Innovative Tools to Stand out in a Crowded Market

How options are helping hedge funds make a difference

STUART FIELDHOUSE

Originally published in the July 2013 issue

As the hedge fund market continues its cautious resurgence we are seeing a different investment landscape emerge compared to that which preceded the financial crisis of 2008. The rules of the game have changed considerably. The market now features an increased dominance by institutional investors in the alternative investment market, forcing successful fund managers to adapt their funds to meet higher liquidity and transparency requirements.

Those funds which have been able to grow consistently in this new environment have often been those which deliver to investors exactly what they want, beyond simply superior or consistent performance (although these remain the most critical factors). Meeting investor expectations can often be challenging unless the fund’s manager is prepared to make use of additional overlays or strategies to smooth returns, manage risk, and/or provide additional liquidity to the portfolio.

“Just like any financial instrument, when used appropriately, options can provide a hedge fund with the means to be successful,” says Andy Nybo, head of derivatives at TABB Group. “There is a role for options within certain types of strategy – the challenge is how [hedge funds] are able to use options within their portfolio and whether they provide a useful mechanism for executing their strategy.”

Since 2008 there has been an increased focus by investors on portfolio liquidity. Lessons were learned the hard way during the financial crisis, and active hedge fund investors now want to be able to see how a single fund can impact their overall portfolio liquidity picture. Options markets in the US remain particularly deep and liquid, especially for indexes and the most actively traded single stocks. A hedge fund running a strategy concentrated around large or mid-cap equities can use options as a powerful way to take directional views, to manage risk exposures, and hedge strategies effectively and economically.

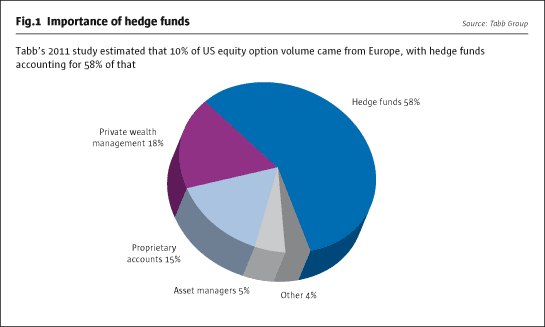

There has also been a surge in the use of weekly options in the US, which account for up to 20% of volumes. This has enabled hedge funds to become more active in options markets, allowing them to take a directional view around corporate events (e.g., an earnings announcement or pending approval of a new pharmaceutical) that can move the price of a stock. The availability of these weekly options allows active trading hedge funds to efficiently express directional views on specific companies (see Fig.1).

Adds TABB’s Nybo: “One of the types of fund we’ve seen emerging over recent years has been the volatility fund that can provide uncorrelated returns for investors seeking to diversify or get exposure to a particular segment of the marketplace. You’re seeing greater demands from institutional investors for funds that can trade a portfolio of volatility, providing investors with an investment vehicle that may allow them to have uncorrelated returns or exposure to a different type of asset.”

A good example of such a strategy is that adopted by the volatility arbitrage team at Amundi. This takes a short to medium-term view on volatility using highly liquid options and futures contracts based on the Standard & Poor’s 500, Eurostoxx 50 or Nikkei 225. The portfolio managers aim to identify mean reversion behaviour in the market, trading both long and short depending on core volatility within these markets. Because the fund only uses listed options, it is able to deliver a high degree of transparency and liquidity to investors, with little concern over capacity constraints.

This goes beyond simply going long or short the VIX index – after all, VIX-based ETFs can tend to suffer from mispricing, allowing volatility funds to arbitrage differences in perceptions of volatility. There are significant components of volatility embedded in an option, hence why they are favoured by volatility funds. It is the liquid and non-correlated nature of these strategies which make them such a good fit with institutional portfolios and why successful funds within this bracket have been able to raise considerable sums on both sides of the Atlantic.

Replication of hedge fund portfolios

Options contracts are also being used to aid in the replication of hedge fund portfolios by banks and investors. Options provide the alternative investor with some considerable advantages over allocating to funds of hedge funds, including a relatively small investment and less time and money spent on carrying out due diligence. As discussed above, there are also the obvious liquidity advantages to consider.

The aim of a hedge fund replication strategy is for an investor to mirror the returns of a multi-strategy hedge fund portfolio with a higher level of transparency and lower fees. Such strategies have managed to attract considerable investment from US institutional allocators.

From the investor’s perspective, exchange-traded options offer high levels of transparency including a higher level of confidence that risks can be quantified. Finally, options contracts are more liquid than hedge fund investments.

Replication of hedge fund strategies can include a combination of both options and futures. For example, a convertible arbitrage strategy might use a combination of equity options with fixed income and equity index futures. Generally speaking, contracts based on major indices will be used by the replicator.

It is worth noting that the market for hedge fund replication strategies is nowhere near as big as it was pre-crash: statistically-based replication strategies which relied on regression analysis were hit hard, but replication does now seem to be making a slow return to favour.

Outcome-based allocation

There has been a sea change in the way pension funds and other institutional investors approach their overall strategies, taking a more risk-based approach which has progressed a long way from the traditional shift in the balance between equities and bonds. Now consultants and investors are learning to wean themselves off sovereign debt and corporate bonds as they seek to make assets work harder for stakeholders.

Consultants advising institutional investors now say that their clients are much more focused on outcome-based investments, for example products that might help investors to manage volatility and tail risk as well as delivering low correlation to market beta.

Institutional portfolios are still heavily weighted towards non-inflationary growth periods, with as much as 90% of portfolio risk concentrated in these periods. Thinking that was shaped during the long equity bull market in the 1990s is now having to be re-shaped. While diversification into other assets such as commodities has provided a temporary solution, institutional investors are now seriously looking at investment strategies that make use of exchange-traded futures and options to provide more balanced growth across a range of market scenarios. Hedge fund firms that are able to tailor products that can satisfy these requirements have found it easier to raise money in the institutional space. It requires a different approach to product development, whereby the manager uses options contracts to achieve a more reliable return profile.

Increased regulation

Since the G20 meeting in Pittsburgh in 2009 there has been a coordinated push to bring OTC derivatives as far as possible onto an exchange-traded or centrally cleared system. This has implications for hedge funds that make regular use of derivatives contracts. Regulations intended to reduce systemic risk in the industry, while not impacting options markets directly, are changing the way in which options are bought or sold.

Says TABB’s Nybo: “Given the introduction of MiFID and Dodd-Frank, you are going to see the use of listed options increase, simply because the cost for dealers to remain active in the OTC marketplace will increase. Their capital charges are going up and they have to rationalise their provision of capital to their clients. Any type of OTC agreement needs to be examined from the dealer’s point of view. There is a natural tendency now for dealers to promote the use of listed options given the regulatory restrictions around the use of capital.”

There is also a natural reticence on the part of dealers to write OTC options which require the use of capital reserves. As risk exposure and credit concerns become a bigger part of the landscape, options brokers are becoming much more diligent in the screening of those hedge funds which they will take on as clients. Smaller funds with limited trading activity that do not represent a significant volume of trades can find themselves beingculled from the client list. Ultimately, the fund in question will have no choice but to move to listed instruments as an alternative.

Within Dodd-Frank there is also a limit on the ability of broker dealers to use proprietary capital. Broker dealers have been forced to spin off proprietary trading desks, which once contributed significant volumes to the options market. This has led to the creation of new ventures, with many professionals leaving the dealers to act as small, independent options shops. Fund managers now have a wide choice when seeking an independent options broker.

In Europe, the UCITS IV directive has also played a large role in the way hedge funds are marketed within the EU. In particular, there is a spotlight on concentration risk and liquidity. Most UCITS offer daily liquidity, which many investors now expect as a matter of course. Some of the more successful funds in the alternative UCITS fund marketplace are those which have been able to grow without concerns for liquidity constraints. Typically these will be more systematic funds that make heavy use of exchange-traded derivatives and seek to achieve a consistent rate of return.

Managers considering a UCITS fund launch will need to ensure that the options they hold meet the risk framework criteria laid down by the directive. Limits are in place governing leverage, counterparty risk and position exposure. It is worth noting that index-based derivatives are exempted from position exposure rules, but position exposure from assets underlying derivatives (e.g., a single-stock option contract) must still be combined with physical exposure.

Because UCITS funds are not permitted to directly short securities, many will make use of futures and options based on indices to synthesize short-side exposure. Funds that are very active investors in options will also need to determine which VaR model they will use. The variance/covariance model is not considered ideal for funds which contain many options, resulting in non-linear performance behaviour on underlying market movements.

A UCITS fund must also comply with the cover rule, ensuring that sufficient cover is in place to meet any liabilities caused by outstanding derivative positions.

Capital raising

Increased use of exchange-traded options by hedge funds is occurring in parallel with enhanced investor concerns about risk management. The success of the UCITS hedge fund market has been partly driven by such worries, with nearly 1000 UCITS-compliant hedge funds now operational, demonstrating 16% growth in assets under management in 2012. A recent survey by Alix Capital has indicated that 69% of institutional investors planned to increase exposure to UCITS hedge funds in 2013.

Listed options contracts remain a friendly instrument to hold in a hedge fund portfolio in this new environment. Unlike OTC contracts they are highly transparent, and it is easier for investors to identify sources of alpha. Issues over pricing and valuation are also less of a concern. The most frequently traded contracts – e.g., on the S&P 500 – generate high levels of liquidity, bringing comfort to even the biggest funds. In addition, centrally cleared options deliver more peace of mind to the end investor, as credit concerns are addressed with OCC (The Options Clearing Corporation) issuing and guaranteeing the trade, in contrast to a bilateral OTC agreement, which rests on the credit risk of an individual dealer.

Options are also being used by managers to run tail hedge books to protect the fund against unforeseen risks and market events. This has become more widely adopted as a risk management tool as market volatility and ongoing regular political intervention impact debt and currency markets, with knock-on effects on other assets.

“Investors are becoming more concerned about portfolio risk,” says Charles Vernudachi, senior vice president with Eaton Partners. “More investors are wanting to see some kind of risk overlay and how the manager is hedging the portfolio. It is hard or impossible to turn a portfolio around quickly and consequently investors in this market want to

know that a fund manager has a plan B, whatever that might be. There is simply not time to change overall exposure.”

Conclusion

Hedge fund managers who wish to succeed in a marketplace where the barriers to entry are ever higher, and where a successful fund must be larger in terms of AUM and more institutional in its operational protocols, may wish to look more closely at exchange-traded equity options. Investors are less averse to them than OTC contracts, and they can perform a useful role in many portfolios, in helping funds to function within the constraints of the new regulatory environment. Superior transparency and more efficient pricing are hard to argue with, especially when the instruments in question are being used to reduce portfolio risk.

Sponsored by OIC. The views expressed are solely those of the author of the article, and do not necessarily reflect the views of OIC. The information presented is not intended to constitute investment advice or a recommendation to purchase, sell or hold securities of any company, but is intended to educate users concerning the use of options.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical