles. But a fund may utilise a combination of strategies which straddle the labels, orhave a market footprint and an investment process which is commonly seen in one box, and a return stream which is deliberately atypical for the broad strategy type.

Funds which do not fit neatly into the Boxes are often the most interesting to delve into, but the path to commercial pay-off for excellence can be long, or more often the case, given the new normal of dominant institutional flows with long lead times, very long.

Off to a good start

London-based Harmonic Capital Partners has been around for a long time. The name will be familiar to those who have been actively engaged in the hedge fund industry for a decade or more. The firm was set up in 2002 when Richard Conyers and David Pendlebury left trend-following CTA Aspect Capital with the familiar motivation of preferring to accept the challenges of running their own investment firm. Conyers was head of fixed income and currencies at Aspect and Pendlebury was software development manager there. They were joined at inception by Richard Noble who was formerly a trader at J.P. Morgan for what became the London Diversified Fund. Noble carried out classic fixed income arbitrage-type investing – the sort of trades that Salomon Brothers prop traders introduced to the world that took advantage of bond mispricing.

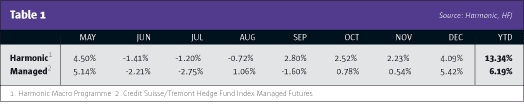

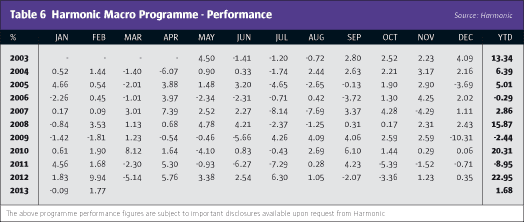

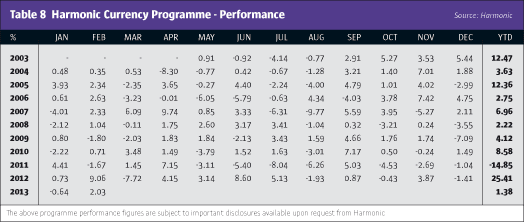

At the outset, it was very easy for investors in hedge funds to assume that Harmonic Capital was going to invest like a CTA, but maybe specialised in a couple of asset classes – fixed income and currencies. The founders of Harmonic Capital spent a year researching and writing new programmes for their investment strategies, and started trading in May of 2003. The returns in that year are shown in Table 1, along with the returns of managed futures funds at the index level.

Maybe investors who had not met the investment managers could be forgiven for assuming that Harmonic Capital ran a managed futures programme. Swap the returns of August and September 2003 and the return series looks identical to the returns of a very good CTA manager at the time. It is an easy assumption to make, but a false one.

Less correlated by design

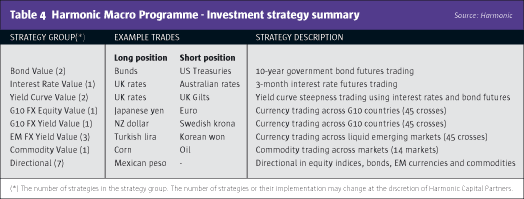

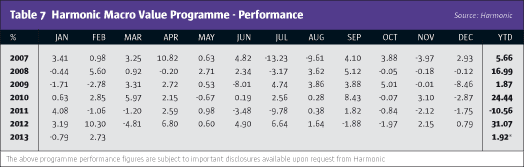

Harmonic Capital is a systematic manager of macro investing. It is that purely now, as the firm ceased classic relative value fixed income arbitrage in mid-2006, the year before Richard Noble left the firm. Harmonic runs three investment programmes – Macro, Macro Value and Currency, with the latter two being derivatives of the Macro programme which share the same research and risk management processes. The Macro programme has 17 investment strategies. The Macro Value programme trades only the 11 relative value strategies, specifically excluding the directional strategies. The sources of signals are models of yield curves and macroeconomic variables, not pattern recognition or technical analysis of breakouts and trend strength.

CIO Richard Conyers states that they have set out to have the majority of position taking done in spread form: “There is less risk competition for this relative risk taking – being long one bond against another – and I would contend more alpha available. There are a lot more people taking directional risk, and that means of course that their returns can be more correlated with the underlying markets. We are less correlated by design.”

Further, having a number of spread-based strategies across asset classes gives effective internal diversification of sources of alpha, as the strategies that combine to make up the funds have low correlation to one another according to Conyers.

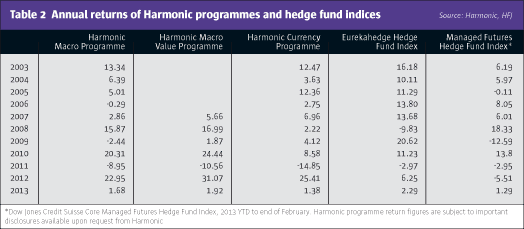

Harmonic Capital has taken a long time to get to a position where it can be considered commercially well placed. But it is there now. The absolute measure is assets under management – the firm manages $916 million – so Harmonic Capital is expected to join the billion dollar club this year, but the reason it is able to fill the metaphorical application form is the returns produced in recent years. There are a number of plausible inferences from the better performance data shown in the lower (more recent) half of Table 2. It could be that the hit rate (successful trade percentage) has gone up post-2007 on a similar level of risk assumption, or that the level of risk assumption has been increased for a similar hit rate. Outcomes are also a function of how suitable an opportunity set the markets present for a given style of investment. But the answer for Harmonic Capital is a combination of all three: some increase in permitted volatility (gross and net risk assumption), more successful models, and, for better relative performance, market environments that suited Harmonic Capital’s way of addressing markets more than others.

Investment principles turned into alpha

The investment principles by which Harmonic Capital operates are: seek low correlation by design, run independent investment strategies to diversify sources of return, utilise a wide range of financial data, equally weight positions, take risk overwhelmingly via long/short positions, and cut losing positions automatically. The focus is on relative value strategies wherein balanced positions are taken long and short in related markets. This gives returns that are non-correlated to the underlying markets.

To illustrate by reference to the flagship Harmonic Macro programme, in the last three years the correlation of returns to the JPM Global Bond Index was a scarcely measureable 0.05, to stocks 0.15 (the S&P 500 TR Index) and to hedge funds 0.29 (the HFRX Global Hedge Fund Index). The diversification of hedge fund returns from the returns of other asset classes is the attribute ranked second highest in importance (after absolute returns or alpha) by investors in hedge funds. Whether measured over recent years or from inception the returns of the three programmes of Harmonic have exhibited low correlation to stocks and bonds. In this area it is particularly striking that the Harmonic Currency programme has only a 0.36 correlation with the Deutsche Bank G10 FX Carry Index since inception, demonstrating good investment strategy diversification within the programmes.

Table 2 shows evident alpha, and the return history across the range of funds reflects low correlation with the core asset classes. That is, Harmonic Capital meets the top two requirements of institutional investors in hedge funds, the performance criteria. David Pendlebury, CEO of Harmonic Capital, is proud that it also satisfies the hygiene factors of institutional-quality infrastructure. “We have built robust platforms for pre-trade and post-trade,” he says. “The pre-trade platform is called Q (after James Bond’s quartermaster) and the post-trade operational platform is called Symphony. Symphony was constructed to perform real-time reconciliation of trades (on T+0).”

The capabilities of Symphony have been augmented through time. It now carries out tasks beyond trade processing such as monitoring of performance in real time. CIO Richard Conyers notes, “We are a software business. The vast majority of the people in the business are in research and development for a reason. It allows us to be efficient in our activities with less people.”

The quality of the infrastructure at Harmonic Capital is reflected in interest from third parties in buying the systems that handle trade execution and clearing. Investment partner Patrik Säfvenblad adds that the systems have to take account of the particular requirements of clients such as prohibitions on trading with specific counterparties.

Four factors of external assessment

Principal at investment consultant Mercer, Diane Miller oversees currency manager research. She has stated that assessment of currency managers is based on four factors: the ability to generate new ideas to add value; the way in which those ideas are translated into portfolio construction; the management of capacity constraints; and the outlook for the business. Taking each in turn, we will look at how an investment consultant would see Harmonic Capital.

Some software companies capitalise their R&D spend. Some software companies count the cost of the support desk as a contribution to R&D (the D rather than the R). That is, what exactly constitutes research in software generally will vary greatly, and is somewhat in the eye of the beholder, or the investor in the case of research at systematic investment management firms. Harmonic Capital has 21 people, with nine members of staff dedicated to research and development. If it is a game of absolute numbers, then there are always some bigger numbers elsewhere or proportionally more. For example the BlueCrest systematic research team combines research, model development, implementation and execution functions. This BlueCrest programme is supported by a 41-strong quantitative research and development team and a 51-strong systematic trading team.

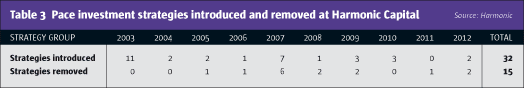

Of more significance to investors is what the researchers do, how productive have they been historically, and does the firm have a structure that will facilitate effective research output in future? Harmonic Capital give a partial answer to this by disclosing the pace at which investment strategies have been introduced and removed (see Table 3). 2007 was clearly a pivotal year for the firm as a record number of new strategies were introduced.

“Our research efforts over time have been allocated 60% to alpha generation and 40% to risk management and portfolio construction,” says CIO Conyers, “though it will be more focused in any one year.” For example in 2011 there were no new alpha strategies introduced, but there were many improvements to risk management brought in that year. The reverse was true in 2012 when significant improvements were made to systems devoted to producing alpha, and not many changes to risk management.

Like many successful systematic investors Harmonic Capital management have implemented an investment (and more importantly an R&D) culture in which a good idea can be introduced by anyone in the team, and indeed can be developed by the originator through the whole research and development process. An idea for development may be brought up at the weekly research meeting, and the originator may be asked to go away and research it. The result may be a document of 180 pages – that document will generate written feedback from team members. Only after the written feedback has been delivered is the idea in process subjected to debate in a meeting (which might be at the level of the monthly research policy meeting if the concept has been advanced sufficiently).

A vote is taken amongst the investment principals at the firm about whether further resources should be devoted to the idea under development. The CIO has the same weight of vote as anyone else, though CIO Conyers acknowledges he may have given more verbal feedback than other staff members to that point. The crucial point for how the firm operates is that the debate should be a high-level debate with rigour, not dominated by personality or strength of voice, but strength of rational argument. “We are keen that everyone here is aware that any one person can turn an idea into part of the systems we trade with,” explains Harmonic Capital’s Conyers.

Investment partner Patrik Säfvenblad reinforces how Harmonic tries to uphold the productivity of the research effort. “There are two ways of messing up the research in a systematic manager,” he observes. “First all the fresh ideas are filtered through a hierarchy (which we avoid by equally weighted votes), and second by looking at the research ideas through a single prism.” The varied backgrounds of the investment staff of Harmonic Capital are allowed to be brought to bear in how they look at the research under consideration. One mindset does not dominate, though the firm does have a broad framework in which to operate that is defined in a 15-page document that lays out the investment principles to be applied.

The ability for a systematic manager to generate new investment ideas is an essential prerequisite for an investor to allocate on a medium-term basis. The process that generated the signals and ideas that are baked into returns of the last few years (the returns that get immediate attention) may not be adaptive to the changing market environment of the two to three years that follow. It is essential that new alpha generating models are developed. Table 3 shows that Harmonic Capital historically have met the first criterion set out by Mercer’s Diane Miller. The firm’s structure and culture for research should support R&D productivity in future.

Beyond alpha generation

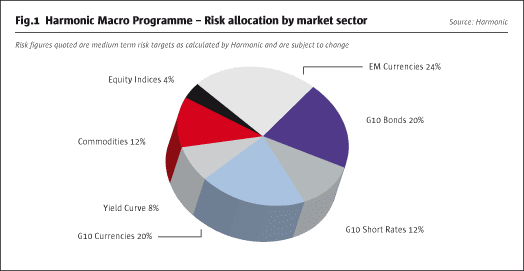

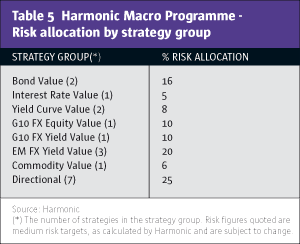

The second factor the investment consultant needs to see is a portfolio construction that is effective at implementing the investment ideas. At Harmonic Capital allocations across strategies are philosophically ‘equal’ with no tactical trading. Short and medium-term allocation variations occur through risk management processes. For example, as long ago as 2007 the firm had developed a model to reflect regime change in markets. Input from the regime change model can alter strategy allocations and overall risk appetite at the portfolio level. In addition to strategy allocations, market allocations are also broadly equal, with no one market favoured over another. When trading fixed income and currency spreads, all possible country pairs are traded, and are equally weighted. The results of the rules to shape portfolios at Harmonic Capital are shown in the risk allocation illustrations (see Table 5 and Fig.1)

Investment ideas are translated into portfolio construction at Harmonic Capital in a disciplined and structured way which meets the investment principles of the firm. Richard Conyers believes that the dynamic of strategy allocation (how the systems cope with change, and in particular react to losses) is a particular strength of the firm, and is a differentiating factor versus competitors in macro investing. The proprietary method used to change allocations by model within the risk management system is extremely unusual in a firm that uses a systematic approach to markets. As this method is intended to keep the programmes at Harmonic Capital engaged with markets in a drawdown, it is believed that this method has significantly contributed to the outstandingly positive returns seen in two of the last three years. Certainly portfolio construction at Harmonic, or more specifically the dynamics of it, will be well perceived by investment consultants.

Investment ideas are translated into portfolio construction at Harmonic Capital in a disciplined and structured way which meets the investment principles of the firm. Richard Conyers believes that the dynamic of strategy allocation (how the systems cope with change, and in particular react to losses) is a particular strength of the firm, and is a differentiating factor versus competitors in macro investing. The proprietary method used to change allocations by model within the risk management system is extremely unusual in a firm that uses a systematic approach to markets. As this method is intended to keep the programmes at Harmonic Capital engaged with markets in a drawdown, it is believed that this method has significantly contributed to the outstandingly positive returns seen in two of the last three years. Certainly portfolio construction at Harmonic, or more specifically the dynamics of it, will be well perceived by investment consultants.

Investment capacity is not an issue for Harmonic Capital. The firm invests in some of the deepest markets in the world – the futures markets for G10 government bonds and interest rates and the related FX crosses – plus some of the fastest growing markets in FX – the currencies of the larger EM countries. Harmonic currently manage $916 million, and dependent on whether the future flows are biased to the Currency Programmes or the Macro Programmes (futures plus FX), the processes of the firm can handle between $4 and $5 billion in AUM. The management of capacity constraints is a third factor of assessment used by investment consultants, and will not be an issue at Harmonic Capital for some time, if ever.

Change has been good

The growth of Harmonic Capital over the last eleven years has not been smooth. After a flying start, frankly the returns were not good enough for the next four years (2004-2007). The firm did well to grow assets from $300 million in late 2004 to $500 million in March 2006. It was at this time that additional research staff were taken on: Samir Sheldenkar, who is now an investment partner, joined at that time and Per Ivarsson, today also an investment partner, joined shortly thereafter. In 2007 there was a broadening of the investment strategy and a plethora of new models were deployed. The changes of 2007 set up an excellent 2008 for the firm.

One of the striking things about the senior management of Harmonic Capital is that they are open to new ideas, and can put ego aside enough to listen. That does not always occur in hedge fund management businesses on the investment side. This attitude gives a chance for newer members of staff to come in and make an impact. Patrik Säfvenblad is no junior analyst. He had plenty of ideas he wanted to put to work in a systematic firm, and discussions with Harmonic’s CIO, Richard Conyers, gave him an entrée in 2009. It is relatively unusual for a small asset management firm to take on an experienced senior investment professional, as it can be a risk to the cohesiveness of the existing team of investment professionals. Again it is testimony to the qualities of the management at Harmonic that Säfvenblad was allowed to make a (positive) impact on the portfolio construction and risk management/hedging of the programmes at Harmonic.

New office space – good or bad?

Harmonic Capital has recently moved offices within the City of London from one side of the Bank of England to the other. The new office space has plenty of room and could accommodate twice as many people as the previous offices, though Harmonic does not have, or need, that many people as yet. Moving head offices has long been seen as a potential warning signal to investment analysts looking for signs of corporate excess and ego in the c-suite. But it has been made plain here that the senior investment staff at Harmonic are able to put ego aside in considering new investment ideas.

The new offices are an expression of the confidence the executives and owners of Harmonic Capital have in their company. The improvements to the investment process and investment staff have turned into better outcomes at Harmonic – very competitive investment returns as it turns out. The returns produced in 2008, 2010 and 2012 have created a problem, but it is one for the allocators of capital to hedge funds. Do they have an appropriate box in which to put these outsized returns?

For the investment consultants who advise institutional investors about investing in hedge funds like Harmonic Capital the four factors for assessment were: the ability to generate new ideas to add value; the way in which those ideas are translated into portfolio construction; the management of capacity constraints; and the outlook for the business. The owners of Harmonic Capital have expressed their confidence in the outlook for the business by taking larger office space. So the results of testing the quality of the four factors are tick, tick, tick and tick.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical