Lucerne Capital Management LLC (“Lucerne”) had a vintage year in 2019, delivering 52.8% net to investors. This is well ahead of the manager’s long run target of 15% per annum, but founder, Pieter Taselaar, remains highly constructive on the opportunity set. This is in part due to the huge disconnect between the growing free cash flow yields of some equities and their cost of corporate debt, but also because he judges European equities to have reached the greatest levels of inefficiency since he formed the firm in 2000. European equities have never been the most efficient asset class in the first place; in contrast to US equities, the median active manager beats the benchmark by a small margin. Lucerne has outperformed by a massive margin. Between its inception in January 2002 and December 2019, the strategy has a net annualised return of +12.2%. This translates into a total cumulative return of +693.2%, versus +39.2% for the STOXX Europe 600 and +156.8% for the German DAX over the same period.

Coronavirus is a good example of how indiscriminate moves can throw up opportunities on both sides of the book.

Pieter Taselaar, Founding Partner and Portfolio Manager, Lucerne Capital Management

“We have maintained a very consistent strategy and stuck to our knitting. Throughout we have focused on the most inefficient parts of the market in continental Europe, which are mid-caps with market cap between €1bn and €20bn,” says Taselaar. (The European mid-cap index has performed better than large caps but the STOXX 600 is the most appropriate benchmark given that around 80% of Lucerne’s book has market caps between €2bn and €20bn; the manager sometimes invests in mega caps with market caps as high as €30bn or €40bn, and avoids less liquid mid-caps.)

Fundamental investors: the new heretics?

The outperformance has partly come from high-conviction ideas, a commitment to the firm’s strategy and focus. Investors who have the vision and nerves to hold long term compounders – one of Lucerne’s core long book buckets – can outperform those who get fixated and distracted by short term volatility, which is often little more than random noise. “Many hedge funds focused on volatility and monthly return management. We found that too hard to predict and so instead concentrated on annualized returns,” says Taselaar. “We are looking for businesses that can compound at 15% per year for 10 years and are not so much worried about short term EPS revisions,” says Jaap Pannevis, who heads the Amsterdam research office. Lucerne has outperformed through multiple cycles but does not expect to make money every month or year; in 2018, 2016, 2011 and 2008 the long portfolio got de-rated despite making fundamental progress. “Free cash flows advanced 15-20% in 2018 but we were down over 20% due to derating reducing valuations,” says Taselaar. Given that multiple expansion was the main driver of returns for the broad equity markets in 2019, it is surprising that these perverse dynamics have continued into 2019 for some of Lucerne’s holdings. For instance, Bawag and Telenet saw their valuations contract while growing earnings or FCF in 2019.

(L-R): Pieter Taselaar, Founding Partner and Portfolio Manager and Thijs Hovers, Partner and Portfolio Manager, Lucerne Capital Management

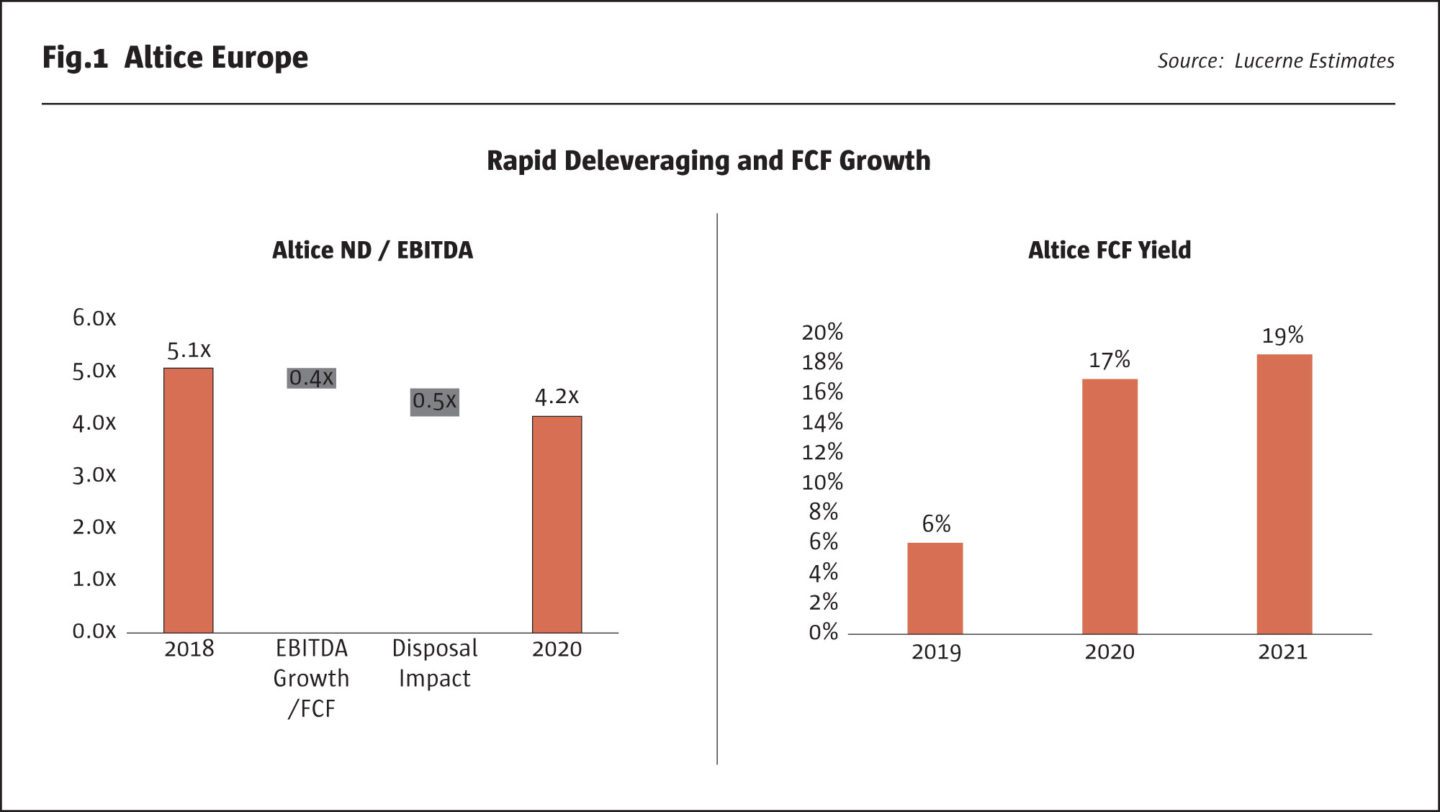

Irrational short-term price moves have continued in 2020. “Coronavirus is a good example of how indiscriminate moves can throw up opportunities on both sides of the book,” says Taselaar. “A European telecoms company, Altice, dropped by as much as a global luxury goods firm (LVMH) that has big exposure to China and Asia. We added to the former.” Lucerne trades around core holdings but on average only adds or removes about one long name per month; some positions are held for years. Short turnover is generally higher, as Lucerne will be keen to monetise a position, say after a profits warning.

Fundamental analysis, based on medium to long term time horizons, has steadily dwindled to a minority pursuit. Lucerne estimates that 90% of European equity volume is now accounted for by index trackers, ETFs, UCITS funds with daily dealing, and quantitative and algorithmic traders. “These short-term traders are not always fundamentally right. They often over-react to news-flow and can reinforce each other: if UCITS funds get a few redemptions, that drags down prices, and the momentum and quantitative funds then start selling, amplifying the moves,” says Taselaar. For instance, in 2018, BE Semiconductor shares dropped by around 60% over six months, as quantitative and momentum investors responded to short term earnings downgrades, but fundamental investors who saw the buying opportunity were rewarded as the shares recovered their peak within 18 months. “Everybody wants to make money every month. Very few investors are left who really do the homework,” he adds.

Taselaar reckons the most important other category of longer term active fundamental investors are currently private equity firms, which are now ascribing higher valuation multiples to companies than the public markets. It seems that less liquid assets now command a premium, reversing the common sense notion of a discount for illiquidity. Taselaar surmises that investors averse to mark to market volatility are prepared to pay up. Private equity firms are potential acquirers for some of Lucerne’s book – and CVC did buy Ahlsell in 2018. Lucerne estimates upside of 30-100% for key holdings based on comparable private equity bids but does not expect private equity will spoil the fun for public equity investors because they are not really foraging in the same fields. “Private equity prefer to buy lower quality, unlisted businesses, take out costs, and lever them up in a low interest rate environment,” observes Taselaar.

52.8%

Lucerne delivered 52.8% net to investors in 2019

In-house research from Greenwich and Amsterdam

Lucerne views and values companies through the lens of a private equity investor but is only taking minority stakes. As well as seeking out long term compounders, Lucerne seeks out more complex situations that may be misunderstood by other investors, such as conglomerates trading at a discount to the sum of their parts. “We have a repeatable and consistent process,” declares Taselaar. His background in corporate finance at ABN Amro has provided a strong network and deep expertise in corporate finance and private company valuations, including advising on mid-cap M&A deals and cashflow sensitivity analysis in Germany, Switzerland and the Netherlands, while Thijs Hovers, who joined the firm in 2008, has a background in public equity research. Hovers had a fascination with equities from an early age, initially sparked by tales from his father, who was the CEO of two Dutch public companies. Hovers became head of Benelux research, and later head of European small cap research for ABN Amro, where Taselaar also worked, selling not only in-house research but also research from other brokers, such as Alfred Berg in Scandinavia, which ABN had bought.

Portfolio candidates need to disclose enough to facilitate thorough analysis through a quant screening process that has expanded coverage over the years to cover the market more broadly and home in on interesting geographies, sectors and sub-sectors: “We have become more efficient at covering the whole universe of 2,500 companies and whittling it down to a portfolio of 25 longs,” says Taselaar. When Hovers joined the firm in 2008, a portfolio review identified the 20 key metrics that lay behind the top performing stocks over the prior seven years. “We built proprietary screens to measure nearly all of the key points with cashflow metrics; ratios like return on invested capital; working capital to sales trends; capital intensity and depreciation; free cash flow generation and share counts. We then ranked firms based on these measures and identified inflexion points for their outperformance and underperformance. We use quarterly data from S&P Capital IQ to pick up changes in trends faster than we would if we looked at annual or semi-annual data,” says Taselaar. “Our process includes rigorous proprietary valuation models, which scythe through historical accounting and KPI data to measure organic growth, gross margins, cash margins and capital allocation optimisation with respect to capex, M&A, buybacks and dividends,” says Hovers. Standardised models expedite screens for long and short candidates, which can focus on deteriorating fundamentals and cashflows that are being hidden by aggressive accounting. These filters create a shortlist of 100 or 200 companies that are investigated in more depth by meeting CEOs and CFOs to do classic SWOT analysis of pricing power, competitors, suppliers and build company specific earnings and valuation models, which ultimately arrive at 25 long candidates. The same process applies to the short book, which has evolved from indices and sector baskets to single names over the years.

Top (L-R): Jonathan Larken, former Chief Marketing Officer; Daniël Merkus, Research Analyst – Amsterdam Office; Sean Poyntz, Head of Trading; Pieter Taselaar, Founding Partner and Portfolio Manager; Thijs Hovers, Partner and Portfolio Manager; Jonathan Copplestone, Senior Research Analyst; Jaap Pannevis, Head of Research – Amsterdam Office; Patrick Moroney, Chief Operating and Compliance Officer. Bottom (L-R): Thibault van Heeswijk, Research Analyst – Amsterdam Office; Claudia Taselaar, Marketing Director; Vivian Badagliacca, Executive Assistant; Ernest Verrico, Senior Controller; Matthew Ostrye, Head of Middle-Office.

Lucerne’s research is partly populating gaps left by the dearth of quality sell side research. Investment bank equity research budgets had been declining for a decade even before MiFID II further eroded them. “MiFID II has reduced the quantity and quality of sell side research to the point where large caps can now be as inefficiently priced as small caps were some 20 years ago,” according to Taselaar. “Some analysts have not updated their models in six months and others are using hard coded spreadsheets,” he laments. Lucerne likes to have a handle on sell side research, particularly where analysts with a different view may challenge their thesis, but most research is in-house. Expert networks have never been used. Some independent research provider boutiques can be retained on the short side in areas such as forensic accounting. The Amsterdam research office, in the manager’s native Netherlands, opened in 2017. Its head, Jaap Pannevis ran European mid-cap research for Goldman Sachs and has known Taselaar and Hovers, who are based in Greenwich, Connecticut, since 2009. The Amsterdam office is not actually about getting corporate access. “Most mid-cap European companies pass through New York at least twice a year, and less competition for meetings means we actually get better access being in the US than we would in Europe,” says Hovers. He and Taselaar spend on average a week a month in Europe, but nonetheless need an on-the-ground presence to provide more thorough and extensive research – and particularly to build out the short book.

Active ownership approach

This is part of an old school approach that includes dialogue with companies. A longer average holding period makes it more worthwhile to constructively engage with management and boards around capital allocation, with the aim of effecting change, typically over a multi-year timeframe. “We are assertive in our dialogues with management and boards in suggesting catalysts that can ensure a stock trades at fair value, such as their financial communication strategy or capital allocation. We would not invest if we had no access to management,” says Hovers. “The US has a much stronger culture of capital allocation optimising the balance between buy backs, M&A, and capital spending. In Europe this is not so much in the DNA of management teams,” says Pannevis.

A common misconception is that GDP growth is needed to generate returns. Italy has a slow growing economy, but certain sectors can be very dynamic.

Thijs Hovers, Partner and Portfolio Manager, Lucerne Capital Management

The philosophy is more typically US than European but the dialogue is nearly always private. Lucerne has only gone public two or three times in the past decade. “Going public with activism is a last resort. We only do it if management do not respond at all to letters or requests for meetings. The ten letters written to Telenet, shown on Lucerne’s website, are highly exceptional. We almost regret having bought the stock but it is the cheapest telecom company in Europe on a free cash flow yield of > 10%, which can increasingly be returned to shareholders as debt is refinanced at ever lower interest rates. Eventually, buybacks are set to reduce the free float to a level where Liberty Global might surpass 75% and be forced to squeeze out the minority as Telenet is Liberty’s best asset. The company could also attract private equity interest,” he adds.

Pockets of excellence

“Europe tends to have pockets of excellence in certain sectors: industrials in Sweden, semiconductors in the Netherlands; oil services in Norway and luxury goods in France,” says Pannevis. Though the average return on invested capital for the STOXX 600 at 12% lags behind the US S&P 500 on 20%, Lucerne owns European companies with ROICs of 30-40% and a few that even reach 100%.

The portfolio is mainly invested in core Europe countries of Germany, Switzerland, Benelux, Sweden and France but has often found high quality companies in Italy. The sectors invested in are principally business services, industrials, financials, telecoms and energy, avoiding sectors such as biotech where the managers lack expertise. But themes and factors matter more than sectors or countries for portfolio construction, since the majority of the companies owned generate most of their revenues outside their home country. Companies listed in the Netherlands might make up 30-40% but generate little or no revenues from the Low Countries.

The long book has an average free cash flow yield of circa 10%, which is double that of European equities, but this cannot easily be put into the box of a value/income/high dividend portfolio and has very little in typical high yield sectors such as utilities, and real estate (which is actually more prevalent on the short side). A handful of higher quality cyclicals only partly explain why it is higher than the market. What is most remarkable is that Lucerne not only projects free cash flow yields for some holdings growing to as high as 20, 30 or 40% of the current share price over the next two or three years – as earnings grow and buybacks reduce share counts – but also expect that this cash could be returned to shareholders through dividends and buybacks.

The long-book is roughly evenly weighted amongst three thematic buckets: rate-sensitive, steady cash compounders generating strong free cash flows with low cost of debt; special situations firms that can improve say through selling non-core assets; and stocks on low multiples that can sometimes be higher quality cyclicals or may occasionally be seen as “cigar butts” in the Graham and Dodd sense. These three sleeves broadly overlap with momentum, growth and value factors and a reasonable degree of balance is maintained. “We want to run a broadly factor neutral book because a strong bet on any factor can become vulnerable to shorter term quantitative investors rotating around factors. Factor tilts of 10-20%, as measured by the prime brokers, are within the range of tolerance,” says Taselaar.

Italy and telecom towers

“Many high-quality businesses, including some in luxury goods, are already at fair value so we see no upside to target prices. We are searching in less obvious areas of the market, including Italy, which is the most inefficient market in Europe – sell side analyst models can be 50% or 100% off the mark. We often have around 10% of the book in it. We opportunistically moved into Ferrari in late 2018 and sold it for a 75% profit a few months later. We have also benefited from the re-rating on fashion group Moncler shares,” says Hovers.

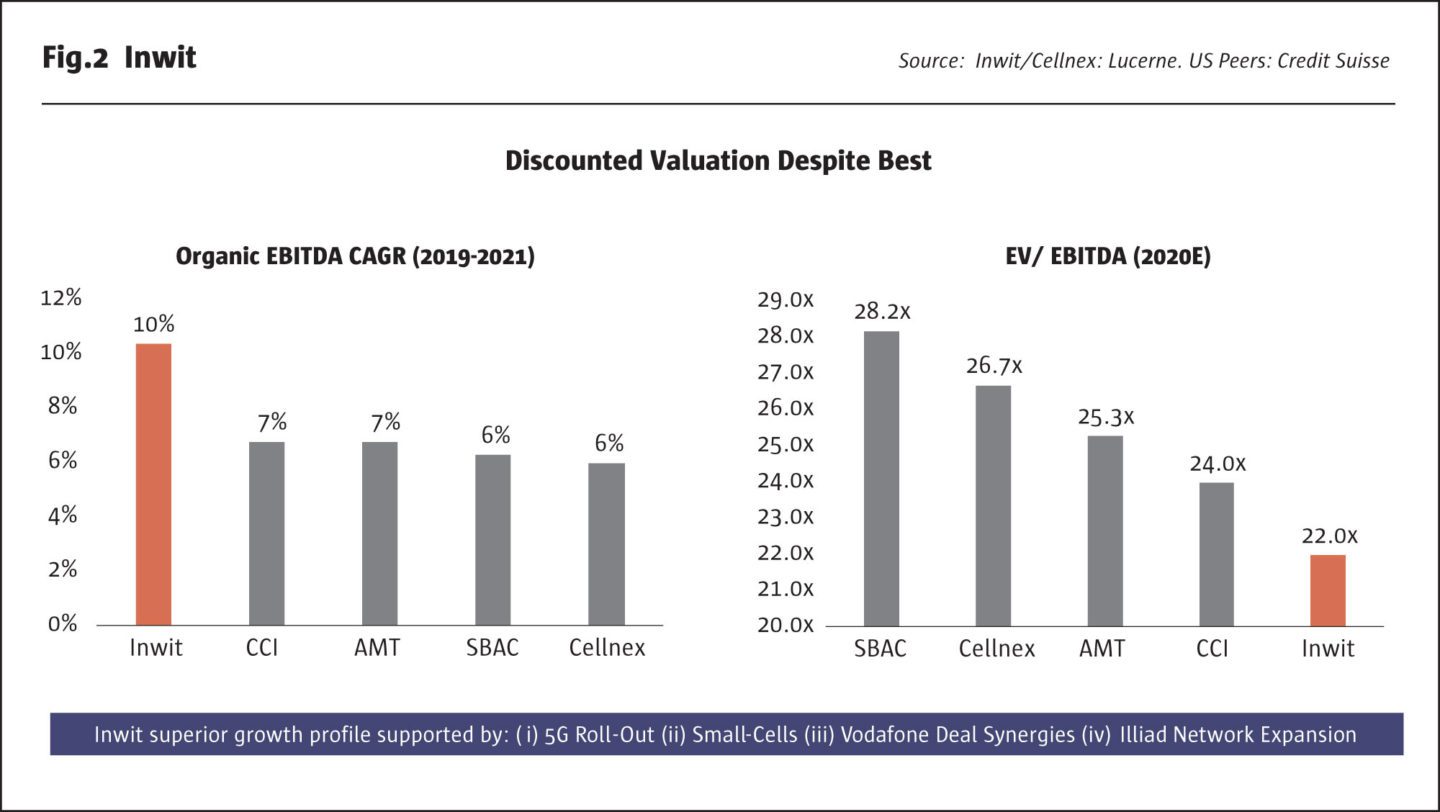

“Currently our largest position in Italy is in telecom towers operator, Inwit,” says Hovers. “A common misconception is that GDP growth is needed to generate returns. Italy has a slow growing economy, but certain sectors can be very dynamic. Mobile data usage is growing everywhere and Italy is a special case where cable and fibre is under-penetrated. The country will see a rapid rollout of 5G, generating organic growth of between eight and ten per cent, the fastest globally. Meanwhile, merging Inwit’s towers with Vodafone Italy could double EBITDA and provide significant synergies; we expect EU approval for the deal. Inwit could have faster earnings growth than any other tower company globally, yet its valuation of 22x EBITDA stands at a discount to Spain’s Cellnex on 27 times and US peers on 25x+ times. Even without any re-rating, earnings growth alone could double the share within three years.” Taselaar adds, “The merger should also improve liquidity and free float in the stock.”

The analysis of towers – where Lucerne was an early investor in Spain’s Cellnex – also feeds into valuation analysis for other positions. Altice – which Taselaar pitched at the Sohn Conference Foundation London event – is partly driven by the theme of refinancing debt at lower rates to increase free cash flow but is also a conglomerate discount story. “Altice’s sale of 50% of its Portuguese Fibre To The Home (FTTH) tower assets for €2.3bn to Morgan Stanley Infrastructure Partners implies an EV/EBITDA multiple of 20 times, for what sets a precedent as the first carve out of fibre assets of a former incumbent (Portugal Telecom). Stripping out these assets has highlighted the huge sum of the parts discount that Altice trades at: the whole firm is on an EV/EBITDA multiple of around six times,” says Pannevis. “We expect that Altice’s French fibre assets could prove to be very attractive, as they have been granted regional monopolies in certain rural areas where the government wants to plug gaps in coverage. Fibre valuations are partly based on market concentration metrics, and we reckon Altice’s French assets might be worth as much as €10bn.”

Lucerne has recently ventured into a frontier markets firm (listed in London) to find more attractive valuations and even faster growth. “African tower operator, Helios Towers, intended to IPO in 2018 at 15x EBITDA but came to market at 8.5x EBITDA in late 2019 while American Tower recently bought its main peer Eaton Towers at 14x. Organic top line growth should be at least 10%, EBITDA 12-14%, and the firm could triple or even quintuple earnings over a few years. As many parts of Africa have no fixed line infrastructure, they are leapfrogging directly to mobile infrastructure. Helios is active in South Africa, Ghana, DRC, Congo and Tanzania. There are operational problems in terms of security and access to power – which can be self-generated through diesel – but these factors also raise barriers to entry. Currency risk is mitigated by the majority of contracts being USD based. Even so, the position is sized smaller to take account of the risks,” says Pannevis.

European technology niches

Europe’s technology sector is obviously tiny compared with the US but has its niches. “We do not have Googles and Apples, but we do have very strong industrial software, for chemicals, refineries, asset optimisation, process engineering,” says Taselaar. A deep dive research project analysing 20 software companies in Europe honed in on three to invest in: Dassault Systèmes in France; Simcorp in Denmark, and Aveva in the UK. Lucerne judged Aveva’s valuation to be most compelling, partly based on taking a view on pro forma synergies arising from its merger with Schneider of France. “We knew the CEO from his time at PTC and thought that the opportunity was compelling. Lucerne waited a year before buying the stock to get comfort that the synergies were on track, and although it has already been a strong performer, further upside is envisaged, since it still stands at a hefty discount to US peers such as Aspen Technologies,” he adds.

The Netherlands has three listed semiconductors, ASML, ASMI and BE Semiconductor, all highly regarded; Germany’s Infineon is also tapped into EVs and AVs. “Semiconductors have some cyclicality so sales might be up or down by 35% or 40% in one quarter,” says Pannevis. “We are looking through this to focus on a long-term trend of 10% organic sales growth. Structural growth is driven by niche positions in 5G and EVs. BE is very geared to Apple and 5G. Its revenue and profits could more than double on operational leverage so the stock could be on a forward PE as low as seven compared with today’s multiple of 18.” He adds, “This is more likely to be an earnings growth story than a takeout. The chipmakers need to stay independent to work with a wider variety of customers.”

15%

“We are looking for businesses that can compound at 15% per year for 10 years and are not so much worried about short term EPS revisions,” says Jaap Pannevis, who heads the Amsterdam research office.

Tobacco, ESG and oil services

“Swedish Match has made phenomenal returns on capital of over 50%, and returns capital to investors via dividends and buybacks, which reduce the share count by three to four per cent each year. Though regular tobacco may be a declining business, Swedish Match is in two growth niches. It has a 70% market share in snuff, or oral tobacco, which is growing at about three to four per cent but its new nicotine pouches are growing even faster, by 100% year on year. This has contributed to accelerating earnings growth of 20% per year and made Swedish Match the fastest growing consumer staples stock in Europe.” Yet the stock got de-rated to a PE ratio of about 14 when Lucerne bought in. “This was partly due to the growing number of institutional investors excluding tobacco for ESG reasons. Swedish Match has no Swedish institutional investors left. We do not completely exclude tobacco and related products; the investment thesis would remain intact if Swedish Match was required to cease or divest its flavoured cigar business,” clarifies Pannevis. Lucerne does exclude gaming, and weapons, including indirect exposures to the latter; they have investigated the end uses for the Dutch semiconductor makers’ chips.

Elsewhere in ESG, Lucerne is also taking a forward-looking view measuring the second derivative or the rate of change – rather than taking a static approach. Hence oil services firm, Fugro, is favoured partly because it is shifting its business mix towards offshore wind power generation, leveraging the same intellectual property and data analytics used for offshore oil and gas production. (Danish firm, Orsted, has fully transitioned from oil and gas to wind power and has seen a huge re-rating in its valuation.) But the cornerstone for this holding is Lucerne’s constructive outlook for oil services in general. “The oil majors need to replace very high decline rates of five to seven per cent each year, and US shale production may not fill the gap due to a growing realisation that shale has not been profitable for investors. Meanwhile, advances in technology mean it is possible to find offshore oil with a breakeven price around $30 to $40, so the story does not require a higher oil price,” says Pannevis. Fugro is also something of a special situation. “Investors, including a very high short interest, may be unreasonably worried about debt refinancing risk. We are relaxed about this because growing EBITDA and disposals have reduced leverage, and investors have started to agree with the stock going up 50% in a few months,” he adds. In mining, Lucerne has also owned a service provider, Epiroc, rather than the miners themselves.

ESG may partly explain why fund administrator Intertrust trades at a discount. The tax structuring activities of its trust business have become controversial, although the division only accounts for around 10% of earnings, according to Pannevis, who emphasises the big picture. “Intertrust’s steady growth of four to five per cent and very high cash conversion of earnings to cashflows would normally attract a high multiple, but investors were concerned about the CEO; dilutive acquisitions, and unrealistic guidance. After Lucerne’s presentation at the Intertrust AGM, the firm replaced its CEO with a manager hired from SS&C – one of the best compounders of all time – ceased dilutive acquisitions; made an acquisition of technology firm Viteos, which could accelerate its growth; initiated share buy backs; and made earnings guidance more realistic, yet the shares continue to trade at the highest free cash flow yield – circa 12% – in the business services sector in Europe. CVC’s recent acquisition of TMF for €1.8bn would read through to a share price of €30 for Intertrust, which is actually a faster growing business. But a quick profit from a takeover would not necessarily be the best long-term outcome for Lucerne: continuing to hold a stock with a 12% free cash flow yield, and six per cent earnings growth, could generate returns of 18% a year without any re-rating. Intertrust can raise incremental debt at two per cent, so has a huge spread between equity returns and cost of debt.”

“The valuation trades like a postal company,” says Pannevis; Lucerne has been short of some legacy postal operators including the UK’s Royal Mail that face structurally declining businesses.

Banks

Lucerne has also been short of some European banks, a chronically sick sector in general. The persistent problems of Europe’s banks explain a significant part of the continent’s poor large cap equity performance over the past decade. Lucerne has shorted some European banks that are serial value destroyers, making returns on capital below their cost of capital. A more opportunistic short was found in the UK’s challenger bank, Metro Bank, which was flagged up on a quantitative screen due to plummeting free cash flows and return on capital. “The valuation was discounting extremely high returns on capital of 20-30% that were unlikely to be achieved in the UK’s highly competitive banking market,” says Pannevis.

The poor sentiment towards banks also results in neglected deep value opportunities. Austria and Germany are in general challenging markets for banks, with exceptionally poor net interest margins even before the advent of zero and negative interest rates, but some players can ferret out lucrative market segments. “Despite low interest rates, Bawag is generating a 17% return on equity from its niche strategy of lending to smaller and medium sized companies in Germany, Austria and Switzerland. The bank is also acquiring other banks in Germany for between 0.2 and 0.5 times book value, and streamlining costs to make returns of 30-50%. Bawag became notorious for losing $1.5bn on foreign exchange back in 2000 but 20 years later it has attained fame for a more benign reason: becoming the first EU bank to obtain approval for share buy backs. Bawag is returning >15% of its market capitalisation each year through dividends and buybacks,” says Pannevis. Yet Bawag’s PE ratio of around six, is a 30% discount to the sector average of around nine, although it is clearly a very different beast.

Short themes

The Amsterdam research office has ramped up the short effort, which has been generating absolute profits of two to four per cent each year over the past four years. “Quant screens for shorts can seek out firms with multi-year construction contracts where it is hard to get a handle on true margins or cashflows; firms with high unbilled receivables; working capital disconnects with sales and EBIT,” says Pannevis. This analysis has flagged up the UK’s ASOS and Switzerland’s Aryzta.

Shorting in anticipation of capital raises has been an important bucket for Lucerne, with Aryzta, Imtech and Vallourec examples. The other core short buckets are firms undergoing structural change (such as postal monopolies or commercial television); those with balance sheet issues; those that lack pricing power in the value chain (food retailers and branded food producers); and accounting shorts that report good P&L but actually have deteriorating cashflows, like retailer B&S.

A structural, secular, multi-year short theme in most of the developed world has been second tier retailing outlets that are losing business to e-commerce. This megatrend is plain and clear to see with retailers renegotiating rents 20-30% lower, which increases real estate companies’ leverage ratios. In this highly disruptive and dynamic climate, traditional measures of valuation such as discounts to historic net asset value, or dividend yields, are quickly outdated and often turn out to be value traps. Companies trading on a 50% discount can soon be on an 80-90% discount, in anticipation of equity issuance. Lucerne has shorted a selection of names of which Wereldhave is above the 0.5% disclosure threshold. Lucerne keep a close eye on short interest and cost of borrow.

Alignment with investor time horizons

The short side is the main constraint on capacity for Lucerne’s strategy, which has assets of circa $1bn and is approaching its capacity target. “Though we keep the average market cap on shorts in line with that on longs, liquidity has deteriorated, partly due to MiFID II. We have a good network of brokers and other liquidity providers such as dark pools, but the flip side of MiFID reducing commission is that bid/offer spreads have increased,” says Taselaar.

Limited strategy capacity exists, but the managers are very selective about their investor base. “In 2008 we did not have the right liquidity profile in terms of our client base as funds of funds rushing for the exit forced us into a fire sale of stocks. Now we conduct careful due diligence on our investors and know them well personally. All of them have stayed invested throughout 2011 and 2018,” he adds. Most of the investors are now family offices and high net worth individuals. Lucerne’s own partners and staff now own more of the fund than do funds of funds.

For investors with at least a medium-term time horizon, Lucerne remains very upbeat on the portfolio based purely on earnings growth, even without any valuation upside. Some of Lucerne’s positions are expected to generate catalysts on a one to two-year view. “If you find a great compounder, the biggest risk is to sell it too early and make only 20% after one year,” says Pannevis. “Europe in general does not share the US value investing private equity mindset, but we do feel an affinity with this approach and very much expect to continue beating the market.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical