Now into its third year, the Legends4Legends conference has helped leading investment industry charity, Alternatives 4 Children (A4C), raise more than €1 million since it was founded. The yearly event aims to bring together leading investment managers and allocators of capital who want to hear and discuss the latest investment ideas from some of the best minds in the industry. The 2018 gathering alone raised more than EUR 100,000 from nearly 200 speakers and attendees who congregated at the iconic EYE Film Museum on the north side of Amsterdam’s Ij river. A legendary roster of hedge fund luminaries covered topics spanning macro, credit, emerging markets, frontier markets, ESG, activism and cryptocurrencies. A4C’s projects are involved in improving the living standards of children globally – in countries including Tanzania, Kenya, Ghana and India – so it’s particularly appropriate that several speakers discussed ESG investing.

A legendary roster of hedge fund luminaries covered topics spanning macro, credit, emerging markets, frontier markets, ESG, activism and cryptocurrencies.

Macro outlook

CQS founder, Sir Michael Hintze, is interviewed by A4C co-founder, Marc de Kloe. Hintze argues that some investors may have unrealistic return expectations. Global financial assets, valued at around $240 trillion, are unlikely to generate a 10% return (that many institutions target) of $24 trillion from global GDP of $80 trillion. But Hintze is broadly constructive on economic and market fundamentals; US equities are on a mid-teens p/e valuation, the economy is growing, there are sufficient excess reserves in the banking system, and the BRICs are also growing. CQS, which has net assets of $18 billion evenly split between hedge fund and long only strategies, does see some risk of inflation, partly owing to wage inflation and oil prices, and believes that certain inflation swaps are good value. CQS offers clients both commingled and bespoke vehicles, as investment management is increasingly more about providing client solutions. Aged 65, Hintze has no plans to retire, and is looking forward to carrying on trading, reading and pursuing philanthropy for as long as possible.

Horseman Capital’s Russell Clark envisages the USD underperforming every currency in the world, as he sees the US budget deficit rising. In particular he identifies the British pound as undervalued, and views UK assets as being extremely under-owned.

(L-R): Marc de Kloe, co-founder, A4C and Sir Michael Hintze, Chief Executive and Senior Investment Officer, CQS. Photography: Carolyn Seeger.

Credit outlook

CQS invests across the whole capital structure, identifying relative value in credit, ABS, Loans and structured credit, with a present focus on short duration and floating rate assets.

Fulcrum Asset Management Investment Director, Graham Neilson, believes that the credit cycle – which typically lasts around five years – is closer to the end than the start, as the big picture theme of “normalisation” applies to economic growth, inflation, central bank activity and financial market volatility. Corporate credit has had an extraordinary bull market, with some highly leveraged corporate debt products such as CLO equity annualising at up to 20%, beating the best performing equity sector, US technology, which had a CAGR of 17% over the past four years and with a lot less volatility. But Neilson expects that this will soon give way to a phase of deleveraging and stress, as central banks continue to wind down their asset purchases; over-leveraged economies such as China and certain other emerging markets continue to deleverage amid slowing economies; and the problems of huge covenant-lite loan issuance and the leveraged buying base come home to roost. Fulcrum, which has a fundamental and behavioural approach to liquid, multi-asset investing, has been either neutral or short credit so far this year. “The methadone is ending,” sums up Neilson.

Similarly, Eiffel’s Emmanuel Weyd does not find a long only stance is attractive in European credit markets. Weyd judges new issue performance to be a bellwether for risk aversion, and this does not bode well: new issues from the second half of 2017 are on average trading down by five points, and 2018 issuance volumes are down year on year.

The good news is that heightened dispersion in credit markets is throwing up good idiosyncratic opportunities for long and short trades. Steep bond price crashes have been occasioned by bankruptcies (Air Berlin, Astaldi) and accounting issues (Steinhoff, Lebara). Conversely, corporate events such as asset disposals (OHL) or acquisitions (Wind Tre’s by CK Hutchinson) can generate sharp jumps in bond prices, which can however be short-lived.

Weyd has used CDS to short a French holding company (Rallye) that he perceives as a heavily leveraged, value-destroyer, that services its debt with dividends from its supermarket subsidiary (Casino). This is despite the fact that the latter does not generate any free cash flow from its regular operations. As food retailing is also an industry facing structural and secular challenges, Weyd judges that Rallye faces high refinancing risk. On the long side, Weyd has identified a shipping company (Exmar) that has very little credit research coverage. He expects that asset disposals, contract wins and a fleet refinancing, could let Exmar redeem debt at an attractive call premium.

Weyd is also identifying selective value in subordinated bank debt, as he is of the opinion that banks are now run in the interest of creditors. He likes some additional tier one (AT1) and Contingent Convertible (Coco) paper, but underscores that super stringent name selection is needed.

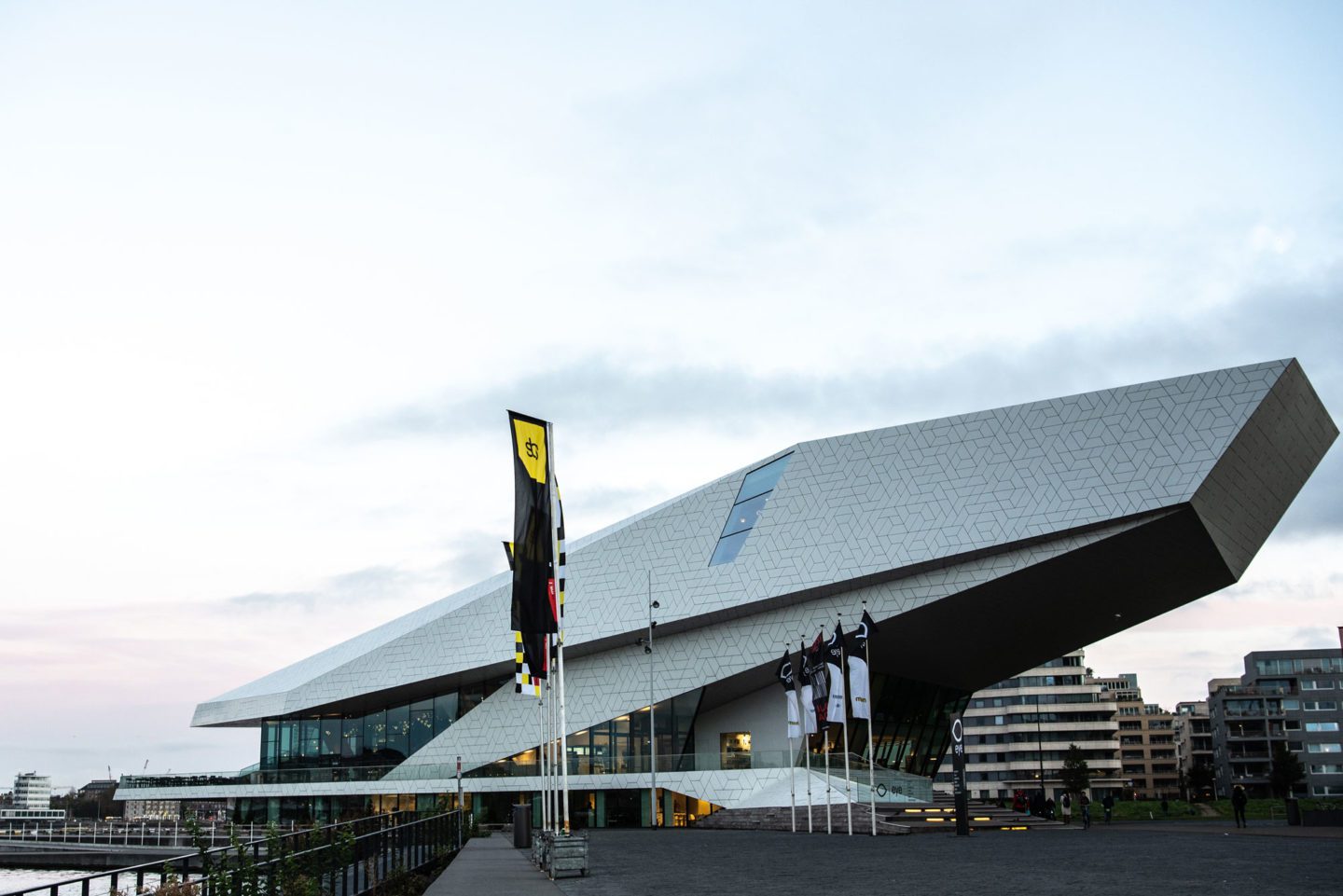

EYE Film Museum, Amsterdam’s. Photography: Carolyn Seeger

EM and frontier markets: Indian growth, African mobile money, and Russian value

Emerging markets have seen a sharp pullback in 2018, which has thrown up some bargains, according to several stock-pickers.

Kempen Capital Management, which has been profiled in The Hedge Fund Journal, has $1.5 billion invested in non-traditional strategies including structured credit, distressed debt, insurance-linked securities, volatility trading and long/short equity. Kempen’s Co-Head of Hedge Fund Solutions, Remko van der Erf, interviewed Mohan Rajasooria of long/short equity and credit fund, Zaaba Capital. Rajasooria points out that Asia’s GDP has now overtaken the US and Europe’s, and it is an attractive market for stock-pickers: the universe of listed stocks has been growing at a faster pace than the US and Europe; financial markets have become more fundamentally driven, and have less sell side coverage. Zaaba, which typically has 20 longs and 20 shorts, is finding very deep value in the China market, but presented on India’s largest mid-market hotel owner and operator, Lemon Tree Hotels, which floated in April 2018. Rajasooria previously followed the firm when it was private, as did Europe’s largest pension fund, The Netherlands’ APG, which is a strategic partner with a stake in the group. India has a structural shortage of hotel rooms, with only around 200,000 organised rooms against around 4 million in China, and around 5 million in the US. Moreover, the majority of the current supply is estimated to be in higher-end hotels costing over USD150 per night, which leaves a huge gap in the mid-market, where Lemon Tree charges USD50-60 per night. The firm, which has managed to deliver a strong combination of good location and service quality at an affordable price to its customers, should benefit from the multi-year demand growth in the India mid-market hotel segment.

Malabar Investments Managing Director, Sumeet Nagar, expects India will eventually re-attain the status it had in the sixteenth century – as the world’s largest economy. Already ranked ninth at the beginning of the decade, India is set to rise to fifth by 2020. India is the fastest growing large economy and is supplying two thirds of the world’s incremental labour force, fuelling strong consumption growth. India’s stock-market has best in class return on equity of 16%, and has annualised at 13.8% in USD terms this millennium from end of 2000 to end of 2017.

Nagar sees a spectacular runway of growth ahead for PNB Housing Finance, India’s fifth largest, and fastest-growing, mortgage lender. Indian mortgage volumes have registered growth rates of between 12% and 21% over the past decade, catapulting mortgage books from USD 49 to USD 239 billion. Yet mortgage to GDP ratio in India of 10% is still the lowest of any large country. Nagar sees scope for PNB Housing, which has outpaced industry growth whilst keeping Gross Non-Performing Assets below industry averages, to grow its earnings per share as fast as 25% a year. The firm has doubled profits since its IPO two years ago, but has been de-rated due to stock overhang and fears of rising interest rates.

Another secular growth story with mid-teens industry growth rates is branded luggage maker, Safari Industries, which is benefiting from strong air traffic growth. India’s current annual 0.08 flights per capita is forecast to at least quadruple to the current Chinese level of 0.3 by 2035. Safari, which has grown its market share from 4.4% in 2012 to 14.1% in 2018, has grown even faster at an annualised rate of over 35%, and Nagar expects the firm could continue to benefit from economies of scale, expanding its profit margins and return on equity.

Just as US equities had a “lost decade” in the first ten years of the new millennium, African equities over the past decade have lost an average of 1.4% per year, as measured by the MSCI Africa Index. The period began with Kenyan election violence, Nigeria’s banking crisis and Zimbabwean hyperinflation and continued with the Arab Spring and Libya’s civil war. Then came Sudan’s separation and civil war, soon followed by the Ebola tragedy, Egypt’s currency collapse, and Mugabe’s overthrow. Yet even so, in the course of the decade running up to September 30, 2018, the Coronation Africa Frontiers strategy made gross average annual returns of 9.5% (7.1% on a net of fees basis). Coronation’s Head of Global Frontier Markets, Peter Leger, who follows emerging and frontier markets globally, has identified mobile money as a best idea. The largest listed player, Alipay, has had valuation of $150 billion in its latest funding round, but Leger is researching less well followed firms in the space, in countries such as Bangladesh, Pakistan, Kenya, Ghana, Senegal and Tanzania, that trade on lower price/sales ratios. He homes in on two African examples: Kenya’s M Pesa and Zimbabwe’s Eco Cash, two businesses that are very profitable in a landscape with many loss-making and break-even businesses. Monetising customer data could power the next leg of growth for these firms, and Leger expects the next decade could be much more lucrative than the past one for investors in Africa.

As geopolitics and sanctions pressure the Russian market, Balchug Capital founder and CEO, David Amaryan, believes that Russian equities are broadly undervalued, on a PE ratio of around six versus 12 for the MSCI Emerging Markets index. But rather than buying the broad index, he prefers to select specific stocks, based on events such as: debt restructuring; company reorganisation; asset divestitures; mergers and acquisitions; privatisation; corporate governance; and interim and special dividends.

A core long holding for Balchug has been Tatneft, Russia’s fifth largest oil company. Argues Amaryan, “Tatneft is the most technologically advanced and innovative oil company in Russia; has strong operational efficiency and capital spending controls; good corporate governance and socially ecological responsibility”. He has met the management, is encouraged by insider buying, and expects the firm could quadruple its free cash flow and dividends by 2030; up to 100% of free cash flow is distributed to shareholders.

Whereas Tatneft has been one of the top performing energy stocks in Russia (and globally), Gazprom has been a laggard. Its market capitalisation is slightly below that of Novatek, despite having seven times more production, and 13 times more reserves. Reasons for the discount include political issues, huge capital spending, a low dividend pay-out ratio, opacity, and inefficient management. Amaryan envisages that a new political cycle could pave the way for a transfer of power and a change of management, which could prompt a re-rating of the stock’s valuation.

ESG, impact investing, activism, and commodities

A dearth of data and disclosure can make ESG investing in emerging markets more laborious than in developed markets, but it is gathering momentum. Niki Natarjan, Director of In Ink, interviewed one of Mobius Capital Partners’ (MCP) founders, octogenarian Dr Mark Mobius. During the discussion, Mark mentioned how over decades of investing in emerging and frontier markets, he had witnessed some of the issues poor governance can cause. For example, when families siphon off assets from companies; when bureaucrats corruptly interfere with firms, or when governments nationalise them. MCP’s aim is to engage actively with investee companies to initially improve their corporate governance – the G in ESG – and then their environmental and social impact. MCP can invest in companies with low – or even no – ESG ratings but have potential to improve, and may then reward investors with higher valuations. MCP may also invest in countries with a low Transparency International rating, as they can be home to some real corporate gems. MCP is researching companies in countries including Nigeria, Kenya, Somalia and Ethiopia.

Inherent Group complements traditional investment analysis with ESG in several ways: to get a broader perspective on risks; to engage with companies in order to promote policies such as good practices for executive compensation and reduce costs of capital; to benchmark companies against best practices, and to report ESG metrics to investors. ESG considerations can form part of the investment thesis for both long and short positions, and can apply to investments in public and private companies, throughout the capital structure, including equity and credit. Some of Inherent’s long positions could be viewed as examples of “Impact Investing”. Founder and CEO of Inherent Group, Tony Davis, previously co-founded Anchorage Capital Group LLC. Davis and Inherent Group pursue philanthropy devoted towards environmental, educational and health and wellness goals.

Another fund with a strong focus on governance and giving is CIAM, whose fund prospectuses promise to donate 25% of performance fees to charities including A4C. CIAM has pursued 12 successful activist campaigns over the past five years, which demonstrate how a medium-sized investment manager, running USD 550 million, can bring about change at companies with market capitalisations of up to tens of billions. “Many European countries offer some of the world’s most protective minority shareholder rights. We know these rights very well, and also have the right network of lawyers, PR firms, experts and work with associations of minority shareholders” says co-founder, Anne-Sophie D’Andlau. She discussed two recent CIAM activist investments.

The Netherlands has been widely criticised for weaknesses in corporate governance (most recently in relation to Akzo Nobel and Unilever rejecting offers), which arguably justifies a Dutch valuation discount for some firms, but activist investors can sometimes improve matters. Retailer, Ahold Delhaize, has an Option Agreement (OA) letting its Stichting – or governing body – issue preferred shares, which can be a poison pill to block hostile bids or other shareholder initiatives. In 2018, the board of Ahold Delhaize threatened to renew the OA without shareholder approval, prompting CIAM to engage with the company. In a series of actions escalating pressure on the company, CIAM first raised concerns about the renewal, then asked for it to be put on the AGM agenda, arguing that its omission would be unlawful. CIAM later attended the company’s AGM in Amsterdam, and mounted a public campaign with support from various minority shareholder defence associations, demanding an EGM. The board renewed the OA, but agreed to a compromise clause giving shareholders an effective veto: if shares were issued under the OA, a shareholder meeting would be held to discuss the matter, and shareholders could ultimately vote to cancel those shares.

CIAM’s actions in relation to the world’s fourth largest reinsurer, SCOR, concern an actual rather than a potential bid rejection. CIAM scented suboptimal governance after SCOR’s board rejected

an offer worth EUR 43 from its largest minority shareholder, French insurer Covea, and Covea’s CEO, Thierry Derez, temporarily stepped down from SCOR’s board, leaving no real independent directors to balance the power of Chairman and CEO, Denis Kessler. CIAM then wrote letters, stating that SCOR’s fiduciary duty (per Article 1833 of the French Civil Code and other case law) was to engage with the bidder, and properly assess any approach, or demonstrate that the company was worth more than the bid offer. CIAM further made clear that it would not hesitate to hold the CEO/Chairman and Board of Directors liable for a decision that could be seen as gross management negligence, and has complained to the remuneration committee about a “golden parachute” poison pill provision. The case remains outstanding, and CIAM judges that SCOR, trading around EUR 41 in October 2018, could have fundamental value of EUR 47-50.

Commodities and ESG

Though many of the world’s largest pension funds and endowments have been investing in commodities for decades, the asset class remains somewhat controversial. Swedish pension funds cannot invest in commodities and UCITS cannot do so directly. Presenting on “Responsible Investing in Commodities”, Harold de Boer of Dutch CTA Transtrend, which was profiled in The Hedge Fund Journal, and began life in 1989 as a research project in a Rotterdam-based commodity trading house, points out that many claims made about commodity investing are fallacies. He gives the example that “commodities are not necessarily more volatile or risky than equities – and commodities cannot go bust like a company, or default like a bond. With regard to leverage: this holds for all futures markets; and non-futures markets such as banks are effectively also leveraged. The claim that speculators trading commodity futures increase food prices is not necessarily true. On the contrary, futures have historically proved to play an important role in well-functioning food markets. Speculators are vital in that for their willingness to bear price risk, to offer liquidity, and to contribute to the price discovery process”. However, according to De Boer, this requires an active approach – trading long and short in individual commodities. He explains why passive long investors in crop futures don’t receive a natural risk premium from hedgers. And he argues that trading indices that are composed of fundamentally different commodities is prone to disturb the price discovery in the underlying markets. For this reason, Transtrend does not trade futures on commodity indices. De Boer concludes by stating that commodities should not be regarded as a different asset class, but instead be recognized as an integral part of our economy and be treated as such. Also by investors.

Horseman Capital’s Russell Clark argues that the biggest beneficiaries of the shale gas boom have been land owners. Shale oil drillers cannot make a decent return on equity at current land prices and the companies are destroying capital. The only way for shale oil drillers to generate a return on capital is to slow land purchases and hence reduce output. He expects massive consolidation will continue and views a recent all-share mega merger as marking peak shale oil production. The geological constraints also mean that US oil supply could surprise on the downside. Clark expects non-US oil companies to outperform those in the US.

Digital Assets: Cryptocurrencies and Blockchain

Theta Capital Partner and Portfolio Manager, Ruud Smets, introduced a discussion on digital assets, arguing that he envisages two phases in its development: “In the current phase, a new, parallel financial system is being built to deal with digital assets, thereby removing a lot of friction in the existing system. In a second phase, we could see the full potential for blockchain based decentralised systems, but for that there are significant technological bottlenecks to be overcome first,” he says.

Former Tiger macro trader and current blockchain pioneer, Dan Morehead, believes that bitcoin and other block-chained digital assets will be the biggest disruptive force of his generation. He argues that highly centralised industries and vertical functions within them are highly susceptible to substantial de-centralisation in the coming years.

One of Morehead’s insights is that cryptocurrencies are quite simply Money Over Internet Protocol (MOIP), analogous to Voice Over Internet Protocol (VOIP), which cut the cost of telephony by over 99% and vastly increased data transmission beyond all previous capabilities. Morehead also views cryptocurrencies as part of a wider disruptive trend in which “web 3.0” will reject centralised business models (e.g. Facebook, Google, Airbnb, Uber, etc), in favour of de-centralised, cooperatively owned, versions. Morehead views the entry of trusted institutional quality custodians, including Fidelity, Nomura, Bakkt and eventually large regulated bank custodians, as “hugely credentialising” and further evidence of near-term broad investor adoption.

Morehead’s Pantera Capital, which began as a macro-style fund in 2003, oversees four best-in-class strategies that use blue chip external service providers one would expect from the industry leader. In 2013, Pantera launched the first crypto fund in the US, the Pantera Bitcoin Fund, which is up over 10,000% since inception. Pantera also has two crypto hedge funds and makes private equity investments for itself and on behalf of its clients in areas such as exchanges, custodians, remittance businesses, stable coins and other very selective companies that will provide lower cost on-ramps and scalability solutions to increase the operability of blockchain transactions.

ETF aspiration

The bitcoin paradigm of irrevocable and non-governmental ownership records is close to the heart of VanEck’s Director of Digital Assets, Gabor Gurbacs, because his grandparents and parents had property expropriated by two authoritarian regimes: Nazis and Communists. Gurbacs believes that a bitcoin ETF is necessary to enable investment from established institutions. The SEC had rejected at least nine ETF applications, including both those based on physical ownership, and others based on synthetic ownership using the new CME Group /CBOE futures markets, but is revisiting them in light of potential rule changes that might permit self-regulated exchanges as venues. VanEck and blockchain technology company SolidX proposed a physical bitcoin ETF with features that seek to address the SEC’s various concerns and questions. For example, a compliant and regulated index provider, MVIS, would provide pricing; a custody and safekeeping solution appropriate for bearer assets, including insurance, would be offered; trading would take place via OTC (Over the Counter) venues, which trade larger volumes of bitcoin than the exchanges. Gurbacs points out that NASDAQ’s Smarts technology is also making headways to ensure no market abuse such as wash trades or spoofing on digital asset trading platforms. VanEck’s discussions with the SEC are ongoing. Gurbacs concludes that, “Bitcoin is already widely available to investors via lightly regulated trading platforms or websites with few protections. A Bitcoin ETF would bring investors capital market protections, liquidity, clean pricing sources and overall a way to invest in Bitcoin like we invest in equities and commodities today”.

Another speaker whose family has grappled with the vagaries of regime change is Hintze, whose forbears moved from Europe to China to Australia, partly as a result of revolutions. His grandfather also had assets expropriated in Indonesia. Hintze believes the rivalry between the US and China will continue. He also warns of the political risks of the populist pendulum swinging both left and right due to a disenfranchised generation of young people, with socialists gaining support from people with little capital and few assets.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical