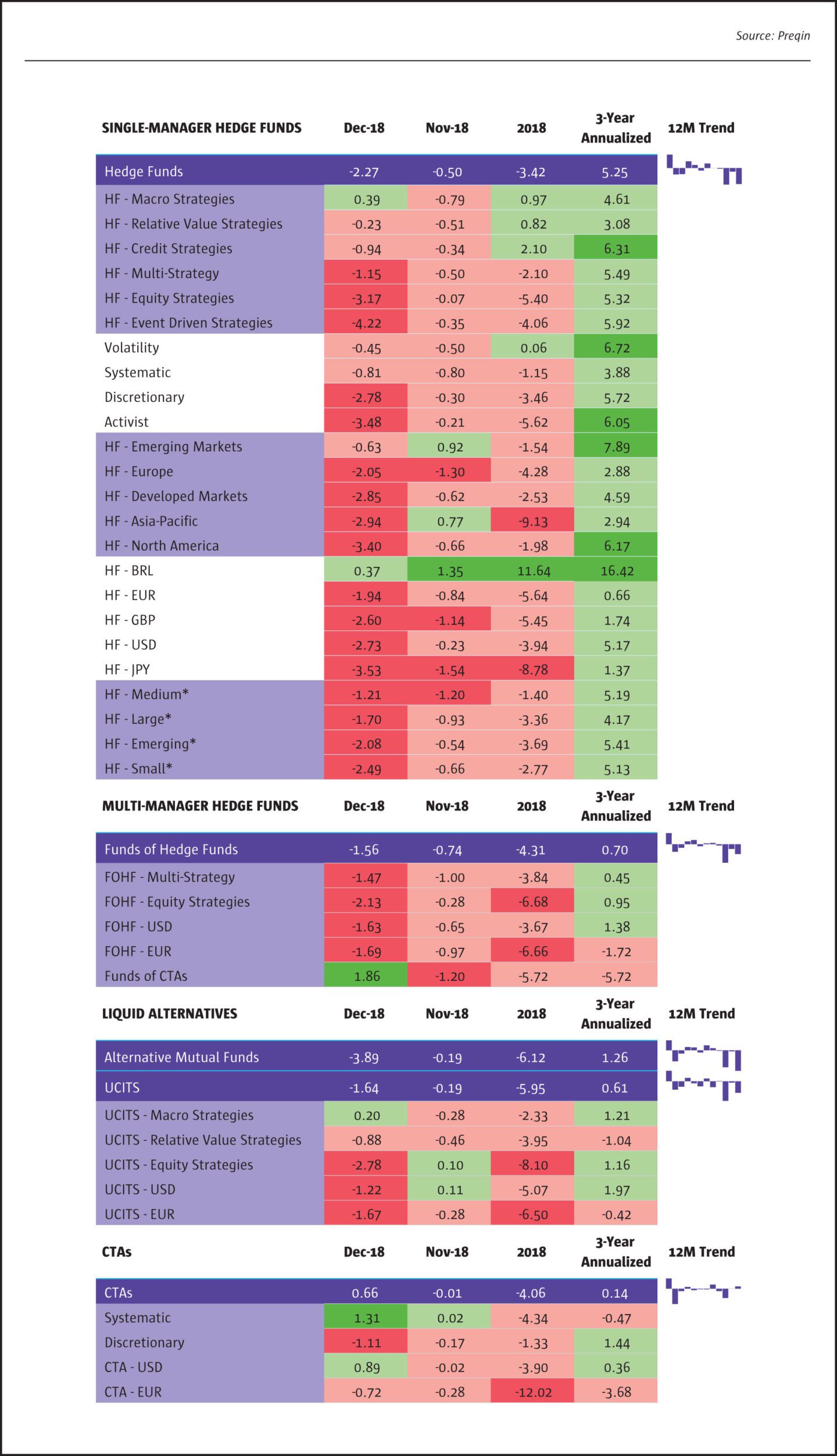

Hedge funds faced another tough month in December 2018, with losses increasing: the Preqin All-Strategies Hedge Fund benchmark returned -2.27%, bringing the 2018 full-year losses to 3.42%, the first negative year since 2011.

Macro strategies hedge funds returned +0.39% in December, helping to recover losses made in November (-0.79%) and bringing the 2018 return to +0.97%, making this the only top-level strategy tracked by Preqin to generate a positive return for December. Notably, returns for both equity and event driven strategies fell sharply, returning -3.17% and -4.22% in December respectively.

Hedge funds denominated in BRL continued to outperform funds denominated in all other currencies tracked by Preqin, returning +0.37% for December and continuing from the strong performance in November (+1.35%). This marks the 10th consecutive year of positive returns for BRL-denominated hedge funds.

Globally, all regions tracked by Preqin faced an adverse December. Hedge funds focused on emerging markets minimised losses (-0.63%), whereas those focused on North America experienced substantial losses (-3.40%). Hedge funds focused on the Asia-Pacific region ended 2018 with their lowest annual return (-9.13%) since 2008 (-22.25%).

Please note, all performance information includes preliminary data for December 2018 based on net returns reported to Preqin in early January 2019. Although stated trends and comparisons are not expected to alter significantly, final benchmark values are subject to change.

*Preqin fund size classifications: Emerging (less than $100mn); Small ($100-499mn); Medium ($500-999mn); Large ($1bn plus).

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 138

Hedge Fund Performance Update

December 2018

Preqin

Originally published in the January 2019 issue