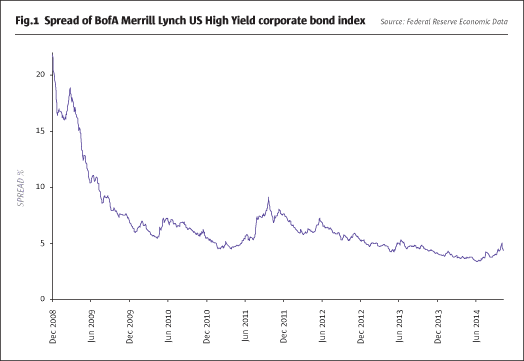

The recent sharp correction in the corporate bond market, which in mid-October saw the spread on the BofA Merrill Lynch US High Yield corporate bond index jump above 5% for the first time in 15 months (see Fig.1), is a stark reminder of how volatile and thinly traded this key asset class can become. One of the bigger drains on liquidity in this market is the 2010 Dodd-Frank Wall Street Reform Act – designed to reduce volatility.

The so-called “Volcker Rule” provisions of the Dodd-Frank Act were introduced in part to curb banks making “speculative” proprietary investments with depositor funds, and to ensure that bank depositors are not left “holding the bag” should asset values tumble as they did in 2008.

While that end goal is laudable, as so often happens with regulatory intervention in complex markets, the rule of unintended consequences is bound to have its say. Aimed at reducing risk in the market, the result may be the polar opposite.

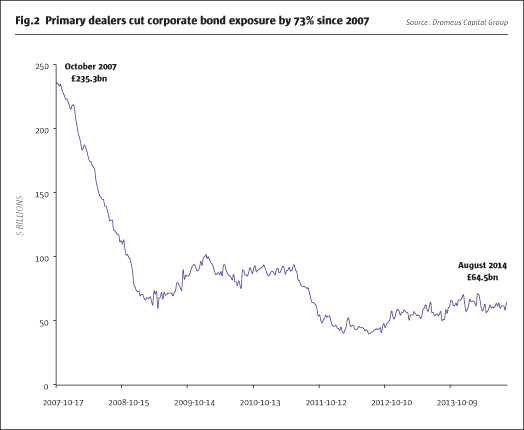

Holdings of corporate bonds by the major dealers – J.P. Morgan, Goldman Sachs, Citigroup and the 19 other banks that trade with the Federal Reserve – have fallen by more than $170 billion since 2007 (see Fig.2), as the Volcker Rule sharply curtails the size of the bond inventories banks can hold.

Whilst Volcker does allow banks to engage in market making of corporate debt, trades are not allowed to exceed the “reasonably expected near-term demands of clients”. Nor can the size of market makers’ positions be excessive in relation to the institution’s current inventory of financial instruments.

Market makers are also now required to put in place detailed policies and extensive internal controls designed to ensure that the risks involved in market making are kept to a minimum. The compliance costs alone of these measures would be enough to put off some potential market makers. The end result is that investment banks are now prevented from increasing their inventories should large-scale outflows be triggered, and plunging prices present an opportunity to buy low. A major circuit-breaker in the market has been removed.

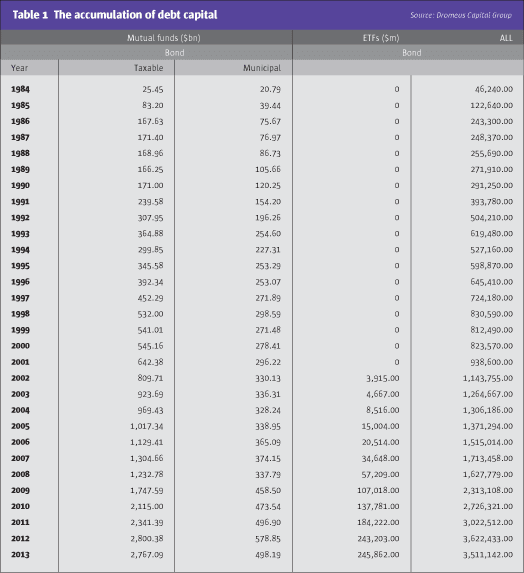

At the same time as the major dealers have been forced to shrink their bond inventories, the size of bond mutual funds and ETFs have grown considerably – doubling since 2007. Statistics from the Investment Company Institute show more than $3.5 trillion held by funds managed by fixed income heavyweights like Pimco, Vanguard, Templeton and Fidelity Magellan – an accumulation of potentially flighty debt capital that is epic in scale (see Table 1).

The combination of asset concentration in the hands of a few asset managers, the mismatch in liquidity of the underlying credit investments with redemption terms, the concentration in holdings of individual issuers and the thinner secondary markets create an explosive mix.

The limited risk-off in the market over recent weeks has focused minds on what might happen if an event triggered a larger-scale surge to the exits. There is little doubt in this analyst’s mind that the Dodd-Frank-straitjacketed bond-dealers would be wholly unable to negotiate the flood. There would be a consequent loss of liquidity, akin to 1987’s Black Monday – when markets around the world crashed – and then possible “herd behaviour” by anxious bond sellers.

Bond markets are once again dangerously positioned for sudden losses of liquidity, with attendant results for investors and the economy. If the departure of a single fund manager, Bill Gross – albeit the “King of Fixed Income” – can spark tens of billions of dollars in outflows in a few short weeks, the potential certainly exists for much larger outflows to be triggered by a more serious event.

Making predictions over what could awaken the bond bear is difficult. But when looking for risk and trigger events, remember that bourses and business cycles are only part of the picture. The trigger for trouble in bonds may lie outside the scope of this financial world, just as it did in 1987, when unrest in the Middle East played a role.

Regardless of whether the final trigger is pulled by a monetary event, a geopolitical event, or something else entirely, the resulting plunge will happen without the safety net of investment bank bond inventories to break its fall and it will be investors who will feel the full impact of that fall.

Achilles Risvas is CEO of Dromeus Capital Group, an alternative investment manager. Risvas co-founded Dromeus in 2008, after working at Lehman Brothers International in London as a director in its fixed income division. He holds an MSc in Investment Management from Cass Business School, and is a CFA charter holder.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical

Commentary

Issue 99

Is the Volcker Rule About to Bite?

Restrictions on bond inventories mean any fall will be hard

ACHILLES RISVAS, CEO, DROMEUS CAPITAL GROUP

Originally published in the November | December 2014 issue