Interview With Gianmarco Mondani

Generating alpha through anticipating earnings revisions

INTERVIEW WITH GIANMARCO MONDANI, INVESTMENT DIRECTOR, NON-DIRECTIONAL EQUITIES AT GAM

Originally published in the issue

Financial markets continue to be dominated by volatility, short-termism and investors’ oscillating risk-on/risk-off appetite. Markets remain resolutely range-bound as a long-term solution to the world’s global economic problems continues to elude policymakers. This is not a new phenomenon, and conventional wisdom suggests that it is not going to go away too soon either. Perhaps it has become, to a greater or lesser extent, the new normal.

In this environment, investment strategies that aim to harness beta are likely to struggle over the medium term and be too volatile for many investors. However, a non-directional approach, minimising beta exposure whilst focussing on consistent alpha generation, may prove to be an effective way to navigate through today’s choppy financial waters.

This is exactly the approach that GAM’s Gianmarco Mondani developed shortly after leaving Martin Currie in 2002: “I analysed the universe and realised that most hedge funds incorporated a lot of beta. We sought to identify a methodology that was conducive to alpha generation.”

Over a decade later, Mondani heads up an investment team at GAM, which manages over $800m of client assets, primarily in long/short equity strategies, from its office in Lugano. The highly experienced, nine-strong investment team developed its track record at boutique investment manager Arkos Capital, which was recently acquired by GAM. The team’s products complement GAM’s existing single manager hedge fund offering, whilst the transaction will enable Mondani’s team to broaden its distribution strategy globally. Their active, conviction-driven and absolute return approach to investing fits perfectly with GAM’s culture, which provides its managers with the freedom to invest according to their own investment philosophy, without having to conform to a single ‘house style’.

Mondani, who co-manages the team’s flagship European equity portfolios, recognised that the widely accepted Anglo-Saxon approach to investment prioritised quality criteria – strong balance sheets, healthy cash flows, robust earnings growth – but investors did not question how effectively this approach worked. He says: “The trouble is that those quality criteria are well-known by everyone in the market and are therefore fully reflected in the share price.”

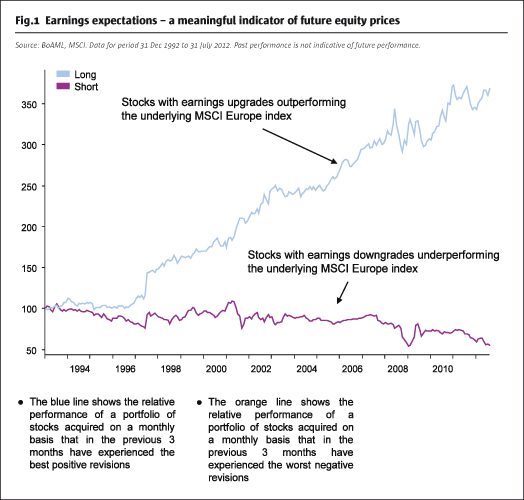

He soon came to the conclusion that identifying in advance where such expectations are likely to change could be a more attractive and sustainable approach to generating returns. After analysing the many potential catalysts for change in a company’s share price, Mondani ultimately concluded that the one approach that consistently performed was to anticipate earnings surprises: “As a strategy, buying companies with positive earnings revisions performed far better than other approaches, whereas buying companies with negative earnings revisions made considerably less money.” These two opposing forces form the basis of the team’s long and short books.

But if it worked, why didn’t everyone do it? And was it repeatable? The answer to both these questions was rooted in investor psychology. “Here behavioural finance comes into play” says Mondani. “Earnings revisions correlate with price performance – if a share price is rising, usually it is going up because of information available in the market. If that information is positive, the company is more likely to beat expectations. By buying earnings revisions, a fund manager is buying price momentum.” This dynamic goes against an investor’s psychological bias to sell stocks on strength and buy stocks on weakness. Statistical analysis says that one should do the opposite. Mondani, therefore, seeks to exploit this inefficiency – and it is one that he believes will persist.

Mondani’s research suggests that the likely candidates for the long and short books will be those companies that are already seeing positive or negative revisions, respectively. “This is rooted in ‘anchoring’ behaviour by analysts” he says. “They can be slow to revise their figures higher or lower. This creates great opportunities for alpha generation.”

The team combines a range of proprietary screening tools incorporating earnings, valuation and momentum models to help identify those companies most likely to experience earnings revisions. Historical evidence, Mondani insists, shows that an earnings revisions approach works best when supported by valuation and price momentum. Favourable valuations can magnify the success of the team’s earnings revision approach – companies with cheaper valuations typically experience bigger pricing impacts (ie re-ratings) from positive earnings revisions than more expensive ones, and vice versa. Meanwhile, if price momentum is supportive, the team will have higher conviction in a stock’s positioning, reinforcing the team’s strong discipline of buying on pricing strength and selling on weakness.

The team’s methodical process allows them to narrow the universe and isolate the most promising long and short positions for intensive fundamental analysis. This analysis, which is designed to determine which companies are likely to beat or miss analysts’ expectations on a 12-month view, concentrates on those factors deemed to be good indicators of future performance, namely likely changes in analysts’ expectations, valuation, price momentum and financial structure. “We speak to each company to understand what factors are driving their P&L, balance sheet and cash flow. In order to stay ahead of the crowd, we then seek to form our own view as to whether the brokers’ upgrade or downgrade is likely to be right.”

The final portfolio is a balance of long positions in those stocks that are likely to beat analysts’ expectations and short positions in those stocks that are likely to miss analysts’ expectations. If the valuation is supportive, the portfolio will have a higher weighting. Similarly, if price momentum is favourable, the managers will have a higher degree of confidence and reflect this in the sizing of the position. Liquidity is also a consideration and position sizes will be weighted accordingly.

Risk management is inherent in each part of the process. Portfolios, built from the bottom-up, are well diversified with generally no pre-determined maximum limits in terms of sector and/or geography. Importantly, the team seeks to mitigate correlation to all factors that are not alpha sources across stock markets, interest rates, commodities, investment styles and currencies, but does not attempt to time the market. Portfolios aim to provide consistent returns with low volatility and low-beta or beta-neutral targets.

Mondani’s team currently manages developed Europe and emerging market long/short equity portfolios, as well as dedicated financials and convertible bond strategies. They use the same underlying earnings revisions based process across their various strategies, but in order to optimise results they tailor and tweak the approach for each different market depending on its individual characteristics. “European markets have historically been quite uniform with companies operating in similar conditions until relatively recently. But emerging markets can have very different dynamics and what’s going on in South Africa could be very different to what is happening in Mexico, for example. In emerging markets, we therefore have to be more aware of the differences in the economies in which companies operate.”

The result has been strong consistency of returns. The team’s flagship European long/short equity strategy has a 10-year track record and over that time it has outperformed the index (FTSE Eurotop 100) at around a quarter of market volatility with zero beta and a correlation to European equities of only 0.1 (from inception July 2002 to 30 September 2012). In 2008, as markets went into freefall during the global financial crisis, the strategy dipped just -2.2% whilst the broader European markets collapsed over 40% (all data net of fees, EUR terms).

The team’s emerging market strategy rode the financial storm of 2008 even more impressively, posting a positive return of 8.7% while emerging markets plummeted by more than 50%. Since its inception in February 2007, the portfolio’s excess returns have been generated at less than a quarter of market volatility, with a beta of 0.1 and correlation to emerging equities of 0.3 (all data net of fees, EUR terms).

Mondani says that in spite of the dislocation created by the global financial crisis, he still sees plenty of opportunities. “We are finding companies – even in beleaguered countries such as Spain – that have beaten expectations and have risen very strongly and are still making new highs because their businesses are thriving. Equally there are those that are being revised lower because their fundamentals are deteriorating. The differential between companies in this environment is strong and this creates many exciting opportunities for us.”

Although the team’s approach has worked well across different environments, Mondani has made some enhancements to the process to accommodate today’s markets. For example, he has incorporated more top-down factors into the team’s analysis, given the disproportionate influence macroeconomic events are having on share price movements.

“During 2009 we saw investor sentiment change from very negative to very positive. Companies were issuing profits warnings, but their price was still going up. At that point in the market no-one cared because they expected conditions would improve in the following year. Changes in earnings estimates can be wrong-footed during these periods if the top-down environment is not somehow factored into equity analysis.”

Mondani is now monitoring more closely, therefore, a set of macroeconomic indicators – such as global growth expectations, manufacturing data and trade statistics. Whenever he sees that these forward-looking indicators are improving, he will reduce his underweight position in the most sensitive sectors to protect the portfolio: “We will move to a neutral bias to cyclicals, for example, when economic indicators are improving, without allowing the bottom-up stock selection to take us to a very negative position.” This qualitative conditioning overlay, as Mondani refers to it, may help protect portfolios during brief periods when the reliability of the pure earnings revisions approach may be clouded by other forces.

That said, Mondani does not believe the current environment is one of particular economic instability. Western governments have ‘fired all their bullets’, banks, governments and consumers are deleveraging and it seems likely that economic growth in developed markets will be zero or thereabouts. Mondani believes that this provides a good deal of certainty as to the likely path of the global economy over the next few years. In his view, this a good position from which to do fundamental analysis because it is not necessary to incorporate rapidly changing growth statistics into analysis.

“We seek out companies that can benefit as a result of their growth characteristics, their management, the niches in which they operate and the countries to which they are exposed – and therefore those companies that we believe will be able to produce earnings growth in a low growth environment.”

Mondani draws parallels between the current market environment and that of Japan in the 1990s. In Japan, the difference between good and bad companies became extreme. The companies that were subject to the weak economy of Japan – banks, construction, life insurance – were subject to downward revisions every year. Many investment managers spent a long time trying to ‘bottom-fish’ these names and it never proved a successful strategy for longer than a few months at a time. In contrast, those investors that bought companies with access to growth outside Japan saw positive revisions in earnings.

Mondani sees a similar situation in the areas he is researching: “We find many companies for our long book which can achieve earnings growth that is not dependent on economic growth. We are able to buy them on attractive multiples because prices are still behind the rises in earnings revisions”.

He cites companies that are beneficiaries of the austerity drive within Europe, for example, or selective outsourcing providers, which are also on attractive multiples. In contrast, for the short book, he is finding a number of European companies that have structural problems and trade on higher multiples.

Energy companies, which are exposed to the recovery in capital expenditure and trading on attractive multiples, are also proving a fertile hunting ground. Pure media peers, in contrast, are suffering from a structural decline in viewership and yet still trade at a premium, making them interesting candidates for the short book. He is also shorting a number of European utilities, which are likely to be plagued by government intervention and falling demand, yet still trade at a premium to the market.

Alpha is in short supply and over the past 10 years, Mondani and his team have shown that earnings revisions are a consistent and reliable means to deliver it. In range-bound markets, their non-directional, low beta approach has produced strong risk-adjusted returns with limited exposure to underlying markets. The strategy has served the team well through a range of market conditions thanks to its focus on single stock differentiation. It’s a story that GAM, which seeks to offer investors access to the world’s most talented managers, believes is set to continue in today’s volatile and low-growth environment.

KEY FACTS

• Team formed in 2002 at Banca Arner in Lugano. Launches its first fund, a non-directional, European long/short equity fund

• Team incorporated as boutique manager Arkos Capital SA in 2007

• GAM acquired 74.95% of Arkos Capital in July 2012

• Investment process focuses on anticipating company earnings revisions

• Strategies include European and emerging markets equities, financials and convertible bonds

• Access via offshore and SICAV funds

• 9 investment professionals averaging 13 years’ investment experience

• Total AUM $807m (31 Aug 2012)

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical