Coeli Asset Management AB (Coeli) has just become the sixth client of automated front-to-mid office systems operator Limina Financial Systems (Limina). The other five are: a London-based FCA-regulated AIFM; a manager of a daily traded long-only strategy; a managed futures CTA manager; a billion dollar UCITS fund; and a fixed income credit fund, trading corporate bonds and credit default swaps, run by Strukturinvest, founded by Sean George.

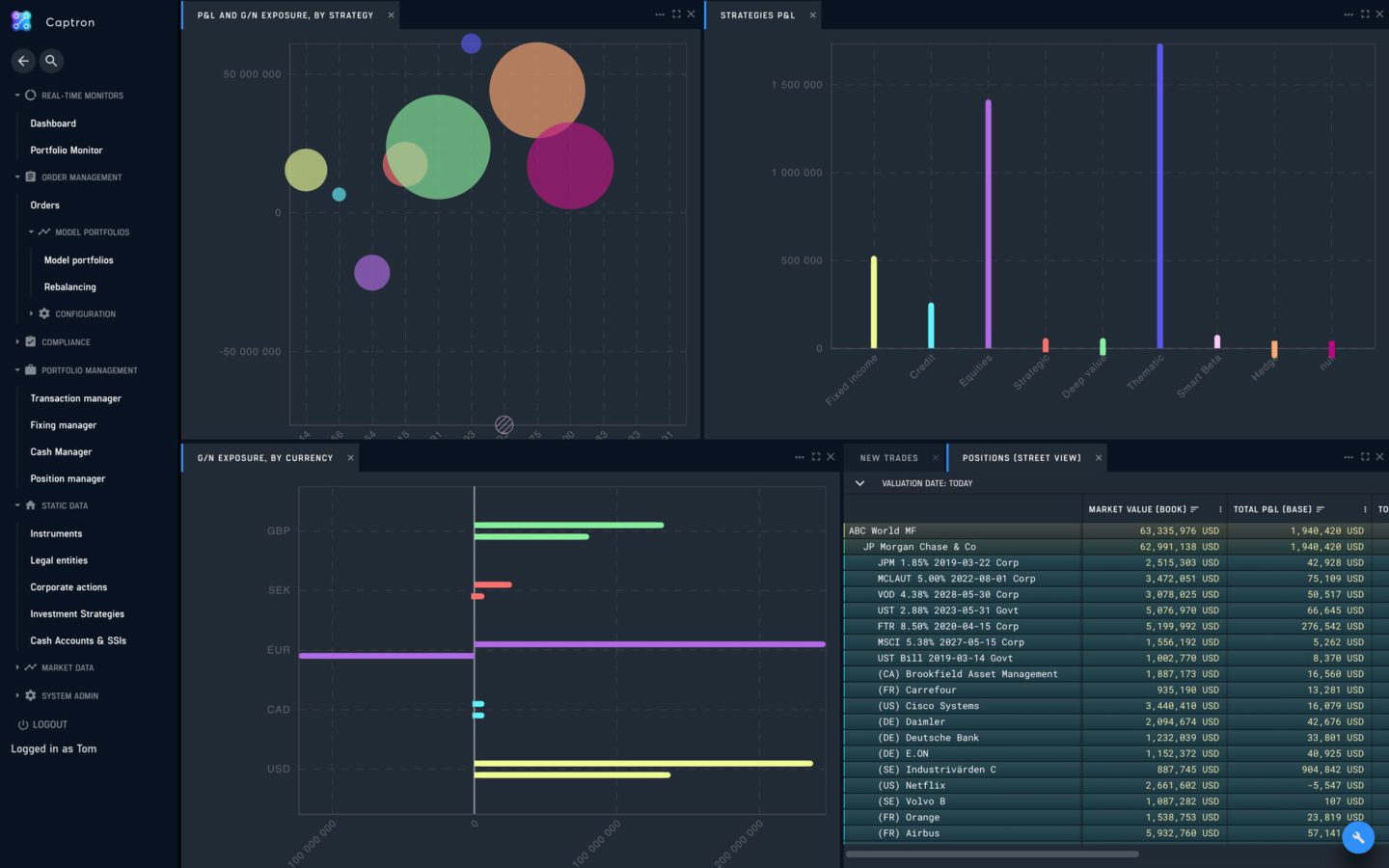

Coeli signed up to Limina’s flagship Captron solution, which covers front to middle office needs with four seamlessly integrated modules: order; portfolio; risk; and compliance management. Coeli had discussions with Strukturinvest, which was using one module of Limina’s offering, however the breadth and complexity of Coeli’s business meant that they decided to go for the full Captron package.

Coeli’s Chief of Staff, Emelie Laurin, explained, “we were looking for a new portfolio and risk management system to accommodate all of our needs today and in the future. We are a diversified asset manager running c.SEK 20 billion in several different strategies, including equities, fixed income, hedge funds, global macro, real estate, and a private equity fund of funds. Our Swedish equity funds are less complex than the hedge funds, which trade more complex instruments. The frontier markets fund run by our sister company, Coeli Frontier Markets AB, needs access to different brokers in different countries. Limina can respond to and accommodate, these needs”.

We had previously used different systems for trading, risk management and settlement procedures, which was not very efficient.

To start off with what could be a deal-breaker for some potential clients, it is worth pointing out that Limina is not customising solutions to the needs of specific clients – as Limina founder, Kristoffer Fürst believes that customisation is too costly. “Customisation through code gets really expensive, with different code bases, and associated testing costs. At the same time, creating too detailed configurations can be counterproductive so there is a golden mean somewhere in between,” says Fürst. Therefore, Coeli are adapting Captron to their requirements. For instance, Laurin says that, “the system has a risk solution, that can be customised through configurations, allowing us to define our own parameters for pre-trade and post-trade controls, alarms and alerts, without any code change”.

“The key attractions were: automation; flexibility; the cloud; integration between modules; seamless integration with external parties; and cost savings,” she continues.

“We want a more automated solution to reduce the risk of manual errors. Automating many tasks that are manual reduces operational risk. For instance, Straight Through Processing (STP) frameworks make settlement and valuation easier and more efficient. Previously, settlements contained several manual steps. Daily compliance report generation and collation of data had also included some manual processes that are now eliminated”.

Beyond this, she says, “The cloud-based nature of Captron lets us use it everywhere, so there is no need for a terminal”.

“We had previously used different systems for trading, risk management and settlement procedures, which was not very efficient and was starting to get outdated. Now these functions are integrated. We are also using Captron for shadow accounting and reconciliations. Order management and compliance workflow management solutions are also helpful”.

“Captron smoothly and efficiently integrates with trading platforms around the world and with our data provider, Bloomberg. It is also easy to build connectivity with administrators and depositaries, such as RBC”.

Costs and chemistry

“Limina is a young company with efficient new technology and architecture, so we were able to get a solution for a lower cost,” Laurin continues. Fürst argues that, “cost saving is typically not the main reason to choose Captron. However, we can sometimes provide a significant saving on top of a superior solution. In those cases, the more complex an asset manager is, the higher the saving mainly because more systems are typically being replaced and more processes are being automated. For a small, long/short equity fund, the cost saving could be less. More complex asset managers can achieve greater savings as cost increases exponentially with complexity, following a power function”. Yet Laurin clarifies that, “cost savings were not the primary reason for choosing the system”.

Personal chemistry also helped to clinch the deal, “we felt very confident in the team on a personal level, and so got off to a good start. Our impression is that they are very serious about the product and client needs. As we will spend much time together on a long journey, we need to be sure that the relationship will work well on a personal level,” says Laurin.

The tendering process that selected Limina lasted for almost a year. “We spent eight months evaluating different solutions, and three months on negotiations before signing the contract in June 2018. We expect to be fully on-boarded by June 2019. It is a big thing to procure an entirely new system or platform,” explains Laurin.

The provider and client see eye to eye. “We are both growing pretty fast and have the same views and ambitions. We need a solid partner to follow our journey. It was a matter of luck or coincidence to have found Limina. Their system is very new so we can work together to expand and develop it.” Limina staff include former hedge fund COOs and CTOs who help with the on-boarding process.

Product development

Limina’s ongoing product improvements have made the system more attractive to clients such as Coeli. For instance, Limina is now integrated with more brokers, administrators and market data vendors. The broker integration has been facilitated through NYFIX, which is wired up to over 300 brokers through the FIX network. “This allows for efficient messaging, and testing, at no cost to the client,” says Fürst. Limina is also connected to other networks, execution systems (such as EMSX) and quite a long list of fund administrators, including one of Coeli’s: RBC. “We can enable real-time communications, which are less commonly seen in the administrator space but we do have one such integration and hopefully more administrators will follow suite,” observes Fürst.

Limina’s order management system (OMS) is now up and running. The firm decided against going down the execution management systems (EMS) route. “As clients will typically use mature and efficient systems such as Bloomberg EMSX or REDI from Refinitiv, we did not see a good business case to compete there,” says Fürst.

“Client feedback is that the system is already intuitive and easy to understand. The transparency of the platform is already bearing fruit: clients click a drill-down menu to ask the system for explanations to numbers, which enables them to understand figures themselves, and therefore get answers immediately and have less need to contact Limina for support – which also brings down the costs of client support,” adds Fürst.

“The next enhancement will be collaboration functionality, which allows for built-in workflow collaboration functionality, adapted to client workflows. Instead of looking into the system, and emailing a colleague, you can send a comment directly on the transaction, and tag the colleague to notify them. This increases the ability to track what is going on, who’s doing what, and increase efficiency significantly.”

Team growth

Limina’s headcount has now grown to 19 staff, mostly on the client services, product development and infrastructure sides. Some 16 are in Stockholm, two in Vietnam, and the latest hire is in Rio de Janeiro in Brazil, adding a US time zone – so that Limina now covers markets from the New Zealand opening out to the West Coast opening.

Recent hires have included Ulf Svensson, who has spent most of his career in New York, including over eight years as CTO at Soros Fund Management, was CTO at CQS Management in London, and Head of Third Party Business Strategy for EMEA/APAC at Bloomberg. Max Eklund has been hired as Head of Sales, to focus on potential clients in the macro investing space; he was previously Head of Sales, Americas for Macrobond Financial. Rohan Sherrard, who had worked for FX options and derivatives trading solutions firms, has been appointed Head of Client Services, and is formalising the client services team.

Additional working capital has been raised from strategic investors, to ramp up product development. While headquartered in Stockholm, Fürst and Svensson are in London every week, meeting potential clients and various business partners. They are having constructive conversations with some of the largest hedge funds that are pursuing more complex strategies.

Visit

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical