The impending International Maritime Organisation Marpol Annex VI regulation on limiting sulphur content of bunker fuel to a maximum of 0.5%, beginning January 1st, 2020, will herald a change for the oil and associated industries the likes of which most participants have never experienced.

The impact of this regulatory challenge cannot be underestimated as it seeps into virtually every sphere of the global industrial ecosystem driven in no small part by 90% of the world’s goods still travelling by sea. Beyond the seaborne market, the knock-on effects may well impact other sectors that are also procuring transportation and associated fuels as the maritime sector migrates, in part, away from 3.5% bunker fuel to a mixture of Marine Gasoil (MGO) and the new Ultra Low Sulphur Fuel Oil 0.5% (ULSFO).

So, who else could be impacted?

The potential pull on higher value molecules in the refining system has already been creating significant volatility in forward markets of both fuel oil and diesel – and volatility from a forward earnings perspective for corporates is something that is rarely welcomed.

90%

90% of the world’s goods still travel by sea

Not only does this directly impact shipowners and cargo movers who bear the increased costs of the higher fuel prices – which currently stand at a significant 56% premium of 0.5% ULSFO versus 3.5% – but any firm exposed to transportation fuels may also experience a higher cost burden. This would stretch across aviation, road transport, rail as well as industrial sector usage in power generation. This broad reach means that asset pricing of corporations and their equities, bonds and debt are likely to see as yet unpriced volatility as they see a significant shock to their cost base. At the other end of the spectrum, the biggest beneficiaries are likely to be the refining sector, especially those with deep conversion capabilities (the ability to make a higher proportion of the more valuable fuel types such as diesel and gasoline).

An opportunity for the broader fund community

Looking for ways to express this transition through the deployment of risk capital to capitalise on this seismic shift is not something that is overtly obvious and accessible to the broader hedge fund community outside of the niche commodity funds. Thus, the trades being examined in the more historically liquid instruments are somewhat blunt instruments for the nuances of this specific event. Through the creation of a consistent, liquid, exchange agnostic pool of aggregated liquidity there is a clear opportunity for the broader fund community.

At BLOC-X we believe that the best way to effectively manage risk is to have a centralized platform where industry players can participate in an equal footing, and in a transparent and cost-effective way. We recently entered the market to address these issues by providing an alternative digital trading solution for over-the-counter (OTC) oil block futures which aims to reduce trading transaction costs by up to 90%.

Disrupting the model of transaction costs in OTC oil block futures trades

This is a market that is currently bearing transaction costs of circa $1bn a year through voice, chat and existing screen fees.

The cost base for a market participant largely breaks down into three buckets:

a) The clearing fee

b) The block posting fee

c) The transaction fee

Whilst clearing fees are already a well competed space, the posting fees and transaction fees are not. In fact, there has been almost no movement or restructuring in the transaction fee model in decades in the energy space. Whilst initial and variation margin are crucial components of derivative transactions and must be highly correlated with the size of the trade, the same positive correlation between trade size and transaction fees is not a necessity.

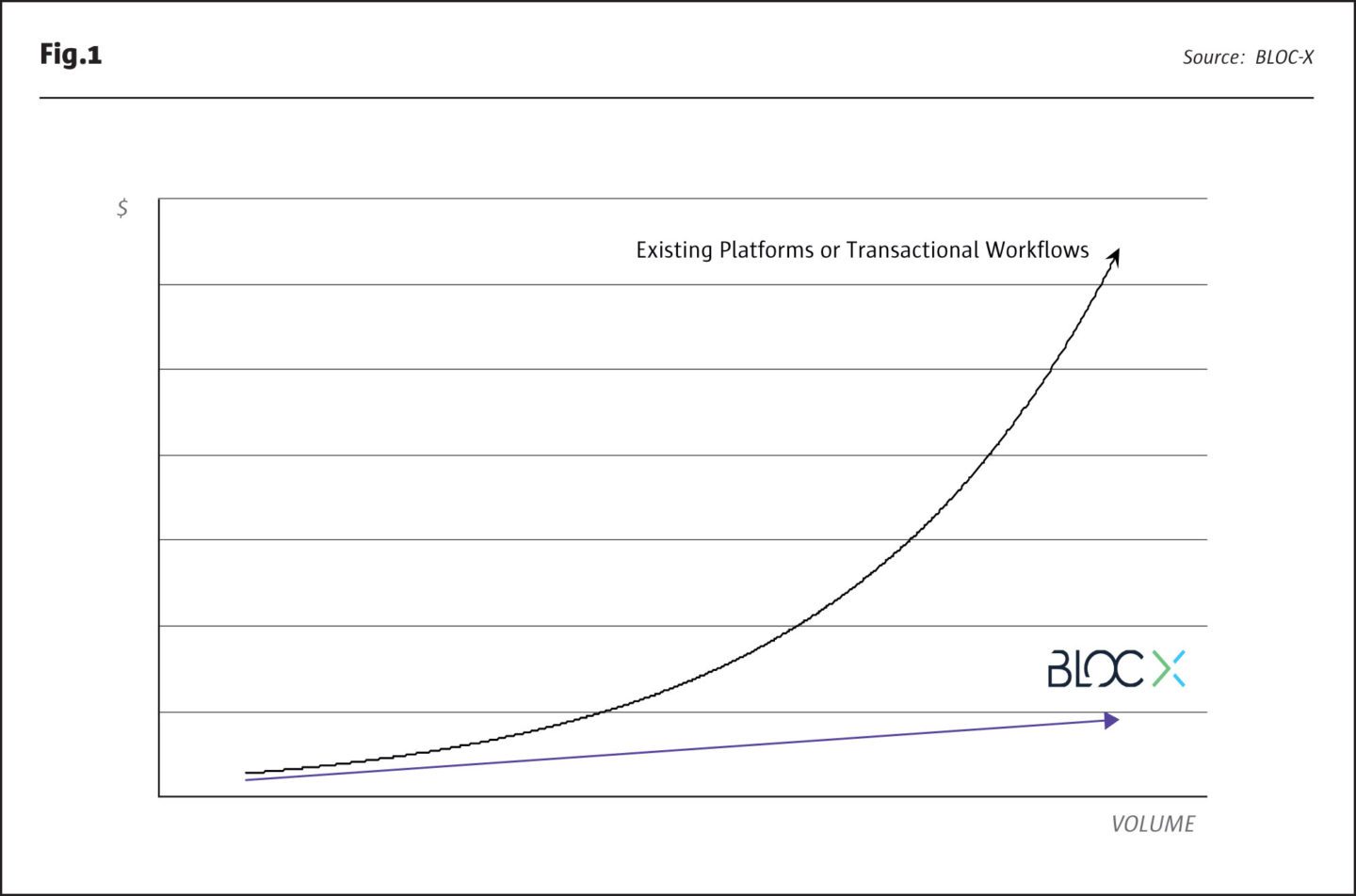

There is nothing materially different about the workflow from a process or operational perspective nor is the trade more complicated or onerous when larger amounts of oil are traded. BLOC-X’s model aims to reduce transaction costs for OTC oil block futures trades by up to 90%.

When examining the fintech space more broadly or even beyond into how disruptive entrants are reshaping markets, there are obvious lessons to be applied to this and other markets. The question really comes down to operational complexity in transactions whatever market they exist in. If there is no financial or risk related cause for a higher charging structure for a larger trade – that is to say that the commission on the trade is volumetric based – then, there is a clear opportunity to transform this model through a standardised and flat rate fee per transaction.

Modernising commodity trading

Lowering barriers to entry, improving market efficiency, providing transparency and reducing transaction costs are critical ingredients to bringing a meaningful change in this derivative class. This modernisation is able to draw on experience and iteration from other assets that have already transitioned whether it be equities, fixed income or foreign exchange. The best example may even be closer to home in energy markets such as gas, and electricity that are the frontrunners in the digitisation of commodities and have already been the domain of a few hedge funds for several years.

The unique regulatory structure in this off exchange futures market is especially conducive to this transformation. The underlying contracts already have a robust regulated architecture underpinning them governed by the exchange where they are listed and the respective clearing houses. As we compare them to more mature asset classes with independent technology providers creating aggregated pools of liquidity, the path to a deeper more active electronic liquidity pool in oil is clear. To date, there has not been an industry adopted technology solution to bind together these multiple regulated exchanges, not at least, until BLOC-X emerged.

The key to unlocking this market exists in driving down transaction costs as the first barrier. It will quickly move beyond that to look at optimising margin and trade compression across exchanges to achieve better capital allocation against risk being deployed. These are concepts already present in more mature asset classes like fixed income but are equally relevant in the commodities space with two big competing exchanges operating siloed businesses that create huge inefficiencies for end clients.

With Basel IV firmly on the horizon as well as FRTB, the use of capital and cost to deploy risk from financial institutions and their clients is likely to become ever more expensive and as such the appetite to compress costs in other areas is only likely to grow.

As we see the likes of AHL, Aspect, Gresham and others search for more esoteric and uncorrelated markets to deploy risk into in the search for alpha, the parallel lowering of the barrier to entry from voice to electronic dealing with a huge compression in transaction costs should, we assert, be a highly synergistic and symbiotic relationship.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 145

IMO 2020

Challenges, risks and opportunities in the marine fuel transition

Andrew Toumazi, Chief Executive Officer and Founder, BLOC-X

Originally published in the November | December 2019 issue