One of The Hedge Fund Journal’s Europe 50 managers, IPM (Informed Portfolio Management) is doing something different. The Stockholm-based group, who we visited in March, is attaining its refreshingly realistic targets for risk-adjusted returns. Whereas many hedge funds now combine fundamental and technical signals, and blend systematic with discretionary strategies, IPM clearly defines its approach as purely systematic, and purely fundamental. IPM also constructs portfolios and manages risks that set it apart from many. IPM’s style is definitely not trend or carry, and its return profile avoids correlation not only to conventional asset classes – hedge funds in general, CTAs and discretionary macro managers – but also, perhaps surprisingly, demonstrates low or no correlation to other systematic macro managers.

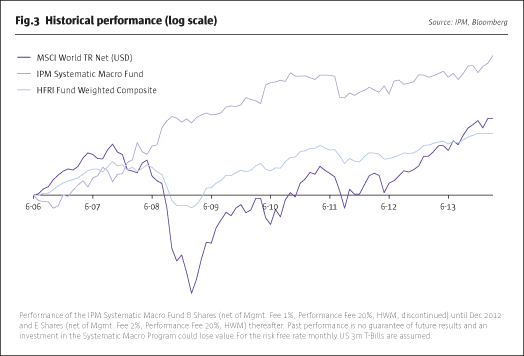

Although IPM does not deliberately trade against the market consensus, contrarian trades can be a consequence of IPM’s process. Some systematic macro managers (such as QFS and FX Concepts), that shut down in 2013 and 2014, have explicitly made blanket statements that they do not think recent financial market conditions are conducive to a systematic fundamental macro strategy, or have tried to argue that their woes are symptomatic of an industry-wide malaise. IPM adamantly disagrees: the manager is upbeat and is ramping up its US marketing drive as reported performance makes new all-time highs.

1990s Sweden: trading bonds for global macro funds

Macro trading, in one way or another, has provided the livelihood of IPM founder, Anders Lindell, for nearly his entire career. Engineer Lindell still seems nostalgic for his fixed income trading days in 1990s Sweden, when JP Bank ruled the roost of local government bond trading markets – the bank, which no longer exists, was then the largest fixed income trading house in Sweden, eclipsing all of the well-known banking groups.

“There was a big demand for macro analysis,” says Lindell, who recalls how the Fed’s 1994 rate hikes wrong-footed many players. Lindell worked under Kent Janér, who now runs local Europe 50 manager Brummer’s award-winning Nektar fund, and who was a formative influence. Profligate government spending and voracious government borrowing in ‘90s Sweden created a burgeoning local debt market that attracted the attention of hedge fund luminaries such as George Soros and Louis Moore Bacon. This was an exciting time to be trading government debt, and to this day traders still regale each other with tales of how they could have (and sometimes did) choose to retire early from the profits they made out of overnight interest rates that touched 500% in 1992 as Sweden’s Riksbank haplessly tried to defend the Swedish krona’s ERM membership. Soros may be legendary for making a billion from shorting the pound sterling at this time, but Lindell recollects a less well-known story of how Soros, Moore, and others made an early, and accurate, move into Swedish government debt – on the long side.

Their foresight was to be handsomely rewarded over the subsequent years as Sweden underwent a metamorphosis from emerging market basket case to the status of paragon of safe havens it boasts today. Yet as Sweden’s fiscal situation was rehabilitated, its currency stabilised, and debt was repaid, Lindell laments how the bond markets “became a less thrilling place, with volumes down and bid-offer spreads collapsing.” All of this helped to reignite Sweden’s now mighty economy, but bond trading became less lucrative and restless Lindell sought a more dynamic industry.

Importing US techniques to Europe

Lindell, who had once studied at MIT in Cambridge, Massachusetts, looked west to the United States for leading-edge financial technology and investment methodology. Just as Salomon Brothers had introduced fixed income trading technology to Europe in the 1980s, so too Lindell envisaged that US asset allocation techniques would be adopted. At that time Lindell claims that European pension funds carried out their asset allocation through committees, with the attendant flaws of “groupthink”. Discretionary committees seldom deviated far from consensus benchmark weightings, which resulted in herd behaviour and clustered returns. In contrast, US pension funds had already begun to systematise their asset allocation approaches. In particular, macro overlays were perceived as a form of “portable alpha” that could be orthogonally bolted onto any portfolio. Lindell resolved that his mission was to “import that type of thinking into the European market to support European pension funds with their tactical asset allocation in a repeatable and systematic way.”

Founding IPM in 1998, Lindell drew inspiration from several pioneers of systematic macro management, including Pan Agora and Mellon, but it was Rob Arnott’s First Quadrant that Lindell saw as the foremost thought leader in the field. In the late 1990s the mere concept of European pension funds outsourcing investment decision-making was novel enough and doing so to a new firm, based on a newly built investment model, would have been such a leap of faith that Lindell feared the nascent IPM might never get any traction. An additional distraction was the TMT bubble, which made GTAA look like a trivial sideshow. So in May 2000 Lindell met Rob Arnott and learned how the First Quadrant business model was being cloned in Canada, Japan and elsewhere. IPM decided to license FQ’s alpha models and signals, but retained responsibility for risk management and client reporting. IPM’s mandates used FQ alpha signals until 2010, when IPM began to implement its own alpha models – on top of the distinctive risk management approach it had already developed. The separation after 2010 between IPM and First Quadrant was amicable, and Lindell says their “methods and principles are probably now quite different”.

Systematic macro: the devil is in the detail

Yet some common ground remains – and not just between IPM and FQ, but also throughout the space. CIO Björn Österberg thinks that most macro managers share many traits in terms of investment philosophy. Lindell goes further and asserts that most systematic macro managers are employing the same generic concepts, such as valuation factors like PPP or inflation differences, flow factors like cross-border flows, and carry or yield curve factors. So why is it that (contrary to the generalisations made by now defunct managers!) systematic macro managers show such low correlations to one another? Lindell argues that the devil is in the detail and gives just a few hints as to how systematic macro managers differentiate each other. “How to define concepts; over which look-back periods they are measured; which types of weighting schemes [e.g., exponential] are used; whether strong form or weak form theories are used and how to adjust for trade flows – all feed into the ultimate alpha-generating factor,” according to Lindell.

Yet these distinguishing features of signal architecture are far from where the story should end. “Most people focus on these alpha factors but that’s only one link in the chain,” says Lindell. Once the individual signals are arrived at, other important differentiators are how positions and models are weighted and optimised to form a portfolio – and how the overall book is risk managed.

Lindell explains that whereas other managers use Black Litterman models or mean variance optimisation to construct portfolios, IPM uses neither of these widespread paradigms. Instead IPM, Lindell emphasises, “preserves as much of the signals as possible. So if models throw up signals to go long of the Australian dollar and the New Zealand dollar, IPM will own both of them despite their high correlations.” In contrast to many managers IPM does not forecast volatility or correlations for the purpose of its return-generating models (although correlation and forecasts are used for risk management). Consequently, IPM does not follow a “risk parity” approach of scaling individual position sizes for their contribution to portfolio volatility, although absolute position sizes will fluctuate as the entire book grows and shrinks.

Opportunistic risk-taking and dynamic rebalancing add value

As allocations are a function of individual opportunities, overall portfolio risk also expands and contracts according to the number, and strength, of signals being generated. Says CIO Björn Österberg: “Risks, as well as the associated premiums, being dynamic in their nature, should receive an opportunity-based risk allocation. This means that we, unlike many other managers, do not target a constant risk level and we therefore avoid leveraging the model on ideas with weak outlooks.” For instance, in 2009 IPM ran the portfolio at much lower levels of risk than in their banner year of 2008, when they made a net return of 30.9%.

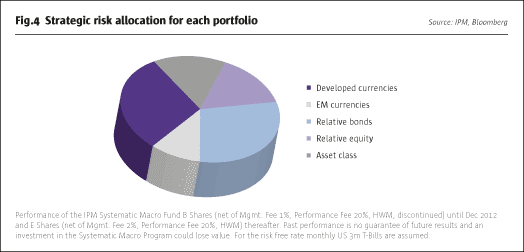

Just as big-picture portfolio risk oscillates, so too do sub-allocations to the different buckets. IPM has always believed in dynamically rebalancing weightings amongst its models, and “this has added a lot of value compared with a fixed weighting scheme,” says Lindell. Weights can gyrate a lot according to the perceived opportunity set. While there is a strategic, or structural, overweight to the developed currency and relative value bond models, even these have swung in a range between 15-20% and 50-60%.

Rather than trying to maintain a steady level of volatility, risk management emphasises tail risk. IPM is alert to what they term “tail co-dependency” between sub models – more than one model could simultaneously run into its worst environment. IPM monitor models’ factor exposures to try and avoid models having the same Achilles heels. For instance, if three models led to concentrated exposures in a risk factor, such as “yield curve steepening”, then the overall portfolio could have an unintended bet, and vulnerability, to a steeper yield curve. IPM do not use portfolio-level stop losses, and do not think they can chop off the left hand tail, but rather want to try to truncate its size.

Longer-term, relative value

Last year IPM added a new model, which trades emerging currencies, on a relative value basis. Clearly 2013 saw some huge moves in emerging foreign exchange with several currencies making all-time lows. However, 2013 was not an unusual or remarkable year for IPM’s emerging currency models, because they trade on a relative value basis. The performance of the EMFX models has been broadly flat since they were added in June, underscoring the uncorrelated nature of IPM’s approach.

Unlike legendary macro mavens such as Soros, Moore or Tudor Jones, IPM tends not to make big directional calls. Four of IPM’s five models are relative value but one of them can take tactical exposures to bonds or equities. On average equity or bond exposure will not exceed 30% but, says Lindell, “Occasionally it can be much more and we are in such a scenario now, with the market driven by cheap money and central banks pushing risk-taking.”

On top of its signal generation, portfolio construction, and dynamic portfolio risk, Lindell thinks that IPM’s average 12 to 15-month holding period is longer than many peers, and this is deliberate as IPM thinks markets are relatively efficient in the shorter term. The point here is that individual positions show longevity; the sizing of positions, and allocations to models, can move around much more.

Sharpe ratios

IPM is partly owned by Swedish “multi-boutique” Catella, which won a performance award in The Hedge Fund Journal’s 2013 UCITS Hedge Awards: the Catella Nordic Corporate Bond Flex Fund was awarded Best Performing Long/Short Credit Fund, based on its 2013 calendar year Sharpe ratio. We surmise, however, that awards for “highest Sharpe ratio” are not something IPM is chasing. IPM is happy to be rewarded partly for taking on volatility risk. They admit that their worst drawdowns have sometimes occurred when “cheap keeps getting cheaper”. Says Österberg, “We believe that most sustainable sources of excess returns are associated with some degree of increased risk exposure.”

Consequently, IPM has always targeted an implicit Sharpe ratio of between 0.7 and 0.8 through a full cycle (they aim to make 10-15% for a 20% volatility target and the ratios should be the same if clients dial up or down to higher or lower risk targets). Lindell thinks this is realistic for a liquid macro strategy using systematic fundamental signals, although he seems open-minded about other strategies, including technical or discretionary ones, targeting higher Sharpes. IPM is relatively unusual in having attained its target Sharpe, and Lindell finds that institutional investors are content with this level.

IPM’s reported returns for its multi-asset class strategy, trading equities, fixed income and currencies, have delivered a Sharpe of near 0.7. Bonds have averaged somewhat higher, with currencies lower, but Lindell thinks it is “inherently risky to rely on one asset class alone,” so prefers clients to go for the multi-asset class strategy. That said, he does venture that fixed income markets are more predictable with “more well-defined factors based on central banks, inflationary expectations and macro.” Currencies are, he thinks, “driven more by behavioural aspects as carry goes on and then implodes, being more sensitive to foreign trade, flows, expectations and shorter-term central bank behaviour.” Yet Lindell does not think that IPM has any bias to being long the currency carry trade. Indeed, one of IPM’s worst drawdowns, in late 2007, coincided with the manager being short currency carry.

If IPM advocates multi-asset class investing, why do they not trade commodities? Historically the reason was simply that some pension funds were not able to trade commodity futures as they were not classified as financial instruments. IPM has in fact discontinued a pure commodities trading strategy, and also ceased running a CTA. But Lindell has no aversion to the asset class. IPM may at some stage resume trading commodities, but to do so within the macro model would have to satisfy the same process: “We would need to build models based on the same underlying principles, systematic fundamental inputs, reliable and repeatable patterns, and apply it to deep and liquid markets,” he says. So, commodities are on IPM’s research agenda, but it may take time for them to get back into the programme.

Academic and advisory board

In 2010 The Hedge Fund Journal profiled Stockholm-based healthcare long/short equity manager Rhenman, who view their eminent academic advisory board as one of their competitive advantages. So too IPM’s board is used for “bouncing specific ideas”. Board chairman Ulf Wissén was a managing director at Salomon Brothers’ fixed income arbitrage desk, before co-founding the fixed income relative value fund Endeavour Capital Management, which peaked at $3.5 billion of assets. Advisory board chair Magnus Dahlquist is professor of finance at the Stockholm School of Economics, and specialises in asset pricing and international finance. Another academic, Boualem Djehiche, Ph.D., is professor at the Royal Institute of Technology in Stockholm, and has published widely on stochastic modeling. IPM will consult the academics for advice on who or what is at the forefront of particular research areas. Such is the open dialogue between IPM and its clients that the research team of 10, working under CIO and head of research, Björn Österborg, also gathers ideas from IPM clients, who are exposed to a broader range of managers, strategies and styles.

Leverage aversion is one facet of behavioural finance research that interests IPM. The theory is simple enough – if investors cannot use portfolio leverage, then those investors seeking to up the ante of their portfolios will be drawn to riskier assets as the only way to turbocharge their portfolios. This might include high-beta stocks, for instance. Investors might then ascribe higher valuations to such riskier stocks than they would if they were able to apply leverage to less risky, lower beta, stocks. IPM does not face this constraint: the portfolio can run gross exposure up to 15 times and will typically be around nine times.

Regime switching is another example of academic research of which IPM keeps abreast. For any systematic macro manager, it is crucial for models to be robust against different regimes. Lindell points out that some models based on 30 or 40 years of data have not worked in a post-crisis QE environment. Any allocator must by now be fatigued with hearing how regime changes have scuppered models. Lindell is particularly wary of models that might have worked well during the 30-year bond bull market – but which would not work well in a climate of rising interest rates, as seen in the sixties and seventies. Says Österberg, “We are always prioritising stability, robustness and long-term data over recent trends or the few themes dominating the news flow for the moment.”

Enhanced equity indices

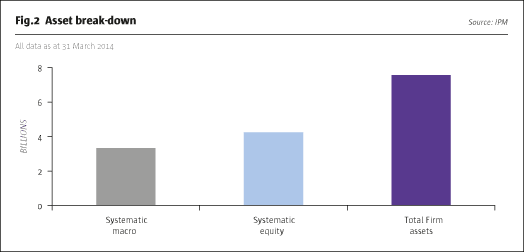

Discontinuing commodity and CTA strategies, for the time being, leaves IPM fully focused on two strategies: their systematic macro offering, and also long-only enhanced equity indexes. As with the systematic macro strategy, IPM started using alpha signals crafted by Rob Arnott’s Research Affiliates. In January 2006, IPM began to strictly apply Arnott’s RAFI methodology (and incidentally Lindell claims that after eight years IPM has a competitive advantage at implementing the RAFI approach, with relatively low costs and tracking error for those clients that want the pure RAFI signals). However, over time IPM has shifted from the strict RAFI weights to the FTSE RAFI index weights.

Additionally, IPM has modified the RAFI approach with what Lindell terms “enhancements”. IPM does not generally want to compete in the market for enhanced equity indices with less than 2-3% tracking error, because pricing pressure from giants like Blackrock or Vanguard leaves only slim margins in that space. IPM has increased tracking error up to 3.5% or 4% to help justify higher fees – and intends to differentiate further as “this is an active risk-taking firm,” Lindell says. What are the synergies between systematic macro and enhanced equity index products? IPM is “finding opportunities to cross-fertilise between the two in both directions,” as some risk factors used in the long-only equity strategy can cross over into the macro strategy.

Lindell acknowledges that the value and small cap tilts of enhanced equity indices do explain some of their outperformance of market cap weighted indices, but he stresses that it is not that simple. IPM’s value tilt is dynamic rather that hard-wired, and there are other factor tilts aside from value and small cap. EDHEC research has recently highlighted the “quality” factor as being a source of outperformance in its own right, for instance. Would IPM consider developing their long-only equity strategy into a long/short or equity market-neutral approach? Lindell has investigated this, but sees several obstacles. Simply inverting long factor tilts to try to arrive at short signals does not work, he says. And even if it did, shorting entails practical problems of short squeezes and Lindell thinks that shorts could “stay underwater for a long time,” as they may overshoot on the upside. Lindell is willing to hint that IPM might begin trading equity sectors within the macro programme, but will not be drawn further than that. The enhanced equity index strategies can be accessed through Ireland and Luxembourg UCITS funds, or through dedicated managed accounts.

Swedish-style transparency

Sweden is famous for being the first country to introduce freedom of information laws, dating back to 1766. Notwithstanding the 12 nationalities working at IPM, the Swedish cultural flavour may have permeated IPM when it comes to client communications. Clients get full position transparency and attribution in a monthly report. They also get an explanation of what IPM thinks are up to 30 or 40 independent alpha drivers within the portfolio.

Product specialist Serge Houles handles sales meetings, replacing research staff “to the extent possible” so that researchers do not get distracted. He explains how developed currencies contributed the most in 2013, with a long euro position the biggest winner. Rather than viewing currencies as pairs, IPM trades each position against a whole basket of others. A long position in core European equities has been on the books for over a year. IPM admit that their contrarian short Nikkei stance cost money in 2013, as they did not anticipate Abenomics, but it has helped them to profit in 2014. In particular, IPM produced a strong return in January 2014. Recent positioning has seen a relative value trade long treasuries, and short JGBs. The commodity currencies of Canadian and Australian dollars have also been shorts along with Sweden’s own krona.

A yen case study illustrates how IPM’s world view is informed by non-consensus inputs – and why IPM’s positioning has been different from both discretionary macro and trend-following managers. Between 2011 and 2013 IPM has profitably traded the yen from both long and short sides. The short in 2012 was not inspired by the stated intentions of “Abenomics” – Abe’s words had to be manifested in hard data before feeding into IPM’s process. IPM’s initial short was driven by factors including Japan’s swing into a trade deficit in the wake of the tsunami. The short was steadily reduced and then reversed into a long by early 2013, partly due to the yen becoming undervalued and capital flowing into Japan. Later in 2013, IPM reverted to a short stance as Abenomics finally registered on their radar screen via a sell signal from the mushrooming money supply, combined with capital flows easing off as equities reversed.

So IPM can be very open about its positioning and process. Lindell dislikes the term quant as he thinks it implies a black box, and argues that “an aquarium” would be a more apt metaphor for IPM’s client communications. IPM’s client base includes Dutch pension funds that are well-known for running their own macro strategies in-house. Yet Lindell insists he is not worried about the Dutch, or anyone else, reverse-engineering IPM’s approach. He actually claims to be sympathetic about others investing with IPM as part of a learning process that may help them to develop their own models – perhaps, we might venture, just as IPM itself did with First Quadrant. This relaxed and transparent attitude is partly because the factors are more complicated than they seem at first sight. Additionally, Lindell argues it would make no sense for other systematic macro shops to ape IPM’s approach, reiterating his view that in this space managers are trying to be different from each other.

IPM is poised for growth like a coiled spring. “Our process is very scalable and nothing would change if we doubled assets,” says Lindell, as “we have the slack and we would not need to hire anyone.” IPM has always passed due diligence tests and has an ISAE 3402 certification for its operational processes, with Charles River used to help automate execution. Clients mainly invest through segregated accounts, although they can go via funds or three platforms run by DB Select, Citi and UBS. Having always been regulated in Sweden, IPM made one of the earliest AIFMD applications in October 2013, although Lindell does not think AIFMD will make any difference at all in practical terms. IPM has been hammering away at the US for two years now, meeting consultants and institutions.

Director and head of marketing and communications, Douglas Norström, says, “We are not exactly a household name but we are starting to secure brand recognition.” IPM does not underestimate the challenges of breaking into the US market, but Lindell does feel proud that “the track record is where it should be.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical