The Kairos Group, an asset management company with assets under management of around EUR 11bn is celebrating its 20th year anniversary this month. The Group belongs to The Hedge Fund Journal’s ‘Europe 50’ ranking of the largest hedge fund managers in Europe and it is one of the pioneers in the European hedge fund industry, having launched its first European equity long/short in 1999. Today the Group has several absolute return strategies and operates primarily in four areas: European long/short equities, Italian long/short and long-only absolute equities, European fixed income and finally global multi-strategy fund of funds.

KIS KEY UCITS, which was launched in June 2013 and runs in excess of EUR 500mn, is one of the two L/S European funds run by the Group and has received The Hedge Fund Journal’s UCITS Hedge Award for best performing fund in its strategy category, Long/Short Equity-Regulated Utility Sector Specialist. As at the end of January 2019, KIS KEY has delivered annualised returns in excess of 10% with a Sharpe ratio above one since inception. In absolute terms, it has also outperformed long-only indices of infrastructure stocks, generating annualised alpha of 4.8% versus the NMX Infrastructure index produced by LPX AG.

KIS KEY selects a concentrated book of 30-40 long and short stocks from a highly specialised universe of around 150 regulated, semi-regulated or other long duration companies in the infrastructure, utilities, transportation, communications and real estate sectors. Most are mid-caps (defined as between EUR 1-5 billion), Europe-oriented and are predominantly listed in Europe. These are often monopolies or quasi-monopolies and many boast revenues with relatively predictable cashflows and little sensitivity to the economic cycle.

“Returns in our opinion will not differ materially from the ones you can extrapolate from listed operators, when it comes to the potential cash upstream. Gatwick Airport is six times levered versus a blended average of below two times for listed airports.”

Vittorio Villa, Portfolio Manager, KIS KEY

Yet the sector also exhibits substantial performance dispersion, with the top decile of stocks generating an annualised total shareholder return of 30%, whilst the bottom decile destroyed value at an annual rate of 20%, over the past five years. The group is rife with “value traps” where various regulatory and other risks can become “widow-makers”. It is vital to be politically savvy to dodge the bullets.

KIS KEY was launched because Kairos historically has always had a strong team focusing on regulated and unregulated businesses and wanted to capture on one hand the opportunities for alpha available in those sectors and at the same time the demand from clients seeking a product which would diversify their allocation and would fit nicely between their fixed income and long equity allocations.

Politics or fundamentals?

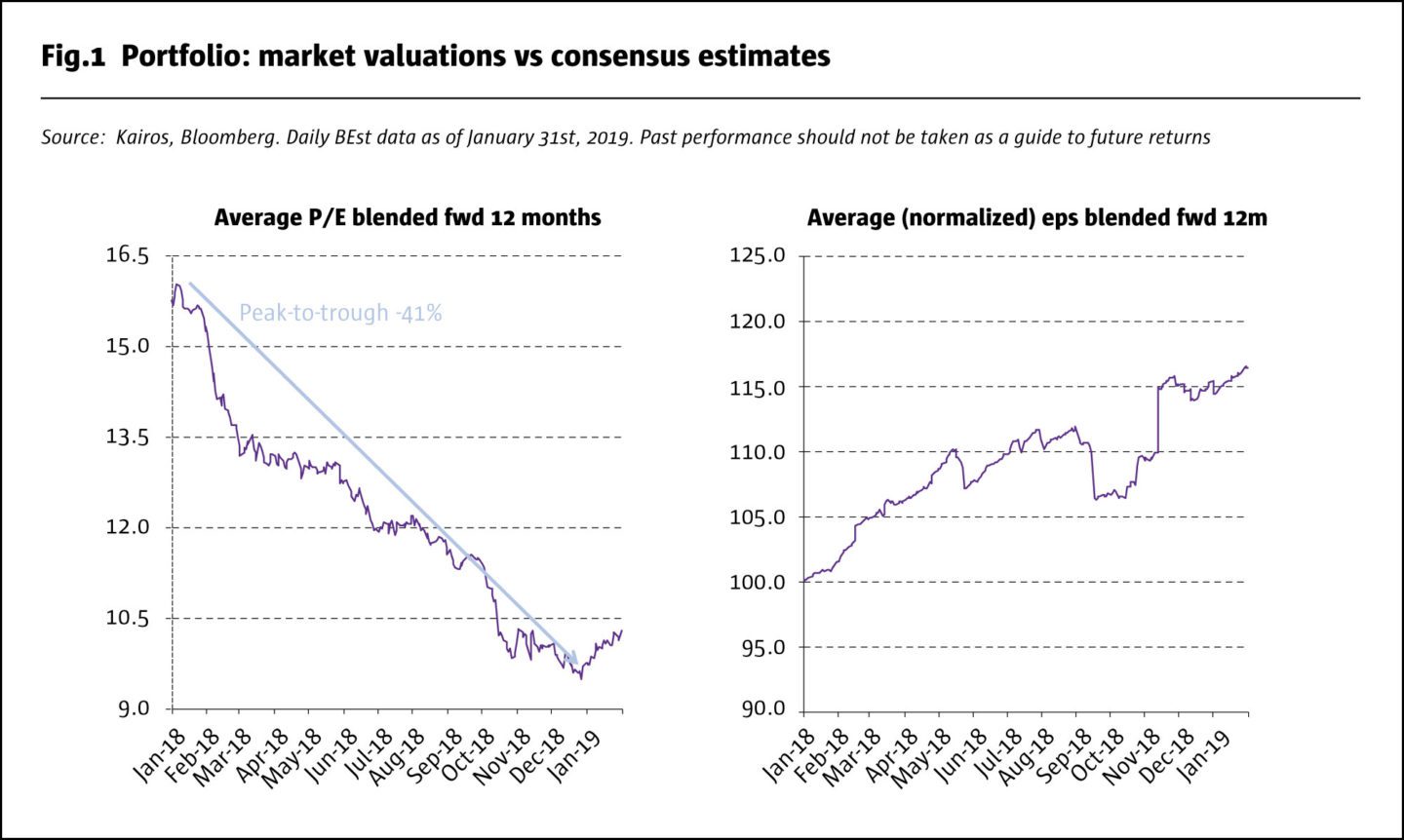

2018 performance was very frustrating for the team since it was KIS KEY’s only losing year. The frustration was mainly related to the fact that if fundamental earnings had been driving share prices last year, KIS KEY would have fared much better as earnings grew in most of the fund holdings, but the multiple ascribed to them contracted. In 2018, the PE ratios on KIS KEY’s book moved in the opposite direction of earnings forecasts, as shown in Fig.1.

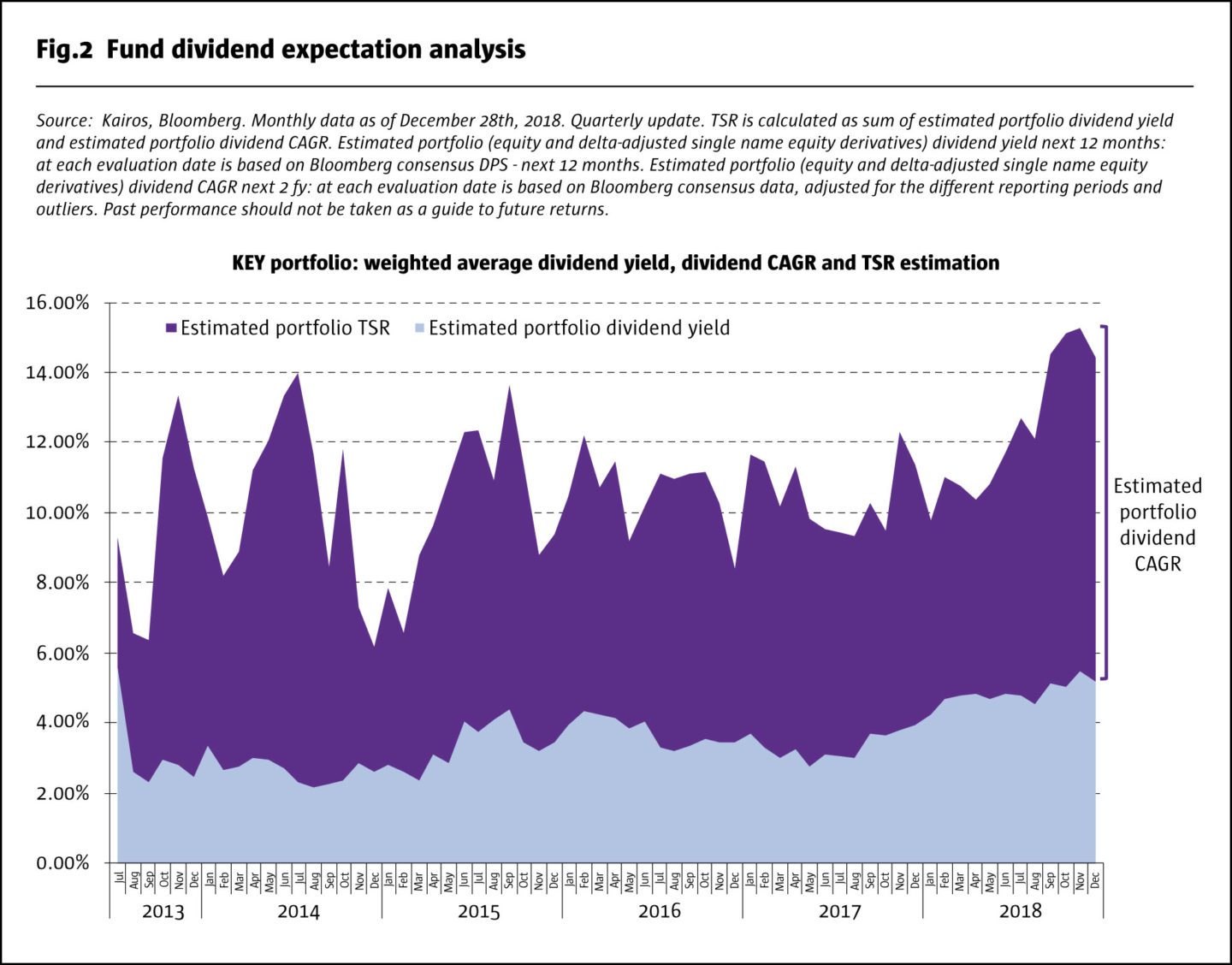

KIS KEY’s Portfolio Manager, Vittorio Villa, joined Kairos in 2006 and after a successful career as an analyst providing long and short ideas for the flagship Kairos pan-European fund, he launched a sector fund. Villa currently thinks that his portfolio is more attractively valued now than at any time since fund inception in terms of earnings multiples, dividend yields, and expected growth in both earnings and dividends. Utilities in Europe now offer dividend yields above the yield to worst on European high yield corporate debt, but Villa insists that these equities are not “bond proxies”. Whereas high yield bonds offer nominally fixed income, his preferred stocks will typically be able to grow income at least in line with inflation; sometimes at a rate comparable to nominal GDP, and in other cases, even faster than the economy. See Fig.2.

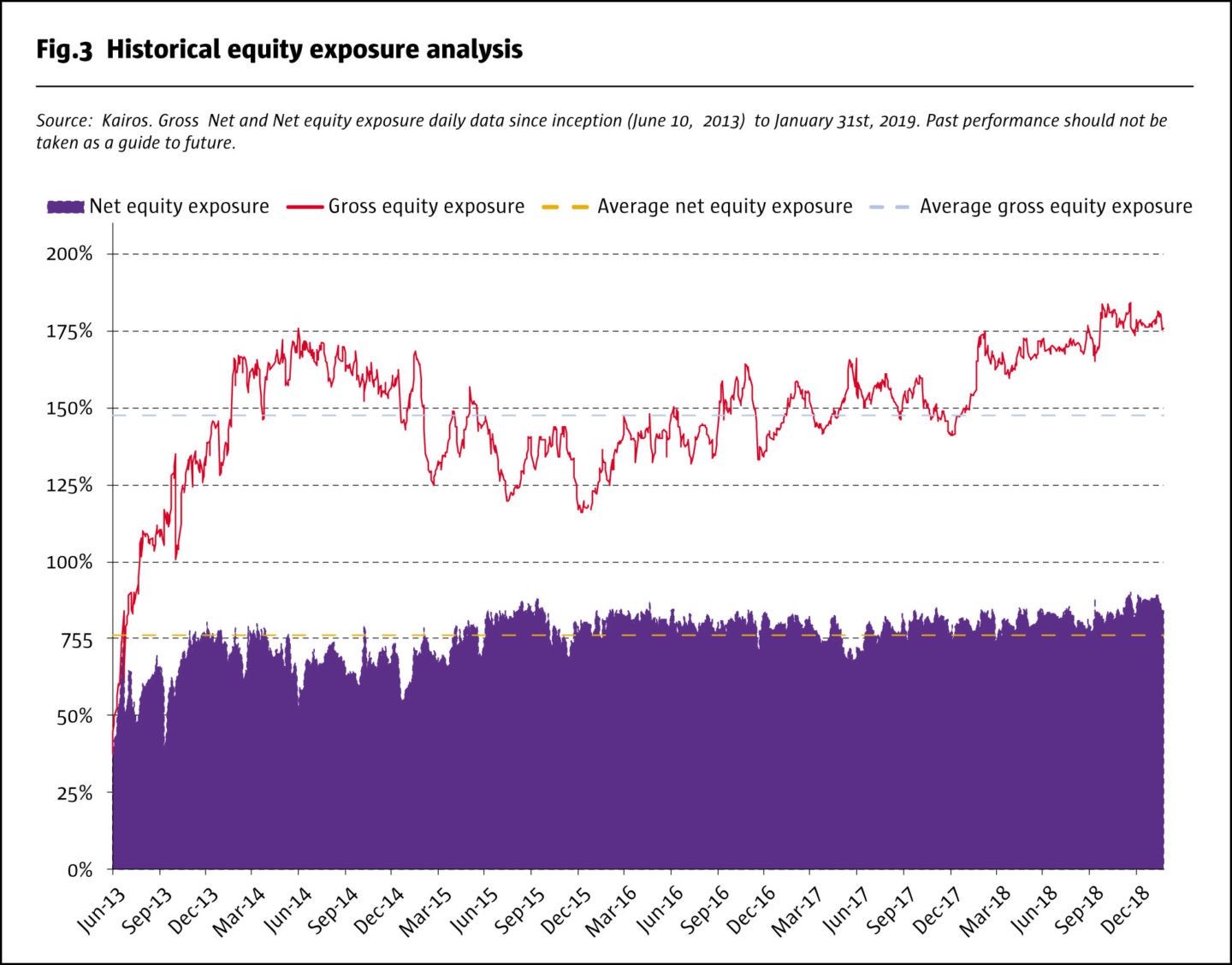

Villa’s high conviction is reflected in net exposure having reached around 90% in February 2019, the highest level since inception.

Public asset discount

The recent bid for Gatwick Airport throws into sharp relief the gaping disconnect between public and private market valuations of infrastructure assets. Villa asserts, “51% of Gatwick was acquired by Vinci with an implied EBITDA multiple of c.20x on 2019 estimated numbers. The asset is good quality, freehold property, a “negotiated” tariff system, a high percentage of passengers being VFR (visiting friends and relatives), offering more predictable revenues. GIP has proven to be a very smart airport operator over time. However, returns in our opinion will not differ materially from the ones you can extrapolate from listed operators, when it comes to the potential cash upstream. Gatwick Airport is six times levered versus a blended average of below two times for listed airports. Once this is adjusted for, the listed operators are significantly undervalued”.

Although Villa does not actually think that many airports are likely takeover targets (with the possible exception of Aeroports de Paris (AdP) upon full privatization), elsewhere in regulated infrastructure there has been plenty of M&A activity with pension funds and private equity firms vying to acquire prize assets. Meanwhile, the publicly listed sector massively de-rated in 2018, for various reasons. Villa adds: “Globally, geopolitical risk increased. We saw fears around interest rate rises; sector rotation out of defensives and stocks seen as bond proxies and into cyclicals in early 2018. There were also problems in specific countries: currency devaluations in emerging markets such as Turkey and Argentina contributed to a wider sell-off in emerging markets. The Genoa bridge collapse dragged down all similar Italian concession assets. UK assets de-rated even more than they did post-Brexit on fears that a Corbyn government could lead to nationalization of water, energy, and rail. The phasing out of coal in Germany could also affect some utilities”. The near-perfect storm in 2018 did not reach private assets, leaving public firms looking cheap in general and on a sum-of-parts basis. The implied equity risk premium has spiked by several percentage points, and Villa thinks it could come back down.

Utilities

Germany’s EON, which will soon be the largest regulated utility company in Europe after taking over Innogy, and Italy’s Iren amongst others, have

seen de-ratings: “Iren shares dropped by 20% in 2018 and have been savagely de-rated, with its valuation multiple contracting by more than one third,” says Villa. EON fell by less, but still de-rated given its earnings growth. In both cases, with risk-free interest rates in Europe still near zero, Villa reckons an appropriate PE multiple could be closer to 15 times than the 11-12 times seen today. Applying this to an earnings forecast of EUR 1 per share suggests that EON’s share price could double in a few years. Villa argues that utility equity valuations are factoring in extreme hikes in ECB policy rates to 3% or 4%, which he views as very unlikely. (Incidentally, Iren also features in the top ten holdings for another award-winning Kairos strategy, Federico Riggio’s Pegasus). Villa has also opportunistically bought into some UK utilities, such as Pennon, that excessively discount a Corbyn government nationalization scenario, which is also improbable. “More visibility on Brexit should bring a re-rating,” he says.

The big picture story is earnings growth and expansion of valuation multiples, but there are also plenty of company-specific stories where the KIS KEY team think that the market has mispriced various risks, based on their collective decades of dialogue with companies, regulators and politicians. Villa works with senior analyst, Oriana Bastianelli, who, like him, started out as a sell-side equity analyst following the sector. She joined Kairos in 2005 and was ranked number one buy-side analyst in Italy in the 2018 Extel survey and number one buy-side analyst in Europe for Transport and Leisure sectors in 2018 and 2017. Analyst, Alessandra Lupi, joined in 2013. The trio can also draw on the expertise of the wider Kairos equity investment team of 14, spread between London and Milan.

Gaming

Italian gaming is a regulated sector where regulatory change can make investors nervous, but Kairos judges that Italian government proposals will only prove to be a temporary setback for US-listed IGT, which generates 50% of its profits from the Italian market, managing lotteries and gaming machines. The proposals increase taxation on gaming machines, but there is also a chance for the company to lower payouts to players. Although there could be a one-off hit to earnings in 2019, longer term, the changes should have marginal overall impact. A smaller gaming firm, Gamenet, has also been marked down on short term fears, but should equally manage through the changes. This position is sized smaller due to its lower liquidity.

Airports

Airports are currently underweight — well below its peak, when KIS KEY had positions in privatized Spanish operator, AENA, and in Flughafen Wien (Vienna Airport), which was substantially acquired by Australia’s IFM Global Infrastructure Fund. Kairos has generally become a little cautious of airports in light of regulatory reviews that could reduce returns from commercial activities, such as the highly lucrative concessions selling luxury goods to tourists from Asia. Additionally, hopes of AdP being privatized have faded, partly due to Macron’s political challenges, and the airport is still arguing about tariffs with the regulator, which may be lower than it had wanted.

3%

Kairos is committed to engagement on active positions above 3% of NAV.

But Kairos has opportunistically bought into an operator called Cooperation America Airports, which saw its share price roughly halve on the Argentinian crisis. “Argentinian airports do contribute 70% of EBITDA but it also has stakes in Italy’s Pisa, Brazil’s Brasilia and Armenia’s Yerevan airports. Some of its assets are losing money but could be turned around,” says Villa.

Engagement

One airport position is classified as “special situation” and provides a good example of KIS KEY’s engagement activity, where Kairos sometimes takes a “friendly activist” stance. Kairos is committed to engagement on active positions above 3% of NAV, and this can be done with one or more of directors, key shareholders and regulators. Kairos has sought to persuade companies to improve balance sheet efficiency and capital structure. For instance, it recently engaged with a local utility company, disputing that it was under-levered and advising that it should increase its leverage in order to enhance shareholder returns through an increased dividend. Kairos has also asserted that management compensation at another firm should become more performance-related.

One of the most important engagement activities of 2018 involved a regulated airport – and engagement with the regulator rather than management or directors. At the end of 2018, a relatively new European airport regulator proposed draconian cuts in allowed rates of return, based on government bond yields, and demanded that a much higher proportion of profits from activities such as parking and shopping concessions be returned to customers. Kairos wrote to the regulator, pointing out that the proposals seemed perverse. “We suggested that extrapolating from an electricity tariff regime to airports does not make sense. Airports have more risks such as traffic fluctuation and counterparties. Using a government bond yield that was negative for much of the relevant period was not appropriate for a company which needs to make very long-term capital spending investments in terminals and runways. We also explained how many other European regulators had actually done the opposite and carved out commercial activities,” says Bastianelli. A final decision is awaited, but some municipalities that host airports in this country have already been critical of the regulator’s proposals.

Special situations

In early 2019, the above airport undergoing regulatory regime review, and an Italian infrastructure firm, Atlantia, are dubbed special situations. KIS KEY was somewhat serendipitous in exiting Atlantia in May and June 2018, a few months before the Genoa bridge collapse. The reason for divesting had been fears of a complicated corporate structure after the merger with Albertis. KIS KEY re-entered Atlantia shortly after the Genoa accident, based on the view that the stock had over-reacted. “We, as a team took a few weeks to weigh up what the Italian government was planning to do. The previous government had allowed the Benetton family to become monopolists without upgrading the network, and the investigation was pointing towards multiple parties being held responsible, even dating back to the original construction, not only the maintenance. We concluded that there was a very low probability of the government revoking Atlantia’s license without offering some compensation. A sum of the parts breakup valuation exercise, including the Rome airports, Chilean and Brazilian assets, suggested that the stub was worth EUR 13-14 per share, implying that only EUR 5 was ascribed to the Italian assets,” says Bastianelli. “We steadily built up a position of around 5%, and the stock has responded positively to the outcome of the independent commission,” she adds.

Long term winners

Positions such as Atlantia can be more opportunistic and actively traded, but overall many of KIS KEY’s biggest winners have been held for multiple years, albeit with some trading around them. For instance, attribution shows that utilities Iren and Acea were the top two contributors in both 2015 and 2017, whilst IGT was in the top ten in both 2015 and 2016.

Shorts and covered option writing

Although KIS KEY has a long bias, it also shorts single stocks. The short book has historically put on some catalyst-driven trades, but has recently been using mainly country or sector hedges on the short side. For instance, some Italian names were shorted to reduce the country exposure in Atlantia.

The covered option over-writing strategy has been mainly lying dormant, as although the aggregate equity market volatility has picked up, the volatility on single names has remained rather subdued. However, Villa did find a few opportunities to sell richly valued call options in December 2018, and expects to reap some time decay from these over 2019. This strategy will sell calls on longs and/or puts on shorts, 5-10% out of the money. This reduces the potential profit on the positions but enhances yield by 2-3% annualized.

Villa could easily deploy more capital. KIS KEY’s investment universe has a free-float adjusted market cap of EUR 850bn, with average daily volumes of EUR 3bn. He is confident that the strategy can scale up without impairing returns. The daily-dealing Luxembourg UCITS offers some share classes with a performance fee of only 10% and a management fee of 1%.

In summary, Villa’s return projection is at least 11%, comprised of a 5% dividend yield, plus 8% earnings growth, even if valuations — which have compressed from a PE of 16 to 11 — remain in the doldrums. Should valuations revert towards former levels, KIS KEY could conceivably have its best year ever. Furthermore, if the economy does weaken significantly, Villa expects that defensive sectors, such as utilities, should outperform.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical