IPM Informed Portfolio Management AB (IPM), one of The Hedge Fund Journal’s Europe 50 managers, runs a systematic, fundamental, predominantly relative value macro strategy that continues to deliver uncorrelated returns against a challenging post-crisis climate for many global macro managers and strategies. IPM’s strong start to 2016, up 6% in January, comes after a single-digit 2015, up 4.4%, and a double-digit 2014, up 14.6%, and the strategy has only had one losing year (2011) since inception in fund format in 2006. The firm began in 1998 and the fund will celebrate its 10th anniversary in June 2016. Reflects Head of Client Portfolio Management, Serge Houles, “IPM has attained its aims in terms of delivering returns averaging around 10% per year, with volatility well inside the 15% risk budget, no correlation to conventional assetclasses or other hedge fund strategies – and we have stuck to our philosophy of investing based on fundamentals”.

Asset growth, taking macro strategy assets to around $1.6 billion, is coming not only from performance but also from significant net inflows; $80 million in January alone. The firm has geared up for further growth by hiring a new CEO, augmenting certain teams, and widening its menu of investment vehicles: the strategy can now be accessed via onshore ‘liquid alternatives’ UCITS and ’40 Act fund vehicles as well as Cayman or Ireland funds, and all of these are garnering allocations, vindicating IPM’s decision to diversify routes into the strategy in response to the evolving regulatory climate. IPM has always offered dedicated managed accounts, and is also investible through several managed account platforms (MAPs). IPM wants to remain palatable to the largest institutional investors, and hence continues to strive for industry-leading levels of reporting, transparency, and client service.

Performance drivers included short commodity and carry currencies

Investors receive full performance attribution across many axes – factors, asset classes, positions and so forth. Here we home in on a handful of key performance drivers over the past few years. In terms of the four proprietary families of factors, also called investment themes, IPM’s risk premia and valuation metrics have delivered below expectations recently, whereas the macroeconomic and market dynamics investment themes have done far better.

CIO Bjorn Osterberg illustrates: “We made 6% net in January in what was a volatile month, so the model scaled back risk more than once. Gains came from relative currencies including long yen, Swissie and euro versus short carry and commodities currencies. Relative bonds profited from longs in US Treasuries versus a basket of developed market bonds. Directional asset class trading was also positive. Though we suffered some setbacks on the relief rally associated with Draghi and Bank of Japan statements, the volatility overlay deleveraged mid-month to stay inside the volatility cap allocated to developed currencies, and hence locked in a lot of profits.”

January, to a large extent, has continued the themes of 2015. Investors might be surprised to hear that going long of euros was one of IPM’s biggest winners in 2015, even though the euro declined over the full calendar year. But timing and sizing are critical, and IPM added to the long euro position at lower levels, as more models generated progressively stronger signals. Of course, the risk premia model remained short euro throughout 2015, as negative interest rates made it a funding currency. But over the year, the three other models – valuation, market dynamics, and macro-generated signals – contributed to a steadily larger position.

Short positions in carry currencies, and ‘commodity currencies’ including the Canadian dollar, were another strong contributor that has become more of a consensus trade than the contrarian long euro. IPM’s macro models identified signals including deteriorating terms of trade that were mainly a consequence of weaker commodity markets. Though IPM does not trade commodities directly, the strategy captures indirect exposures via markets including ‘commodity currencies’.

This ‘risk-off’ positioning helped to generate profits in August 2015 when the de facto Chinese currency devaluation sparked a carry trade unwind. IPM is wary of the downside risks of carry, so the allocation is based on conviction in line with the other factors, and not based on a constant position or risk level. Given these limitations, the carry exposure to currency carry has been small, as the level of carry has not been perceived to be high enough to compensate for the tail risk. Interestingly, the short carry stance was mainly a consequence of signals emanating from the macro and market dynamics models, and was not an anti-carry position per se. Several rather similar episodes occurred in the past, e.g., in 2008, when value and macro themes resulted in implicit short carry positioning, which proved successful as risk aversion rose.

Some element of carry trade exposure can come from emerging market currencies, which were added to the programme in 2013, with some losses incurred on the Russian rouble and Brazilian real. But IPM views FX as an asset class; however, they implement EMFX separately from DMFX to avoid unintentional “convergence” or “divergence” positions. “The EMFX and DMFX sub-models are complementary,” says Osterberg. The EMFX weighting is only 10% against 30% for the DMFX weighting. IPM’s bond positioning in 2015 entailed a small degree of positive carry, and profited from trades that were not, perhaps, intuitively obvious. Though the European and Swedish central banks were both pursuing various styles of QE, and both had negative interest rates, the models were short of German Bunds and short of Swedish government bonds. And though the Fed was tapering its asset purchases, by only reinvesting income from them, and clearly flagging the rate rise, the models were long of Treasury bonds. Some degree of convergence between the longs and shorts permitted IPM to make profits in bonds. These relative value trades would be viewed as “pair trades” by some managers but IPM views each market relative to the basket of others it trades in the same asset class. So in 2015, IPM’s other bond exposures, short of German Bunds and Japanese government bonds (JGBs), also made money for the fund, as these markets advanced by less than IPM’s longs in other government bond markets.

Most of what IPM does is relative value, and is much more diversified than some traditional, discretionary macro managers that may only employ between two and five big-picture, and often rather binary, themes. But IPM does have a sleeve, fluctuating around roughly 15% of the risk budget, devoted to directional trading, which can go long or short of equities or bonds – and contributed 1% to performance in 2015. Trading in 2015 was tactical, starting the year short of bonds and ending it long of bonds. Similarly in equities the positioning reversed from being somewhat long in early 2015, to a neutral stance over the summer and a short one in early 2016.

Dynamic rebalancing

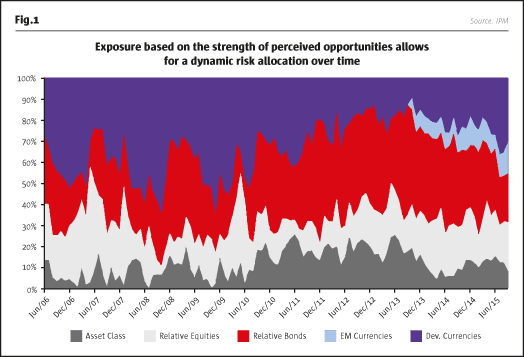

Within the core relative value book, IPM’s asset class exposures dynamically shift around, as shown in Fig.1. Between 2012 and 2014, IPM’s models identified the largest dislocations in the relative value bond book, so the biggest positions were various G7 government bond futures traded against each other. These trades also generated most of the performance over that period. By 2015 IPM’s analysis suggested that dislocations in fixed income markets had faded, but only to be replaced by large divergences in developed currency markets. Currencies were the biggest contributors to 2015 performance at 7.3%, and in early 2016 most of the risk still resides in this asset class. Until around 2010 relative equities were occasionally the largest weighting, but since then this sleeve has consumed less risk on average. “Signal conviction in the equity model has been lower and many fundamental patterns that have been reliable during the whole century, such as the value premium, have struggled just a few years shy of a decade,” explains Osterberg. “The positive correlation between value and market beta is also something that we haven’t seen in a very long time”. But Osterberg is keen to stress that IPM has made good profits on equities within its directional bucket.

Portfolio construction: return forecasts key

The total size of the book also moves around, partly in response to volatility forecasts. In contrast to many quant managers, IPM does not target a minimum or constant level of volatility, although it should not exceed 15% through the cycle and risk can be reined in at the level of each individual sleeve and at the portfolio level if volatility is overshooting. IPM has never used a risk parity approach to size positions inversely to their recent volatility, or maintain equal volatility contributions from particular asset classes or models.

Instead, IPM sizes positions in proportion to their models’ perception of the opportunity set, which is defined as standard deviations from the norm. This philosophy means that IPM may ‘average down’ and add to losing positions, and indeed markets’ historical performance has no bearing on current position sizing. Value-oriented models will naturally buy more into a loss, but large positions do not arise solely from value models or from any other single category. “A wide array of reasons is needed to develop a big position,” says Osterberg.

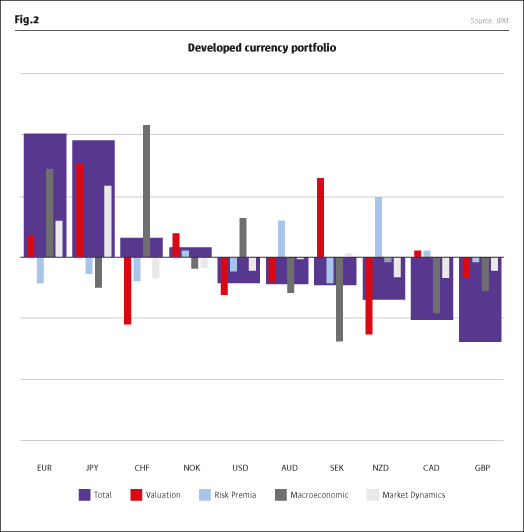

Positions in each market are the sum of signals, of varying strength, from the four families of models. If all four point in the same direction, overall exposure will be larger. If they throw up signals in opposite directions, of similar size, the residual level of exposure could net out at near zero. Fig.2 shows how the four families of signals generate positions, using developed currencies as an example. The relative weightings of the four model types will shift around over time, and macro, for instance, has gone from the smallest to the largest over the past few years mainly because macro models have seen larger dislocations. One example of a macro model could include how trade balance figures have feedback effects for financial markets and another model could look at the volume and direction of capital flows.

Robust and repeatable research process

How are the models developed? The research group is not siloed at all, and everyone in the team is involved with both the systematic macro strategy and the ‘smart beta’ cash equities strategy, working on a project basis. This means that there are synergies between the two products, particularly where stock-picking factor research provides insights that can be used for stock indices. “Our systematic equity strategy has helped the systematic macro strategy to evolve,” says Osterberg, and the IPM managers think their single-stock research distinguishes the firm from many shops that just look at futures markets. IPM’s 20-strong investment team is encouraged to play to their strengths so “some people are better at computers and others are better at econometrics,” says Osterberg. The research team numbers 10 people, and 14 including programmers.

The models are all grounded in fundamental, and intuitively sound, economic relationships that must be quantifiable and statistically testable. IPM uses very long look-back periods to look for repeatability. IPM avoids over-parameterising factors as they can be less robust. Though IPM eschews data mining, the manager finds data cleaning is essential. The data must go through daily ablutions before entering the sacred database.

Another important test of robustness is that IPM’s signals are not sensitive to the precise timing of execution; if a trading signal only works when executed at, say, the closing price of the day, then it is vulnerable to any deterioration in execution efficiency. Admits Osterberg, “A small subset of factors may see some alpha decay from sub-optimal execution”, but in general IPM is quite content to execute over a longer time frame to minimise slippage costs.

Most of the 50 signals are being honed and refined in some way, but only two or three of them in any year are brand new concepts, with both alterations and new arrivals approved by the Investment Management Committee. IPM’s research evolves incrementally rather than making wholesale shifts, and this is entirely intentional. “We do not want to delete the fundamental rationale for our models because every factor has strong intuition behind it, and we want to use high-conviction ideas,” says Osterberg. So it is more likely that IPM updates signals than deletes them. For instance, the market dynamics models include sentiment indicators that have been refined to take account of market reaction patterns around economic events such as releases of ISM and other data. IPM has also developed its own metrics for inferring sentiment from the pricing of “risky assets”.

Risk and liquidity

IPM has always viewed risk more in terms of risk factors than asset classes or instruments, before this approach became fashionable. IPM applies risk filters that control for risk in many dimensions, summing up many independent factors that could result in unintended or excessive risk premia bets. IPM also seeks to minimise tail risks through guidelines for allocating risk to the five independent sleeves.

Going beyond risks easily quantified by the models, the Risk Management Committee aims to think outside the box – and to anticipate risk scenarios outside the model framework. A good example here is currency pegs, which clearly change the structure of data. IPM removed the Swiss franc from models when the currency was pegged in 2011, and hence had no position in January 2015 when the de-pegging caused a violent surge that wrong-footed some traders, prompting some funds to shut down while others incurred unusually large losses. Now that the Swiss franc is floating, it has been added back. As well as removing specific instruments that are not freely traded, the RMC can turn down the volume of overall risk, and it exercised this discretion by reducing risk to 15% of normal levels in October 2008 after Lehman Brothers failed, and also cut risk in 2011 after the USA was downgraded by S&P and when the second Greek crisis led to huge risk aversion.

Liquidity is closely monitored by the independent Chief Risk Officer, Elisabeth Frayon, and IPM has not experienced liquidity problems for two reasons. The manager trades the most liquid markets (10-year government bond futures, equity index futures and currencies) and also executes trades in a slow-moving fashion. IPM tends to adjust positions gradually, scaling in and out of positions over multi-month time frames and has multi-month average holding periods. Yet the IPM managers estimate that they could liquidate the entire portfolio in less than a day, even under stressed conditions. IPM currently projects macro strategy capacity at around $10 billion, calibrated to a typical 15% volatility budget.

Gearing up for growth

To spearhead this drive for growth, Stefan Nydahl joined IPM as CEO in September 2015, after nine years at Sweden and Scandinavia’s largest hedge fund manager, Brummer and Partners. Nydahl’s career has spanned both portfolio management and general management, in the US and Europe, and he has for many years even combined the roles of CIO and CEO. At Brummer, Nydahl joined as a PM on the Nektar fund and later ran the Archipel Equity Market Neutral fund. Given this investment experience, Nydahl is also happy to be “a sounding board for the research team”.

Nydahl’s vision is to “take IPM to the next stage” in terms of growth. He believes that he brings both experience and diversification to the management team, yet he does not envisage any drastic changes will be required. Nydahl sees substantial spare capacity for IPM’s liquid macro strategy, and wants to make sure that there is enough slack at the organisational level to handle the expected asset growth. Nydahl is keen to make sure the firm is ready for further expansion, and IPM will hire individuals who are a good fit with the existing teams. Staff turnover has been fairly low at 5-10% per year, and currently IPM might expand the team in client relations, in systems, and operationally.

Nydahl is fond of his old shop, a few steps over the road from IPM’s offices in a salubrious district of central Stockholm. The embryo of both Nektar, one of the Brummer funds, and IPM was the legendary JP Bank. He says, “Brummer is a great place and has done a lot for the hedge fund industry in Sweden”, singing the praises of the “Nordic hedge fund wonder”. Nydahl points out that Scandinavia has many successful funds trading global markets, not just local equities or bonds. Indeed, Sweden may rank second only to the United Kingdom for hedge fund assets in the European Union, and the country has given retail investors access to hedge funds for many years before the advent of UCITS hedge funds. What lured Nydahl to IPM? “I was very impressed with both the investment process and the research work behind it. The returns delivered at a 10% compound rate and the non-correlation with anything out there is the ultimate stamp of approval of that work,” he points out. Nydahl also has confidence in the versatility of the operational set-up. “IPM has so much in place on various products and channels, from managed accounts, to Irish and Cayman vehicles, and liquid alternatives in the US and Europe,” he explains.

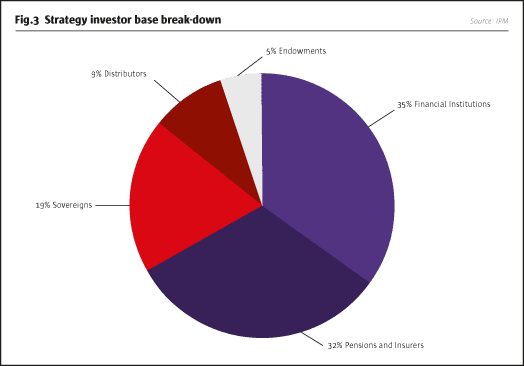

The previous IPM CEO, Lars Ericsson, has transitioned to a client-facing deputy CEO role, working closely with Houles, who, like Business Development executive Laura Lu, came from the fund of hedge funds world. The three of them are actively meeting with institutional investors in the US. They find that the strategy is well received by public and corporate pension plans, and by leading investment consultants. Existing US clients, including public endowments and fiduciary managers, cannot be named as IPM does not disclose client names unless the allocation is mentioned in clients’ publicly available annual reports. One such publicly known relationship is IPM’s mandate running money for the Swedish National Debt Office since 2006. This is an overlay whereby IPM actively manages the interest rate and currency risk for the Swedish government’s non-SEK-denominated debt. The plurality of IPM’s client base is corporate and public pension funds in Europe, with some also in Japan and the USA. The breakdown of assets by client type is shown in Fig.3.

Risk reporting is important for many institutions. IPM’s risk aggregation interface can handle standardised systems, such as the non-commercial Open Protocol Enabling Risk Aggregation, formerly known as OPERA, commercial vendor systems such as Hedge Platform offered by RiskMetrics, and can tailor customised reporting specific to client requirements.

ESG (Environmental, Social and Governance) considerations can also be a requirement for some institutional investors. On the long-only cash equities side, IPM has well developed and highly regarded SRI (socially responsible investment) policies, which can be manifested through exclusion, engagement and proxy voting, but for the time being it is not practical to implement SRI on the macro side. Explains Ericsson, “Equity indices contain a mix of companies and it is not possible to exclude certain firms.”

Investment vehicles and distribution

New CEO Nydahl was immediately impressed by IPM’s ability to handle managed accounts, which the firm has operated since 2003. IPM follows an open-architecture model here, using the infrastructure of each client and allowing them to choose their own service providers. IPM can also be accessed via several managed account platforms (MAPs). Deutsche Select offers both the FX only, and the full macro strategy; the full macro strategy is also available on the UBS Liquid Alpha Managed Account Platform (LAMP); while Citi FX offers the FX-only strategy.

IPM’s UCITS launch in August 2015 has been “one of the most successful launches on the Morgan Stanley FundLogic platform,” says Lu. The product raised $200 million in its first five months and is expected to reach $250 million quite soon; some inflows are being staggered as some allocators cannot be more than 10% or 15% of the fund. The UCITS trades pari passu with the offshore fund, meaning there is “essentially no tracking error,” says Lu. The UCITS has a slightly higher total expense ratio (TER), but only marginally for the institutional share class. IPM carried out a beauty parade of all of the UCITS MAPs before selecting Morgan Stanley FundLogic, with attractions including “Morgan Stanley’s structuring abilities and their distribution footprint in many European markets,” says Ericsson. He recognises that IPM’s distribution team is still quite small so it is helpful to have partners widening coverage in Europe.

IPM has registered the UCITS passport in key markets including Sweden, Switzerland, France, the UK and Germany. IPM also has AIMFD passports for its Ireland fund in a number of major markets, while its flagship Cayman fund is mainly marketed outside Europe. IPM is one of many hedge fund managers who have found that passports “are not extremely straightforward and require registration fees and paperwork,” recalls Ericsson. The firm is open-minded about adding passports in response to demand in particular countries. IPM has also appointed a local legal representative and paying agent in Switzerland following the revised Collective Investment Schemes Act which restricts the distribution of foreign funds to qualified investors in Switzerland.

IPM is part of a ’40 Act product launched by Blackstone. IPM acts as a sub-advisor for a Blackstone multi-manager product, Blackstone Alternative Multi-Strategy Fund (BXMIX). The Blackstone IPM strategy focuses only on the ultra-liquid, core markets that IPM trades, and also has a somewhat lower risk target. (The other 18 sub-advisors for the Blackstone fund of funds product are other leading investment managers: AlphaParity, Bayview Asset Management, Blackstone Senfina Advisors, Boussard and Gavaudan, Caspian Capital, Cerberus, Chatham Asset Management, D.E. Shaw Investment Management, Emso Partners, Goldman Sachs Investment Strategies, Good Hill Partners, HealthCor Management, Nephila Capital, Rail-Splitter Capital Management, Sorin Capital, Two Sigma Advisors, Waterfall Asset Management and Wellington Management Company.)

Though IPM is raising assets globally, the investment team remains far larger than the distribution team with 20 staff, against seven doing investor relations, client servicing and sales. On the research front, as well as the ongoing refinement of models, IPM might one day add asset classes, which could include revisiting commodities at some stage. But IPM is quite content with their Sharpe ratio just shy of one. “In our research, we will always choose the more robust alternative, even if it means paying away a decimal point or so of Sharpe,” says Osterberg. “We believe this will help limit drawdowns and we are fine to leave a bit of Sharpe on the Street.”

Bios

Stefan Nydahl, PhD Chief Executive Officer

Stefan Nydahl joined IPM 2015 having spent nine years with the Brummer Group. Previously he held positions as portfolio manager at AMF Pension and Quantal Asset Management and as a research associate at Quantal International and economist at Sveriges Riksbank. Nydahl holds a PhD in economics from Uppsala University.

Lars Ericsson, Deputy CEO, Head of Client Relationship Management

Lars Ericsson joined IPM in 2002 having worked for 12 years at the fixed income divisions of Chase Manhattan Bank, Bankers Trust, and most recently Merrill Lynch. Ericsson holds a MSc in Industrial Engineering and Management from the Institute of Technology at Linköping University.

Björn Österberg, Chief Investment Officer & Head of Research

Björn Österberg joined IPM in 2008 with extensive experience from the financial industry. He held various senior positions within Quantitative Research and trading at JP Bank, Unibank/Nordea, and most recently was a Senior Equity Portfolio Manager at AP4. Österberg holds an MSc in Engineering Physics from the Royal Institute of Technology in Stockholm.

Serge Houles, CFA, FRM Director, Head of Client Portfolio Management

Serge Houles joined IPM in 2013, bringing 15 years of industry experience. He held roles spanning from research and risk analysis to product design, most recently at Unigestion. Houles holds a MSc in Econometrics and Finance from the University of Paris Dauphine and a postgraduate degree in Banking and Finance from the University of Paris V.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical