Bitcoin (BTC) is the cryptocurrency that grabs the headlines as it bounces around the charts but, for the increasing number of professional investors taking an interest in crypto, there is much more to consider. Cambridge Associates made this point in January 2019 when they published their note: Cryptoassets: Venture into the Unknown, mapping out the range of strategies and arguing that institutional investors – however sceptical they might be about the current investability of the market – should recognise its long term potential and look at the asset class more closely. Even this cautious endorsement from such a respected investment advisory firm was a huge morale boost for the sector that was still in the depths of the 2018 crypto bear market at the time.

Crypto hedge fund (HF) strategies only get a passing mention in the CA report, largely because they are so small relative to the large pools of capital invested in VC, public ICOs, and in straightforward BTC ‘Hodling’. While still small scale, they have continued to expand and develop in the months since the publication and are now capable of producing attractive and diversifying returns for smaller institutions. Even setting aside the investment potential, crypto is a new asset class and it is fascinating to observe how a new financial ecosystem of products and strategies has grown up in this Terra Nova.

Biological analogies seem to be popular in the crypto space. Indeed, Cambrial is a reference to the Cambrian era, in which a small number of biological (here cryptographic) primitives came together in new ways, leading to an explosion of new lifeforms (here applications). Following the fashion and taking an ecological and Darwinian perspective to crypto markets and HF strategies yields genuinely useful insights.

We shall begin our survey out in the barren lands ….

Long/short strategies have fundamental problems

Long/short equity is an archetypal hedge fund strategy where a manager holds balanced long and short positions in a company or sector, expecting only that the long positions will appreciate relative to the short ones. In the large group of fundamental long/short equity funds, those expectations are based on some form of forecast of the future financial performance of those companies, typically as net earnings. Company management may reinvest a portion of the earnings, but otherwise they flow to shareholders. Equity managers rely on this link, mostly without thinking about it, but for crypto managers, it simply does not exist. By design, the concept of profit, certainly in dollar terms, is absent so there is no profit to distribute. Bitcoin could not function without its miners but the miners are paid in BTC, not USD, a circularity that frustrates attempts to value it from the miners’ perspective.

Whilst companies can exist perfectly happily without public equity, digital assets (‘tokens’) that attach to networks and protocols are, by cryptoeconomic design, essential to the functioning of those networks, and this suggests an alternative to financial fundamentals. Managers have tried to run long/short strategies based on qualities, such as technological features, network growth or developer activity. Many are intelligent and enormously knowledgeable so are likely right in their views but there is no equivalent of the quarterly earning number to prove the truth, move the market and allow them to take the profits they deserve.

The crypto valuation problem is an area of active economic research and some models have been proposed such as MVPQ, stock & flow and adaptations of Metcalfe’s law (NVT), but none are nearly as strong or universal as the dividend discount model is for equities. An economist may find an answer and win a Nobel prize in the process, or the problem may be solved by new forms of digital assets that capture network value in some direct way. In the meantime, fundamental long/short in crypto is a barren land where only the tough and resourceful survive.

Events are an occasional feast

In conventional markets, event driven strategies profit from the key life events of companies and their securities (issuance, M&A and defaults). Digital assets also have such events but they take different forms. An example is ‘forks’ in which the software or logic of a protocol is updated to introduce new features or other desirable changes. Forks require all participants to upgrade and cease using the old version. Sometimes a significant proportion of the network users choose – for technical or philosophical reasons – not to upgrade, resulting in the blockchain ‘forking’ into two parallel alternate versions. If both versions are valuable, then the result looks similar to an equity demerger. Mergers are also possible in theory and may be value-enhancing because of the 2+2>4 nature of network economics; but none have occurred to date.

Events in digital asset markets have created opportunities for a number of very profitable trades but are not frequent enough to support the kinds of specialist funds that exist in conventional markets.

In the absence of fundamentals to tether valuations to some economic reality, there is a strong tendency for technical factors, especially momentum, to push prices up and down.

Edward Nelson, Risk Manager, Cambrial Ltd

Technicals are a thriving jungle

In the absence of fundamentals to tether valuations to some economic reality, there is a strong tendency for technical factors, especially momentum, to push prices up and down. Furthermore a large portion of transactions in crypto markets are attributable to retail investors, often highly leveraged, rather than institutional ones, making this market prone to tides of fear and greed and other behavioural biases that create patterns exploitable by systematic trading algorithms.

So while the fundamental lands are barren, the technical ones are rich with variety. Typically systematic, these quant strategies very much resemble their cousins in conventional markets (e.g. CTA) except that trading is concentrated in the top-5 most liquid coins and their derivatives.

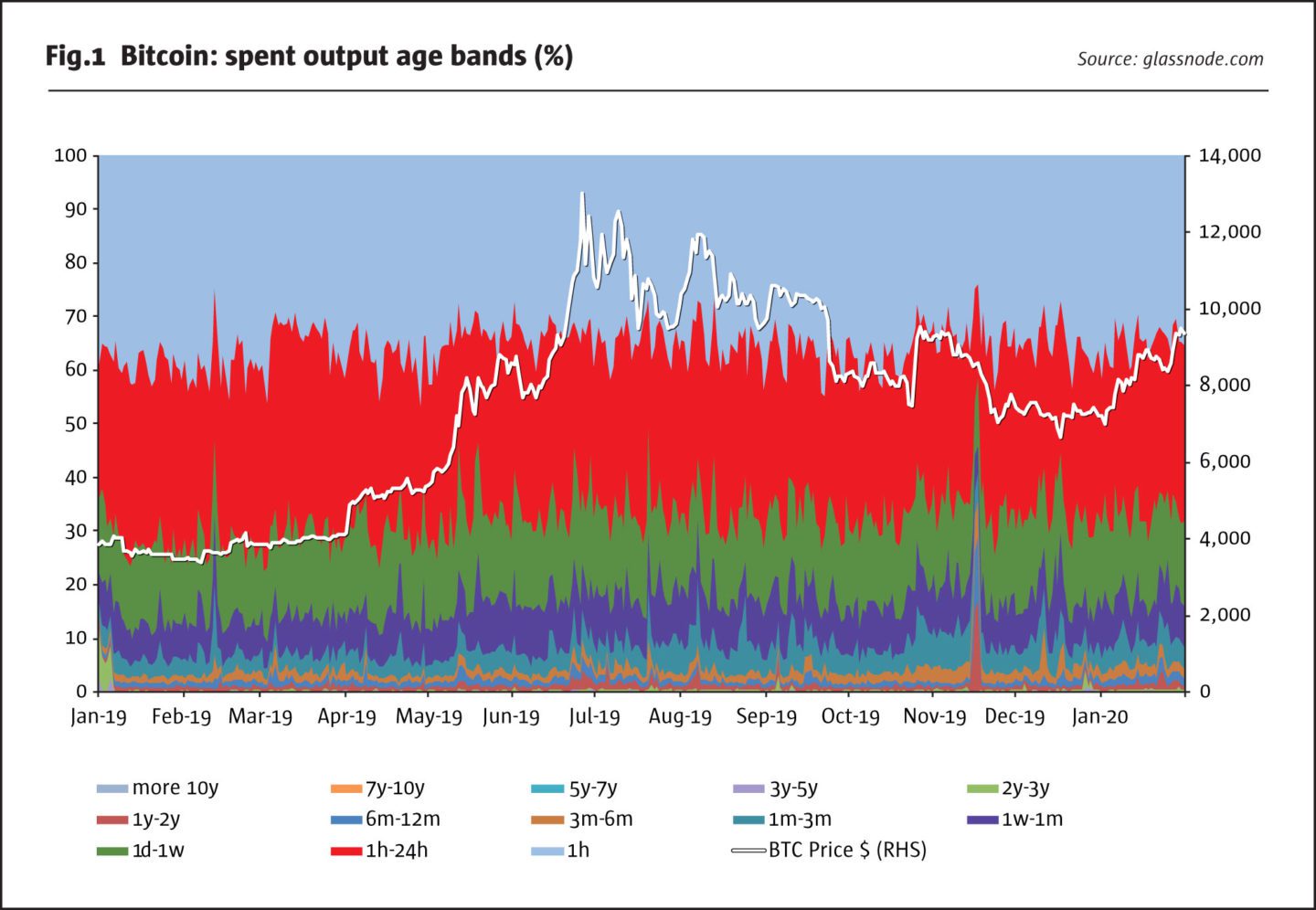

Technical strategies commonly use volume information as well as pure price data but for BTC and other cryptocurrencies, transfers between participants are publicly recorded on the blockchain, although pseudonymously, and can provide additional signals. For example, a large transfer from a long term BTC holder to a wallet address associated with an exchange is very likely to be followed by a large sale from that exchange and a trader would wish to be ahead of that sale. Alternatively, transactions can be decomposed according to how long assets have been held, teasing apart whether volume is being driven by old ‘hodlers’ or ‘weak’ new hands.

These kinds of signals simply do not exist in traditional markets.

Reefs of fractured markets shelter arb strategies

Equities, as securities, tend to be local companies traded globally. AAPL is, to a first approximation, a US company, listed and regulated on a US exchange, but bought and sold by individuals and institutions all over the world; crypto tends to be the reverse. Paradoxically, BTC – a stateless, unregulated, freely transferable asset – is in practice bought and sold by locals in a patchwork of over 150 exchanges, regulated (or not) in the countries in which they are based. Each of those exchanges will trade BTC against at least one fiat currency, EUR, CHF, KRW etc., and against many other digital assets, DAI, ETH, MKR etc., so there are thousands of BTC prices globally. Add the fact that cryptocurrencies are volatile and that these exchanges trade 24/7/365 and you have near ideal conditions for price dislocations between related pairs, and therefore opportunity for arbitrageurs.

Natural selection has been active in these exchange arbitrage strategies and the persistent and wide spreads between markets, especially Asian ones, seen a year ago are now no longer. They are narrow, fleeting, often found in the more obscure and risky markets and not visible as a simple difference in prices between two markets. To succeed, managers must employ powerful computers to scan through tens of thousands of arbitrable combinations of prices and employ low-latency execution systems, imported from high frequency trading to get to them ahead of the competition.

Other arbitrage strategies specialise in the liquid futures markets where the basis or difference between different futures contracts with the same underlying asset (usually BTC) can be multiplied by leverage to yield significant profits when the basis narrows as contracts reach expiry.

The crypto options market enables volatility trading and options arbitrage strategies, but they are small relative to the spot futures markets so, while the profits are potentially attractive, the amount of capital that can be deployed is currently limited.

A consequence of the lack of a fundamental anchor is that crypto markets are volatile and changeable with periods of violent price swings and intervals of relative calm. When these volatility ‘storms’ meet a fractured market, big price dislocations can be created, and the slim pickings of normal markets can suddenly become very rich.

Credit strategies are emerging as volatility moderates

The infamous volatility of cryptocurrencies appears to be gradually moderating as it becomes, as intended, a store of value, and not just a speculative instrument. Money has a time value and borrowing and lending markets are emerging; as interest rates stabilise they create conditions for credit-based strategies.

In ecological terms, the digital markets currently have a lot in common with the isolated islands and their inhabitants that fascinated Victorian biologists. Conventional financial markets are connected by rates, though mechanisms like interest rate parity and their emergence in crypto should be seen as a bridge that will connect them to the wider financial world.

Decentralised finance (“DeFi”) is a new class of animal

Finally, no fresh survey of HF strategies in crypto would be complete without mentioning DeFi. With the advent of the Ethereum ‘World Computer’ came the ability it gives to create public, trustless ‘Smart Contracts’ enabling lending, investments, hedging and many other financial activities to be performed without the services of banks and other trusted intermediaries – all very much in the spirit of the founder(s) of BTC. A host of new companies are taking the technology and using it to build a parallel financial system from the ground up. Functionally, DeFi is very similar to conventional “CeFi” but the architecture is very different: it’s the difference between mammals and reptiles.

It’s very early days but workable investment strategies are beginning to appear and fall into three main groups, two familiar, one completely new. The two recognisable strategies are yield arbitrage and market making. The first exploits dispersions in rates across the different DeFi lending and borrowing markets and the second from price dislocations across the decentralised exchanges as well as being paid simply to provide liquidity.

DeFi market making or price arbitrage is a good example of how things work differently. In conventional markets, if a trader – or more likely their computer – spots that the price of an equity is different across two separate exchanges they will be able to realise a profit by selling on the expensive exchange and buying on the cheap one. The key to success is to be quick. A trader who is too slow may succeed in lifting the offer to sell but miss the bid and be left with half a trade (‘legging risk’). In DeFi, the trader executes the trade by running it as a script on the Ethereum computer and that script is executed atomically meaning that either both trades are executed simultaneously, or neither are, eliminating legging risk. Instead, the competition between traders turns to who can get their script executed first and this leads to ‘gas auctions’ where they essentially bid up the fees they are willing to pay the operators of the Ethereum computer (aka ‘miners’) to process their code first. It’s like two rivals putting more and more stamps on each of their letters to get the Post Office to deliver it before the other. Traders are now using game theory to devise better gas auction strategies.

Finally, there is a growing set of strategies that explicitly require traders to work directly to maintain the integrity and stability of the financial system. For example, DeFi allows the creation of collateralized debt positions that need to be promptly liquidated if the collateral level falls below a defined threshold which will always be greater than the value of the loan. The successful liquidator earns a profit either by getting to sell the collateral at a discount or by receiving a fixed fee.

Conclusion

Biological analogies aside, the serious point should be clear: crypto and its markets, both centralised and decentralised, are a medium of investment, not just a new instrument type. They are new and roughly formed, but therein lies the opportunity; and investors should consider whether they wish to stake a claim in the new land.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 147

Hedge Fund Strategies in Cryptoland

Update on a new financial ecosystem

Edward Nelson, CFA, Risk Manager, Cambrial Ltd

Originally published in the February | March 2020 issue