Although China is of great interest to international allocators, the challenge has always been how best to take advantage of what is, to many, an attractive, long-term opportunity with limited correlation to global markets. Allocators are faced with a number of issues, such as limited access to local exchanges, a lack of hedging tools, currency restrictions, the risk of government interference, regulatory and transparency concerns, a preponderance of retail investors in the domestic markets (80% according to some estimates), and, not least, cultural and language barriers. A pure long-only approach has been rewarded with generally poor risk-adjusted long-term returns. The rally of around 150% in the Shanghai Composite Index in the 12 months up to 12 June 2015, after four consecutive years of decline on the heels of the 2009 recovery, followed by the subsequent loss of -32% so far in the current correction (as of 31 July 2015), have only served to highlight the Chinese market’s volatility and increase the common perception that it is extremely difficult to navigate. Exploring alternative ways to allocate to China seems therefore warranted, and a diversified portfolio of hedge funds may be the better approach as historically this has generated better risk-adjusted returns.

It seems important to correctly delineate the Chinese market in order to show the diverse range of strategies that can be employed. Though still a market largely dominated by equity strategies, it isn’t just locally traded companies on the main markets of Shanghai and Shenzhen that should be considered of interest; allocators should take a broader view including Hong Kong, Taiwan and US-listed ADRs of Chinese companies, each of which have different return drivers. Hong Kong, for example, is dominated by financials whereas Taiwan and Shenzhen have a smart phone manufacturer bias and US-listed Chinese ADRs tend to be focused on technology.

The path to financial liberalization is also creating new opportunities for hedge funds. For example, the recent introduction of the Hong Kong Shanghai connect scheme, and the much-anticipated launch of the Hong Kong Shenzhen connect scheme later in 2016 allow investors to take advantage of valuation differences that are driven by the different investor bases of these markets; approximately 80% of the onshore-China markets compared to only 30% of the Hong Kong markets are made up of retail investors. Additionally, investments through the connect schemes may be limited to certain equities while international investments made through the use of a QFII quota can be much broader, resulting in different liquidity profiles for different mainland-Chinese companies. Arbitrage opportunities also arise between companies listed locally in mainland China, those listed on offshore exchanges, and US-listed ADRs. A further advantage is that many companies listed on non-mainland exchanges can be shorted at a reasonable cost. Additionally, the current ratio of hedge fund assets to market capitalization in Greater China is only 0.6% – far lower than in the North American and European markets.

The best Chinese funds have been able to extract significant alpha by leveraging their local expertize and the inefficiencies of the different Chinese markets, instead of just relying on long-term growth trends. By broadening the universe, it is therefore possible to employ strategies that are familiar to global allocators. Even though long/short equity-related strategies dominate the Chinese hedge fund industry, there is no shortage of choices that allow for a diversified portfolio to be created; long-biased, short-biased, market-neutral, trading-oriented, event-driven, activist, quantitative and China-focused macro funds are all available to investors.

The Chinese hedge fund industry has grown significantly since the late 90s with over 450 launches, but the risks associated with Chinese hedge funds are still often significantly higher than those of their Western peers. This is due to the fact that the industry is still relatively young and while there are around 350 China-based and focused funds reporting to Eurekahedge, the average fund’s life span has been only 57 months, and the average AUM of these funds is only about $250m. The additional risk in exposure to China hedge funds was also evident in 2008/2009 when the average Greater China equity l/s fund lost around 35% (peak to valley) versus 20% for their US peers. The industry is maturing quickly though, risk management post-2008 has improved meaningfully, and the drawdowns in the past few very volatile months have been considerably lower than in prior periods. Some managers, especially those with lower net exposures and the ability to also trade in US-listed ADRs and the Hong Kong market, even made money. On average it does appear, however, that Chinese managers have a greater tolerance for taking risks, making proper manager selection key, as performance dispersion is often not explained by the type of strategy but rather by the discipline with which they approach risk allocation and the quality of their research process.

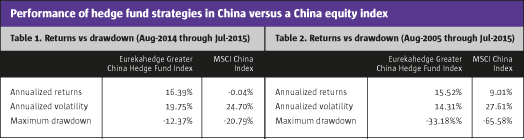

Although approaching Greater China through hedge funds provides investors with access to significantly more attractive risk-adjusted returns, as can be seen in Tables 1 and 2, the overall operational risk of Chinese funds, including the service providers they use, as well as their approach to risk management and the robustness of their overall organizations is, on balance, not yet of the same standard as that of their global peers. All of this means that in order to confidently allocate to Chinese hedge funds, an allocator needs to have a deep local network that cannot just source opportunities before they close to new investors, but that can also properly conduct operational due diligence on these managers.

While China-related opportunities abound, taking advantage of them remains extremely challenging and potentially also very costly to implement, as most international allocators lack the proper local resources to be able to confidently discharge their fiduciary responsibilities when allocating to China. Given the significant obstacles that still remain in place, and both the idiosyncratic manager and market risks, a diversified portfolio of hedge funds managed by a trusted local adviser seems to be the most efficient approach. We have identified diversified portfolios of hedge funds that have significantly outperformed the Eurekahedge Greater China Hedge Fund Index on both a risk-adjusted and an absolute basis. To us they represent the best of both worlds.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 106

Hedge Fund Opportunities in China

An alternative approach for international allocators

PATRICK GHALI, MANAGING PARTNER and PABLO URRETA, PARTNER AND HEAD OF RESEARCH, SUSSEX PARTNERS

Originally published in the August 2015 issue