The latest addition to Lyxor’s UCITS platform, which won The Hedge Fund Journal’s 2016 award for ‘the Leading UCITS Hedge Fund Platform’ is Lyxor/Kingdon Global Long/Short Equity Fund. This is the 10th fund to be on-boarded, and asset growth to $2.4 billion since it started three years ago makes Lyxor one of the fastest growing UCITS platforms, according to Andrew Cocks, Head of Third Party Distribution at Lyxor Asset Management. Notwithstanding the speed of the ramp up, Lyxor is highly selective, only adding three or four funds per year on average, and quality is prioritised over quantity. For example, earlier this year, THFJ profiled the Lyxor Tiedemann merger arbitrage and event strategy UCITS.

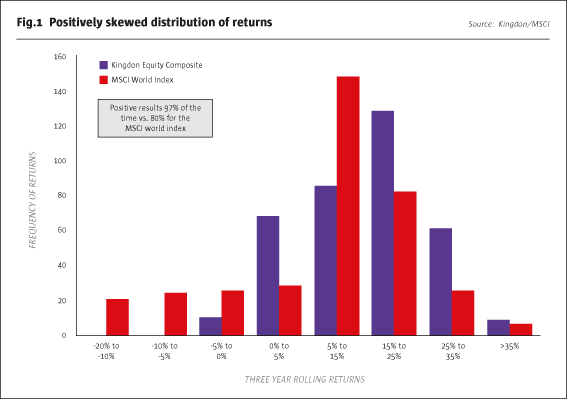

Kingdon plugs an important gap in the growing suite of strategies: “Lyxor now has a fundamental global equity long/short fund with a wide geographic spread and variable directional bias,” says Cocks. Kingdon’s 30+ year track record has the type of institutional pedigree and longevity that Lyxor – which launched its first managed account back in 1998 – seeks. “We are seeing real client demand for this strategy, which has annualised at 13.7% since the inception of its offshore fund in March 1986 and provided downside protection,” says Cocks. Kingdon aims for attractive risk-adjusted returns through the cycle, and rolling three-year returns have been positive 97% of the time.

Variable exposure and active short book

Kingdon’s flagship strategy has historically been less volatile than the wider world stock-market, partly as net market exposure has stayed below 100%, but also because the manager has been adept at tactically adjusting exposure. Since the firm incorporated in 1983, Kingdon has been distinguished by “a unique ability to adapt over a number of market cycles,” argues Cocks.

Varying gross and net exposure is the most basic tool for flexibility, yet this freedom is not always exercised by some hedge fund managers. Kingdon varies its net market exposure typically between 40% and 80%, but can go down to zero net exposure on a dollar basis, which can potentially entail being net short on a beta-adjusted basis. Using thisapproach, the strategy has profited in some bear market years, such as 2001, and performed relatively well in 2008. Exposure is decided by CIO Michael Mackey and CEO Mark Kingdon with inputs from other Executive Committee members. In September 2016 the fund was approximately 50% net long as Kingdon’s analysis of macroeconomic, market, credit and government policy trends leads to the conclusion that “there is room for the economy to expand and, though there are some headwinds, indicators of recession are absent.”

Kingdon also thinks that equities, while not cheap in absolute terms, are fairly valued versus credit and cheap versus government bonds. In particular, Kingdon finds some healthcare and technology stocks to be good value.

Though profiting from short positions has been challenging over the past few years, Kingdon has continued to augment shorting capabilities – and has the gumption to stay with high conviction shorts. For instance, Kingdon has noticed certain companies that are heavily reliant on consumer finance and consumer durables, with poor product cycles, are vulnerable to profits warnings. The strategy is making less use of index shorts and adding more single stock alpha shorts. As a result gross exposure has increased, from a 10 year average of around 112%, to around 150% in September 2016. But Kingdon’s gross exposure does not typically exceed 200% and there are no plans to use significant leverage.

Global remit

Liquidity is another non-negotiable constraint that means some emerging markets are off limits because “liquidity is our first line of defence. We own the stocks and they do not own us. It is better to get out of a stock than try and hedge it and create basis risk,” Mackey explains.

But Kingdon can still invest in dozens of countries’ stock-markets, and the team scours the globe on company visits in search of value in the Mid-West of the US, Europe, Japan, India and China, among others. In developed markets, the fund has more US than Europe exposure. In emerging markets it has more in Asia than elsewhere, not least because Kingdon himself is the sector head for Asia.

Sector allocations

Kingdon’s breadth of geographic reach is matched by its depth of sector knowledge. Kingdon’s deep bench of five sector heads supported by 20 sector-focused portfolio research and investment analysts provides senior expertise in picking stocks on a global basis. The teams are discriminating enough for the fund to invest in approximately 100 long positions and 50 short positions, an average of six per investment professional. Analysts are overseen by sector heads, the number of which was reduced from 14 to five in 2012 when Kingdon set up an Executive Committee. Kingdon argues “fewer decision makers make it easier to allocate capital appropriately and we allocate to sectors rather than individuals.”

Kingdon himself is sector head for Asia, emerging markets, energy and technology. Mackey is sector head for industrials and financials. Patricia O’Donald is head for consumer, Michael Pohly for credit and macro while Jonathan Siegel heads up the healthcare team. Kingdon thinks that each sector team “is probably strong enough to run its own fund,” (and does in the case of Kingdon’s dedicated long/short credit strategy).

Healthcare has been a substantial allocation – peaking at 25% net exposure – that illustrates Kingdon’s proprietary VFT (Value, Fundamentals, Technicals) framework well. Demographics, the increasing propensity for FDA approvals, improving margins, and more corporate activity all provided a positive backdrop that led healthcare to be the largest sector allocation. Kingdon blends this type of top down, thematic analysis of sector dynamics with bottom up, idiosyncratic analysis of single stocks to populate their portfolio with names that offer the most attractive risk/reward profiles.

Kingdon has a bullish bias towards healthcare but in other sectors the manager may find it more appropriate to construct relative value trades and energy – an important performance contributor this year – is an example. Kingdon thinks that both US output fluctuations and OPEC decisions are highly relevant to the price of oil, and bottom up analysis is also important. “Though we are moderately positive on the oil price we view energy as being a heterogeneous industry of winners and losers,” Kingdon explains.

The strategy has invested in the lowest cost US producers, including those in the Delaware portion of the Permian basin in Texas, where high flow rates and technological improvements have reduced costs to as low as $18 to $36 per barrel. Conversely, Kingdon has been short one of the highest cost producers that needs crude at $60 per barrel to break even.

A collegiate team

Though Kingdon predominantly invests in equities – running $2.1 billion in total of which $1.8 biliion is in the long/short equity strategy and $335 million is in a credit strategy – the firm has had an in-house credit team since 2009. “Credit has often proven to be the canary in the coal mine, and after 2008, we brought in Michael Pohly and his team which gives us a tremendous competitive advantage when assessing different market environments,” observes Mackey.

In late 2015, lateral discussions with the credit team, who regularly meet with companies, proved useful, as credit was a leading indicator for the equity rout that persisted until March 2016, when the Fed decided against raising rates again.

Idea sharing between credit and equity teams is just one example of how Kingdon’s culture emphasises a collegiate and cooperative ethos and that “is not appropriate for everybody.” But plenty of them are very well tenured – and amongst the EC, the average time with Kingdon is 16 years with average industry experience of 25 years. Staff need to be good at finding their own names to invest in and also good at helping colleagues. Corresponding with this culture, compensation is based on a mix of individual and overall firm performance rather than the ‘eat what you kill’ model that applies at some managers.

Portfolio themes can run across sectors and geographies, and the sector heads are global. For instance, Mackey points out that steepening yield curves globally could be good for banks in many countries. When analysing a stock such as Apple, a name Kingdon has held in the past, sector analysts will pool their knowledge of hardware, telecoms, semiconductors, and other sectors to create a mosaic throughout the supply chain. The highest conviction ideas from each of the 10 books (Consumer, Energy, Financials, Asia/Emerging Markets, Technology, Industrials, Healthcare, Retail, Interest Rates and Currencies) can be added to in the centre book.

Some external research is used. Kingdon teams read sell side research partly to keep abreast of the levels of consensus earnings estimates, which may well differ from its in-house estimates. Strict rules apply to expert networks, and Kingdon staff only participate in calls with consultants that are free from any public company affiliations. Additionally, such calls must be approved in advance by compliance and all ideas are monitored by compliance.

Longer holding periods

Notwithstanding the opportunities Kingdon has capitalised on, some headwinds for alpha generation have undoubtedly appeared in recent years. Zero interest rate policies from many central banks have made short-selling harder, particularly as weak companies can easily get acquired; since Kingdon entered the business the number of hedge funds has multiplied from 100 to 1,000, leading to more crowding into certain positions; and the growth of quantitative strategies has also removed some shorter term arbitrages. All of this has made it more difficult to generate alpha over a three to six month time frame in the way that many funds did in the 1980s and 1990s. Therefore, Kingdon has increased its average holding period, and sees strong rewards for being patient, riding out volatility and staying disciplined on valuations.

A longer average holding period does not mean Kingdon is taking its eye off the ball when it comes to risk management, however. The manager, Lyxor and the UCITS regulator keep a close eye on a whole basket of risk factors. In addition to Lyxor’s independent oversight of risk and that provided by the Central Bank of Ireland, Kingdon monitors a range of risk measures, including Value at Risk, estimated losses, binary event risks, and convexity. Kingdon watches implied volatility of holdings and seeks out the most appropriate hedges, partly based on this measure. Kingdon has been making more use of option structures, particularly to narrow the range of outcomes around events such as the Brexit vote or the US Presidential election. For instance, Kingdon held some protection before the Brexit referendum, which reduced net exposure by 13% on the day after the vote.

But Kingdon hints that he views the US Presidential election as more of an opportunity than a threat. With monetary policy arguably having come close to the outer limits of what it might attain, the policy pendulum could swing back to old-fashioned Keynesian reflation. Whether Clinton or Trump wins on November 8th, Kingdon sees “a more fiscally expansionary and pro-growth climate that could be good for infrastructure and construction, while creating more volatility in fixed income securities.”

- Explore Categories

- Commentary

- Event

- Manager Writes

- Opinion

- Profile

- Research

- Sponsored Statement

- Technical