As emerging market equities in September 2018 touched the technical definition of a “bear market” – a 20% peak to trough decline – seasoned managers, Sloane Robinson, are still broadly constructive on the asset class and on their focused emerging market equity strategy portfolio.

Emerging market economies, corporate profits and equity markets can often follow different cycles to those in the US and developed markets.

If the US had its Great Recession between December 2007 and June 2009, “emerging market economies went from one of the strongest ever economic expansions in 2010, to one of the weakest ever in 2015 – which was a steeper slowdown in growth than after the global financial crisis. China was slowing, while other countries, like India and Indonesia, that had overheated on domestic credit booms, also needed to cool down; and Brazil suffered an outright recession. Some countries also needed to correct overvalued exchange rates. By 2016, many excesses had been purged, in terms of exchange rates and external deficits, and early 2016 marked a trough for EM equities,” recalls Sloane Robinson CIO and portfolio manager, Ed Butchart, who was an economist and emerging market strategist before managing money.

(L-R): Ed Butchart, CIO, and CJ Morrell, Managing Executive.

Economic growth cycles matter because Sloane Robinson has found that emerging markets’ nominal GDP growth defined in US Dollars – which was in decline and turned outright negative in 2015 – is a good correlator for their equity markets. “In 2011, return on equity in the mid-teens in emerging markets (based on consensus IBES earnings forecasts) was close to developed markets but it had dropped to 11% by early 2016, as sluggish growth – and weaker commodity prices – squeezed profit margins and pressured asset turnover,” points out Butchart.

“Whereas US return on equity is at cycle highs, return on equity in the emerging markets is still in recovery mode. The US is running up against capacity constraints, and pre-tax profit margins have started to decline, whereas improvements in growth in emerging markets can translate into sharp jumps in profitability as companies’ operational leverage kicks in. US equities are richly valued using the Shiller cyclically-adjusted PE ratio (CAPE). Therefore, we see potential for emerging market equities to outperform US equities over the medium to long term,” explains Butchart

Stock-picking is important as, “the median MSCI EM stock has actually lost money over the past 25 years, and around 30 stocks have generated 60% of the returns,” says Butchart. Investors should only pay for active management if managers are genuinely active and not so called ‘closet trackers’.

Sloane Robinson’s emerging market equity strategy (“EM Strategy”) currently holds around 35 long positions, a few shorts and various equity and currency hedges. “Over time the long book has an ‘active share’ around 85-90%, and we have often owned stocks, such as China ‘A’ shares, that were not even part of the MSCI EM benchmark until very recently,” says Butchart.

A year in emerging markets is like a ‘dog year’ that can be as eventful as seven years in developed markets.

Ed Butchart, CIO

He argues moreover that investors should be confident that their managers can in fact pick the winners. Sloane Robinson’s 25-year firm history provides some institutional memory that informs an awareness of economic and political risks, and company-specific risks. The firm have often followed individual companies at different stages of their histories, and emerging markets are prone to more frequent political and economic change than developed markets: Butchart feels that “a year in emerging markets is like a ‘dog year’ that can be as eventful as seven years in developed markets”.

The firm’s 17 strong investment team have an average of 19 years’ experience, of which nine years has been at Sloane Robinson. All of the investment team generate ideas, discuss research, news and economics, and interact daily in an open plan office environment. The five portfolio managers are: the firm’s founders Hugh Sloane and George Robinson; Richard Chevenix-Trench, CJ Morrell and Ed Butchart. The last two manage the EM Strategy which is available in UCITS form.

Macro and country weightings

Top-down macro analysis helps Sloane Robinson tailor valuations to countries. The EM Strategy has had very little exposure to Brazil, Russia and South Africa between 2013-2015 when these economies faced acute macro problems – and nothing in Turkey over the past five years. In general, countries facing economic challenge are subject to a higher hurdle in terms of cost of capital. “For instance, the assumed cost of capital for Russia in 2018 is 15-16%, made up of an 8% risk free rate and a 7-8% equity risk premium. Turkey would need very cheap valuations and a very cheap currency to compensate for the political risks,” says Butchart.

The EM Strategy’s largest country weighting for the past five years has consistently been China, as the firm’s proprietary analysis has identified reasonably valued companies that have profited spectacularly from the multi-dimensional transformation of China’s economy. “China is moving from capital investment to consumer spending, from industry to services, from old to new technology (ecommerce, online gaming and advertising), from state-owned heavy industry enterprises to big data and consumer-focused technology, from export-led to domestically driven, and is developing its human capital,” says Butchart. Granted, the state still holds sway over private companies, but the big picture is that China has proved to be very fertile hunting ground for companies that deliver secular growth stories.

50-60%

Butchart estimates that 50-60% of the EM Strategy’s long book is clearly a beneficiary of one big picture theme: Asian middle-class spending.

In contrast, the allocation to India has been more variable. Sloane Robinson welcomes Prime Minister Modi’s pro-business reforms, and politics apart, sees the growth story in underpenetrated consumer goods and services markets, but a valuation discipline means the EM Strategy’s Indian exposure has fluctuated more as positions are exited as price targets are reached. “Elsewhere in Asia, we are revisiting South East Asia. Valuations have come back down in the Philippines and Thailand and Indonesia have adjusted their economies post credit booms,” says Butchart.

The EM Strategy has also made more opportunistic excursions into selected stocks in markets such as Argentina and Egypt, partly in response to political change reducing risk premiums. For instance, it participated in Argentina’s post-Macri rally in 2015, and bought into Egypt in 2016 after its currency plunged and the IMF programme was secured.

Few countries are completely off limits. Although some frontier markets that the firm’s dedicated frontier strategy invests in, are not liquid enough for the emerging market equity strategy, but the most liquid names there could be owned. The EM Strategy avoids developed market emerging market plays, such as Unilever, for the reason that investors do not need an emerging market specialist to duplicate existing portfolios of their developed world managers.

Company analysis

“We do not find the simple value versus growth split tremendously helpful in emerging markets, because stocks that appear optically expensive on simple measures such as PE or Price to Book Value, can be undervalued based on DCF (discounted cash flow) models, while other cheap stocks are serial capital destroyers and therefore ‘value traps’,” says Butchart. Sloane Robinson build their own five to 10-year DCF models, carry out company visits, and pick stocks one by one.

Butchart estimates that 50-60% of the EM Strategy’s long book is clearly a beneficiary of one big picture theme: Asian middle-class spending, a megatrend that will see another two billion Asians enter the USD 10,000 to USD 15,000 income bracket by 2030. This propels higher growth trajectories across multiple sectors, but Sloane Robinson’s clear valuation discipline does rule out some consumer staples stocks, in India, Indonesia, South Korea and South Africa, on current valuations. The firm has found more attractively valued stocks that populate other parts of the growth universe: in areas such as mortgages, life insurance, online commerce, healthcare and travel, and in segments such as sports apparel and branded liquor that also benefit from consumers upgrading.

Sloane Robinson’s long term, multi-year holdings are mainly what it terms ‘compounders’: growth stocks that also trade at reasonable valuations, hence they have some similarity with a GARP (Growth at a Reasonable Price) approach. The firm’s compounders also have some overlap with the ‘quality’ factor, as they have strong balance sheets and cash-flows, amongst other things. “These stocks are often found in Asia, because it generally demonstrates higher and more sustained economic growth than Latin America or Europe, by investing and growing productivity at higher rates. Asia has big pools of domestic savings whereas Latin America and Emerging Europe have less savings and so are more likely to run into bottlenecks,” points out Butchart. China has been particularly fruitful, “because some stocks lack an institutional investor following, which can lead to a total disconnect between the share price and fundamentals,” says Butchart.

Tariffs are a wild card, where we do not underestimate the impact on sentiment and confidence but find it hard to quantify the impact on company profits.

Ed Butchart, CIO

A classic compounder is Tencent, which dominates China’s internet ecosystem (which remains substantially closed to non-Chinese firms) and is analogous to, “Facebook plus Instagram, Paypal, Snapchat, WhatsApp plus online gaming, all in the same ecosystem. Chinese internet users want to be in the ecosystem and gain network effects from it. It is hard to see Tencent’s ‘moat’ being broken any time soon, which is why the franchise value of the free cash-flows makes building a ten-year DCF – that is pointless for the average stock – worthwhile for a true compounder,” says Butchart.

“Tencent is clearly not an undiscovered stock, but its franchise value was understated for much of the past five years. It was one of the EM Strategy’s biggest positions between 2013 and 2016, though we scaled it back down in early 2018. Since then, momentum-driven sentiment turned against Tencent and we have subsequently increased exposure to the company. Thus, Sloane Robinson actively trade around core positions, top-slicing on rallies and adding exposure on pullbacks, to profit from the heightened volatility of emerging market equities. In August 2018, the EM Strategy also happens to own Alibaba and Baidu, but does not perceive the three as a ‘BAT complex’. The firm views Tencent as having the strongest ecosystem but have been encouraged by operational improvements in Alibaba and Baidu. “We bought into Alibaba after it overshot on the downside and bought Baidu after its core search engine business improved, and loss-making divisions were spun off or sold,” says Butchart.

These three tech stocks are examples of how emerging markets are at the leading edge of technology in areas such as big data, AI, data science, and electric vehicles. China’s R&D spending has already overtaken Europe’s and may surpass the US this year. Asian companies may be ahead of western ones already in areas such as using social media for targeted, personalised advertising; mobile payments; facial recognition, voice recognition, and use of natural language processing and machine learning to process gargantuan amounts of data. There is also widespread speculation that China is winning the race to develop the nascent technology of quantum computing.

In contrast to its bread and butter ‘compounders’, Sloane Robinson’s ‘dynamic change’ and ‘deep value’ categories are inherently more tactical, with typical holding periods of six to 18 months. ‘Dynamic change’ stocks could be either growth or value stocks, while ‘deep value’ is true to its name.

Dynamic change equities are on the cusp of an improvement in profitability and return on capital. One example is high speed rail equipment supplier, Zhuzhou CRRC Times Electric, which makes electric signals for high speed rail tracks. “This company is geared to the second half of the five-year cycle of China’s high-speed rail programme, when rolling stock is constructed, and our in-house earnings forecasts for the company are well above consensus estimates,” says Butchart.

An example of deep value was South Korea’s Samsung Electronics, which traded on a low multiple of free cash-flow given its history of poor corporate governance. The reason for a re-rating was the adoption of shareholder friendly buybacks and dividends. Butchart acknowledges that today the deep value opportunity is less compelling, partly because the semiconductor cycle may be near its peak.

Risks to the thesis

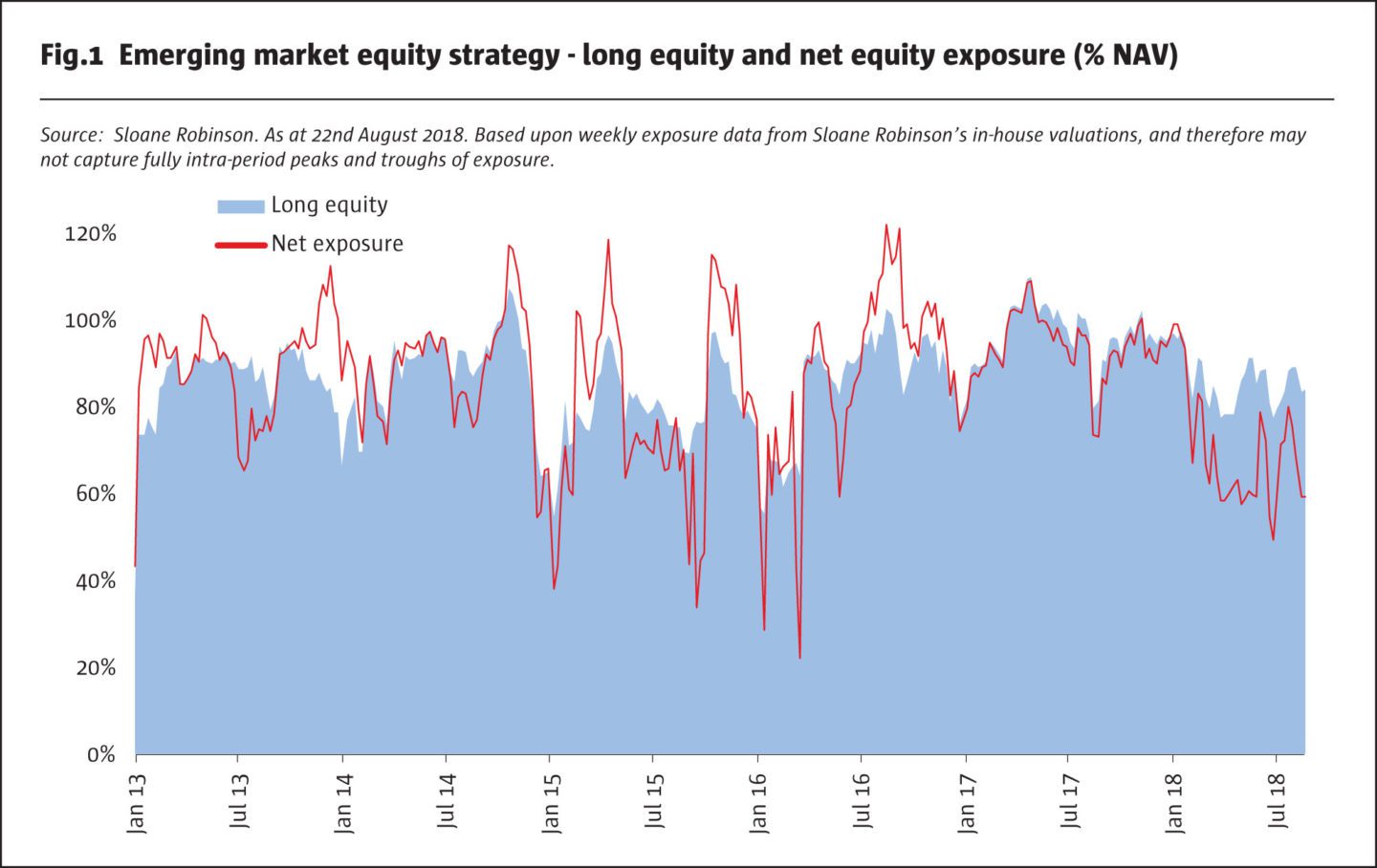

Markets do not travel in a straight line, and Sloane Robinson’s more constructive outlook on the asset class has clearly not materialised in the first nine months of 2018, when the MSCI Emerging Market Equity index has had a drawdown of c.20%. As the chart below illustrates, in order to mitigate this headwind the EM Strategy tactically scaled back long exposure after the January rally, and increased its use of equity index hedges, put options, currency hedges, and some small outright short positions in currencies such as the South African Rand and Brazilian Real (Butchart acknowledges that high interest rates can make some currencies too costly to short). There have also been a few single stock shorts.

There are three potential risks to the emerging market investment opportunity. The current media favourite of contagion, from crisis-stricken countries such as Argentina, Turkey or Venezuela, is not one of them. Butchart is of the opinion that “structural contagion risks are lower than in 2013, 2008, or 1997, because fewer countries have external weaknesses”. Some observers have suggested that a default by Turkey’s government could be the largest ever in emerging markets, but Butchart believes that an explicit default is unlikely, because Turkey’s predominantly local currency public debt could be serviced by printing money.

Three potential game changers could be: “a hard landing in China, a US recession, or an escalation of trade wars into something more sinister with a geopolitical dimension,” says Butchart.

For now, he does not view a severe slowdown in China or a US recession as imminent. Tariffs do appear to be escalating but are not easy to model. “Tariffs are a wild card, where we do not underestimate the impact on sentiment and confidence but find it hard to quantify the impact on company profits. There is no road map or historical context to figure out how economic growth and equity valuations might be affected. Simple elasticities are not sufficient, and in particular it is hard to gauge second-order effects, such as retaliation and reflexivity”. Similar issues apply to sanctions on countries such as Russia. Nonetheless, Butchart does feel that tariffs and sanctions warrant a higher risk premium.

In truly problematic environments, Butchart favours liquidating positions and holding more cash. “We would not try too hard to make money in a crisis, as our first impulse is survival,” says Butchart.

In August 2018, Butchart ventured that US dollar weakness could be a short-term catalyst for reversing the price action in emerging market equities. Long term, he argues that strong earnings growth should drive emerging market share prices forward, quoting Ben Graham’s adage that “in the short run, the market is a voting machine, and in the long run, the market is a weighing machine”.

Kepler Liquid Strategies UCITS

Sloane Robinson decided to launch a UCITS, KLS Sloane Robinson Emerging Markets, in April 2017, on the Kepler Liquid Strategies platform, which is home to assets of around $400 million, and four other funds: KLS Zebra Global Equity Beta Neutral, KLS CDAM Global Opportunities, KLS Arete Macro and KLS Lomas US Equity Long Short.

Kepler Partners LLP partner, Georg Reutter, explained the rationale for partnering with SR. “We had been following Ed and CJ at Sloane Robinson for several years and were particularly impressed with their ability to deliver strong risk adjusted returns in both positive and negative periods for emerging markets. The investment team at Sloane Robinson is one of the largest and most experienced emerging market teams in the market. Combined with the institutional operational and business set-up at the firm, we felt there was a significant opportunity to bring their emerging markets strategy to the UCITS market”.

Sloane Robinson CEO, David Gale, explained SR’s reasons for the launch and why Kepler was chosen. “Within Europe, the increased demand for liquidity and transparency, especially in respect of more traditional equity type strategies such as ours, made the decision to launch a UCITS version of our emerging market equity strategy a simple decision. However, we took a strategic decision to partner with an external group which had more experience of asset raising in the UCITS space. The specific choice of Kepler was predicated upon their pre-existing relationships with asset allocators through their ‘absolute hedge’ product, which provides a comprehensive review of the alternative UCITS universe. Further, their best of breed approach to manager selection gave us confidence in the likely calibre of managers that would ultimately sit on their platform”.

The UCITS launched in April 2017 and is run nigh-on pari passu with the Cayman fund which started in 2013. The liquidity terms and fee structures are different. The Cayman fund offers monthly dealing and has a performance fee that is paid on absolute returns above the benchmark, on a rolling two-year lookback. The UCITS instead charges a higher management fee and no performance fee on a daily dealing fund. Sloane Robinson’s overall emerging market strategy probably has capacity of $1.5 to $2 billion, and the frontier strategy is likely to be capped at $300 million. The UCITS currently has assets of around $150 million.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical