Some alternative credit strategies, including mortgage backed securities, have seen sharp setbacks amid the coronavirus pandemic, as payment holidays and delays reduce their income and could ultimately lead to defaults. Commodity trade finance has not been immune from problems in 2020, and there have been some high-profile counterparty defaults.

But this is a huge, multi-trillion-dollar industry which offers a wide spectrum of risk from multiple angles including geography; jurisdiction; lending time frames; deal structuring; collateralization, security and verification routines.

Horizon Capital AG (“Horizon”) is typically Swiss in following a cautious approach to the strategy and has seen no change to its investment returns in March, April and May 2020. The pandemic has brought only marginal changes to how their European, Asian and US trade finance strategies, running around US$700 million, operate.

Horizon is typically Swiss in following a cautious approach to the strategy and has seen no change to its investment returns in March, April and May 2020.

This would appear to be something of a safe haven, but in contrast to the negative interest rates on the Swiss Franc currency and government debt, it has generated positive annualised returns of 6-7% in USD since 2012. Returns hedged to other currency share classes including Swiss Francs, Euros and Japanese Yen, are reduced by hedging costs, but still offer a comparable spread over cash.

Onshore fund and global firm

The strategy started in October 2012 in an offshore BVI fund, GMS Sovereign Plus Fund, and in December 2017 it seamlessly migrated to an onshore, Luxembourg RAIF: Horizon Capital Funds SICAV RAIF. Horizon acts as investment advisor to the Luxembourg RAIF, with Fuchs Asset Management SA acting as the Luxembourg management company. The fund vehicle is also regulated by the Luxembourg CSSF. Horizon is overseen by Switzerland’s OAR-G, which is itself regulated by FINMA.

Horizon has a team of 34 people spread across the globe, with offices in Geneva, Zug, Lausanne, Singapore and Miami, Florida. The European fund finances borrowers in Europe; the Asian fund, launched in 2018, finances Asian borrowers, and the US fund, launched in 2020, finances US borrowers. Around 80% of assets are in these investment funds with 20% in segregated mandates, which are run pari passu. Horizon is also active in debt capital markets, with two securitization programs, four private debt funds, and a presence in wealth management. In terms of ESG, Horizon is a UNPRI signatory.

Key players in trade finance

Trade finance is an increasingly important alternative credit investment strategy where investment funds are becoming “the new banks”. Some US$8.8 trillion of commodities were exported worldwide in 2014, and 80-90% of this involves trade finance for credit or risk mitigation. Private and government owned banks do finance substantial amounts, but they cannot meet all demand. Banks facing punitive capital charges under Basel III have retreated from the space. Giant commodity trading houses advancing billions of dollars of credit to governments and companies are, in effect, acting like shadow banks, but they too can face regulatory constraints. And those banks that remain active in the space have sometimes incurred losses due to having insufficient risk management safeguards in place; they did not have enough collateral or security, especially in some notable cases in Asia and Dubai. From a regulatory perspective, unleveraged funds are also seen as a more secure source of trade finance than leveraged banks. Therefore, specialist investment managers are sought after.

$8.8trn

US$8.8 trillion of commodities were exported worldwide in 2014, and 80-90% of this involves trade finance for credit or risk mitigation.

Switzerland in general, and the Geneva area in particular, has an extraordinary concentration of expertise in trade finance. The Leman region is the largest global hub for trading coffee, sugar, grains and petroleum. Geneva canton alone has more than 400 commodity traders, contributing 20% of local tax revenues. Over 450 commodity traders are based in Switzerland, trading 50% of the world’s soft commodities and 35% of global oil volumes.

One such trade finance specialist is SCCF (Structured Commodity and Corporate Finance SA), whose co-founder and owner, Dimitri Rusca, has nearly 30 years’ experience of trade finance. “My career began in 1992 at old Swiss firm Andre & Cie, which dates back to 1877. I was trading coffee, sugar, cocoa and oil, including barter deals in Russia and the CIS. I then moved to BNP Paribas before setting up SCCF in 2004,” he says. Other senior trade finance relationship managers of the firm had worked at banks – BNP Paribas, Credit Suisse, ING, Société Générale, Standard Chartered – and at commodity giant Cargill. Since inception, SCCF has been involved with over USD$12 billion of trade finance deals.

SCCF started out on the advisory side, raising a few billion of capital for some private funds and smaller and medium sized traders and in Switzerland, mainly from banks. SCCF then broadened out into a range of relationships with commodity traders: financing imports and exports; pre-export finance; financing for transactions, in commodities. The due diligence process for onboarding includes KYC, financial reviews, credit checks, and site visits.

These broad relationships provide SCCF with plenty of deal flow to refer to its asset management arm, Horizon, which was set up in 2012 by Dimitri Rusca and Sebastien Max, who previously worked at Diapason Commodities Management. SCCF continues to originate and monitor deals exclusively for Horizon and does not syndicate deals with other funds, banks or other parties.

Horizon’s niche focus

But Horizon’s focus is rather narrower than SCCF. Horizon finances commodity merchants who trade a limited number of commodities: agriculturals such as, wheat, barley and corn, edible oils and base metals such as aluminium, zinc and copper. “We avoid crude oil and gas, perishable agricultural goods and precious metals or stones, and finished goods, which are problematic for insurance, quality control and fraud,” explains Max.

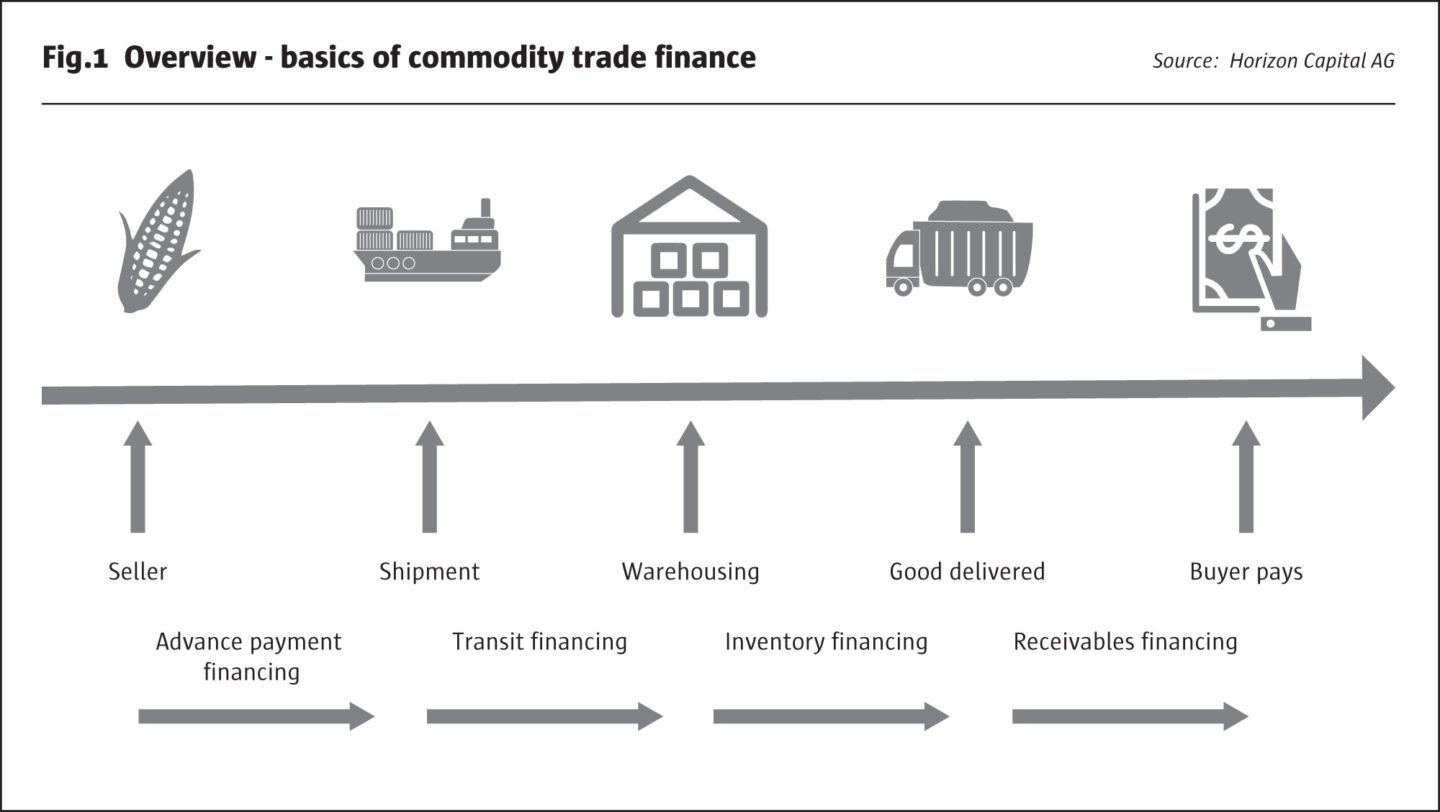

Horizon is also quite specialized in certain niches in commodity trade finance: the firm’s deal types are financing advance payments; transit or cargo; inventory and insured receivables, all subject to certain conditions. “We are cautious. We only do advance payments to major companies, not traders. We do not accept receivables from traders without insurance. We only work with major factories, surveyors, insurance companies and warehouses,” says Rusca. The structures can be lending against collateral and providing letters of credit, bills of exchange or credit insurance, for periods of 45-90 days. Horizon has proprietary software for monitoring the loans on a daily basis.

Diversification criteria

Horizon’s oldest strategy is the European one, which caters mainly for borrowers based in Switzerland. It has a concentrated focus but is diversified from many angles: by borrowers; counterparties; commodities; regions; countries and tenors, and its diversification goes far beyond the minimum levels required for a Luxembourg RAIF. For instance, RAIF rules cap counterparty exposure at 33%, but Horizon’s internal limit is 10%, and in practice is much lower. The European fund has 210 loans, and each one has a specific buyer, supplier and commodity. Investors can see country, commodity and maturity exposure breakdowns, and can get more detail from the manager.

Factors influencing return targets

Horizon’s focus and risk appetite is consistent with a return target in the middle of the range for trade finance, targeting USD returns of 6-7% to investors, net of expenses. Return targets in other trade finance funds can be as low as 3% for some “plain vanilla” strategies or as high as 15% for some more “exotic” ones.

Horizon’s interest rates are referenced to floating rate LIBOR benchmarks, but are subject to a floor (LIBOR+9% pa) so that recent cuts in interest rates have made little difference. Negative rates in CHF and EUR are also not a problem because USD is the base currency for most deals.

Borrowers need to pay this level of yield because banks are reducing exposure due to stricter regulations and higher capital requirements for trade finance under Basel 3 and cannot easily raise capital in public markets, and this also means that the 2020 rout in public credit markets is not a reason for Horizon to raise yields, because its borrowers do not access these markets. Horizon aims to offer its borrowers steady and predictable terms through the cycle.

Fund size, cash drag and turnover

The largest trade finance funds can end up dealing with borrowers who do have access to other sources of finance and can see more competition eroding returns. Smaller trade finance funds can have higher performance for other reasons. “The on-boarding fees received by new trader clients have a bigger impact on smaller asset pools. And cash drag is less of an issue because smaller funds can deploy, and redeploy, their capital faster and more easily, turning over the portfolio more often, and reducing cash drag. Horizon’s European strategy typically turns over its capital every 60 days. This process is expedited by good relationships and communication with investors. If Horizon has advance notice of a big inflow, it is easier to plan ahead and make sure it will be rapidly deployed. We try to give our Treasury four or five months’ visibility,” says Rusca.

Repeat business does reduce cash drag, but also requires risk mitigants. Horizon is offering revolving facilities that are often renewed, but they are uncommitted, so Horizon is not obliged to renew them if risk profiles have deteriorated. The structure is self-liquidating: at each maturity date, liquidity is tested, by asking borrowers to repay funds before the facility is drawn down again. This is one of many risk mitigants that Horizon has built into deal structures.

We avoid crude oil and gas, perishable agricultural goods and precious metals or stones, and finished goods, which are problematic for insurance, quality control and fraud.

Sebastien Max, Capital Horizon

Balancing risk and return

Rusca suggests that other trade finance funds are targeting higher returns for three main reasons. “First, rather than financing already produced commodities as we do, they may be financing crops or projects, which entails more risks over weather factors, pests, project delays and so on. Second, they may be financing borrowers in African countries where market yields are higher. Horizon has no exposure to Africa, Latin America, nor various countries subject to embargoes or sanctions; in April 2020, this list included North Korea, Iran, Libya, Ukraine, Cuba and Venezuela. Third, they may be structuring deals under Cayman or Dubai law, rather than the Swiss or English law that Horizon focuses on.”

Creditor rights in Switzerland

Dealing mainly with Swiss borrowers in the European strategy provides additional safeguards. Loans granted under Swiss law automatically have full recourse to the borrowing company’s balance sheet. Beyond this, Horizon often secures personal guarantees providing recourse against traders’ personal assets.

Seniority

In effect, the deal structures make Horizon “super senior”. In contrast, some trade finance funds are investing in the mezzanine tranche of a trade finance deal that has been securitised into a structure, meaning that investors are subordinate to other, more senior lenders. This is riskier than Horizon’s strategy of only doing whole loans, which are always senior and secured. Horizon also has no leverage at the fund level.

Defaults and recoveries

The risks may be relatively low but are not zero. Looking at the trade finance industry as a whole, aggregate statistics suggest that default rates were very low, at between 0.08% and 0.19% between 2008 and 2015, per IGC data. Recovery rates have ranged between 40% and 80%. Even in the GFC of 2008-2009, defaults remained very low. Although many borrowers may not have any credit rating (because they do not issue rated debt in the public markets), the risk profile appears to be close to that of investment grade corporate debt.

Horizon has done better. Over its life since 2012, the European fund has only had four defaults, of which three have already led to 100% recovery. (The latest one has attained a recovery of 87% so far with full recovery expected in due course).

Working with multiple traders in the same commodity categories (such as metals and grains) makes it easier to resell products if there is a default.

Commodity price risk

Some commodity trade finance funds hedge commodity price risk. Horizon is active in shorter term, pre-sold deals where prices have already been fixed. Horizon is however lending at loan to value (LTV) ratios, usually around 75-85%, which provides some comfort. If a sharp drop in the commodity breaches the LTV ratio, the borrower may in fact get a “margin call” and this happened for several traders in March 2020. Horizon has had no exposure to oil, which has recently traded at negative prices. If other commodity prices went negative, Horizon could cease financing them.

Fraud risk

Overall, Max admits that the main risk is fraud. Anecdotally, trade finance is a source of some “horror stories” involving fraud and zombie funds that took years to repay redemption requests, or never did so. Frauds have included forged bills of lading, fake trade finance bills, and fake warehouse receipts.

Recent cases in China have included China CITIC Bank; Agricultural Bank of China and Qingdao Port. In 2020, at least four commodity trading houses in Singapore (Hin Leong; ZenRock Commodities Trading Pte Ltd; HonTop Energy and Agritrade International) have run into various financial troubles, leading to judicial management; receivership or bankruptcy protection, and potentially large losses for multiple banks. Several of them are accused of pledging the same cargo for multiple loans via letters of indemnity or bills of lading.

One safeguard against multiple loans against the same collateral is a central register of creditors and debtors in Switzerland which also acts as another incentive to pay up. If borrowers do not, they might even have trouble renting an apartment. To limit fraud risk, Horizon’s due diligence works with agents in ports who certify the quantity and quality of goods. They include Swiss company, Societe Generale de Surveillance; UK firm Intertek (which belongs to the FTSE 100 index) and Cotecna. To guard against risks of forged and duplicate documents, Horizon has developed its own blockchain system: ArgosLogistic, which uses technology to check, verify and detect fakes or duplicates. Digitalized documents help to mitigate the risks of fraud, corruption and multiple loans being secured on the same collateral. Documents can be created and shared on multiple devices, stored securely, and linked to a digital fingerprint on a public blockchain. The key documents include forwarders’ certificates of receipt; warehouse receipts; airway bills; bills of ladling; carriage roads; forwarders’ certificates of transport; seaway bills; certificates of quantity and certificates of quality. These can be shared with multiple parties: a fund or bank; a borrower; a supplier; a transport company; a warehouse keeper and an inspection company.

Travelling to visit suppliers, buyers and traders is also all part of the due diligence process, which can take 2-3 months for a new borrower. Once lockdowns are lifted, Horizon can resume very selectively expanding its client base.

Covid-19 and Trade Finance

The pandemic has temporarily stopped the on-boarding of new traders, because it is not possible to do on-site due diligence given the government restrictions in place.

The overall impact of Covid-19 is relatively modest, however. For now, Horizon’s existing client base are keeping it busy. “Borders have been closed to people, but not to freight. The essential commodities that Horizon finances are not subject to production shutdowns. Even in Italy, the worst hit part of Europe, transit has only been delayed by five or 10 days; Switzerland, where most borrowers in the European fund are based, exited lockdown at the end of May. Horizon’s average deal time frame was reduced from 61 to 50 days to improve liquidity during the coronavirus pandemic,” says Rusca.

Horizon’s contracts have not specified pandemics in general nor Covid-19 in particular, and therefore the protocols in the event of default should be “business as usual”. If a borrower goes bust, Horizon has a pledge against the collateral, and if the original buyer does not purchase it, the cargo could be sold to another buyer.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical