LFIS (the Paris-based quantitative asset manager created in 2013), launched LFIS Vision – Global Derivatives Opportunities in August 2019. This is neither a long-biased nor a short-biased volatility strategy, nor can it be described purely as a volatility strategy. Perhaps the best way to define it is as a relative value, broadly market neutral, derivatives arbitrage strategy that trades a range of implied assets: not only volatility but also correlation, dispersion, dividends, and repos.

These derivatives are traded within and between equity, interest rate, commodity and credit markets, in the US, Europe and Asia. In common with many arbitrage strategies, most trades are motivated by mean reversion. But in contrast to purely systematic strategies, the signals are not determined in a completely mechanical manner. The approach can be seen as a hybrid between systematic and discretionary, as is common with LFIS’ investment approach: it uses a strong foundation of quantitative analytics, including in-house models for pricing of derivatives. Yet discretion determines the timing of entry and exit points for the trades.

The paradox of plain vanilla options is that they may appear simple instruments because they are easy to access, but actually they are the most complex way to capture volatility premiums.

Yann Le Her, Partner and Senior Portfolio Manager, LFIS

Though the opportunity set will fluctuate over time, the objective is to generate all-weather, absolute returns, based on dislocations in implied parameters. LFIS Partner and Senior Portfolio Manager, Yann Le Her declares, “We believe that the inefficiencies arise from structural and repeatable anomalies, caused by phenomena such as persistent imbalances in flows, which are partly due to regulations and constraints around banks”.

He continues that, “The genesis of the Global Derivatives Opportunities fund was a reverse enquiry from existing investors who wanted dedicated exposure to the implied family of premia within our flagship premia strategy”. The UCITS version of LFIS’ broader premia strategy has earned The Hedge Fund Journal’s “UCITS Hedge” performance award for “best Alternative Beta/Style Premia/Risk Premia Fund”, over various periods.

To address the investors’ request, the new Global Derivatives Opportunities fund focuses solely on market neutral relative value trades on implied parameters. It targets a volatility of seven to ten per cent in normal market conditions, with a Sharpe ratio above one.

Global Derivatives Opportunities is expected to have a roughly 90% overlap with the implied family of trades in the flagship strategy, but there are, Le Her points out, three differences. “First, monthly fund liquidity affords the opportunity to include some longer dated trades that are not suitable for the daily and weekly dealing funds, for additional performance or decorrelation; though most will still not extend beyond three years. Second, more leverage is needed to reach a seven to ten per cent volatility target. Third, a Luxembourg SIF structure also allows for direct commodity exposure that is not straightforward to structure in a UCITS.”

Hyper-diversification

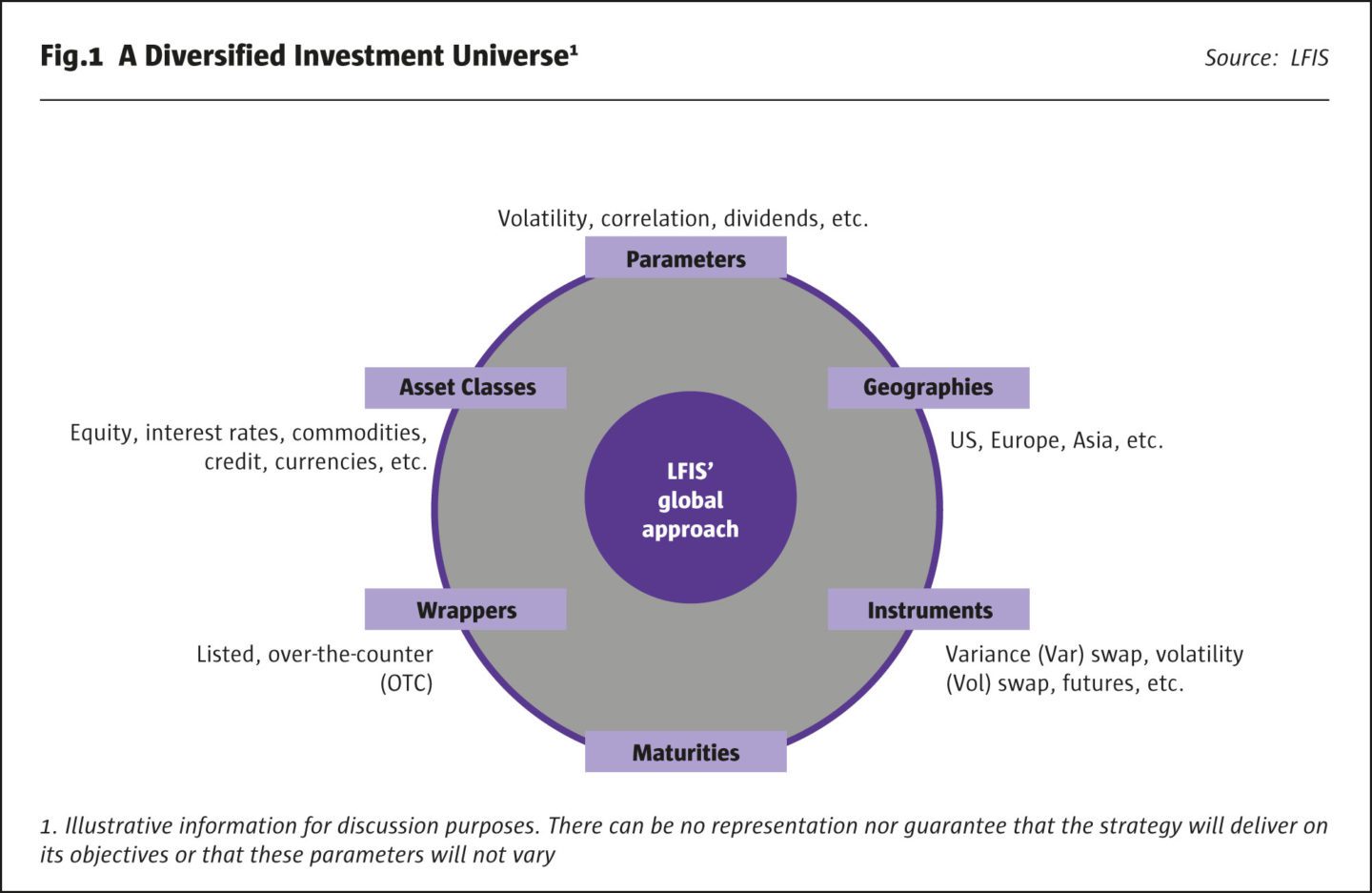

The strategy is highly diversified from both top-down and bottom-up perspectives. Le Her explains that, “six dimensions of big picture diversification are: the implied assets traded (volatility, correlation, dispersion, dividends and repos); the four asset classes (equities, interest rates, currencies and commodities); the three geographies (US, Europe and Asia); the two types of instrument wrappers (listed and OTC); the multiple types of instruments (vanilla puts and calls, variance swaps, and various bespoke derivatives), and the maturities.

“From a bottom-up angle,” he continues, “there are several families of trade types, various implementations of each trade type, and multiple trades per implementation. This adds up to a lot of trades at any time, and the number of positions runs into the thousands since some trades may have multiple legs.”

Portfolio construction sets upper and lower boundaries for each family of trades, strategies, asset classes, and other parameters, but leaves room for some opportunistic tilting towards the most dislocated trades. “On average, we target an equal volatility for each family of trade,” he says. “Overall fund volatility nets out at below 10% due to the diversification benefit across the families, in spite of an overall volatility played of more than two times this number.”

OTC counterparties

LFIS trades listed and OTC derivatives. The manager uses quantitative signals to enter positions, but also to determine whether sufficient market liquidity exists to obtain good execution for certain strategies, which are not executed electronically, and where human traders interact. “OTC is more demanding as you need ISDAs with counterparties, and both a risk management and an infrastructure that are closer to an investment bank than you may traditionally find in an asset management firm,” he says. “We developed the right infrastructure for trading both listed and OTC. We do not arbitrage between listed and OTC derivatives, but rather select the best instruments to implement each strategy. We have access to over 20 OTC counterparties.” Some investment strategies in the derivatives space act as market makers, and/or are designed to relieve banks of regulatory capital requirements. LFIS is not providing prices on both sides of a trade and is not explicitly trying to help banks free up regulatory capital, but some trades do help banks lay off their risks. LFIS has a symbiotic relationship with banks and earns some reward for helping them to deal with their regulatory and capital adequacy constraints, within the structure of the strategy. “We do not take on all risks and are very specific about which volatility, correlation and dividend risks we feel comfortable with,” asserts Le Her, who held roles including Head of Equity Exotics Trading – Europe, and Head of Equity Derivatives – Americas, at HSBC, before joining LFIS. “My background in exotic and flow products on the equity side, including during the 2008 crisis, means I have insights into how banks run their books.”

$1bn

Capacity for the GDO fund is expected to be around $1bn.

Instruments

Banks’ regulatory frameworks and their need to hedge risks more precisely to minimise capital charges have made derivatives instruments more sophisticated over time, as has the buy side’s desire for more granular exposures. “For instance,” says Le Her, “dispersion trading has gone through seven developments over the years: from full index dispersion straddles; to full index VAR swaps dispersion; to full index VOL swaps dispersion; to bespoke VOL and VAR index dispersion; to bespoke corridor dispersion; to geometric dispersion (stocks or indices) to weighted geometric dispersion (gamma, log) products. There are now many products available on the shelf, and those few buyside firms able to understand and trade the whole range of instruments, have an advantage in enhancing their risk/return profile.”

These derivative products may sound rather exotic and complicated, but complexity is mostly on the bank side, and most OTC products – all of which are transparent, standardised, liquid and collateralised – were developed to produce a pure and straightforward exposure to implied parameters. “The paradox of plain vanilla options is that they may appear simple instruments because they are easy to access, but actually they are the most complex way to capture volatility premiums. The Greeks of options move around with the price of the underlying. Options require regular delta hedging and rebalancing in order to monetise realised volatility, and even then, the payoff is somewhat unpredictable and strongly path-dependent.”

There are scenarios under which a strategy of long delta hedged options could lose money, even if there are bursts of higher volatility and even if the realised volatility is above the implied volatility. The situation becomes even more complicated for vanilla dispersion trades which involve multiple legs and path-dependencies. By contrast, volatility or variance swaps offer a much cleaner and more predictable payoff: simply defined as the difference between realised and implied volatility, irrespective of its path or pattern,” expounds Le Her.

Pricing, valuation and risks

These instruments can entail some degree of valuation subjectivity. “We took years to develop our pricing and risk management systems – including data and models – for these more bespoke derivatives. A more granular volatility surface allows for more accurate pricing, adapting trading to pinpoint the perfect instrument for each trade. Sophisticated pricing is also needed to match, and sometimes challenge, counterparty pricing, which might be too high or too low. Trading longer maturity instruments increases model risk and places a further premium on being accurate on everything from plain vanilla to multi-asset derivatives. No standard solution exists so we need to be flexible, and this flexibility is offered by our in-house system,” he points out.

The risk systems are also used to manage exposures to bespoke or historical market scenarios, as well as the standard Greeks including delta, vega, gamma, theta, dividends, rates, and credit which are kept within preset ranges. For instance, “the strategy pays away some theta or time decay but expects to be positive carry overall due to harvesting some gaps between realised and implied spreads,” says Le Her.

Equity dispersion

One core trade type is a long equity dispersion structure, which profits from declines in correlation between equities. Viewing the two legs separately, this trade is short index realised volatility and long single stock realised volatility. Combining the exposures collapses into being short realised correlation or being long dispersion. Academic empirical studies (eg Driessen et al 2009, Bakshi and Kapadia 2003) suggest that the gap between implied and realised volatility is much larger on equity indices (around 3.5% to 4%) than it is on single stock options (around 1%). Historical back-tests therefore suggest that a simple rule-based strategy would have earned some risk premium (though there are differences of opinion over how to account for transaction costs) and it could have seen some deep drawdowns. LFIS is seeking to build on this basic foundation by taking a more sophisticated approach to the selection of instruments, as aforementioned, and also to trade construction and timing.

“Dispersion trading has been around for at least 20 years, but we are distinguished by how we construct and time the trades. Some managers trade equity dispersion in both directions on a mean reversion basis, but we only structure the trade in one direction, going short index volatility and long single stock volatility. This means we are always long idiosyncratic risk such as takeovers when we have the trade on. Additionally, while some managers will sell more index volatility than their exposure to single stock volatility, we size the two sides on a vega-neutral basis so that there is a long convexity bias.” This is important because profits from long convexity exposure can help to balance out losses from spikes in correlation.

We are not a tail risk fund, but want some long convexity bias

Yann Le Her, Partner and Senior Portfolio Manager, LFIS

Le Her reiterates that, “We are not a tail risk fund, but want some long convexity bias. LFIS’ dispersion strategies have made money every year of the past six years and would have profited substantially from single name price action in 2008.”

The intuitive rationale for implied premia persisting is more based on structural and flow issues than on behavioural finance biases that underly other types of premia. For instance, Le Her views flows as creating structural biases and inefficiencies that work in favour of the dispersion strategy.

“Portfolio hedging activity centred on equity indices increases the cost of index put options, while structured product activity leads to selling of single stock options, reducing their cost,” he says. Specific flows can be linked to certain investor patterns, hedging by banks, insurance companies, commodity producers etc, and regulatory constraints. “We are selective in timing and will only implement trades if there is a structural reason to make money with flows in favour of the strategy,” he adds.

The equity strategies are expected to have very low or zero correlation to equities. Other trade types can be within or between asset classes. For instance, gold volatility might be traded against silver volatility, or equity market volatility could be traded against associated currency volatility.

Long holding periods

The fund generally aims for longer holding periods in order to reduce transaction costs. “We buy and hold most instruments to maturity, which is mainly in a one to two-year range, as this is the most liquid part of the curve and offers a good balance between daily carry and mark to market risk,” Le Her continues. “The way in which trades are structured means that exposure passively declines through the passage of time, in a linear fashion. Thus, if there were no trades for six months, risk would reduce by at least 25%,” he adds. If LFIS needed to exit trades prior to maturity, he indicates a timeframe of a day and a week, for an indicative cost of around a few percentage points of NAV.

Opportunity set

The strategy is designed to profit during both high or rising volatility climates, and during low or falling volatility regimes, but in practice certain regimes can be more conducive than others. A review of three specific recent calendar years highlights some patterns of note. “Though the fund is not a long volatility strategy, a 2017 market with multi-year lows in both realised and implied volatility is not an ideal environment,” he points out.

By contrast, 2016 was a much better climate. “The strategy is positioned to profit from surprises, and both the UK Brexit vote in June and Trump’s election in November were substantial surprises. This led to a big rotation and high volatility between stocks and sectors, which we captured through dispersion trades. We are optimistic that the strategy could profit from market action around the 2020 US Presidential election.”

As of November 2019, Le Her observes that, “volatility is pretty low in most asset classes like G10 currencies, equity indices, bonds, and many commodities, though gold and silver have seen some pickup in implied volatilities. However, what is more relevant for a relative value strategy is the gap between implied and realised volatility, which remains high. This offers scope to harvest a premium over the typically long holding periods of the strategy.” Indeed, 2019 is shaping up to be the second best year for LFIS’ implied premia strategies since inception of their premia program in 2013.

Capacity for the GDO fund is expected to be around $1bn.

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical