Despite the current market environment, institutional investor sentiment, in general, remains positive. Investors continue to navigate the uncertainty surrounding global growth and the European debt crisis in search of outperformance. As in previous months, investor groups across the globe are concentrating their portfolios. Disappointed by the lacklustre performance in May, investors are focusing on higher conviction names as they rid their portfolios of managers that have underperformed. Several investor groups have also explored customised products to gain access to more niche sources of alpha. Many of the large institutional funds of hedge funds are being asked by their clients to manage bespoke, as opposed to commingled, products on their behalf.

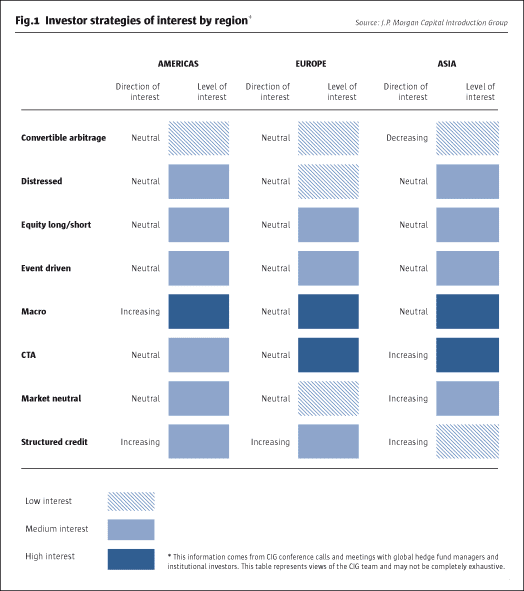

This trend is common among managers, as well, who are increasingly being approached by investors looking for customised portfolios via funds of one and managed accounts. Several US and European funds of hedge funds and family offices are opening research offices in Asia, recognising the advantages of a local presence in the region (see Fig.1).

In a similar vein, many funds of hedge funds in the US and Europe are looking to acquire local firms to gain exposure to the region and provide their clients with comprehensive, global products.

In June, members of our Capital Introduction Group (CIG) travelled to various regions throughout the US including St. Louis, Chicago, Texas, and Boston. Across these regions, investors remain active in the hedge fund space with interest focused on direct lending, structured credit, global equities, global macro, new launches, and CTA strategies. In St. Louis, the investor base is dominated by three major consultants, while in Chicago, hedge fund activity is driven primarily by family offices, funds of hedge funds, and consultants. Despite the volatile market, many of the institutional funds of hedge funds in the Midwest region are stable and actively looking to make new allocations to uncorrelated strategies. The endowments and foundations are optimistic about the space and may look to increase hedge fund exposure in the coming years. Several of the family offices in Chicago have made efforts to institutionalise their businesses by expanding due diligence teams and defining a structured investment process. Some investors are keen to learn about mid-sized managers (assets under management of $250 million to $3 billion); however, most continue to allocate to the larger players with assets under management greater than $5 billion.

The majority of investors in Texas are located in Dallas and Austin. Dallas, which represents the largest concentration of investors, consists primarily of mid-sized family offices whereas Austin is dominated by public retirement schemes. The principals at most family offices in Dallas are actively involved in the hedge fund investment process which allows for a shorter due diligence period as compared to other investor groups. While family offices dominate the investor base, there are also a number of active endowments and funds of hedge funds in Dallas. Among these groups, structured credit strategies, particularly mortgages, have been of interest; however, most have yet to allocate to the space.

Although investors in the region have been disappointed with equity long/short, they remain invested in the strategy, redeeming from some of the larger funds that have underperformed and re-allocating to mid-sized managers.

Many of the public retirement schemes in Austin work closely with consultants and are currently increasing their hedge fund allocations. One scheme, in particular, is focused on emerging managers and has chosen to gain exposure to this space by investing with an external seeder.

Consultants are the principal hedge fund investors in Boston. Historically, they have been partial to large, established, fundamentally-based equity long/short managers. While it still remains a popular strategy, several of the major consultants have been making the effort to move away from equity long/short and expand into more quantitatively-based strategies, such as statistical arbitrage and CTAs. Others are looking to diversify by building out their lists of approved credit and event driven hedge funds. Apart from the consultants, endowments are once again becoming active after several years of making relatively few changes to their hedge fund portfolios, while the funds of hedge funds in Boston are focusing on new launches.

Members of our CIG team also travelled to Zurich and Geneva in the month of June. Zurich has a diverse investor base consisting of funds of hedge funds, family offices, insurance companies, and pensions. While some investor groups have been active in the hedge fund space for years, the Swiss pension universe is just beginning to allocate directly. To help build their knowledge about hedge funds, a number of pensions are hiring ex-fund of hedge funds employees. High net worth individuals and family offices – groups more familiar with hedge funds – have mixed sentiments towards the space. Some groups are pleased with the performance of their portfolios while others are disappointed and are, consequently, reducing their hedge fund exposure. For those investors that are continuing to allocate capital to hedge funds, the main strategies witnessing inflows have been global macro, actively-traded long/short credit, and equity market neutral.

Hedge fund activity in Geneva is still primarily driven by private banks. However, like Zurich, Geneva-based pension funds are becoming more active and are in the early stages of implementing direct investment processes. While there are pockets of activity in the region, many investors are finding it challenging to raise capital. A large portion of the underlying assets in Geneva are from high net worth individuals, many of whom have expressed disappointment with hedge fund returns, fee structures, and liquidity profiles. For those that are actively allocating, interest is focused on macro managers and new launches.

In New York, our CIG team hosted an event focused on global equities. Even though some equity managers have had a difficult time generating positive performance in the current market environment, a large number of investors still remain interested in the strategy. According to our 2012 Institutional Investor Survey, 80% of respondents were invested in equity long/short managers at the end of 2011. The event featured a panel discussion between three US equity long/short managers who, overall, were bullish on US equities, specifically within defensive sectors (e.g., healthcare) and financials. The panellists have actively responded to the volatile macro environment by reducing gross exposure and running lower net exposures. While two of the managers prefer to short individual names rather than indices, they acknowledged the structural changes to the market that are making it more difficult to continue this practice (e.g., new market regulations and higher costs to borrow). Overall, the panellists argued for a higher return potential in equities over bonds in the long run.

US securities lending

Cumulative activity on our book was relatively modest as the volatile flow that we witnessed in the latter part of May continued through June. Despite numerous market catalysts including the Greek elections, Moody’s bank downgrades, and the Obamacare ruling, gross volume was flat month over month and moves on our book failed to gain much momentum. We entered the final trading day of the month evenly split between new shorts and buys to covers. However, we experienced strong shorting on June 29 as the market rallied nearly 2% on positive developments from the EU summit. This swung our book to net short for the month, although the overall move was moderate.

One theme that has developed is the move away from ETFs in favour of single names on the short side. Single names were shorted in decent size this month, but most of the activity was offset by ETF covering. Gross ETF activity was in line with our historical average of 18% over the past year, after representing a larger portion of overall activity in recent months.

From a sector perspective, we saw the strongest shorting in industrial, consumer cyclical, and financial names, while utilities and consumer non-cyclical names drove the covering.

Europe

The biggest flows in June were in distressed Spanish and Italian financials. Borrow costs hit record highs for the year on Banco Popular, Caixabank, Bankia, and Monte Dei Paschi. There were sizeable recalls and rate changes throughout the month of June. The renewable energy sector remains crowded with short sellers keen to increase positions in Vestas Wind, Qcells, and Meyer Burger.

With respect to risk arbitrage deals, Glencore’s bid for Xstrata continued to dominate the headlines. June saw increased liquidity in shares of Glencore due to the mid-June FTSE reweighting. However, the demand for borrow outstripped the new supply and we witnessed an increase in the cost of borrowing throughout June. America Movil was successful in raising its stake in Royal KPN to 27.7%. Very strong demand existed for borrowing the guaranteed untendered shares due to the spread between the tender price and the stock price. Couche Tard succeeded in its takeover bid for Norway’s Statoil Fuel & Retail, with funds taking long positions. Funds also took long positions in Rhoen-Klinikum when Fresenius SE & Co. announced its bid to buy the company. However, Fresenius SE & Co. was unsuccessful as it was unable to achieve approval by at least 90% of shareholders and instead only received the support of 84.3%. This was due, in part, to Asklepios acquiring a 5% position in Rhoen-Klinikum prior to the vote.

Asia ex-Japan

In June, we witnessed a decline in client flows across all of the major countries (India, Taiwan, Korea, China, and many other Southeast Asian countries). On a relative scale, China was the country least affected by the slow momentum. However, the lack of a stimulus package led clients to de-risk and rebalance their portfolios as they wait for economic data that signals improvement. In Taiwan, there was some accumulation by hedge funds in Taiwan Semiconductor Manufacturing Co. Ltd. from a long perspective and shorting in HTC Corp. In India, investors were primarily unwinding positions in the financial services sector, although flows were relatively light.

Japan

The various agreements made in Europe appeared to have quelled some of the global economic confusion; however, Japan and its market remained stagnant. At the beginning of June, hedge funds ignored major technical indicators that pointed to overselling and took no major investment actions, creating a quiet month. On the stock loan side, locates were light, but hedge funds were asking brokers for market colour and recent flow activity. On the swap side, we witnessed an increase in unwinds as clients covered their short positions.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 79

Institutional Investor Sentiment

J.P. Morgan Prime Brokerage global hedge fund trends

J.P. MORGAN PRIME BROKERAGE

Originally published in the August 2012 issue